Happy Saturday friends! The excitement continues!

Let’s get after it!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $3.11T

QQQ (Nasdaq 100): $488.83

Gold: $3,347.40

Oil (WTI): $58.29

US 10Y Treasury: 4.308%

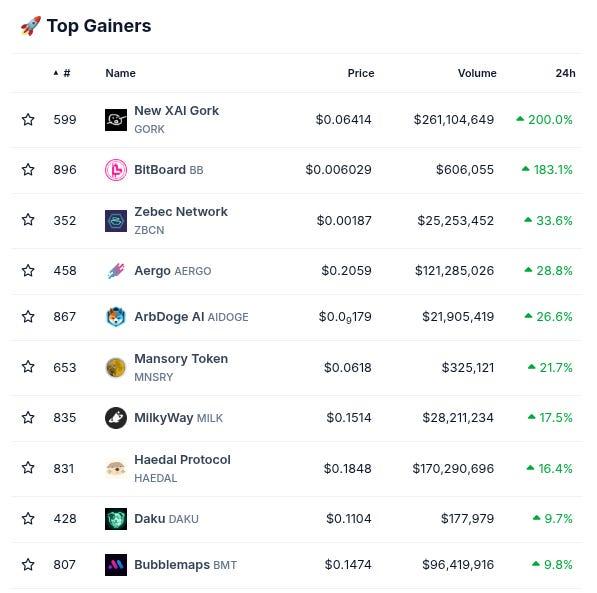

Biggest Price Movers

(From @coingecko top 1000, by 24 hour change)

Spotlight

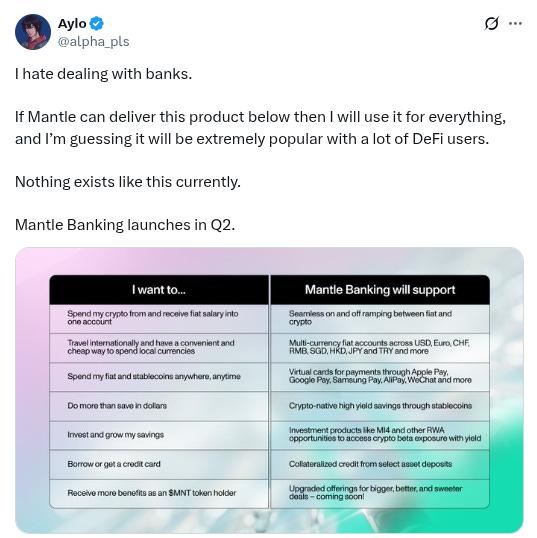

The team at @Mantle_Official continues to execute at an absolutely unprecedented level, shipping a massive host of bullish updates and news so far this year…

A few recent items highly worth checking out:

-Their institutional-grade MI4 Fund in partnership with @Securatize

-The Mantle Yap Club and Mantle Yapperboard Challenge

-New HyperEVM integration into the mETH Protocol Bridge

-$MNT listing from Coinbase two days ago

-A bunch of interesting talks and meetups at Token2049 in Dubai

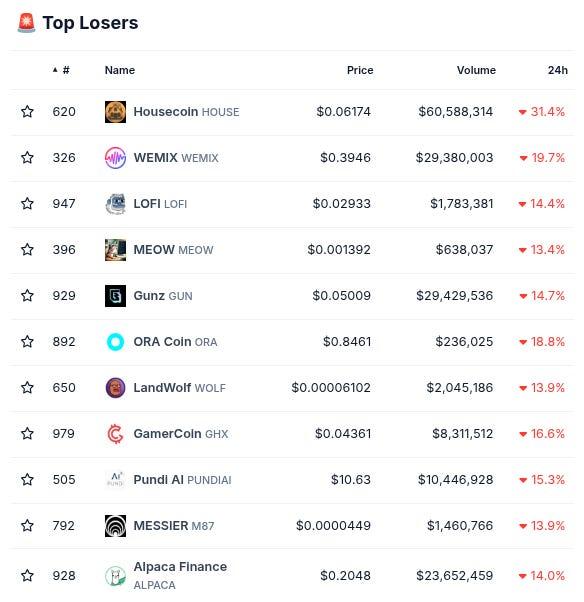

-The EXTREMELY cool new Mantle Banking initiative (see more in tweet from @alpha_pls below!)

-And tons of other insanely bullish stats and news and partnerships and more that are too numerous for us to mention!

We are extremely proud to be helping bang the drum about everything Mantle is doing, so make sure to follow them on Twitter and stay tuned for more updates!

