1/ @ethena_labs is evolving from a single synthetic dollar issuer to an institutional DeFi chain.

In this thread, we will dive into our report on Ethena’s evolution and explore how it is expanding its product suite to meet new market demand 🧵

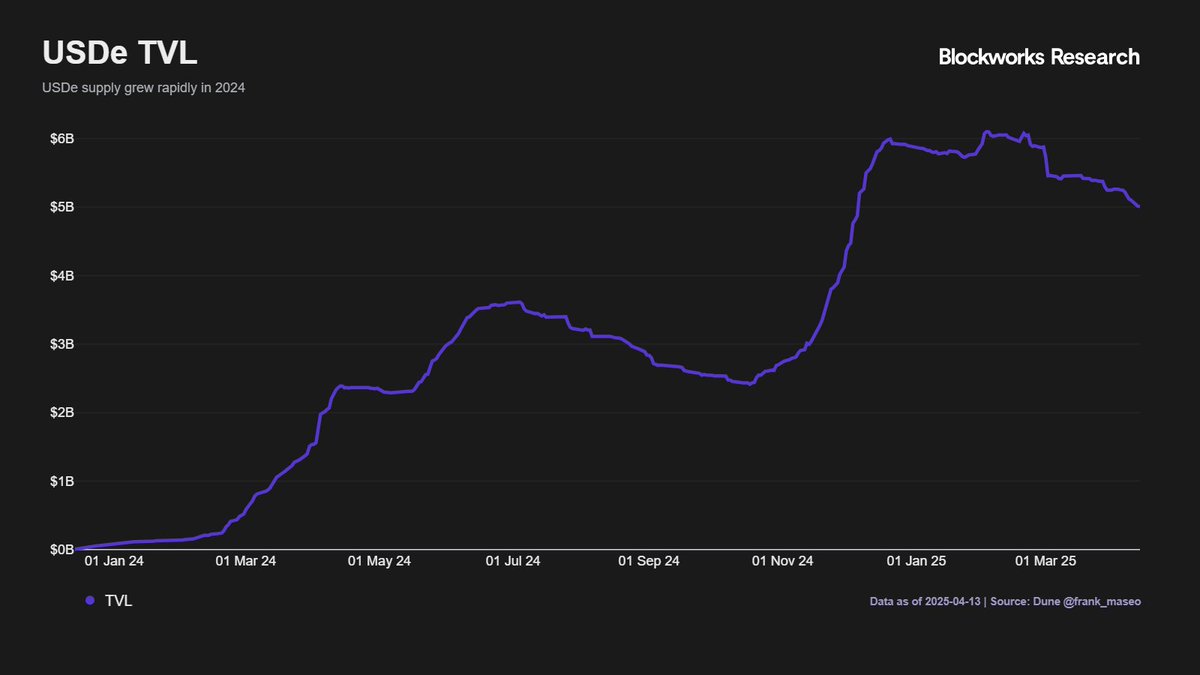

2/ USDe, sUSDe, and soon iUSDe constitute Ethena’s core products.

iUSDe will introduce institutional compliance—incorporating KYC/KYB, transfer restrictions, and permissioned issuance—to enable TradFi participants to access Ethena’s delta-neutral yield engine.

