Since its official launch in February 2025, Layer2 network Unichain seemingly did not immediately create a massive market splash, coinciding with the overall crypto market adjustment period, and its voice was temporarily drowned out.

VX: TZ7971

However, the silence did not last long. On April 15, after Unichain and Gauntlet jointly launched a $5 million liquidity incentive activity, Unichain's cross-chain activity significantly warmed up. Within just 24 hours, 11 addresses collectively injected tokens worth approximately $22.23 million into Unichain. The sudden "cash giveaway" activity took effect immediately.

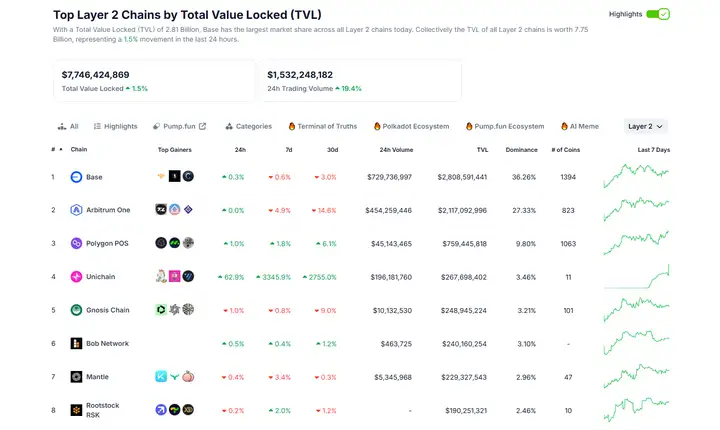

According to defillama data, Unichain's TVL experienced a stunning leap after April 15, soaring from around $9 million to $267 million in just 2 days. This figure quickly propelled it to the 4th position among numerous Layer2 networks. Is Unichain's TVL explosion driven by incentives merely a brief "harvesting" carnival, or an effective validation of Uniswap, the DeFi giant, turning from the protocol layer to the underlying public chain? Can Unichain seize this opportunity to truly become the new home of DeFi?

Returning to DeFi Leadership?

With Unichain's mainnet launch and market activation through incentive activities, Uniswap Labs' full-disk layout has also begun to synchronously land recently. From Uniswap V4 deployment to regulatory waves subsiding, and community governance pushing the fee switch proposal, Uniswap seems to be striving to return to DeFi leadership.

In January this year, Uniswap V4 was deployed on over 10 mainstream networks including Ethereum, Polygon, and Arbitrum. V4 introduced the "Hooks" mechanism, allowing developers to insert custom code at key nodes in the liquidity pool lifecycle, significantly enhancing the protocol's customizability and transforming it from a DEX to a DeFi developer platform. As of April 17, Uniswap V4's TVL had reached $369 million, surpassing the V2 version.

Moreover, the prolonged SEC investigation was announced to have ended in February 2025 without taking enforcement action against Uniswap Labs, and they reached a $175,000 settlement with CFTC regarding specific leveraged token trading. Overall, the systematic regulatory risks facing Uniswap's core business have significantly decreased.

The support of funds is indispensable for Unichain and V4's promotion. In March this year, the "Uniswap Unleashed" proposal was passed, approving a total of approximately $165.5 million to support Unichain and V4's growth, including $95.4 million in grants, $25.1 million in operating expenses, and $45 million in liquidity incentives. These funds come directly from the Uniswap DAO treasury.

The protocol fee switch is undoubtedly one of the core issues most concerned by UNI holders. Although the related proposal has passed the initial voting and final "Uniswap Unleashed" fund voting, its implementation still requires waiting for the Uniswap Foundation to resolve related legal entity issues. Once successfully activated, it will directly bring protocol income to staking and governance participating UNI holders, becoming a key step in UNI token value capture.

Overall, Unichain looks more like a core, highly optimized "home field" built by Uniswap, with V4 being the strongest weapon displayed on this battlefield. Ultimately, migrating most TVL to Unichain is a possible long-term goal, but seems difficult in the short term. Currently, Unichain's TVL (around $178 million) still has a significant gap compared to Ethereum mainnet (around $2.5 billion) and Base (around $600 million).

However, Uniswap will likely continue to stimulate the achievement of this ultimate goal through ongoing community incentives. Currently, Uniswap DAO has approved $21 million in initial liquidity incentives for Unichain (for 3 months) and is expected to require around $60 million in incentive funds in the first year. Additionally, there is a $95.4 million grant budget, part of which will be used for the Unichain ecosystem.

Whether Unichain can truly transform from a "protocol's application chain" to "DeFi's new home" still faces many challenges. Can short-term incentives be converted into long-term user stickiness and real ecosystem prosperity? Can V4 Hooks' innovative potential be fully unleashed? When will the much-anticipated protocol fee switch finally land and truly empower the UNI token? For Uniswap and UNI holders, the future is filled with opportunities and challenges.