This article is machine translated

Show original

🧠 Investment Thinking in the Top 5%

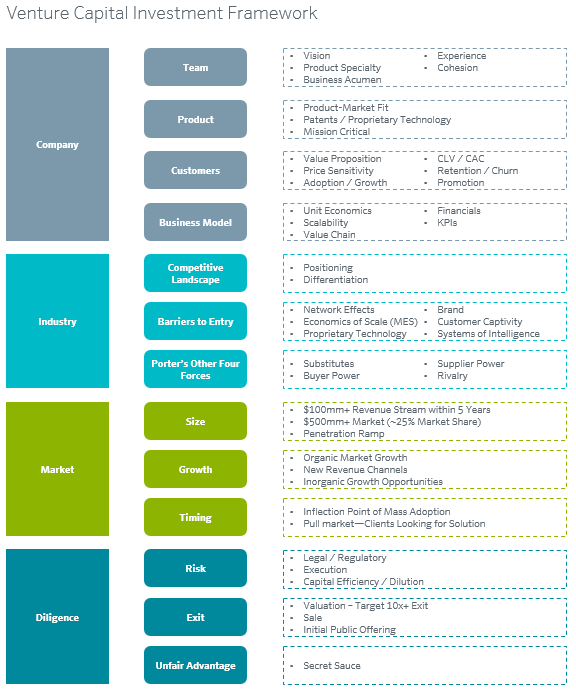

Sometimes I wonder how large organizations make profits in investments while individual investors like myself mostly incur losses.

So is there a common framework or formula that I can apply?

It is not twitter.com/gm_upside/status/1...

2025/04/11 12:37 :

Vietnamese Stocks and Crypto: What is the Wise Path to Wealth?

With unstable macroeconomic conditions and markets like #stock and #crypto experiencing significant declines. Some people currently believe that the market has entered a downtrend and are withdrawing funds to transfer to safer investment channels twitter.com/gm_upside/status/1...

1. Long-term thinking

If you have ever read books or watched interviews with investing legends like Warren Buffett, Benjamin Graham, or any other great investor, you will notice a clear commonality:

Long-term thinking is the core

2. Understand intrinsic value

In investing – especially crypto – understanding what you are investing in is paramount. Only by understanding the intrinsic value can you avoid being swayed by rumors or FUD.

Many newbies often invest in altcoins in a

3. Risk Management

No matter what you invest in, the most important thing is not whether you are right or wrong, but how much money you make when you are right and how much you lose when you are wrong" as George Soros once said.

Warren Buffett also emphasized:

“Rule No. 1: Don't lose money.

4. Contrarian Thinking

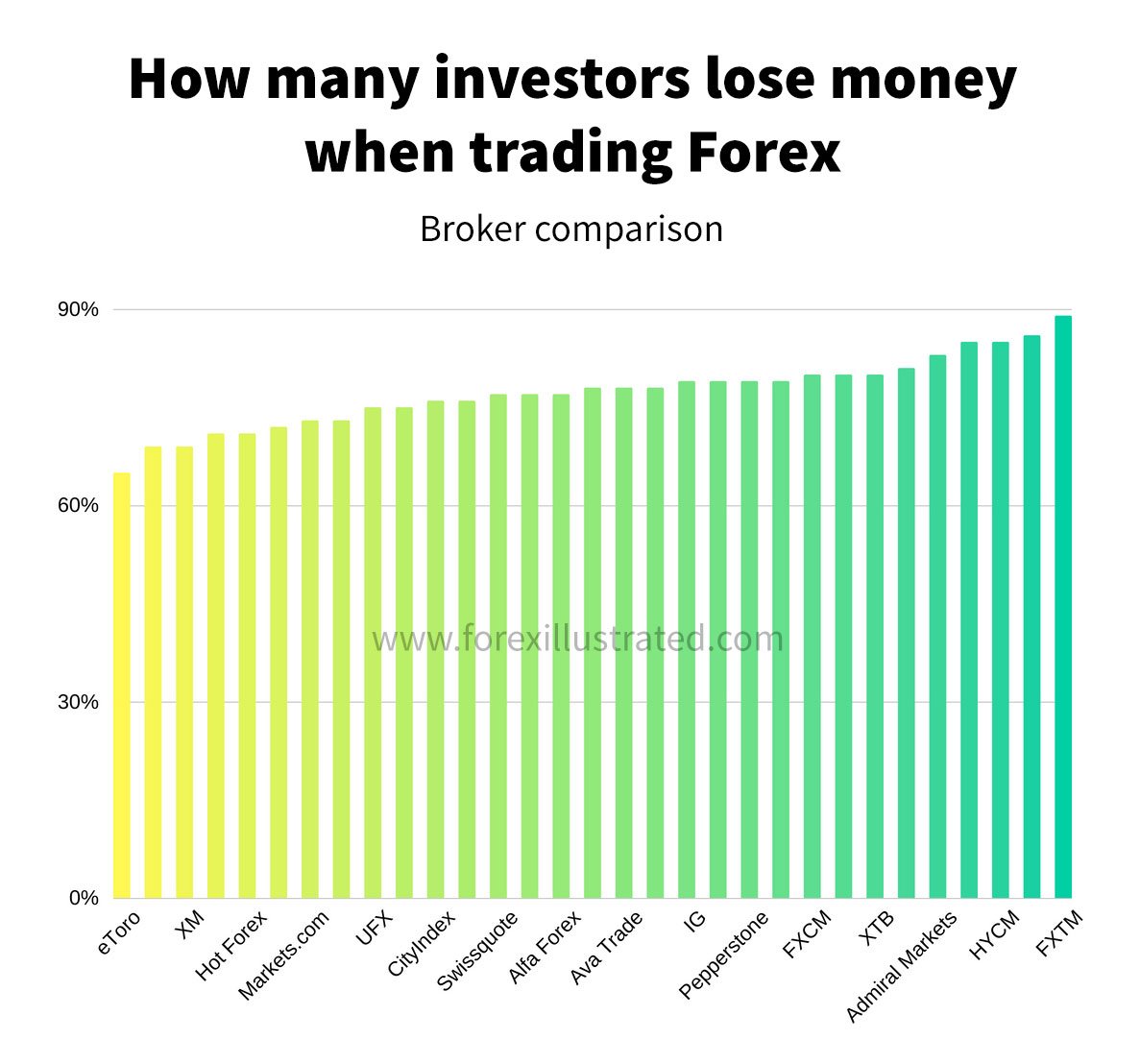

In trading, the success rate is very low – only about 0.28% of professional traders are profitable, even though they are in the industry.

In crypto, many people have started to apply the Fear & Greed index to invest against the majority psychology:

- Buy when the market

5. Respect what you do

Many people often say “playing stocks, playing crypto” – but for me, this is a way of calling that shows a lack of seriousness right from the beginning. And if you don’t XEM what you do seriously, it will be very difficult to survive in the long term.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content