Original: David Puell, Ark Invest Analyst;

Translator: CryptoLeo

Editor's Note:

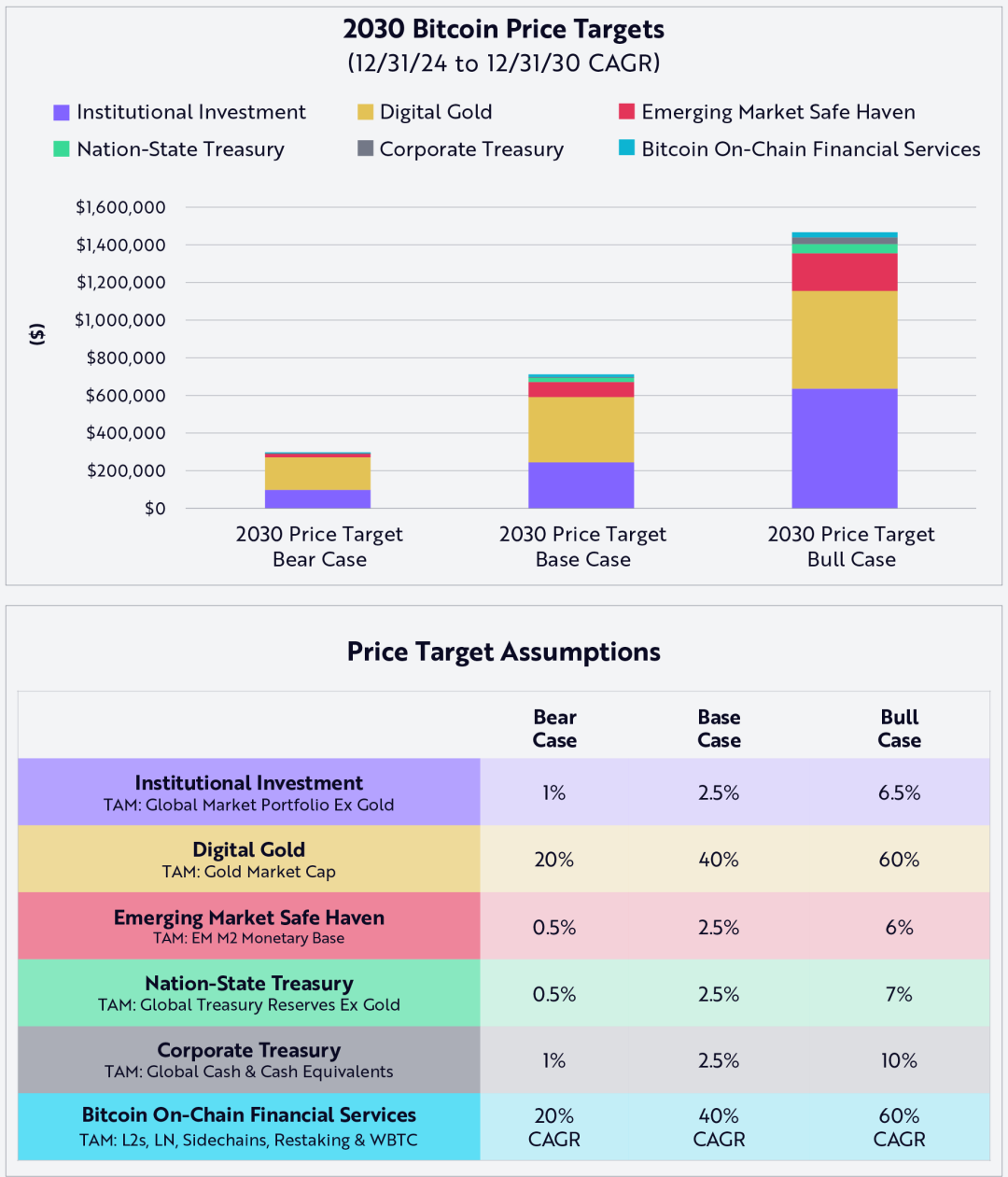

At the beginning of the year, Bitcoin's "dead bulls" and Cathie Wood's Ark Invest released the Big Ideas 2025 report, mentioning three price targets for Bitcoin in 2030: $300$300,000 000(market), $710,000 benchmark market),.5 million (bull market). At that time, it was just "simply shouting" a price far beyond market expectations (like Plan B's madnessness), without disclosing the actual estimation process.

