This article is machine translated

Show original

🇺🇸USD Rises to Global Dominance: How? 🗽

1. Why Did Reserve Currencies Emerge?

2. Ancient and Medieval Periods

3. Renaissance and Discovery Period (13th-16th Centuries)

4. Trade and Industrial Period (17th-19th Centuries)

5. Modern Period (20th Century) twitter.com/gm_upside/status/1...

2025/04/23 22:20 :

💸 "Investment is not about seeing asset prices rise or fall, but about seeing where the cash flow is going."

Here are the reasons why brothers and sisters need to know about money supply

1. What is money supply?

2. What are M0, M1, M2, and M3 money supply?

3. Why does money supply affect the market?

4. Should pay attention to <twitter.com/gm_upside/status/1...>

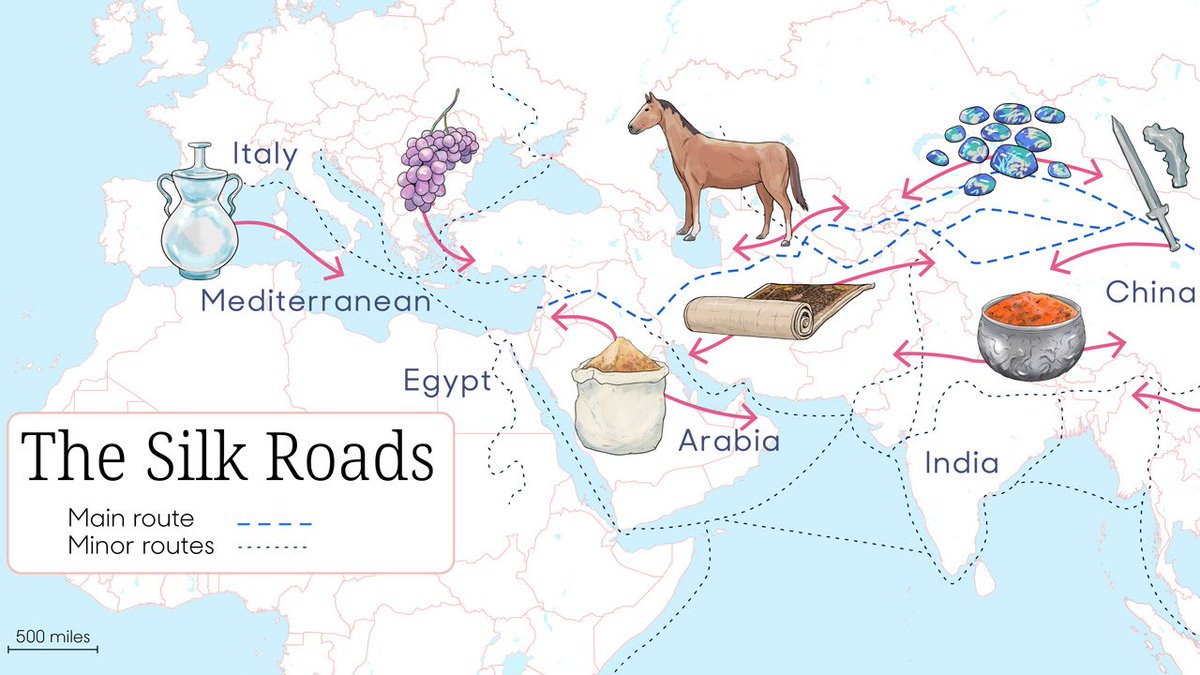

1. Why was the reserve currency created? 🏦 The global reserve currency was created to meet the needs of international trade, helping countries conduct cross-border transactions efficiently, stabilize exchange rates, and settle payments.

2. Ancient and Medieval Periods

Greek Drachma (5th century BC):

Silver coins popularized by the vibrant trade in Athens and the port of Piraeus, widely accepted throughout the Mediterranean. Value stabilized by silver from the Laurion mines. Lost status after wars and

