U.S. Treasury Market Moves: Bear Steepening, Record Issuance & What It Means for Crypto and Other Risk Assets 🧵👇

1/ The U.S. Treasury market is experiencing significant structural changes, characterized by a "bear steepening" yield curve and an increasing risk-averse sentiment, which may also have profound impact on the crypto market. We dive into key indicators and what they mean for the

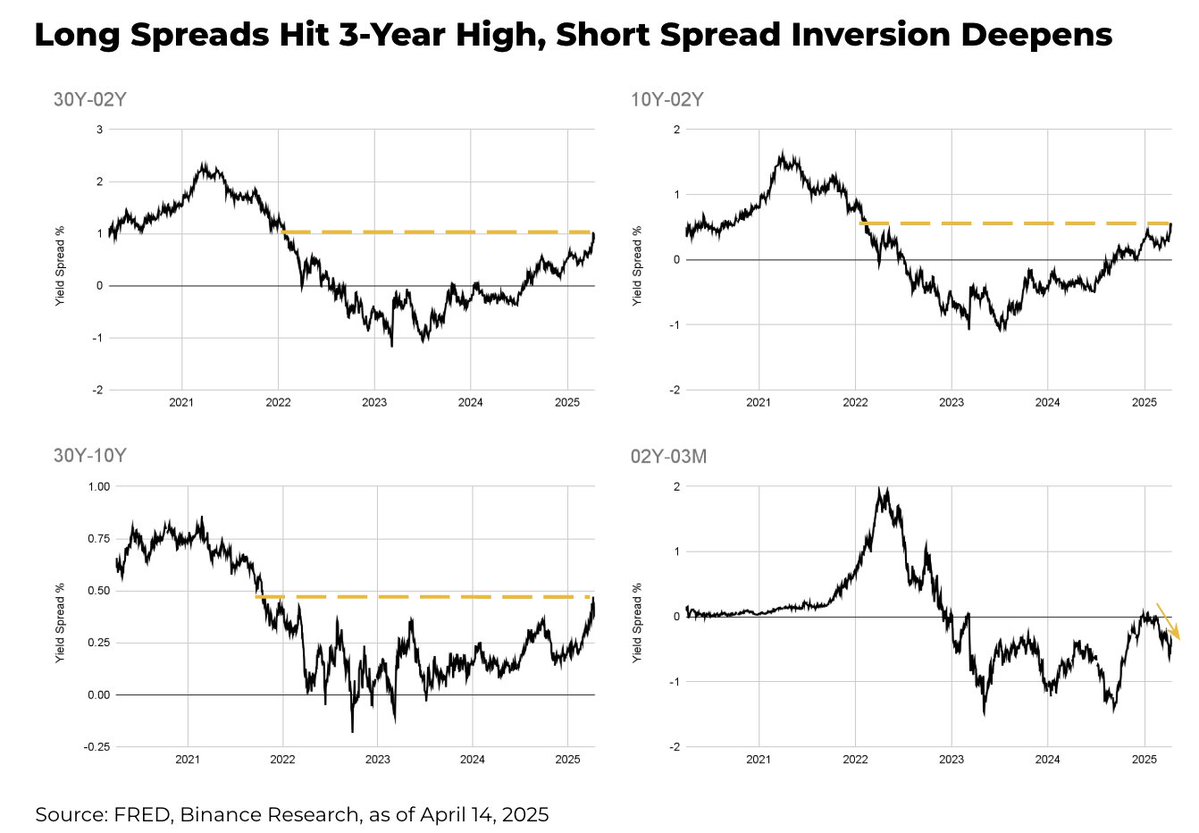

2/ Yield Curve Steepening

We're seeing pronounced "bear steepening" since last fall — long-term bond yields (10Y, 30Y) are rising faster than short-term ones (2Y, 3M). Spreads like 10Y-2Y and 30Y-2Y just hit 3-year highs, pointing to rising concerns around future growth and

3/ Rising Credit Concerns

Investors are increasingly concerned about government debt, but their worries about corporate debt are even more pronounced. Last week, the risk premium for high-yield bonds (measured by HY OAS) surged to its highest level since June 2023, near the peak