Biggest TVL Movers + Other Interesting Data

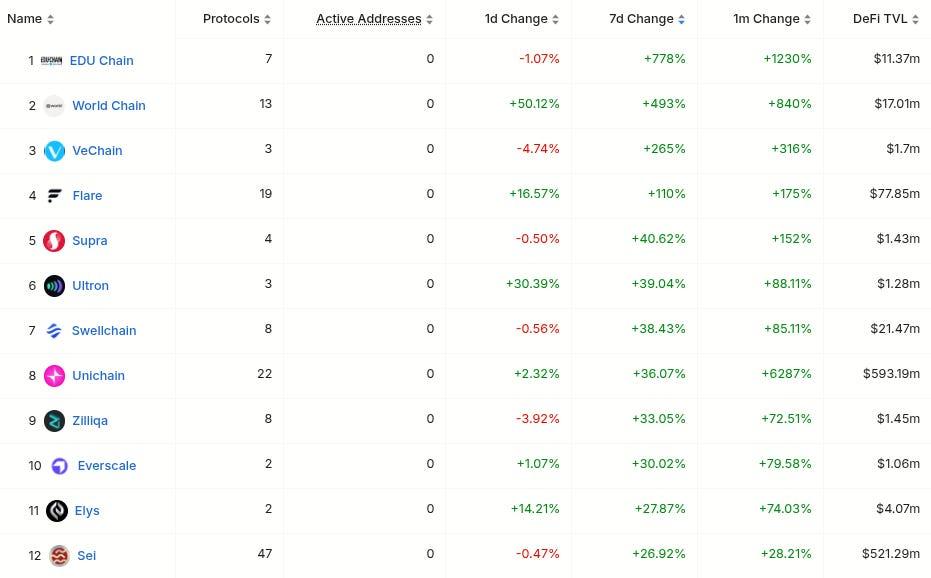

Chains are mixed today. Top 50 chains up at least 20% on the weekly include Unichain (#15), and Sei (#17).

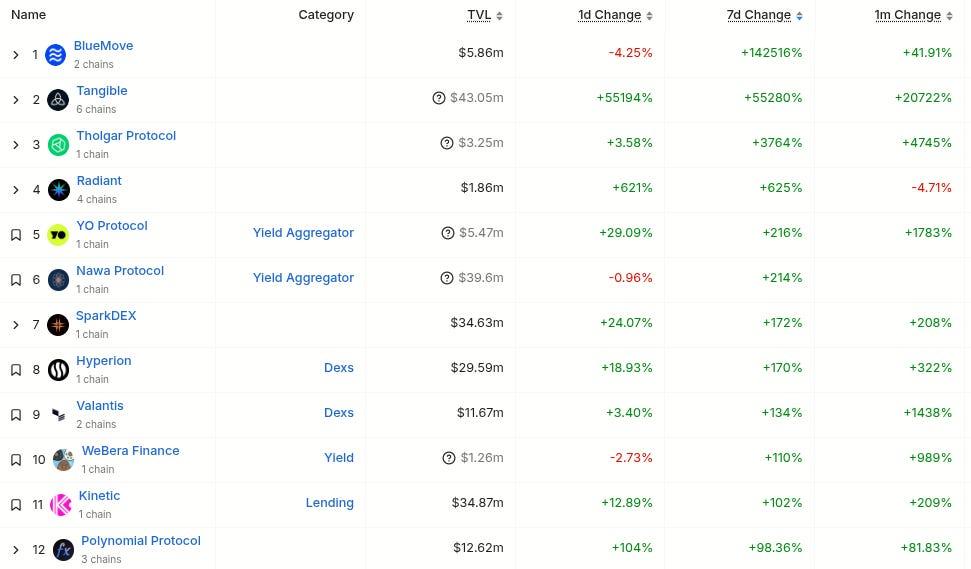

Protocols are mixed today as well. Top 100 protocols up at least 20% on the weekly include Zircuit Staking (#20), and Yei Finance (#93).

