Master's Hot Topic Discussion:

Today, I'll first discuss my personal views on recent trends. So far, I still believe the market won't reverse so quickly, so we don't need to rush and can wait patiently. Although there's some volatility now, many things haven't reached their critical point yet.

First, the risk market can't just focus on tariffs. Although tariffs are important, the biggest trouble for US stocks or global risk assets this year is actually the chain reaction caused by Big Beautiful's reduced spending.

The economy has transmission and lag characteristics. When Big Beautiful reduces spending, economic growth will slow down, employment will decrease, and subsequent problems will arise. So we need to broaden our perspective and not just look at a single point.

Regarding recent market conditions, if you've made money, quickly run away. No matter what you bought, don't keep your position too high. Don't always think about making more; taking profits when things are good is the hard truth.

Before the Federal Reserve recognizes reality and turns its policy, don't expect abundant liquidity this year. So everyone shouldn't think the market will suddenly become bullish.

Speaking of BTC, the daily-level strong pressure, which is the short-term top, has dropped from last month's 88.8k to around 87k, with specific resistance around 86.8. If it breaks below 83k, it will try 80k again, and 79k is the low point of the callback wave, so Master won't look at lower levels unless it breaks through.

If 86.8k is strongly broken through, it will only touch 91.3 to 91.8k at most. This is the range of recent oscillation. Master also clearly said in yesterday's public account article that BTC could drop at any time, and only a big drop can properly adjust market sentiment.

In the medium term, the opportunity to drop is definitely more than the opportunity to rise. Yesterday, it rose to around 86.5k, which was exactly the pre-set short interval Master gave. This morning at 8 o'clock, it dropped below 83.2k. This pre-set short almost precisely reached the second target, making about 3000 points of profit, great!

For ultra-short-term play, you don't need to care about macro regulation at all, just ensure there are no major news influences. Look at trend lines and technical indicators; making money is the king's way.

The trend logic hasn't changed much. Don't think it's going to reverse just because it rose a bit; that's overthinking. Currently, the daily line can still return to the trend line and go down. Considering the American situation and industry rules, a drop is still the most probable outcome.