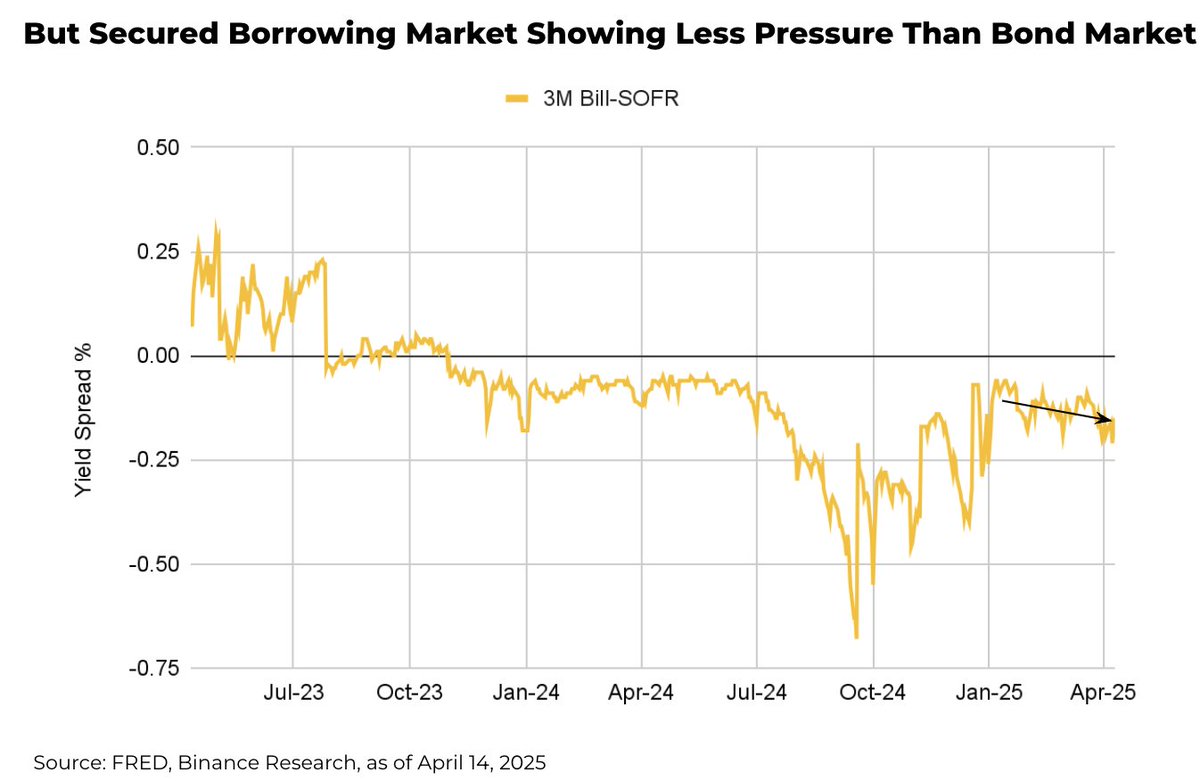

4/ Funding Market Signal #1 – Flight to Short-Term

Despite broader stress, the spread between 3M T-bills and the Secured Overnight Financing Rate (SOFR) remains tight. This points to strong demand for ultra-safe, short-term government debt — a sign that investors are hoarding

