TL;DR

The Web 3.0 vision of 2021 has faded, and Ethereum, its primary advocate, has suffered significant setbacks. Not only has the perception of Web 3.0 diminished, but Ethereum now contends with increased competition from platforms like Solana for the remaining market share. Critical challenges — L2 fragmentation, value accrual erosion, ecosystem control dilution, and leadership shortcomings — further undermine Ethereum. These issues disrupt user experience, divert economic value from ETH, and diminish Ethereum’s influence as L2s gain leverage. These problems culminated in one of ETH’s steepest price corrections. Yet, hope remains. Solutions include enforcing L2 interoperability, prioritizing ETH-centric infrastructure, and embracing decisive, performance-driven leadership. Ethereum’s robust infrastructure and vibrant developer ecosystem are enduring strengths, but swift, strategic action is essential to restore ETH’s prominence.

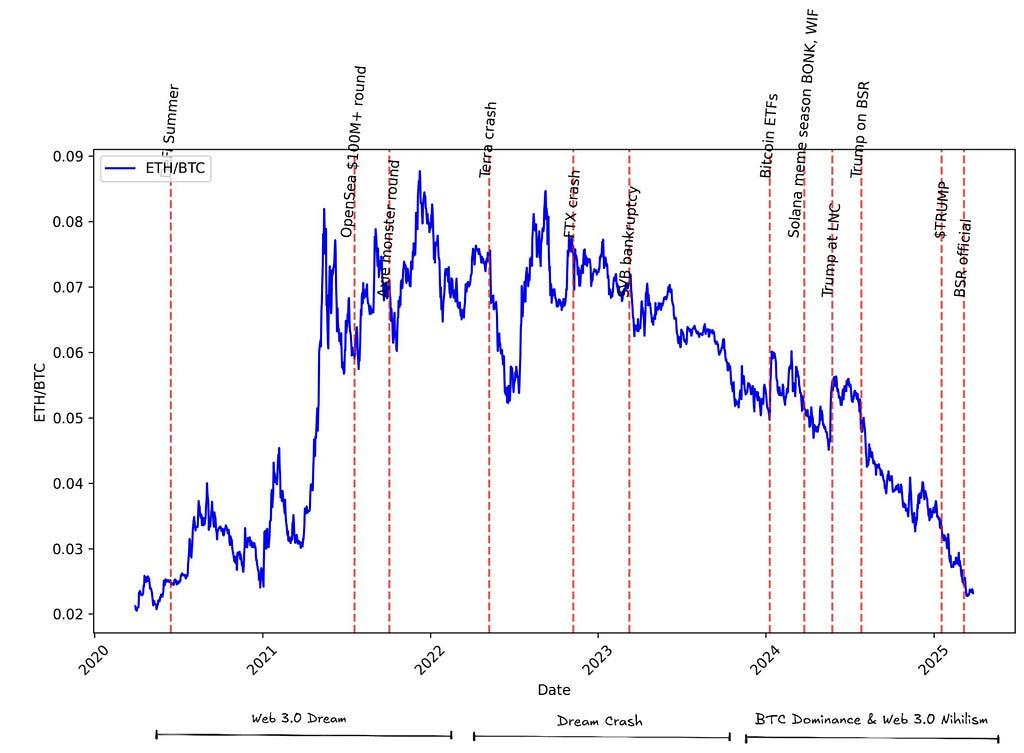

The transition from Web 3.0 euphoria to a more sobering reality has led to a reassessment of Ethereum’s core value proposition. The once-idealistic vision of a decentralized internet owned by its users has been overshadowed by a more cynical perception of the crypto industry as little more than Bitcoin and a digital casino. This shift in sentiment has hit Ethereum particularly hard, as it positioned itself as the bedrock of this new internet paradigm, only to face growing skepticism about its role.

Compounding this challenge, Ethereum is no longer the sole proxy for the Web 3.0 vision. Whether one holds an optimistic or nihilistic view of the industry’s future, it’s evident that Ethereum now faces competition, with Solana emerging as a hub for crypto consumer activity. Against this backdrop, this article seeks to identify Ethereum’s most pressing strategic challenges and propose actionable solutions to navigate this evolving landscape.

The Fundamental Challenges

While Ethereum grapples with a large number of challenges, this analysis focuses on the most pressing issues — L2 fragmentation, value accrual erosion, ecosystem control dilution, and leadership shortcomings — to avoid diluting attention from the core threats to its long-term dominance.