Two months later, Ark Invest finally published its modeling method and logical assumptions for Bitcoin's in 2030 target the model predicting's price in 2023 through its total addressable market (TAM) and penetration rate (popularity or market share).

Even more inspiring (exaggerated) is that under Ark Invest's calculation based on Bitcoin's active supply indicators, Bitcoin's 2030 prices are be respectively: $500,000 (bear market),.), 2 million (benchmark market and) and $2 million (bull market). If any of these TAM or penetration rates do not meet expectations, Bitcoin may not reach these price targets.. So the model also has some risks and biases. The following are the specific details of Bitcoin's price prediction, compiled byAily.

Price Targets and Assumptions

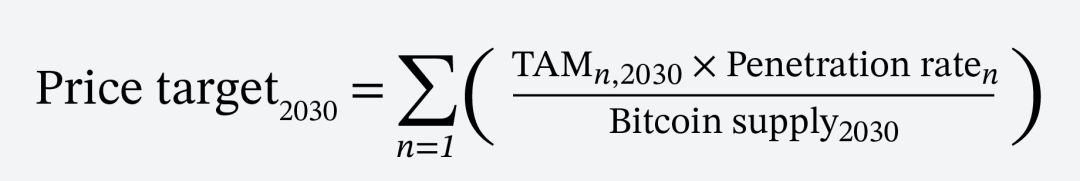

Our price target is the sum of TAM (Total Addressable Market) contributions by the end of 2030, based on the following formula:

Odaily Note: This formula predicts Bitcoin's 2030 price by quantifying the dynamic relationship between market demand and Bitcoin circulation. It calculates Bitcoin's price by multiplying the maximum dollar benchmark demand scale of each market segment by Bitcoin's penetration rate in that market, and divdividing by Bitcoin's circulation supply, then summing the prices of all market segments to obtain Bitcoin's predicted price in2030.

[The translation continues in the same manner for the rest of the text, maintaining the specified translations and professional tone.]4. Potential Contributors to Capital Accumulation: National Treasury

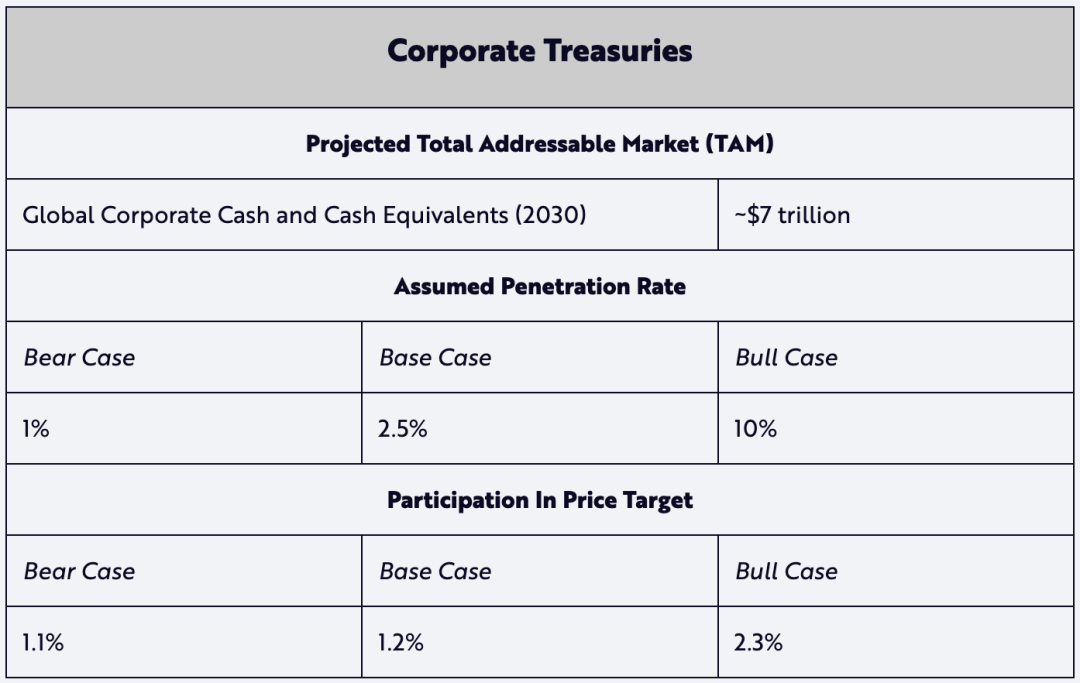

5. Potential Contributors to Capital Accumulation: Corporate Bonds