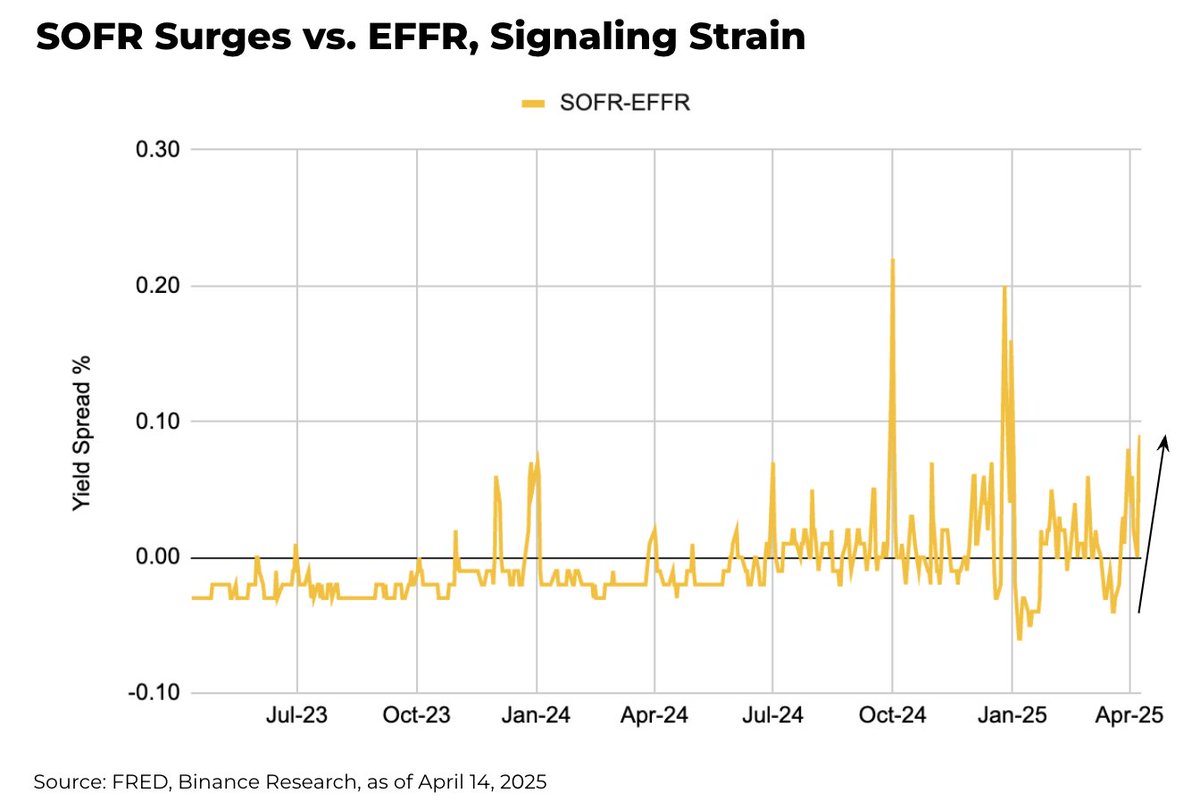

5/ Funding Market Signal #2 – Underlying Strain

The cost of secured overnight borrowing (SOFR) is rising sharply relative to the unsecured interbank rate (EFFR, anchored by the Fed). The widening SOFR–EFFR spread signals stress in the repo market — hinting at growing tightness

6/ Putting It Together – Classic Risk-Off?

Widening HY OAS and SOFR–EFFR spreads, combined with strong demand for T-bills (stable 3M Bill–SOFR), signal a clear flight to safety. Capital is rotating out of risk — even long-term Treasuries — into short-term havens, as long-term

