The utility token of Haedal Protocol, a Liquid Staking platform based on the Sui blockchain, has been listed on the Bithumb KRW market. It aims to maintain the liquidity of deposited assets while simultaneously generating revenue, targeting both DeFi utilization and capital efficiency.

At 8:42 AM on the 8th, according to Bithumb, Haedal Protocol (HAEDAL) was trading at 187 won, down 6.53% from the previous day. HAEDAL, which started trading at 178 won at 6 PM on the 2nd, even recorded 298 won on the 3rd.

Related Articles

- [Do Ye-ri's DeFi Radar] 20% of DeFi funds flowed to Aave... GHO demand also surged

- Broprotocol launches integrated Bitcoin DeFi infrastructure

- [Do Ye-ri's DeFi Radar] 'Deepbook' listed on Upbit... Sui on-chain order book traded without an app

- 1.8 trillion won exits from Babylon... Bitcoin DeFi trust shaken

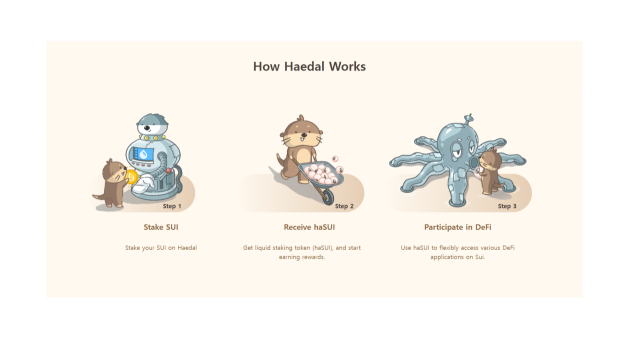

When users deposit SUI tokens, Haedal issues a Liquid Staking Token called haSUI along with network rewards. Typically, depositing assets on a blockchain locks them, making liquidity difficult. However, Haedal resolved this by issuing haSUI, which is linked 1:1 with the deposited assets. Users can utilize haSUI in DeFi while still receiving deposit rewards. This structure is similar to the model Lido implemented with stETH on Ethereum. Just as Lido became a representative of Liquid Staking in the Ethereum ecosystem, Haedal aims to play the role of 'Sui's Lido' in the Sui-based DeFi ecosystem.

haSUI can be used in various DeFi strategies. Users can deposit haSUI as liquidity providers or exchange it for other assets. It can also be used as collateral on lending platforms. Its application range is wide, including issuing stablecoins through collateralized debt position (CDP) structures.

To enhance asset management efficiency, Haedal introduced the 'HMM (Haedal Market Maker)' automated market maker system. Deposited assets are managed in a liquidity pool directly created by Haedal. Liquidity is adjusted in real-time according to market price changes. This reduces slippage during transactions and minimizes losses from sudden price fluctuations. An oracle system reflects market prices in real-time, and a strategy of concentrating liquidity at key price points is also applied. All processes are automated without human intervention.

Haedal's earnings are distributed to users. 40% of total revenue is accumulated in a reward vault for haSUI holders. 50% is used to repurchase HAEDAL tokens and distributed to users who lock them for a certain period. The remaining 10% is used for long-term system operation.

HAEDAL token holders can also participate in ecosystem management. By locking HAEDAL tokens for a certain period, they receive a governance token called 'veHAEDAL'. veHAEDAL holders can participate in key protocol decisions and receive additional benefits like reward boosts. The lock-up period can be freely chosen from a minimum of 1 week to a maximum of 52 weeks. Longer lock-up periods result in more veHAEDAL. veHAEDAL gradually decreases over time. When it reaches maturity, the remaining veHAEDAL becomes 0, and the original HAEDAL tokens can be recovered. This structure provides greater rewards and influence to long-term participants.

Recently, tokens based on the Sui ecosystem have been consecutively listed on domestic exchanges. Starting with WAL in March, followed by DEEP and HAEDAL within two months on the Bithumb KRW market, the influence of Sui-based projects is rapidly spreading domestically.

Haedal has received investments from global investment firms including Hashed, Animoca Brands, Sui Foundation, and OKX Ventures. As ecosystem expectations grow, market attention is focused on whether Haedal can prove these expectations through substantial expansion results.

- Reporter Do Ye-ri

- yeri.do@sedaily.com

< Copyright ⓒ Decenter, unauthorized reproduction and redistribution prohibited >