Alex Mashinsky faces up to 20 years in prison as the U.S. Department of Justice (DoJ) prosecutes the founder and former CEO of Celsius for conducting a prolonged deceptive and self-serving campaign.

Prosecutors are pushing for such a severe punishment, viewing Mashinsky as an example of the consequences of misconduct in the cryptocurrency field.

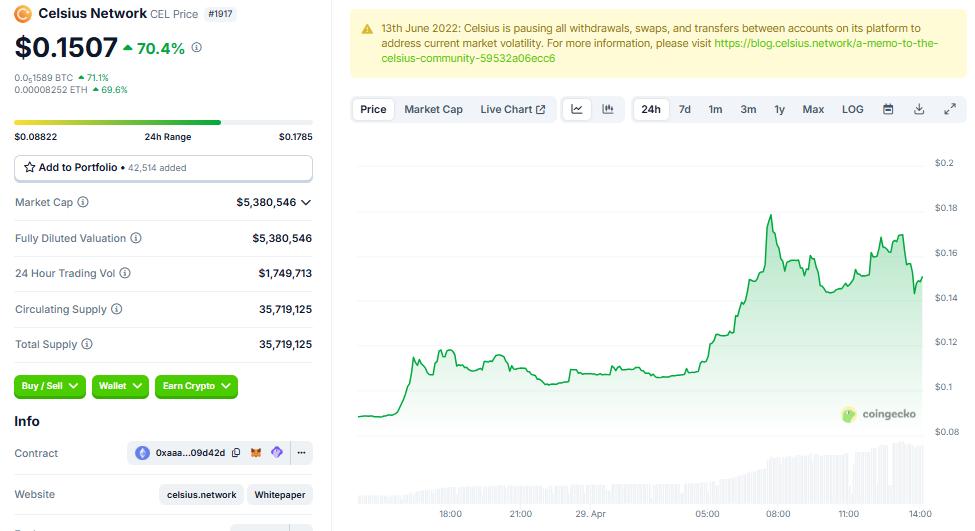

CEL Token Increases 70% Amid Mashinsky's 20-Year Prison Risk

The U.S. Department of Justice made this request in a sentencing memorandum filed on Monday, April 28, requesting a 20-year prison sentence for Alex Mashinsky.

Prosecutors criticize Mashinsky for "intentional, calculated fraud", leading to the loss of nearly 7 billion USD of customer funds.

Despite this report, CEL, the token of Celsius Network, has increased by over 70%. At the time of writing, data on CoinGecko shows CEL is trading at 0.1507 USD.

Celsius Network (CEL) price performance. Source: CoinGecko

Celsius Network (CEL) price performance. Source: CoinGeckoThis request comes five months after Mashinsky pleaded guilty to fraud charges, including CEL token market manipulation, and avoided a trial in January. Commodity fraud and price manipulation were among the plans related to Celsius's collapse.

According to the DoJ, despite pleading guilty, Mashinsky continues to refuse to accept responsibility. Instead, he is said to be blaming regulators, market conditions, and even his own victims.

"Mashinsky's crimes are not the product of carelessness, naivety, or bad luck. They are the result of intentional, calculated decisions to lie, deceive, and steal in pursuit of personal assets," the DoJ affirmed.

Meanwhile, this case originated in July 2023 when the U.S. Securities and Exchange Commission (SEC) sued Celsius and Mashinsky. The securities regulator accused the two defendants of:

- Misrepresenting the central business model and risks to investors.

- Misrepresenting financial success.

- Misrepresenting the safety of customer assets on the Celsius platform.

- Manipulating the Celsius (CEL) token market

In addition to the DoJ and SEC, other agencies, including the Commodity Futures Trading Commission (CFTC), Federal Trade Commission (FTC), and the U.S. Government, have also filed similar accusations against Celsius and Mashinsky.

"SEC, DOJ, CFTC, and FTC have all sued/made accusations against Celsius and Mashinsky in the past hour. A tough day," db reported at the time.

Notably, this occurs one year after Mashinsky stepped down as Celsius CEO. Over the years, a highlight of the case is Mashinsky's claim that he withdrew 10 million USD before the platform's bankruptcy.

However, a judge has frozen his assets and recently denied his request to dismiss fraud charges.

Meanwhile, efforts to compensate victims include unstaking the platform's Ethereum (ETH). In January 2024, Celsius announced on social media that they are working to compensate victims.

"Significant unstaking in the next few days will unlock ETH to ensure timely distribution to creditors," the post stated.

More recently, Celsius announced a second payment to creditors, with 127 million USD in Bitcoin (BTC) and U.S. dollars based on eligible conditions.

Mashinsky's sentencing is scheduled for Thursday, May 8. If the court agrees with the U.S. DoJ's proposed 20-year prison sentence, Alex Mashinsky would receive a lighter sentence compared to FTX's Sam Bankman-Fried (SBF) with a 25-year prison term.