Source: Grayscale; Compiled by Wu Zhu, Jinse Finance

Smart contract platforms are the core infrastructure for decentralized applications and blockchain finance. Therefore, they are crucial for public chains' vision of providing a new architecture for financial markets and digital commerce.

Grayscale Research believes that smart contract-based applications will accelerate adoption in the next 1-2 years, partly due to changes in US regulatory regulations and upcoming legislation.

Ethereum is the largest smart contract platform, measured by: (i) market capitalization; (ii) the scale of application ecosystem and developer community; and (iii) on-chain asset value. However, in terms of fees and other on-chain activity indicators, Ethereum has recently lagged behind competitors like Solana.

We believe that even as some newer blockchains begin to proliferate and gain market share, Ethereum's differentiating characteristics (including a culture emphasizing decentralization, security, and neutrality) will help it continue to maintain a large share of users, developers, and transaction fees in the smart contract platform cryptocurrency space. Therefore, Ethereum should be viewed as an indispensable component of a diversified cryptocurrency portfolio.

The prospects for smart contract platform fees are highly uncertain, partly because we do not know how much pricing power platforms like Ethereum can maintain in the long term. However, Grayscale Research demonstrates in this report how Ethereum can maintain pricing power by executing its scaling strategy, raising total fees from an annualized $1.7 billion in the past six months to over $20 billion.

Like Linux, Python, and some other open-source software projects, Ethereum can be considered one of the most important open-source software projects in history. Despite being less than 10 years old, the Ethereum network now has over 11,000 nodes, processes 35-40 million transactions monthly, secures approximately $46 billion in transaction value, and benefits from support from over 2,100 full-time developers. The broader Ethereum ecosystem composed of interconnected blockchains currently processes about 400 million transactions monthly.[1]

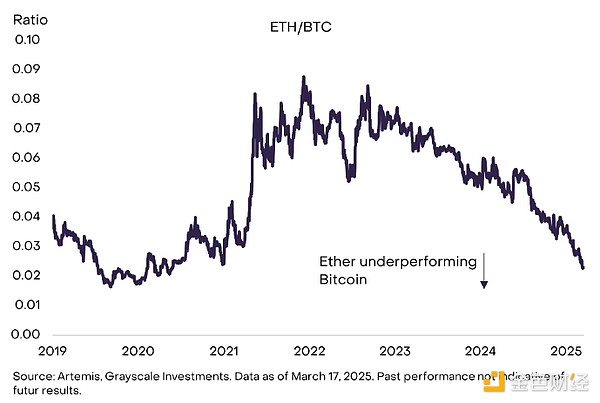

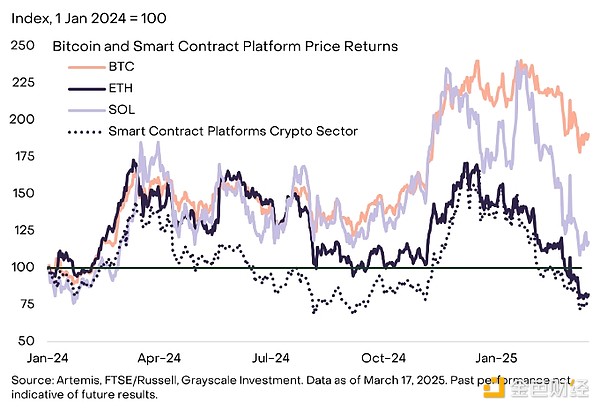

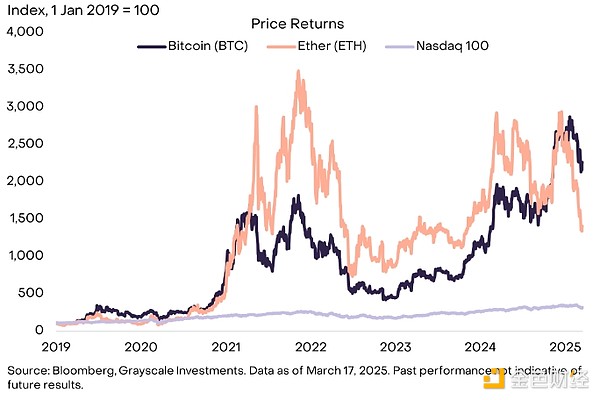

Despite Ethereum's significant position in the cryptocurrency industry and the launch of spot exchange-traded products (ETP) last year, its network token Ethereum (ETH) remains far behind Bitcoin (BTC) in market capitalization. In fact, the ETH/BTC price ratio has fallen back to levels seen in mid-2020 (Figure 1). In terms of market capitalization, Ethereum's market cap has increased by about $90 million since the end of 2022, while Bitcoin's has increased by about $1.35 trillion (approximately 15 times). [2] Ethereum's recent performance has also been inferior to some other smart contract platform tokens, including Solana and Sui.