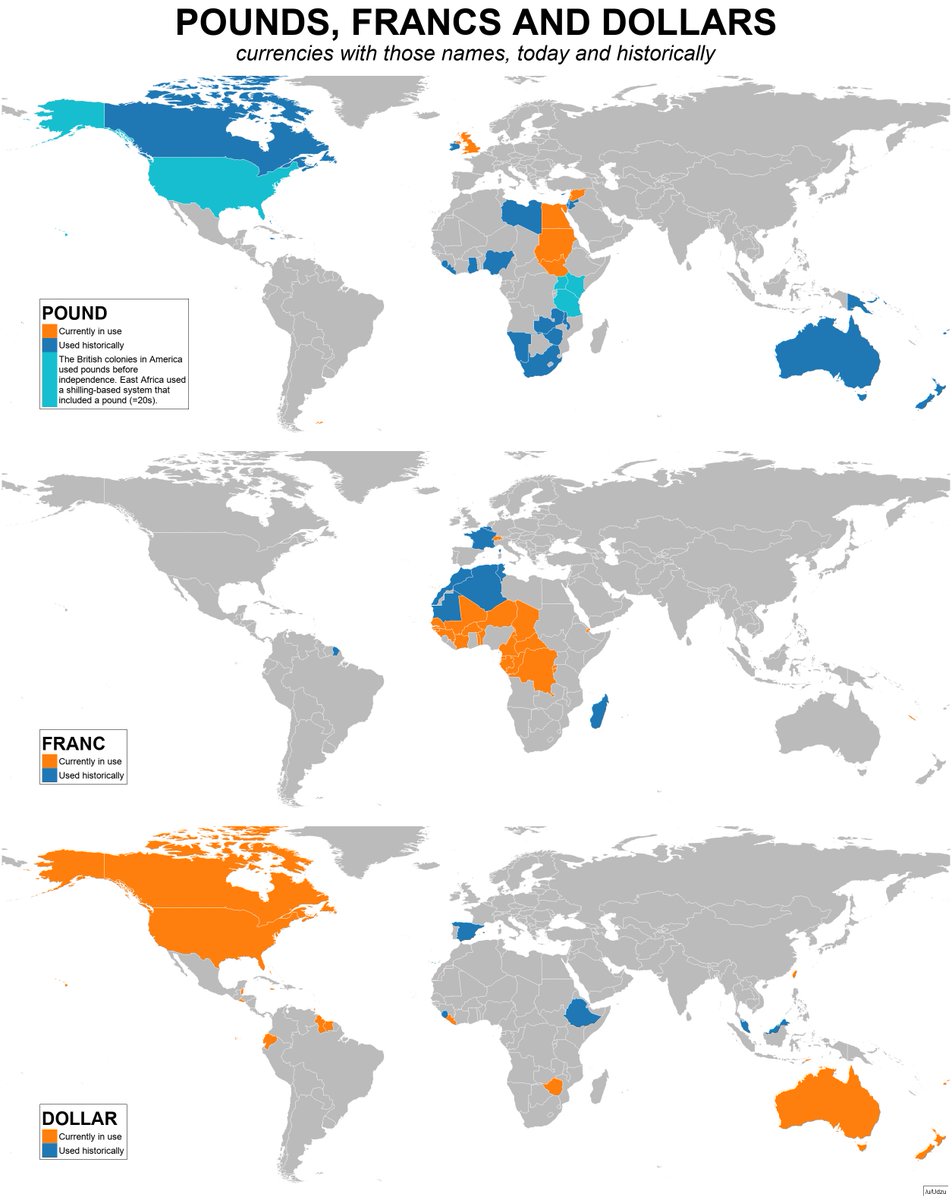

3. The Renaissance and Discovery Period (13th-16th centuries)

🇮🇹 Florin & Ducat (Italy, 13th–16th century):

The florin (Florence, 1252) and ducat (Venice, 1284) were standard gold coins, popular in Mediterranean trade. Emulated by many countries. Lost Vai when Europe

