1/ Last week, @aave listed @pendle's Principal Tokens (PTs) as eligible collateral on the main market, beginning with eUSDe and sUSDe PTs.

Demand for these new markets is hot 🔥

Let's check in on the results 🧵 twitter.com/152264666289578394...

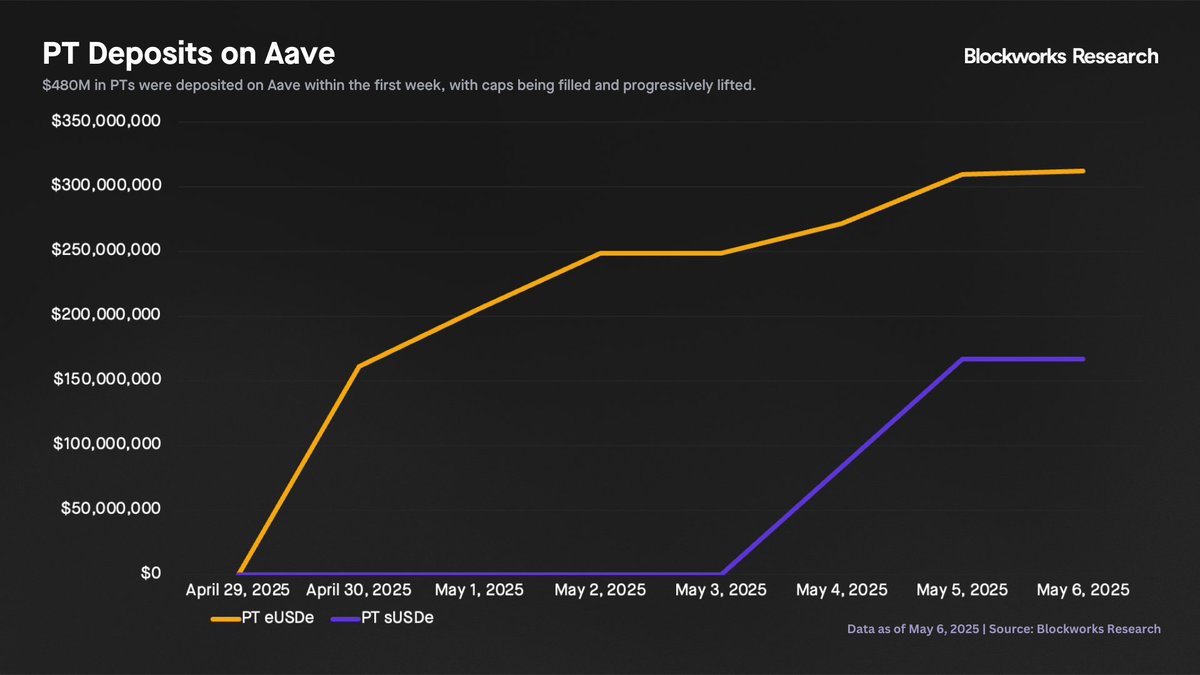

2/ Within the first week, $480M in PTs were deposited on Aave, filling caps immediately which have been progressively lifted.

PT eUSDe accounts for $314M, while PT sUSDe accounts for $167M.

Each of these instruments carries an implied yield of ~7.5%.

3/ Now, 41% of the May PT eUSDe supply and 59% of the July PT sUSDe supply are utilized as collateral on Aave.

Meanwhile, Morpho accounts for 16% utilization of the May PT eUSDe, and 14% for the July PT sUSDe.

Across the board, nearly 30% of all PTs are utilized as collateral

4/ Despite lower implied yields of 7.5%, compared to rates exceeding 20% at the start of the year, there remains incredibly strong demand to borrow against PTs as collateral. twitter.com/152264666289578394...

5/ With Aave listing these new instruments, this brings billions in stablecoin liquidity available to be lent out against PTs.

We'll be monitoring closely if deposit caps are filled and lifted, and which new markets and maturities Aave will add next.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content