A look at how major cryptos ($BTC, $ETH, alts) performed after historical risk events—COVID, banking crises, geopolitical events, tariff wars, and more—revealing key patterns 🧵

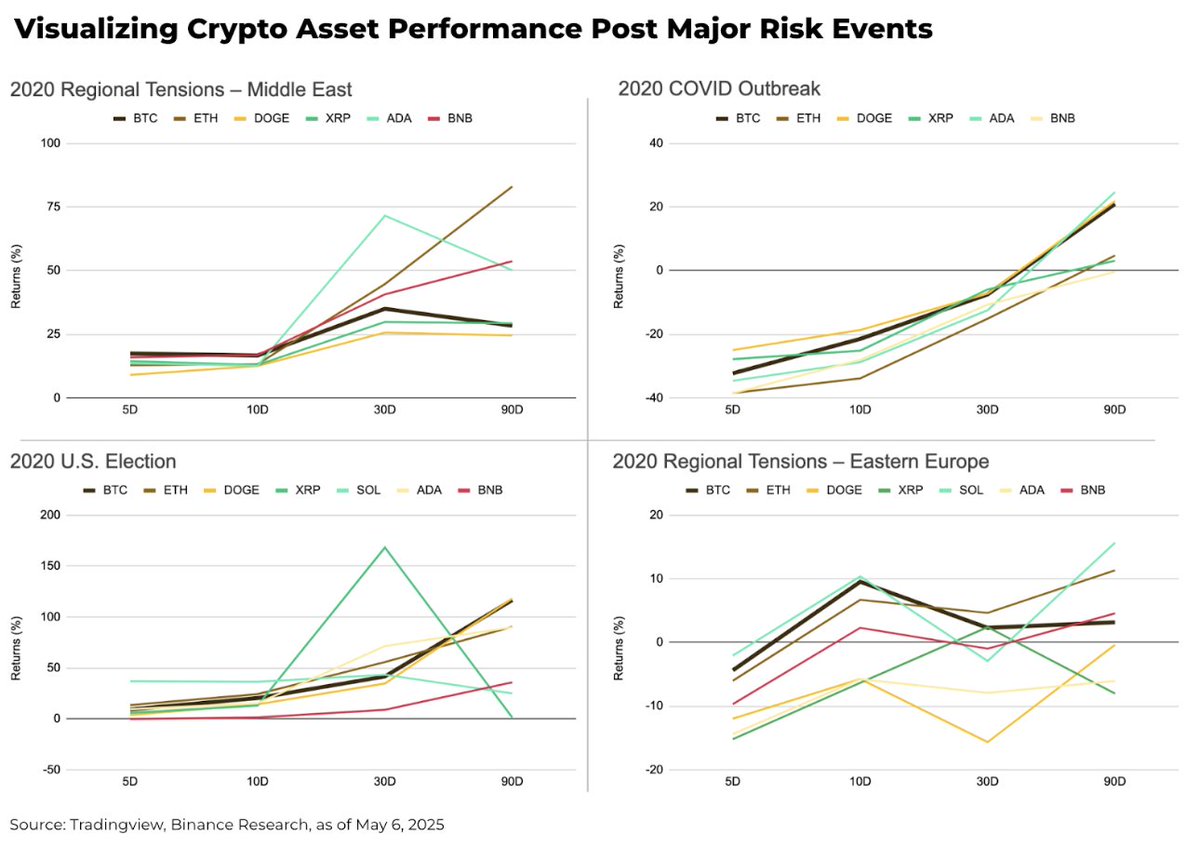

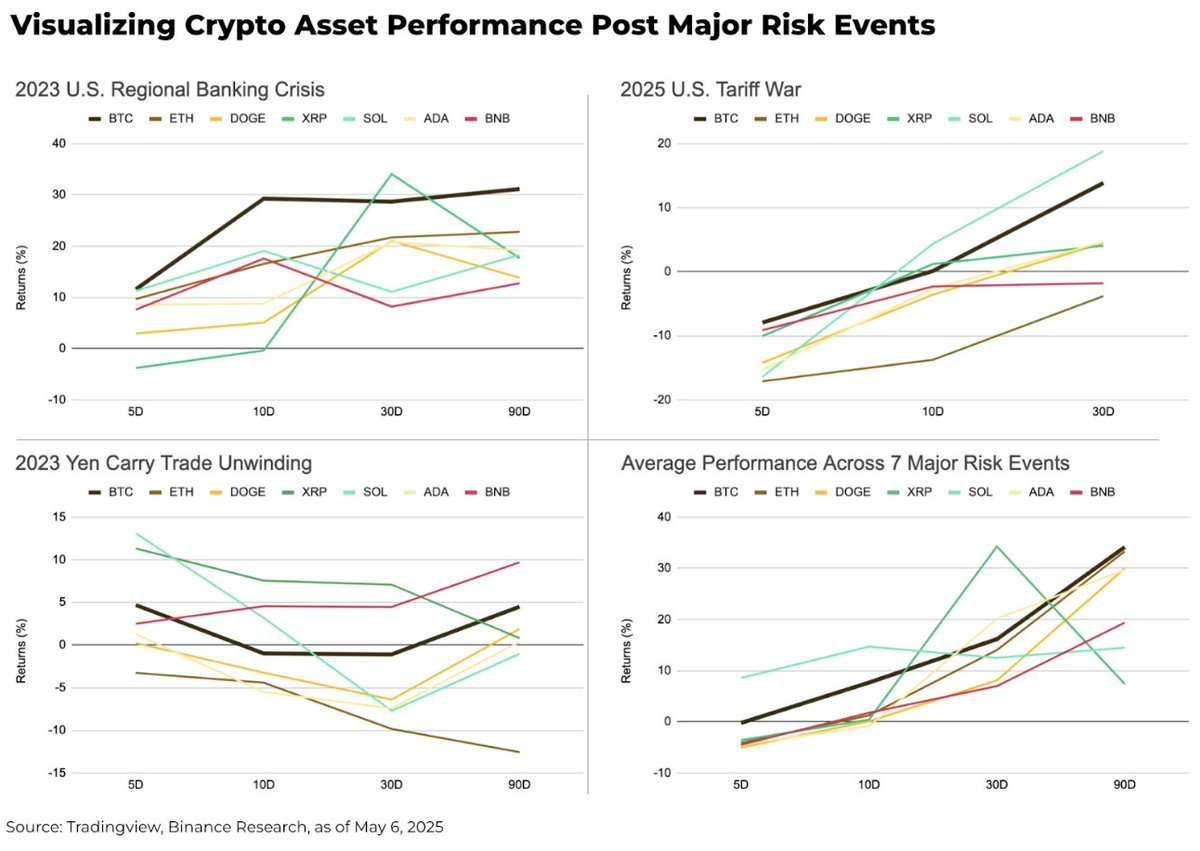

1/ Typically, crypto markets dip in the short term (5–10 days) following risk events, likely reflecting broader risk-off sentiment (e.g., COVID: BTC 5D -32%; Tariff War: BTC 5D -8%, ETH -17%). The U.S. banking crisis (Mar-23) was a notable exception, boosting prices (BTC 5D +12%,

2/ Medium-term (90D) recovery is common. Even after sharp initial drops—like post-COVID (BTC 10D -21%, ETH -34%)—90D returns often turned positive (BTC +21%, ETH +5%). This may reflect improving sentiment, macro responses, or shifting narratives. Strong 90D gains also followed

3/ But mid-term recovery isn’t guaranteed—negative impacts can linger. For example, after Yen carry trade unwinding fears (May-24), 90D returns stayed negative (BTC -5%, ETH -13%), suggesting a more sustained hit to risk appetite from certain macro shocks.

4/ Altcoins generally show higher volatility than BTC/ETH, likely due to lower liquidity and higher perceived risk. For example, during the start of the Tariff War, SOL's 5D drop (-16%) outpaced BTC's (-8%); post-2020 U.S. election, some alts like XRP (+168%) saw much larger 90D

5/ Altcoin relative performance post-event is inconsistent—stronger rebounds aren’t always guaranteed, likely due to varying fundamentals and event relevance. Notably, BTC’s average 90D return (+34%) topped other sampled cryptos post-event, making altcoin selection during crises

6/ BTC and ETH usually move together in the short term, but their relative strength varies by event—possibly reflecting differing narratives like Digital Gold vs. Digital Oil. For example, during the Tariff War, ETH (-17%) fell more than BTC (-8%); post-banking crisis, BTC (+31%)

Found this helpful? Check out the Binance Research website for more in-depth reports.

www.binance.com/en/research

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content