4. The Commercial and Industrial Period (17th-19th centuries)

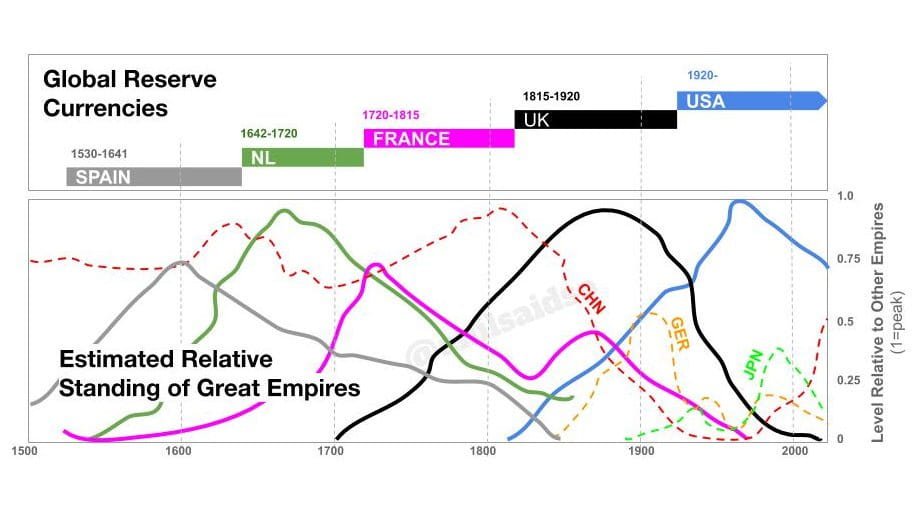

🇳🇱Dutch Guilder (1640–1720):

- During the Dutch Golden Age, the Guilder became a strong currency thanks to global trade and a modern financial system from the Bank of Amsterdam.

- However, the Netherlands weakened due to

5. Modern Period (20th Century to Present)

🇺🇸 US Dollar (USD)