Here’s The Top 12 Best-Performing Chains By TVL On The Weekly With At Least $1M TVL (from @DefiLlama):

Here’s The Top 12 Best-Performing Protocols By TVL On The Weekly With At Least $1M TVL (from @DefiLlama):

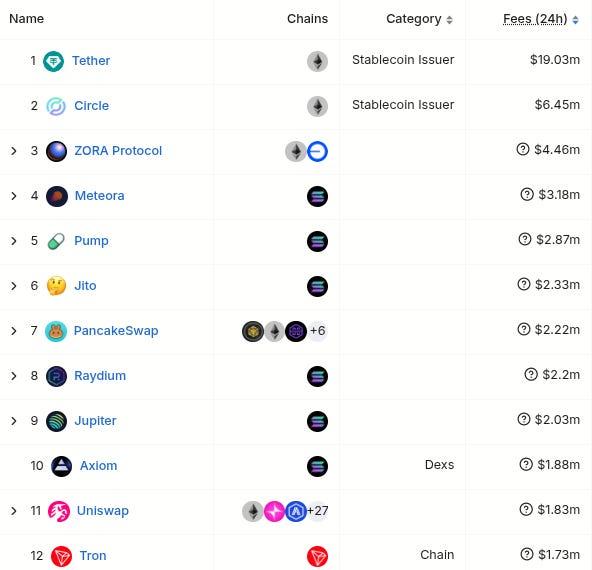

Here’s The Top Entities By 24 Hour Fee Generation (from @DefiLlama):

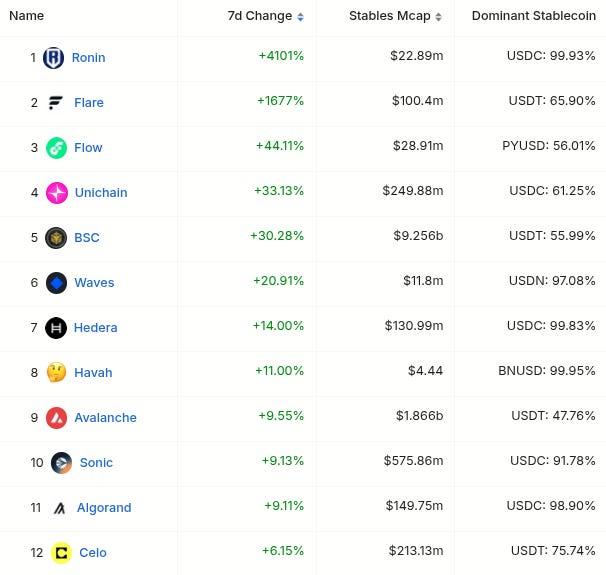

Here’s The Top Chains By 7 Day Stablecoin Inflow % (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

Top Yield Opportunities

(Note! This section is brought to you by our Official Sponsor @upshift_fi! We will include some of their top yield opportunities below as well some of the top ones from sorting on @DefiLlama (single-exposure, no-IL, $25M+ TVL) - note: the DefiLlama ones are just pulled from the raw data, so make sure to always DYOR!)

-13.15% APY on Multipli Upshift USDC - managed by August Digital - with additional 5x Bonus Points - via Upshift (click here)

-27.00% APY on USDC Sylva concentrated liquidity strategy - managed by Sylva(dot)money - with additional 5x Bonus Points - via Upshift (click here)

-10.80% APY on rsETH strategy - managed by Edge UltraYield - with additional 5x Bonus Points - via Upshift (click here)

-27.00% APY on Upshift Avalanche AVAX strategy - managed by MNNC Group - with additional 5x Bonus Points - via Upshift (click here)

-40.80% APY on IUSD on Indigo (Cardano) h/t DefiLlama research

-11.23% APY on GHO on Aave V3 h/t DefiLlama research

-12.19% APY on USDO++ on Usual h/t DefiLlama research

-10.86% APY on SUSDE on Echelon Market (Aptos) h/t DefiLlama research

-9.55% APY on USDC on Goldfinch h/t DefiLlama research

Check out the full list of Upshift yield opportunities here or by clicking the banner below!

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

-Something new called @glympsedotfun. Twitter bio states “Bet on influence”. Followed by 17 of our mutuals. h/t @redphonecrypto:

-Something new called @nemi_fi. Twitter bio states “Private DeFi on @aztecnetwork testnet.” Followed by 7 of our mutuals. h/t @AresLabs_xyz:

Important News And Analysis

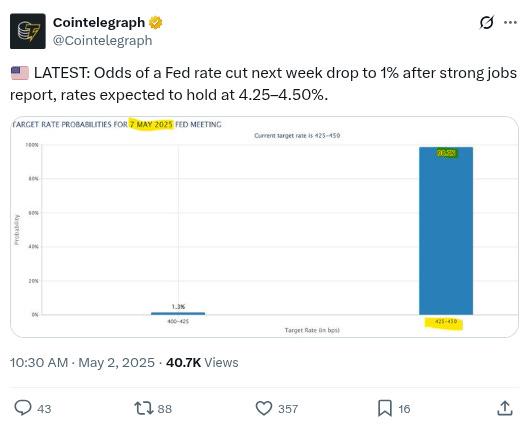

-Markets are currently pricing in a 99% chance the Federal Reserve will not lower interest rates next week, h/t @Cointelegraph:

