📝 Editor’s Note:

Welcome to Part One of OurNetwork's two-part series covering lending protocols, platforms which allow users to borrow permissionlessly, typically against collateralized assets.

This issue features some of the most impactful projects in the DeFi subsector — this includes Aave, crypto’s largest protocol by total value locked, as well as Morpho, whose peer-to-peer model propelled the relative newcomer to rank third by TVL among lenders.

We're also featuring Euler, whose modular infrastructure allows for permissionless vault creation. Euler has ridden a wave of momentum in 2025 to enter the top 10 lending protocols by TVL.

Finally, we've got coverage of Suilend, the leading lending protocol on the Sui blockchain.

Shoutout to Omer + Chaos Labs, JJ, Miguel, and Biff for writing up the reports below.

Let’s get into it.

– ON Editorial Team

Lending Pt. 1 🏦

Aave | Morpho | Euler | Suilend

Aave 👻

👥 Omer Goldberg | Website | Dashboard

📈 Aave Proves Itself as DeFi’s Premier Lending Protocol with 14 Network Deployments and Best-in-Class, Battle-Tested Risk Management

Aave is a decentralized, non-custodial protocol that enables users to lend and borrow crypto assets permissionlessly. Aave has over $28B in TVL across deployments on Ethereum, Arbitrum, Optimism, Polygon, Avalanche, Base, zkSync, and most recently, Sonic. Ethereum remains the largest market on Aave, with over $21.6B in total supply. However, BNB and Avalanche have experienced rapid growth year-to-date, up +19% and +14%, respectively. Sonic, a newly launched EVM Layer 1 developed by the well-established Fantom Foundation, has already reached $480M in TVL.

✏️ Editor's Note:

TVL figures for Aave, Morpho, and Euler include borrowed assets. This means that, in addition to the deposited assets in the platforms, TVL includes assets borrowed against those deposits. The thinking there is that the protocol programmatically 'owns' these borrowed assets.

This does inflate TVL for lenders as it effectively double counts the borrow assets, which were already deposited —and counted as TVL— by a separate user.

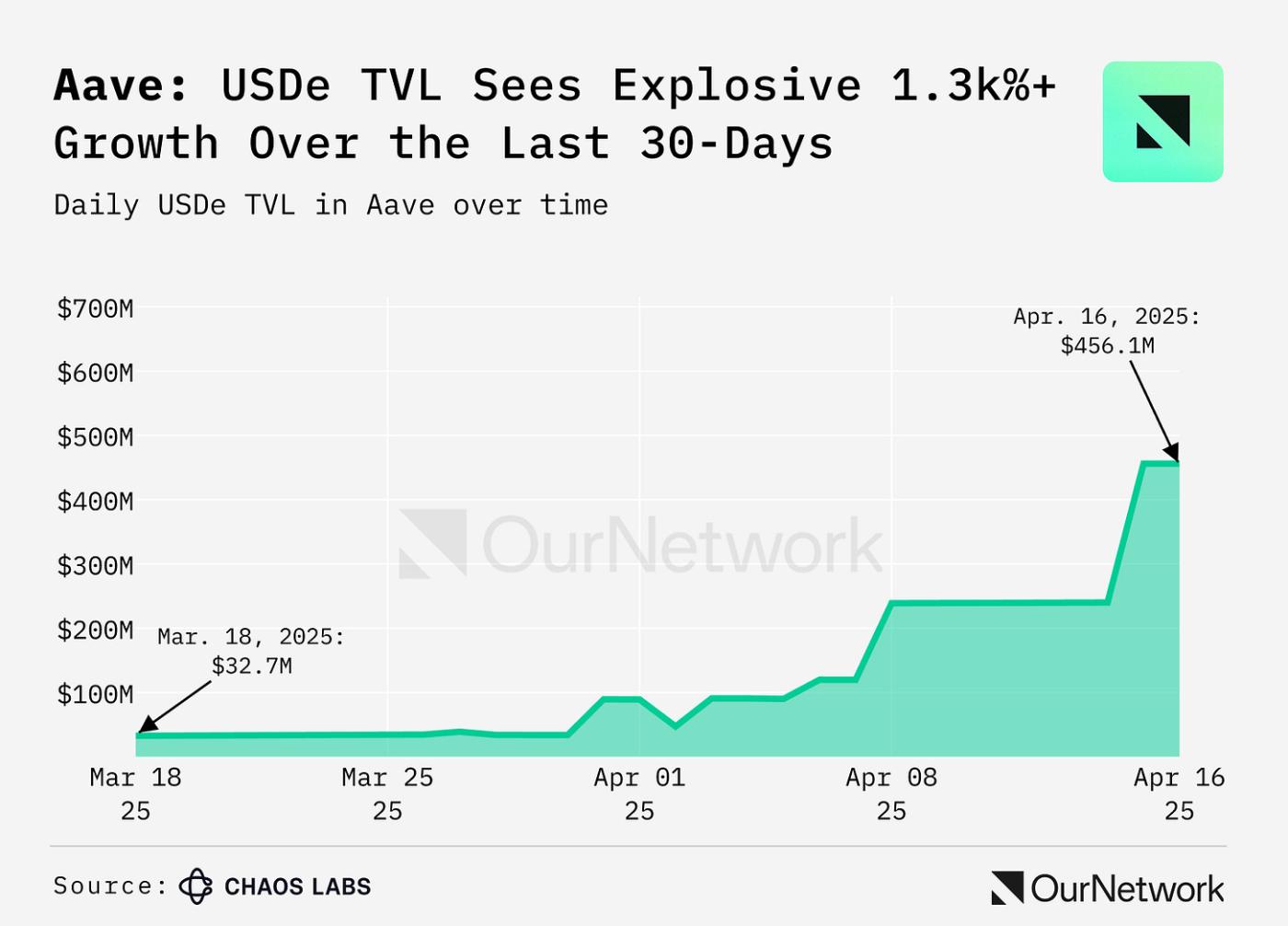

Stablecoins and synthetic dollars currently comprise approximately 31.3% of Aave’s total TVL, totalling $8.81B. Ethena’s synthetic dollar, USDe, has seen explosive growth of ~1,340% over the past month — reaching over $450M in TVL.

Quick Links: Disclosures

ork! Subscribe for free to receive new posts and support our work.