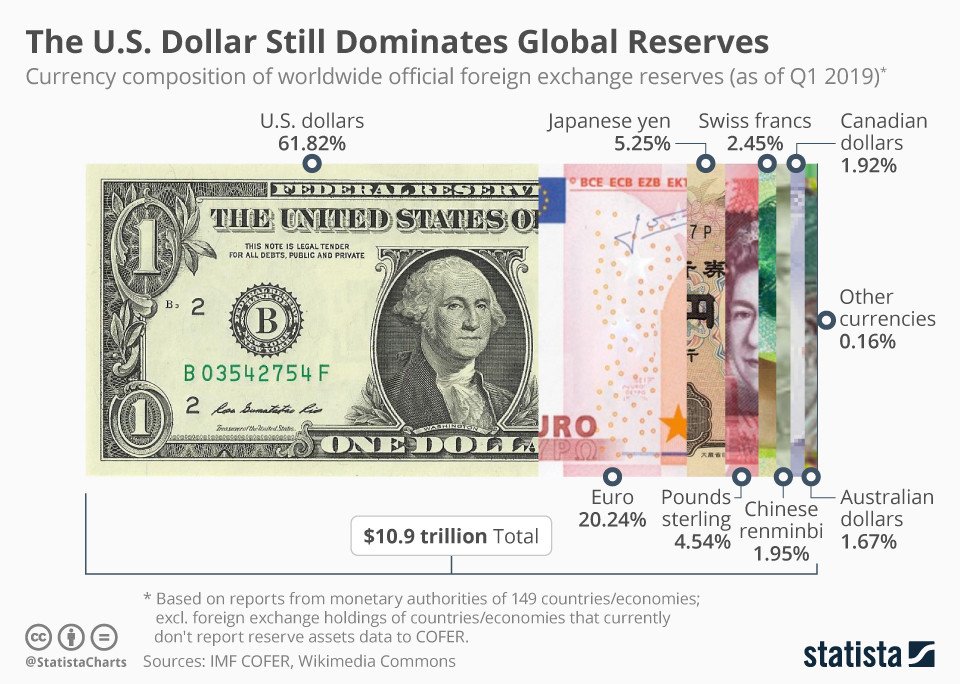

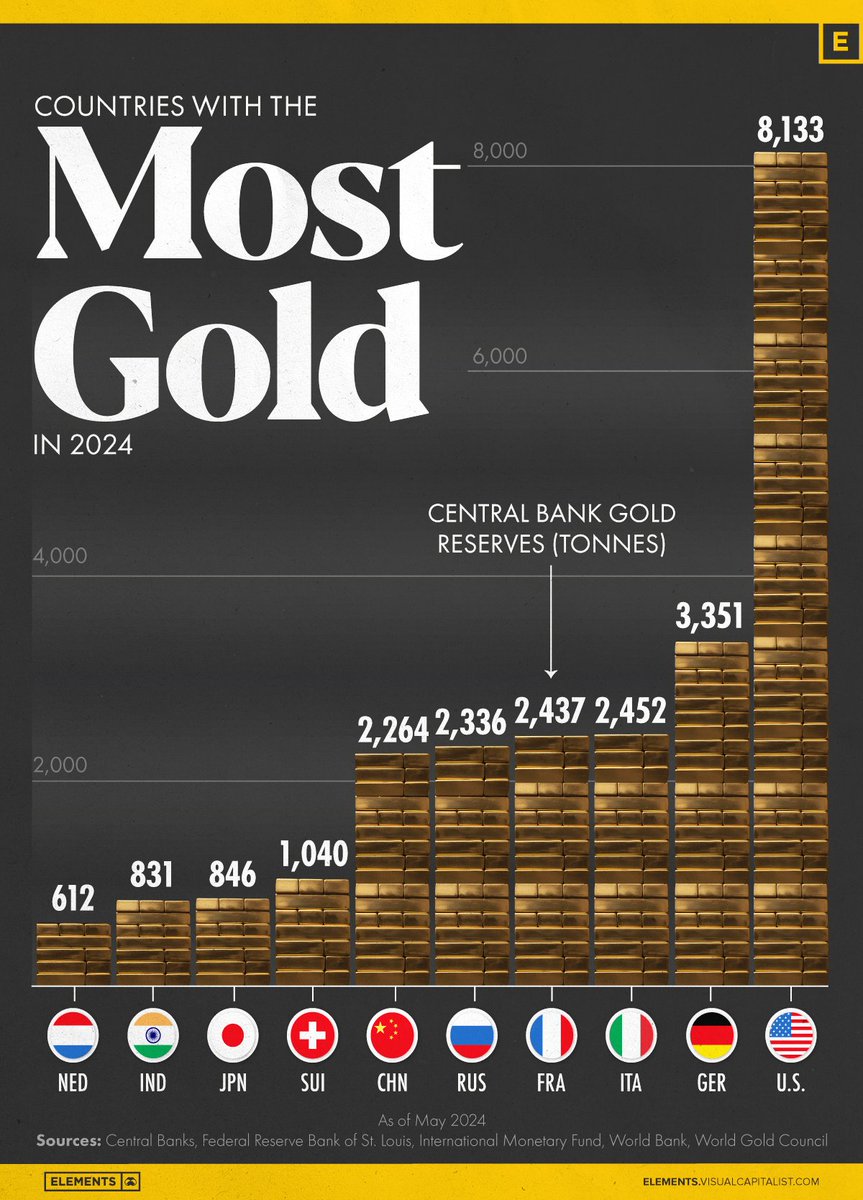

After World War I, the US became a global creditor and accumulated most of the world's gold. In 1944, the Bretton Woods Agreement formalized the USD as the global reserve currency, tied to gold.

🗽In 1971, Nixon

6. How is the reserve currency strengthened?

The change in the reserve currency is influenced by many intertwined factors.