L2 Fragmentation and User Experience Strain

Among the most widely recognized challenges is Layer 2 (L2) fragmentation, which fractures the user experience and liquidity by introducing multiple competing execution layers. This erodes the composability advantages that once defined Ethereum’s mainnet — a strength still evident in today’s monolithic/integrated blockchains such as Solana.

For users, navigating this disjointed ecosystem means grappling with inconsistent protocols, standards, and bridges, which diminishes the seamless interaction Ethereum initially promised. Developers grapple with the burden of maintaining multiple protocol versions across L2s, while startups confront complex go-to-market strategies, forced to allocate scarce resources to reach users scattered across various layers. Consequently, many consumer-oriented applications have migrated to Solana, a hub where users and startups can prioritize entertainment and innovation over navigating fragmented infrastructure.

Ecosystem Control Dilution: A Growing Threat

More critically, Ethereum’s decision to outsource its scaling roadmap to L2s risks diluting its control over its own ecosystem. As general-purpose L2 rollups build their own ecosystems, they cultivate network effects that evolve into formidable moats. Over time, these execution layers accrue increasing leverage relative to Ethereum’s settlement layer, leading to a future where the community overlooks the settlement layer’s importance. Assets may begin to exist natively on execution layers, reducing Ethereum’s influence and value accrual potential as the settlement layer becomes commoditized.

Value Accrual Erosion: A Structural Challenge

The rise of L2s has significantly impacted ETH value accrual, as these platforms increasingly capture Miner Extractable Value (MEV) and fee revenue, leaving less to flow back to the Ethereum mainnet. This shift redirects economic benefits from ETH holders to L2 token holders, eroding the financial incentives for holding ETH as an investment asset. While this trend has notably diminished ETH’s value as a productive asset, it’s an inevitable challenge for any Layer 1 (L1) token — whether modular like Ethereum or monolithic. As MEV becomes a widely recognized and understood concept, its capture naturally migrates upward in the stack, a phenomenon Ethereum, as the most mature programmable blockchain, has experienced earlier and more visibly due to its L2-centric roadmap.

Monolithic chains and even L2s themselves will likely face similar challenges in the near future as applications increasingly dominate the MEV accrual stack. While ETH isn’t alone in grappling with this problem, it remains one of Ethereum’s most pressing concerns, demanding a carefully crafted strategy to address.

Leadership

Ethereum was also facing significant leadership challenges that were hindering its ability to tackle these issues effectively. Within the Ethereum community, performance objectives were often balanced against egalitarian ideals, which can slow progress. Additionally, Ethereum’s commitment to credible neutrality in governance and strategic decisions has proven to be a misstep. Compounding this, ETH holders lack a direct mechanism to influence strategically critical decisions, their only recourse being to sell their tokens in dissatisfaction.

In hindsight, it’s easy to define these issues, yet to some extent they may have been the result of regulatory concerns and mitigating the risks of state targeting rather than true lack of insight with respect to governing and leadership.

Strategic Mitigations: Addressing the Challenges

L2 Fragmentation: A Self-Correcting Mechanism

L2 fragmentation can be resolved through two primary pathways:

- market dynamics (natural selection) may naturally consolidate the ecosystem, leaving 2–3 dominant general-purpose L2s with significant activity, while others either fade away or pivot to stack approach–offering services to use-case-specific rollups.

- establishing robust interoperability standards could reduce friction across the broader rollup ecosystem, diminishing the potential for any single rollup to establish a dominant moat.

Ethereum should proactively drive the latter scenario by enforcing interoperability standards while it still retains leverage over its L2s. This leverage is eroding daily, and the longer Ethereum delays, the less effective this strategy will become. By fostering a unified L2 ecosystem, Ethereum can restore the composability advantages that once defined its mainnet, enhancing user experience and bolstering its competitive edge against monolithic blockchains.

Relying solely on market-driven consolidation, however, risks a bleak future for ETH. If a power-law distribution emerges around 2–3 dominant execution layers, Ethereum’s influence over these layers could diminish significantly. In such a scenario, each execution layer would likely prioritize value accrual for its own token, sidelining ETH and weakening Ethereum’s economic model. To avoid this outcome, Ethereum must act decisively to shape its L2 ecosystem, ensuring that value and control remain tied to the mainnet and ETH.

