This article is machine translated

Show original

Stablecoin Subsidy Era

Yield Farming Pool Upgrades to Autopilot

Aave Umbrella Mechanism About to Launch

Recent Thoughts on DeFi

( - /12)🧵

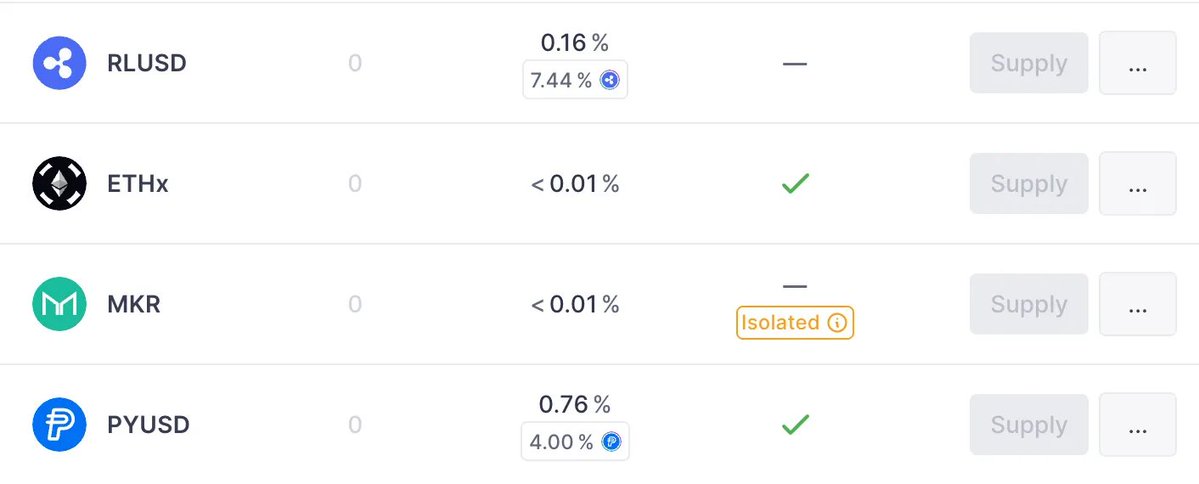

1/ Centralized stablecoins have begun to subsidize, and the amount of stablecoins on the chain continues to grow

(1) PayPal provides 3.7% balance yield promotion $PYUSD

(2) Ripple stablecoin $RLUSD 7% APR subsidy on Aave

2/ Aave's new staking mechanism (security module) Umbrella is about to be officially launched. When bad debts appear in the market, the current Aave security model is to sell stkAAVE to make up for the losses. The new Umbrella mechanism is to support aToken staking, replacing the reduction of $AAVE.

(1) Redistribute part of the protocol revenue to Umbrella aToken stakers to incentivize users to stake aToken to the new security module.

(2)