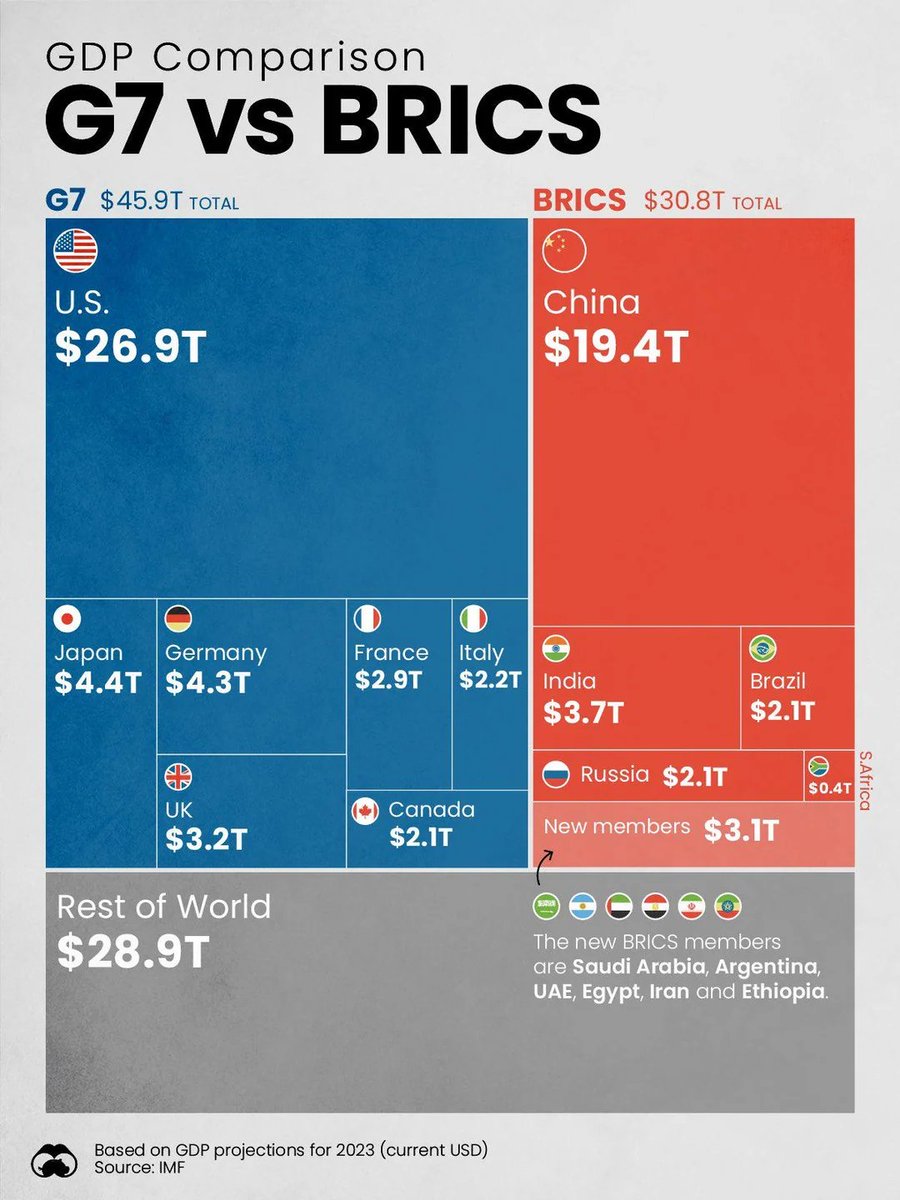

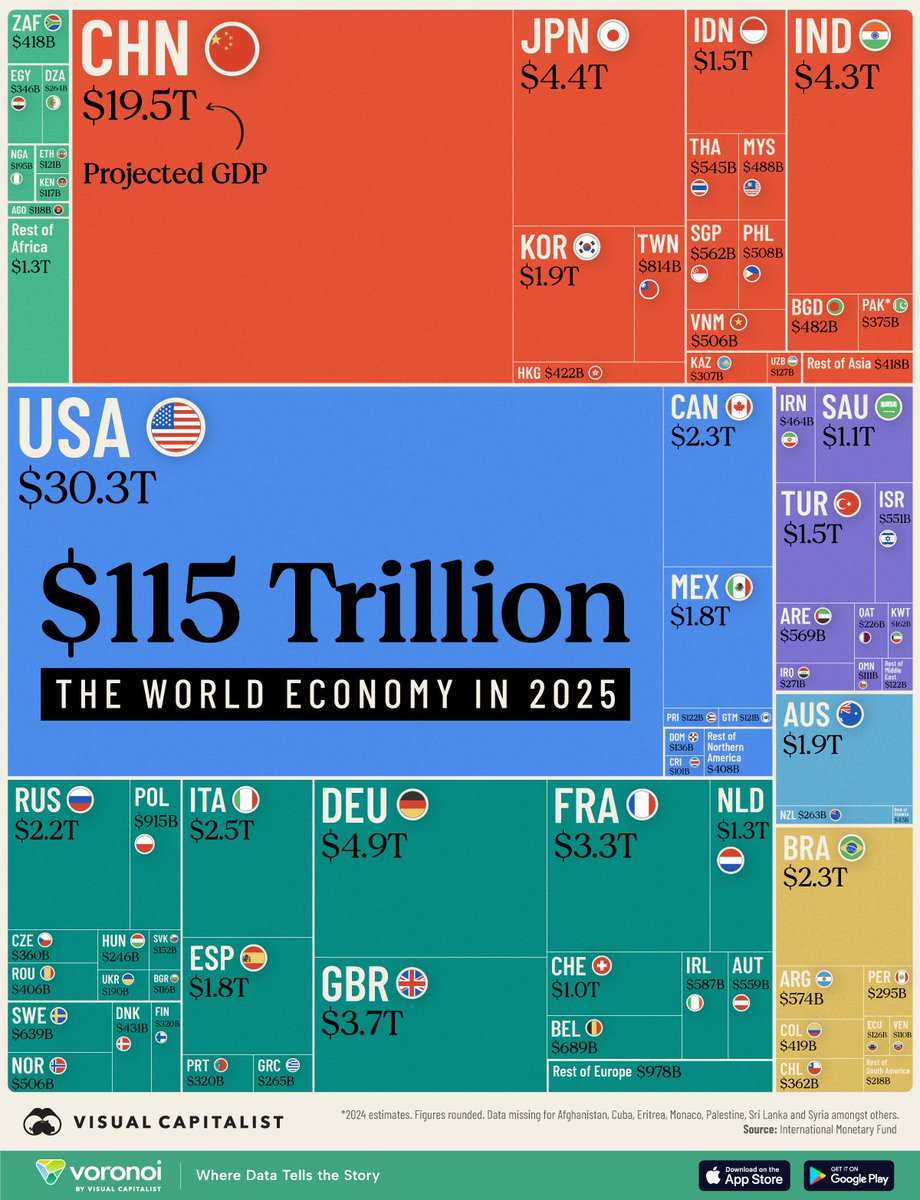

🎯First of all, economic strength is the foundation.

- 16th century Spain dominated thanks to silver from the Potosi mines, 19th century England led

(1 second advertisement😆)

If the article is useful, I hope you guys support @gm_upside with a follow & retweet 😍

🛫 There is no shortage of good articles, just comment:

"Help me analyze project ABC, trend XYZ,..." and Upside will post it right away ✍️

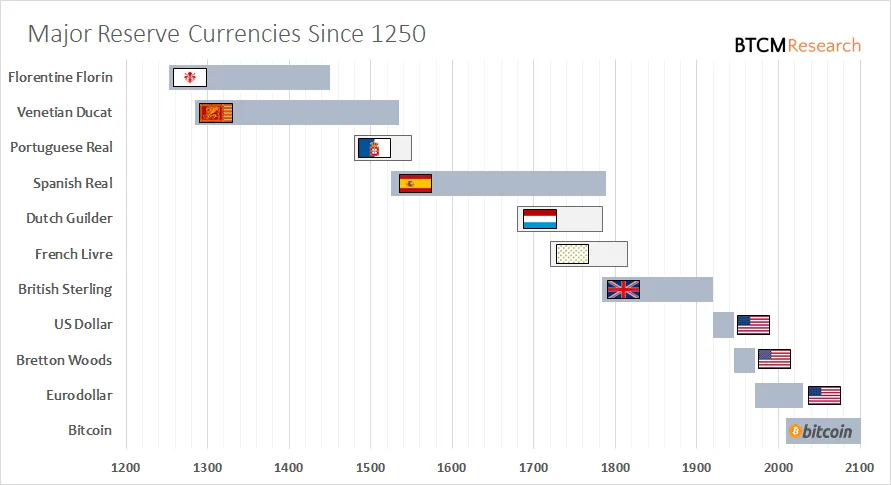

7. The 100-Year Curse of Reserve Curses

Historically, reserve currencies typically last between 80 and 110 years. The Spanish real lasted 110 years (1530–1640), the Dutch guilder 80 years (1640–1720), and the British pound 105 years (1815–1920).