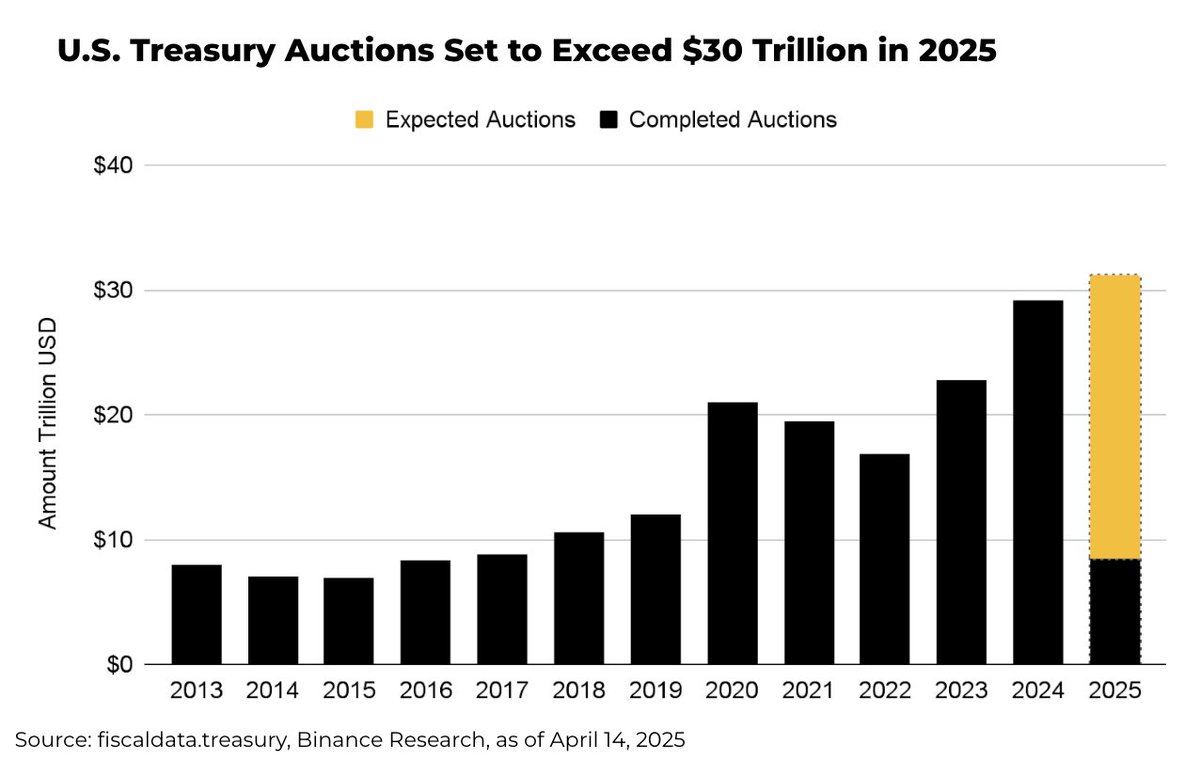

7/ Record Treasury Issuance Driving Market Shifts

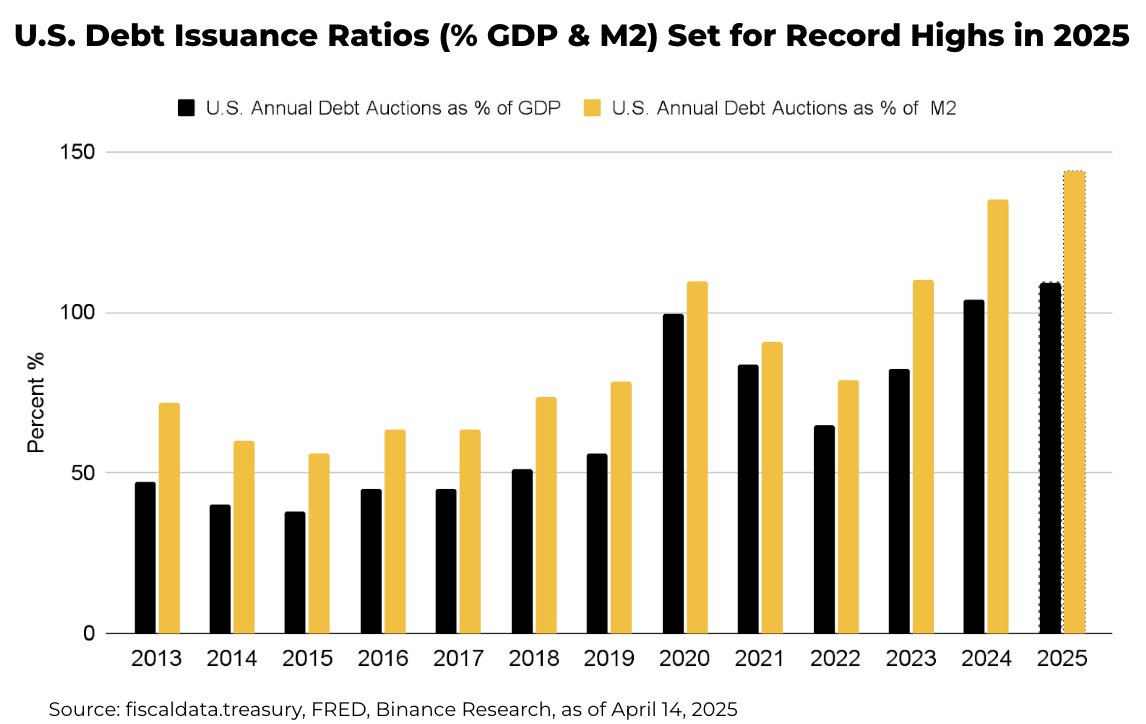

Massive U.S. government financing needs are at the core of these market shifts. Total Treasury auctions (incl. refinancing) in 2025 are projected to surpass US$31T — the highest on record. This supply wave is reshaping yield

8/ Is There Sufficient Demand For This Unprecedented Issuance?

This massive issuance (~US$31T incl. refinancing) equals ~144% of the U.S. M2 and ~109% of GDP in 2025 — truly unprecedented. When supply this large hits the market, bond prices face pressure and yields rise —

9/ Potential Implications – Squeeze on Risk Assets

A flood of “safe” debt acts like a liquidity vacuum — soaking up capital. As the risk-free rate rises, risk assets like stocks and crypto must compete harder to justify returns. The net result is valuation pressures across the

10/ Potential Implications – Recession Warning

A bear steepening yield curve has often preceded slowdowns or recessions. It signals rising long-term fears even as short-term rates stay elevated. Should weak macro conditions emerge, earnings will suffer and risk appetites will be

11/ Potential Implications – The QE Wildcard

If markets struggle to absorb record debt issuance, the Fed may step in (QE, lending facilities) to prevent bond market dysfunction. We’ve seen this playbook before — think 2020–21. On April 11, Boston Fed’s Collins signaled readiness

12/ What to Watch – Key Signals Ahead

Keep an eye on these to gauge where markets (and crypto) may be headed.

🔸 Treasury auction results (signals demand strength)

🔸 Yield curve shape (signals growth and inflation expectations)

🔸 Credit spreads (signals perceived risk of

Found this helpful? Check out the Binance Research website for more in-depth reports.

www.binance.com/en/research

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content