Figure 1: Ethereum's Performance Has Lagged Bitcoin for Over Two Years

The continued lackluster performance has led some observers to question the prospects of Ethereum network activity and Ethereum's value. Although the prospects of each crypto asset are uncertain, we still believe that Ethereum should be viewed as an indispensable component of a diversified crypto investment portfolio.

[The rest of the translation follows the same professional and accurate approach]

How to Make Money with Ethereum

Ethereum monetizes network activity through transaction fees (i.e., "gas fees"), which are the costs required to execute transactions or interact with smart contracts. Unlike Solana and many other blockchains, activities in the Ethereum ecosystem occur simultaneously on the Ethereum mainnet Layer 1 (L1) and a series of Layer 2 (L2) networks. Ethereum plans to expand to millions of users through this approach, as Layer 1 itself cannot fully scale capacity without sacrificing decentralization. If this layered structure can coordinate effectively, it should provide users with high-throughput and low-cost Layer 2 transaction options while maintaining Layer 1's security and decentralization. However, the migration of activities to Layer 2 has impacted the overall network's fee allocation, which we will explain below.

[The rest of the translation follows the same professional and accurate approach, maintaining the technical terminology and nuanced language of the original text.]

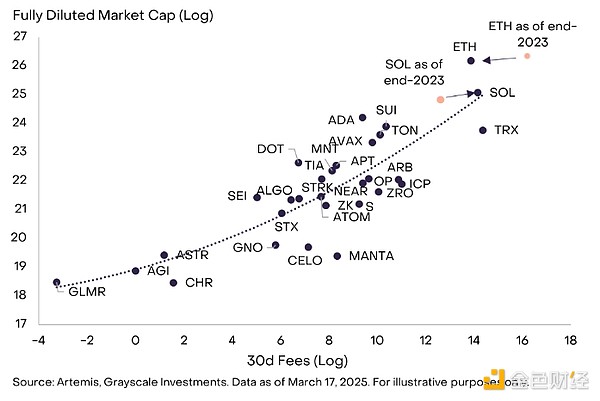

Grayscale Research believes that Ethereum's poor performance is a healthy signal, indicating that the cryptocurrency market is focusing on fundamentals. In our analytical framework, the cryptocurrency market primarily distinguishes smart contract platforms based on fees. Although the way fees are converted into token value is not exactly the same across different blockchains, they are usually passed on to token holders, and fees can be considered the most direct comparable indicator of blockchain activity.

In the smart contract platform cryptocurrency field, Ethereum and Solana both have relatively high fees and market capitalization (Chart 11). Since the end of 2023, Solana has seen an increase in fee income and market share in the smart contract platform cryptocurrency sector, while Ethereum's fee income and market value have declined. In other words, the market has appropriately repriced the relative value of Ethereum and Solana due to changes in fundamentals. In the simple framework shown in Chart 11, Solana's price moves upward and to the right, and its valuation currently seems roughly reasonable ("grown into its valuation"). In contrast, Ethereum's price moves downward and to the left, and its valuation may now be higher than its fee income.

Figure 11: Ethereum Underperforms Solana Due to Weak Fee Growth

While these subtle competitive differences are important, they are far less significant than the potential growth of the entire category. The adoption of all smart contract platforms is still in its early stages. For example, Ethereum currently has only around 7 million monthly active users, while Meta Platforms reports that its applications had 3.35 billion "daily active users" as of December 2024. As adoption increases, smart contract platforms are expected to benefit from compound network effects. Improved participation not only drives transaction volume and fee income but also accelerates developer activity, liquidity depth, and cross-ecosystem interoperability. This cycle of adoption and utility can amplify value capture for the entire category.

The ultimately successful networks are likely those that generate the highest transaction fees over time and have a well-structured native token supply and demand (for example, limited supply growth and structural demand as a collateral asset or payment medium). Solana, Sui, and some other smart contract platforms will stand out from competitors with their high throughput, low transaction costs, and generally excellent user experience. Ethereum stands out with its large and diverse application and developer ecosystem, significant on-chain capital, and a culture that prioritizes decentralization, security, and neutrality. We expect these characteristics will continue to attract a large number of users to the Ethereum ecosystem and believe Ethereum will maintain a significant share of economic activity in smart contract platform blockchains in the future.