The US dollar, since

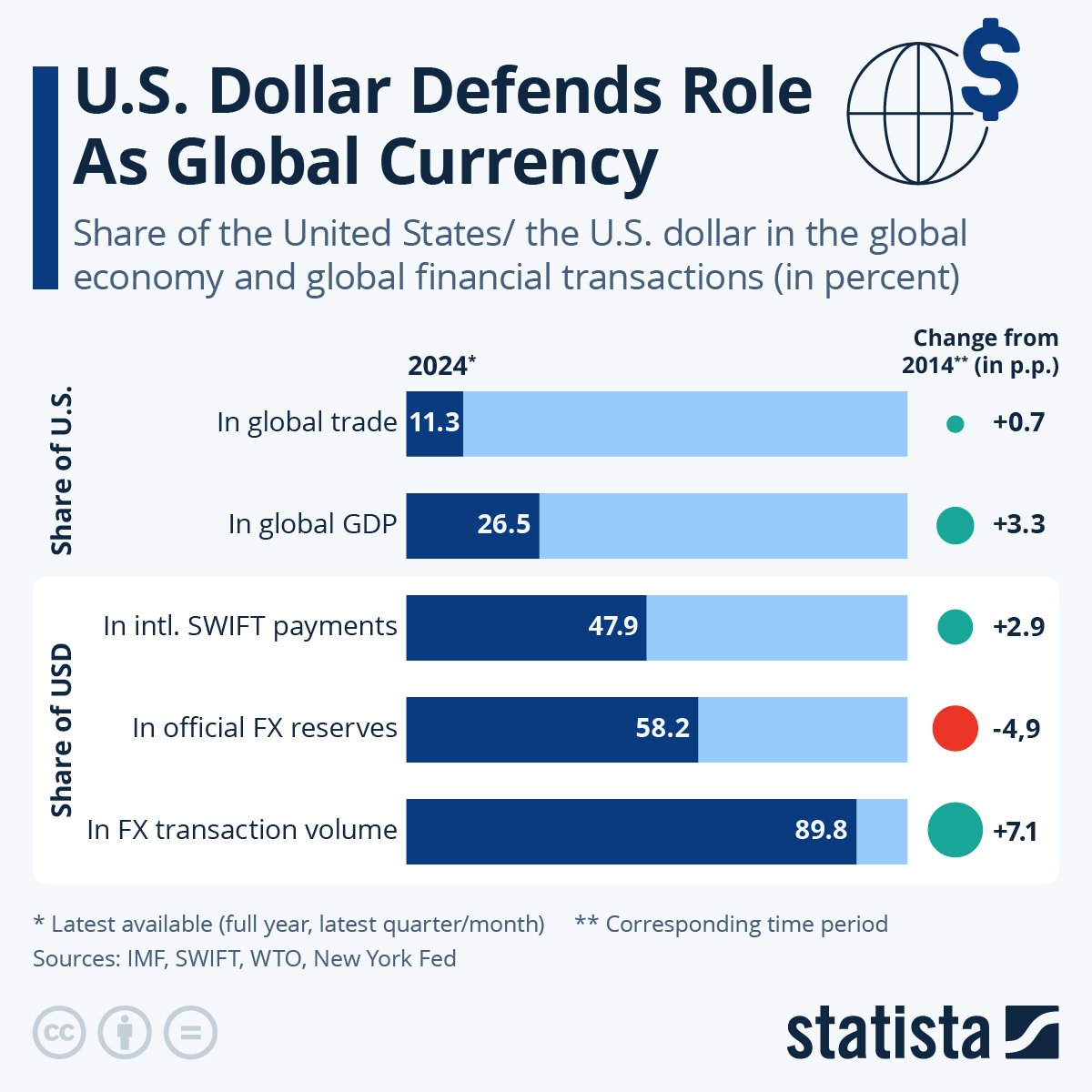

8. How is the USD "dominating"?

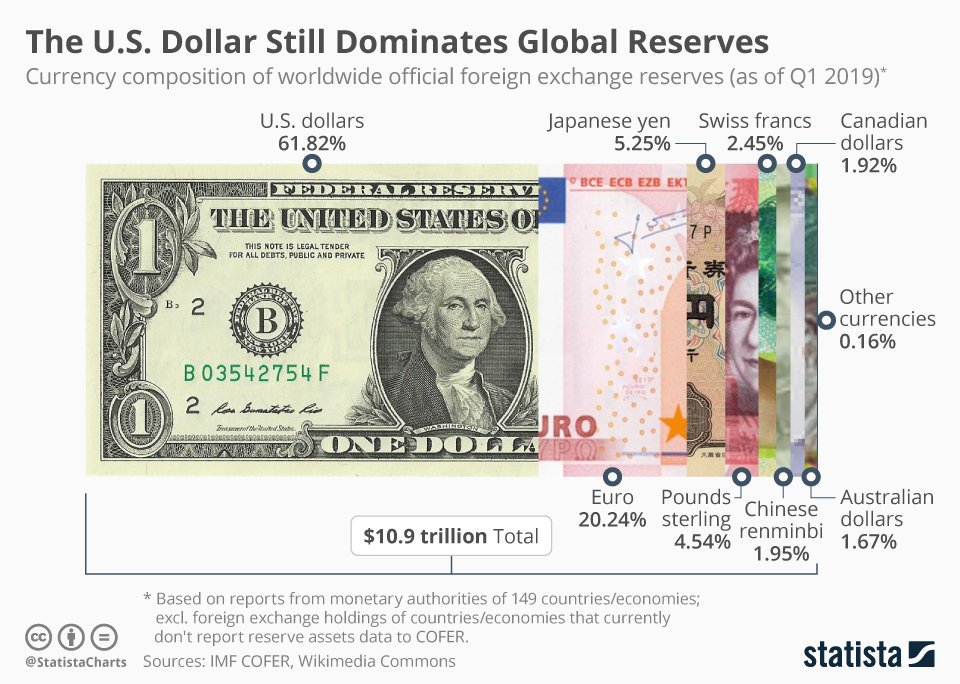

💵The USD is currently the global financial platform, accounting for 58.81% of foreign exchange reserves (2021), valuing oil and gold, dominating markets like Wall Street, helping the US borrow cheaply and maintain a large trade deficit.