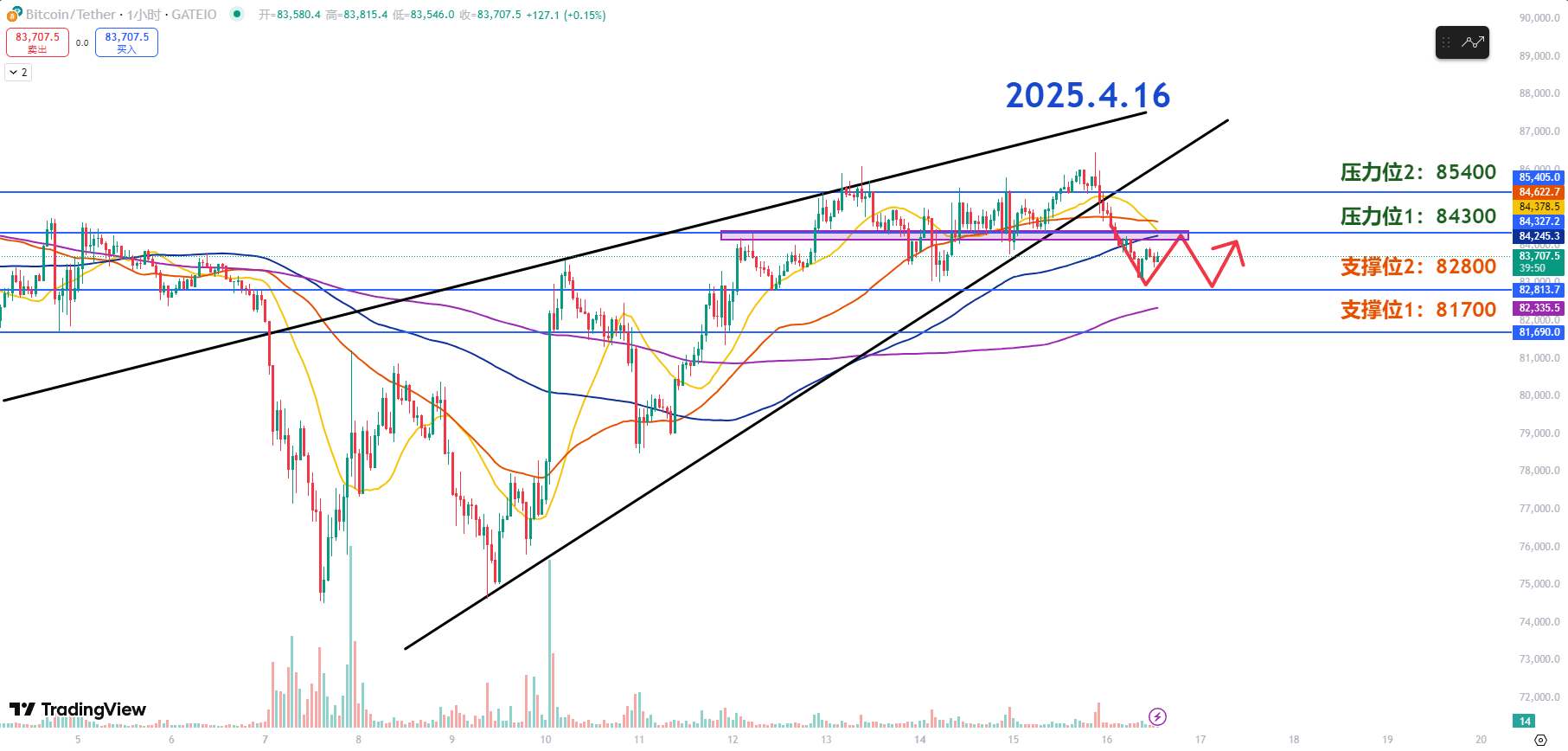

Master's Trend Analysis:

Resistance Levels Reference:

First Resistance Level: 85400

Second Resistance Level: 84300

Support Levels Reference:

First Support Level: 82800

Second Support Level: 81700

Today's Recommendation:

BTC dropped again after re-testing 86K, currently staying at 83K. Price accelerated downward after breaking through the lower edge of the ascending wedge pattern, temporarily stabilizing at the 200-day moving average on the 4-hour level, which can be used as a benchmark for the day.

The recent continuous support level of 84.3K has now turned into a resistance level. Since it was a strong support before and now converted to a strong resistance, and overlaps with the moving average, if there's no significant trading volume to support breakthrough, the coin price will continue to adjust here.

The dense trading area between 84.3K and 85.4K means if the price breaks through and consolidates in this area before re-testing the high point, it can turn to a short-term long.

If the price maintains the first support level, it can maintain the rebound expectation. However, due to low trading volume and strong resistance, if the price breaks below the first support level again, it will accelerate the drop to the previous low.

Before reaching the second support level, pay attention to the 200-day moving average on the 1-hour level. Although it has broken through the upward trend line, the dense trading area of the previous low point can be used as a stage support to seek short-term rebound opportunities.

4.16 Master's Swing Pre-set:

Long Entry Reference: Not recommended currently

Short Entry Reference: Light short position at 84700-85400 interval Target: 82800-81700

This content is exclusively planned and released by Master Chen (Public Account: Coin God Master Chen). If you want to understand more real-time investment strategies, hedging, spot, short, medium, and long-term contract trading methods, operational skills, and K-line knowledge, you can join Master Chen's learning exchange group, which now offers free fan experience groups and community live streaming!

Warm Reminder: Only the column public account (above) is written by Master Chen. Any advertisements at the end of the article or in the comments are unrelated to the author! Please be cautious in distinguishing authenticity, and thank you for reading.