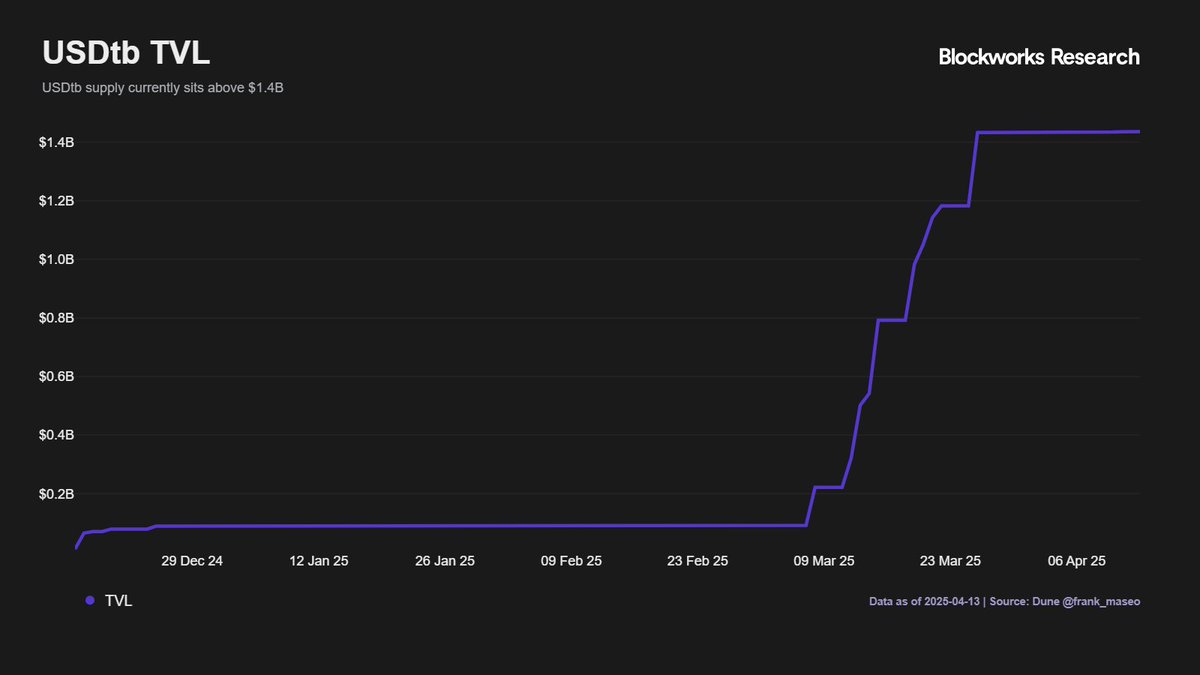

3/ USDtb launched in December 2024 as Ethena’s Treasury-backed stablecoin, targeting the rapidly growing fiat-stablecoin market.

By backing token supply with US Treasuries, mainly BlackRock's BUIDL fund, USDtb offers onchain dollars with robust security and competitive yield.

4/ @convergeonchain, an EVM-compatible Arbitrum Orbit Chain expected to launch in Q2 2025, is built for RWA tokenization and institutional settlement.

It features a hybrid permissioned/permissionless model and native KYC wrappers to bring TradFi onchain.

5/ Ethena’s future rests on three high-growth vectors:

• Stablecoin supply (>$220 B, doubling YoY)

• Crypto derivatives open interest (~$53B)

• RWA tokenization TAM (multi-trillion-dollar opportunity)

Ethena sits squarely at this nexus.

6/ Stablecoins are growing rapidly, with many forecasts predicting they could reach $1T in market cap over the next few years.

If previous YoY growth (~101%) continues, this would produce favorable tailwinds for Ethena.

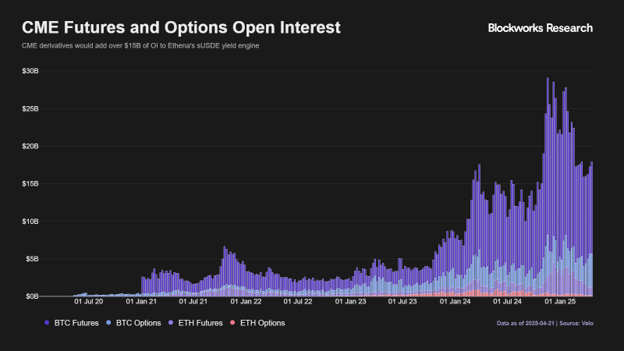

7/ A large portion of BTC and ETH open interest sits in CME and ETF derivatives (futures and options).

If Ethena can move into these markets, they could greatly expand the USDe supply.

8/ Proposed U.S. legislation (GENIUS & STABLE Acts) could provide regulatory clarity, legitimizing synthetic dollars and yield-bearing tokens under defined frameworks.

Conversely, adverse provisions may classify sUSDe/iUSDe as securities, limiting market access and increasing

9/ Other risks include:

• Yield compression from competitors entering the space

• Collateral de-pegs or custodian/exchange failures

• Insufficient staking utility of ENA

10/ Ethena’s multi-product roadmap and institutional orientation position it to capture substantial DeFi and RWA market share, with the Q2 2025 Converge launch being a pivotal catalyst.

Subscribe to Blockworks Research to read the full report by @_dshap.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content