⚔️ But the US uses the USD as

9. Will the USD be replaced by Bitcoin?

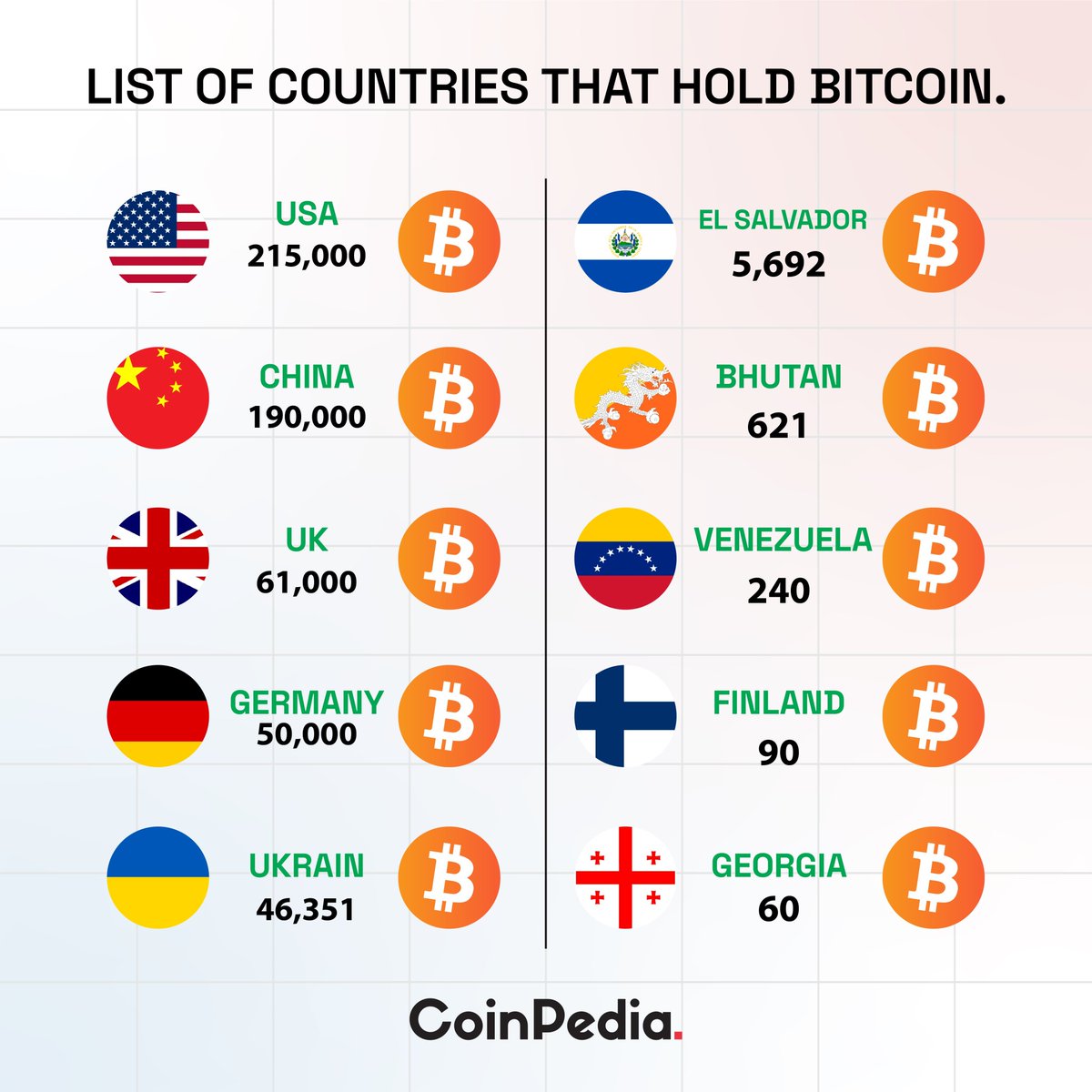

To reduce their dependence on the USD, many countries are diversifying their reserves by trading in other currencies (like the yuan) or investing in Bitcoin – a decentralized asset with a limited supply and

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content