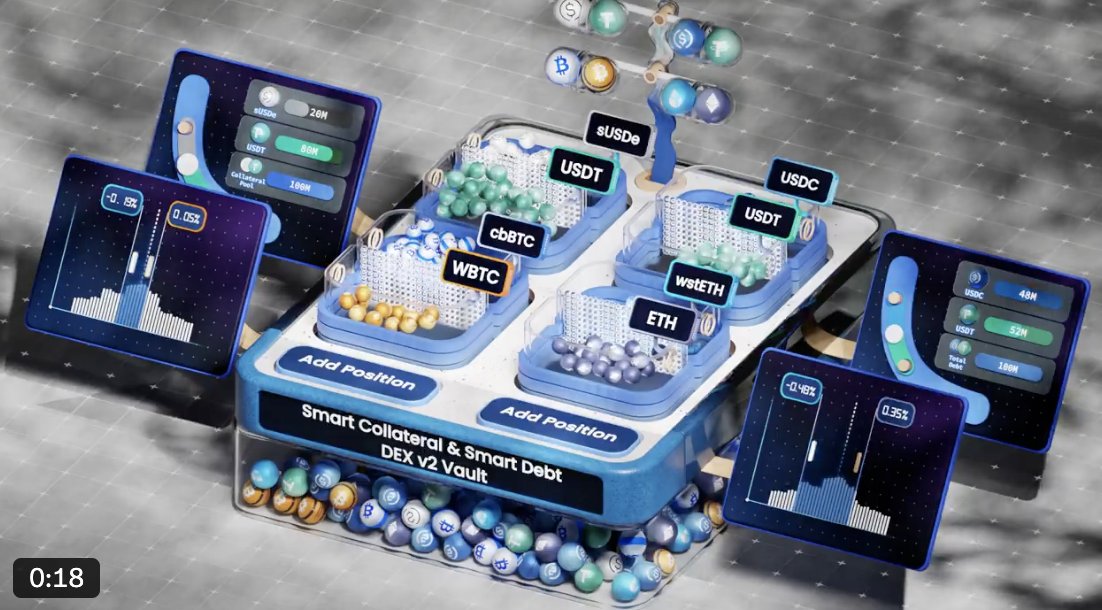

3/ @0xfluid announces DEX v2

Fluid DEX v1 was launched in late 2024, introducing "Smart Collateral" and "Smart Debt".

V2

(1) Users can customize ranges on both smart collateral and smart debt, bringing greater flexibility and capital efficiency to LPs.

(2) Support for multiple DEXs

4/ @pendle_fi New product based on the funding rate market @boros_fi is about to be launched

Pendle should be the best performing and well-received project in the new DeFi. It is rare to see a project with bad reviews. The funding rate trading market is a brand new track in DeFi. Pendle has taken the interest rate market to the bottom and has secured its position as a blue chip in the new era of DeFi.

Roughly speaking, the perpetual contract trading volume in the crypto market in 2023 is about 28.65

5/ USDT0 is penetrating the market

(1) Listed on Bitfinex

(2) Major liquidity mining pool on Unichain

(3) Launched validator on Hyperliquid in partnership with Luganodes

6/ Frax launched the North Star upgrade on April 29

(1) Rename $FXS to $FRAX, and use it as the Fraxtal Gas token.

(2) Destroy Gas and fees through the "Frax Burn Engine" mechanism.

(3) In the future, the Frax ecosystem plans to transition from L2 to L1 and run a validation node by staking $FRAX.

7/ Autopilot war The machine gun pool of the new era

(1) Tokemak

(2) Harvest

(3) Superform

8/ Mantle Cooking

(1) Mantle Banking is in the works

(2) Coinbase includes Mantle in its coin listing roadmap

(3) Mantle plans to launch the MI4 index and cooperate with Securitize

MI4 aims to become the “S&P

9/ Cosmos announces IBC-Powered DEX (Stride Swap)

(1) Interchain Foundation Investment

(2) The first IBC Eureka-driven DEX based on Cosmos Hub

(3) Realize instant swaps of multi-chain assets through IBC Eureka technology (such as transactions between ETH, SOL, USDT and Cosmos native tokens such as ATOM and USDC)

@stride_zone was originally a liquid staking protocol, Stride

10/ @plumenetwork released Q1 report

(1) RWA vault product Nest exceeded 50M TVL in pre-deposit activities.

(2) Announced cooperation with Paypal's PYUSD, Goldfinch Prime, Superstate, etc.

(3) Collaborated with LayerZero to launch Skylink, supporting the flow of RWA income to multiple ecosystems.

There are currently two RWA projects of interest: Ondo and Plume

11/ Dinero cooperates with Ink on Superchain to launch superETH

(1) The first batch of Ink, Optimism, Base and Mode are launched.

(2) superETH is an evolution of iETH. iETH is the LST before Ink, which is upgraded to a unified pledge asset to serve Superchain.

The goal is to be the universal ETH of Superchain

12/

(1) Euler launches Vault Swap.

(2) Morpho’s smart contracts have been deployed to HyperEVM.

(3) f(x) Protocol launches fxSAVE and supports lending as collateral on Morpho.

(4) Centrifuge’s multi-chain asset tokenization platform is exclusively powered by Wormhole.

Full article link:

Welcome to subscribe👏

cmdefi.substack.com/p/cmdefi-f...

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content