Value Recapture Mechanisms

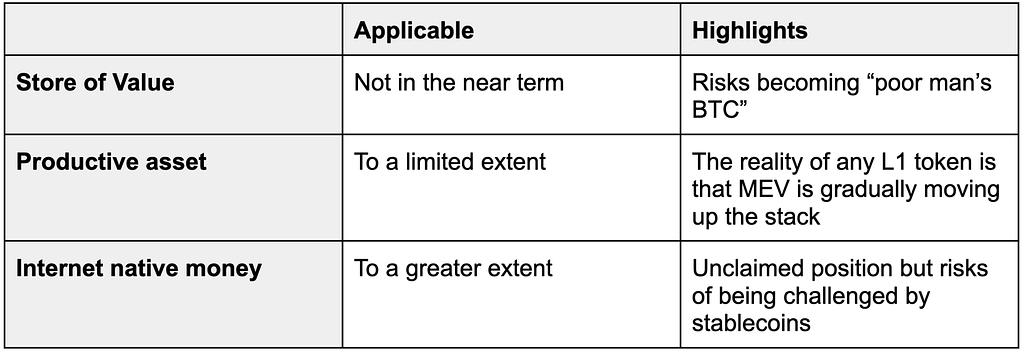

Relying solely on the productive asset narrative is not a sustainable long-term strategy for ETH — or any other L1 token. The window for L1s to capture the majority of MEV is likely limited to the next five years at most, as value accrual continues to shift upward in the stack. Meanwhile, the store-of-value narrative is firmly occupied by BTC, leaving little room for a second asset in this category. If ETH attempts to compete here, the market may perceive it as a “poor man’s $BTC” — akin to silver’s historical positioning as a lesser alternative to gold. While ETH may eventually demonstrate clear advantages over BTC as a store of value, this shift could take at least a decade to materialize, a timeline ETH cannot afford to wait out. In the interim, Ethereum must carve out a distinct narrative to maintain its relevance.

Positioning ETH as “money” and the pristine on-chain collateral offers the most promising path for the next decade. While stablecoins dominate on-chain finance as payment mediums, they remain tethered to off-chain ledgers. The role of internet-native, unstoppable money remains unclaimed, and ETH is uniquely positioned to seize this opportunity. However, this requires Ethereum to reclaim control over its ecosystem’s general-purpose layer and prioritize ETH adoption over the proliferation of wrapped ETH standards.

Reasserting ecosystem ownership can be achieved through two key approaches: a) scaling Ethereum’s L1 to deliver performance parity with more centralized chains, ensuring consumer apps and DeFi experience no lag; and b) launching Ethereum-native rollup and focusing all business development and adoption efforts on this layer. By concentrating activity on ETH-owned infrastructure, Ethereum can reinforce ETH’s centrality in the ecosystem. Ethereum must transition from the outdated ETH-aligned paradigm to an ETH-owned ecosystem model, prioritizing direct control and maximizing value accrual for ETH.

However, both reclaiming ecosystem control and reinforcing ETH adoption are delicate decisions that risk alienating key contributors, such as rollups and liquid staking providers. Ethereum must navigate this carefully, balancing the need for control with the risk of fracturing its community, to ensure ETH can successfully establish its new narrative as the cornerstone of the ecosystem.

Leadership Evolution

Finally, Ethereum’s leadership must evolve to address its governance and strategic challenges. Ethereum leaders should emerge with a performance-focused mindset, a greater sense of urgency, and a pragmatic approach to ecosystem development. This evolution requires abandoning the commitment to credible neutrality that has hindered decision-making, particularly in developing Ethereum’s product line and positioning ETH as a competitive asset.

Moreover, the market has signaled its dissatisfaction with Ethereum’s tendency to outsource critical infrastructure — from rollups to staking — to fragmented entities. To address this, Ethereum must transition from the outdated ETH-aligned paradigm to an ETH-owned model, ensuring that critical infrastructure is unified under a single ticker: $ETH. This shift will reinforce ETH’s centrality and restore market confidence in Ethereum’s strategic direction.

ETH’s Marketing Challenge & Untapped Narrative Potential

Despite all its challenges, Ethereum still possesses a wealth of strengths that support its position in the crypto space — strengths its leadership has often underplayed, allowing negative criticism to overshadow its narrative. Highlighting these positives offers a more balanced perspective on Ethereum’s potential.

Battle-Tested Infrastructure

Ethereum, alongside Bitcoin, delivers unmatched decentralization, meeting the rigorous demands of sovereign entities and major financial institutions. Its consensus mechanism provides security guarantees no other smart contract platform can rival, ensuring true censorship resistance — non-negotiable for infrastructure securing billions in value. Ethereum’s DeFi ecosystem has secured approximately $76.32 trillion in cumulative value over time (TVL * days) with minimal exploits, establishing a deep moat through its proven time-value security.

