The cryptocurrency venture investment market saw funds flowing into large projects over the past week, with a selective investment trend centered on promising startups. Seed rounds dominated, with consistent interest across practical infrastructure sectors such as artificial intelligence, real-world assets (RWA), and payments.

According to CryptoRank on the 8th, a total of $339.1 million in venture funds were injected into the cryptocurrency industry through 20 investment rounds last week (April 28-May 4).

The number of investment deals decreased by 6 compared to the previous week (April 21-27), and the investment scale dropped by approximately 76% from $1.41 billion.

During this period, ▲dao5 ($222 million, stage undisclosed) ▲Miden ($25 million, seed) ▲Camp Network ($25 million, Series A) raised significant funds. Miden received investment from a16z on the 29th of last month, and Camp Network was invested in by Blockchain Capital on the same day.

Additionally, projects such as ▲Dinari (Hack VC) ▲Fuse (Galaxy) ▲ZAR (Dragonfly Capital) ▲Kaia (Blockchain Capital) ▲Gata (YZi Labs, former Binance Labs) ▲Buff Fund (Raj Gokal, Solana co-founder) raised funds from Tier 1 venture capitals.

The cryptocurrency industry has secured venture funds worth approximately $323.45 million so far this month. The record for March was $5.08 billion, and the record for April was around $2.37 billion.

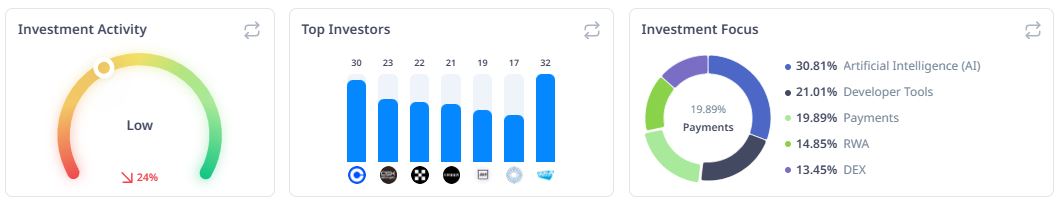

The investment activity index based on the recent 30 days indicates 24% compared to the average of the past year. It slightly improved from 20% last week but maintains a 'low' level.

A total of 103 investment rounds were counted over 30 days, a 27.5% decrease compared to the previous month. The total investment scale also shrank by 24.2% to $4 billion. The average round size is between $3 million and $10 million.

Seed stage investments were most active, with investments distributed evenly across various sectors including artificial intelligence (AI, 30.81%), developer tools (21.01%), payments (19.89%), RWA (14.85%), and DEX (13.45%).

The main investment firms most actively investing over the past 6 months were ▲Animoca Brands with 32 deals ▲Coinbase Ventures with 30 deals ▲a16z CSX with 23 deals ▲OKX Ventures with 22 deals ▲Amber Group with 21 deals ▲MH Ventures with 19 deals ▲GSR with 17 deals.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>