-Total crypto market cap back over $3.00T- the high point of the 2021 bull market- but still 30% below the recent high of $3.90T, and $TOTAL/altcoins are chopping sideways, h/t @DaanCrypto:

-Update on Vitalik and ETH tech stuff, h/t @WuBlockchain:

-OPEC production increases look to drive oil prices even lower, h/t @WarrenPies:

-Reminder that you can sign up for @fantasy_top_ and begin farming ‘Clout’, their new equivalent of Kaito’s ‘Yaps’, as they continue to pivot in a more Kaito-like direction, h/t @0xJohannes_:

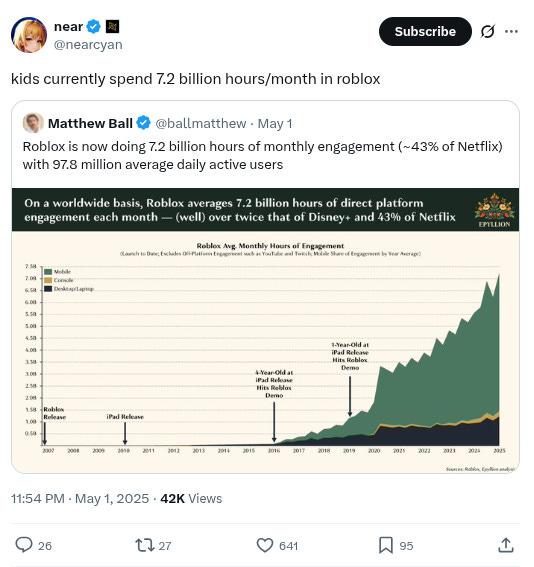

-Fascinating crypto-adjacent stat that Roblox now sees 7.2 billion hours of monthly engagement (43% the size of Netflix), h/t @nearcyan and @ballmatthew:

-More interesting crypto-adjacent thoughts, from @blockchaingod69:

-Good list of tools for the trenches from @Flowslikeosmo:

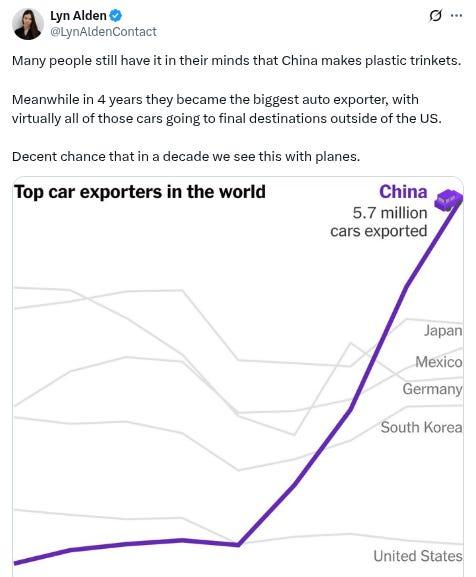

-Ongoing discussion and debate about China and the US and tariffs and manufacturing and etc, especially vis a vis the automotive industry (interesting note is that the number of yearly car purchases in the US is at the same level as it was in 1985), and whether this will lead to more short-term tariff pain and/or a weaker dollar long-term (which would likely be good for crypto) and a host of other downstream effects of the situation, h/t example from @LynAldenContact:

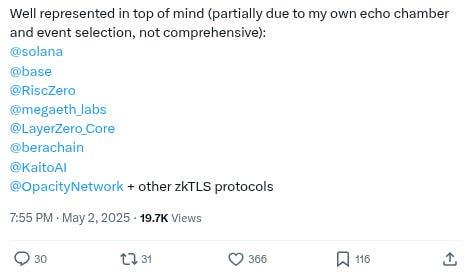

-Takeaways from the conference in Dubai this week, from @dabit3:

-Much debate today after Arizona Governor vetoes Bitcoin bill, example c/o @fejau_inc:

-New interview from @pahueg with Tether CEO Paolo Ardoino:

-New roundtable from @Blocmatesdotcom featuring TN Pendle, Daniele Sesta, Jedi, Hamm, and Figue:

-New crypto/macro video from @fejau_inc and @qthomp:

-New episode of ‘TAO Talk’ from @Blocmatesdotcom featuring @563defi and @DistStateAndMe:

-New macro interview with @LukeGromen:

-Newest macro interview with Doomberg:

-Parting wisdom from @cormachayden_:

Conclusion

Have a great Saturday friends and don’t forget to touch some grass this weekend!

And please RT/subscribe/etc if you found this valuable!

-

-

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.