Ethereum currently hosts over $120 billion in stablecoins, accumulated in an era lacking clear regulatory frameworks or widespread institutional adoption. With regulatory clarity emerging and institutional tailwinds driving stablecoin adoption, Ethereum is poised to host upwards of $1 trillion in stablecoins within the next decade. This growth, fueled by new issuance and increasing trust in Ethereum’s unmatched security and composability, could solidify its role as the platform for global finance.

Future-Proof Design

Ethereum’s forward-looking architecture sets it apart. It boasts a superior quantum-resistance transition path compared to Bitcoin and a culture of adaptability that drives continuous technological evolution. Unlike $BTC, which may face future security budget constraints, Ethereum’s flexible monetary policy allows it to adjust to market conditions while preserving strong security incentives, ensuring long-term resilience.

Unrivaled Development Ecosystem

Ethereum hosts the largest and most diverse developer community in blockchain, with nearly a decade of accumulated knowledge and best practices. This intellectual and social capital creates another layer of moat for the EVM ecosystem, empowering innovation and adoption at a scale.

Modular Approach: The Only Path for Scalable, Decentralized Systems

Ethereum’s modular design has made significant progress in addressing the blockchain trilemma — balancing decentralization, scalability, and security. As time progresses, it’s increasingly evident that monolithic chains must sacrifice decentralization to achieve global financial scale, whereas Ethereum’s modular strategy offers the only sustainable path to scalability while preserving trustlessness and decentralization, a strategic choice that will prove increasingly obvious.

The Most Customizable Stack

Ethereum’s L2 ecosystem provides unparalleled customizability, making it the ideal platform for application-specific use cases and institutional adoption. Institutions can build tailored L2s, leveraging technologies like Fully Homomorphic Encryption (FHE) for privacy, while companies like Robinhood can replicate models like payment for order flow through payment for sequencing on their L2s. Anchored to Ethereum’s L1 — the most secure public ledger — these L2s offer a safety net: users can always fall back to L1 for trustless settlement, even if an L2 becomes unavailable.

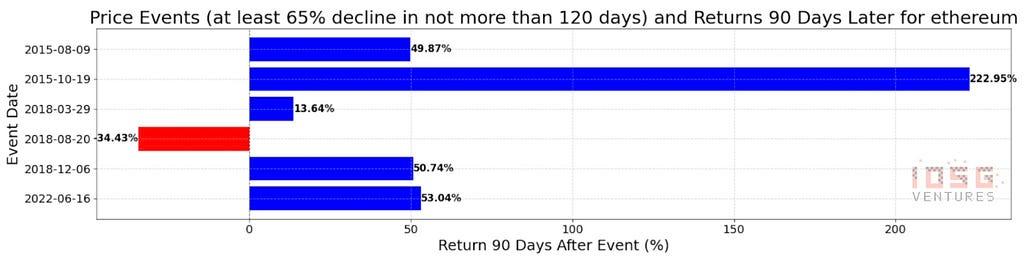

Market Signals: $ETH In Historically Oversold Territory

The recent price movement has positioned ETH as a contrarian and unpopular bet, with ETH holders signaling a lack of confidence in recent developments. Such a dramatic correction — only the sixth of its kind in ETH’s history, with five occurring during its infancy — is a rare and significant event. For Ethereum to experience a decline of this magnitude in its 10th year is a wake-up call that no entity in the ecosystem can ignore. Historically, five out of six such corrections were followed by strong recoveries in the subsequent months, offering a spark of hope. Whether ETH can replicate this pattern or continue its steep downward trajectory hinges on the message Ethereum’s leadership delivers in the short term and their execution over the next 12 months. Despite the challenges, the situation is far from irreparable, and a strategic response could pave the way for a robust recovery.

To reclaim its dominance and restore confidence in ETH, Ethereum must urgently address its critical challenges. First, it must enforce robust L2 interoperability standards to mitigate fragmentation and preserve the seamless composability that once defined its mainnet. Second, Ethereum must shift from an ETH-aligned to an ETH-owned ecosystem model, prioritizing L1 scaling and Ethereum-native rollups to reassert control and maximize value accrual for ETH. Finally, leadership must evolve, abandoning credible neutrality for a performance-driven approach that unifies critical infrastructure under $ETH. Failure to act decisively risks ceding ground to competitors like Solana and relegating ETH to a commoditized settlement layer.

Ethereum Reimagined: Restoring Control and Value to ETH was originally published in IOSG Ventures on Medium, where people are continuing the conversation by highlighting and responding to this story.