Happy Saturday good degens! Quite a week its been!

Let’s dive in!

As always… stats/alerts/etc at top and tweets/news/links/videos/etc at bottom… and all tweets are hyperlinked so just click on them to pull them up on Twitter!

Market Update

Crypto (from @CryptoBubbles):

Total Crypto Market Cap: $3.41T

QQQ (Nasdaq 100): $487.97

Gold: $3,323.20

Oil (WTI): $61.02

US 10Y Treasury: 4.382%

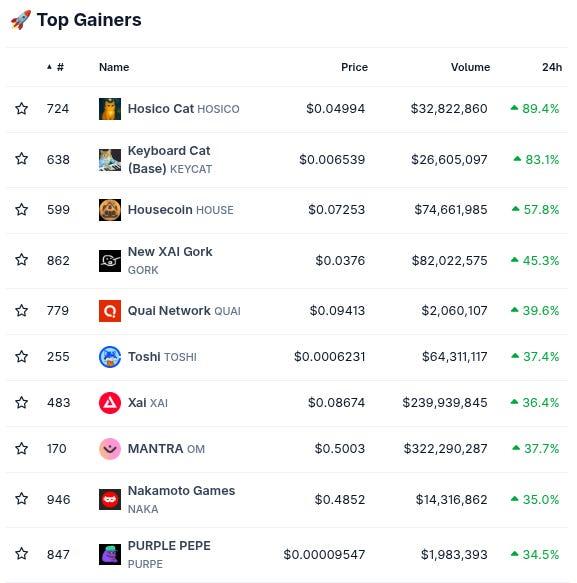

Biggest Price Movers

(From @coingecko top 1000, by 24 hour change)

Spotlight

Our Official Sponsor @upshift_fi provides yield-maxxing vaults spread across the defi-verse, but one of the most exciting is smack dab in the heart of the HyperEVM trenches!

Indeed, according to @DefiLlama, Upshift is currently ranked #9 on Hyperliquid L1 by TVL!

The primary opportunity they provide is via their Hyperbeat Ultra HYPE Vault!

“Partnering with @0xHyperBeat and @ultrayieldapp, the hbHYPE vault will dynamically allocate $HYPE deposits across HyperEVM DeFi protocols. Delta-neutral strategies, funding arbitrage and more will be deployed to maximize returns. hbHYPE democratizes institutional yield for $HYPE holders…

The hbHYPE vault offers incentives from @Hyperlendx, @HypurrFi, @HyperSwapX, @0xHyperbeat, @TimeswapLabs, @silhouette_ex and more. Early depositors can also earn 5x Upshift points… Deposit to earn yield on your HYPE...”

Learn more by clicking here, and make sure to follow Upshift on Twitter for more updates!

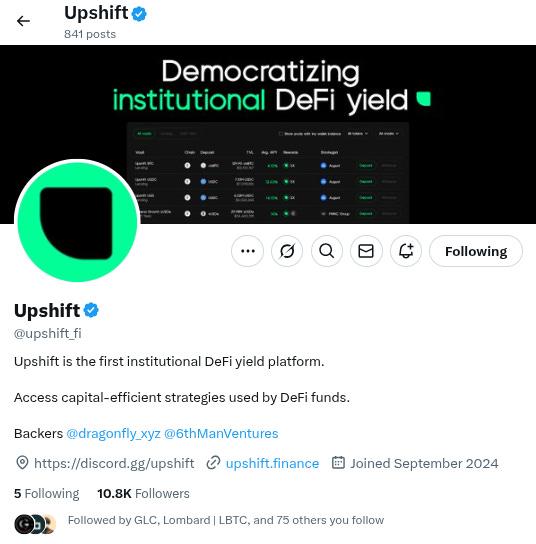

Biggest TVL Movers + Other Interesting Data

Chains are quite green today. Only top 25 chains red on the weekly are Berachain (#9), Sonic (#12), Sei (#16), Core (#17), and Hemi (#25).

Protocols are also quite green today. Only top 50 protocols red on the weekly are Ethena (#10), and Infrared Finance (#30).

Here’s The Top 12 Best-Performing Chains By TVL On The Weekly With At Least $100M TVL (from @DefiLlama):

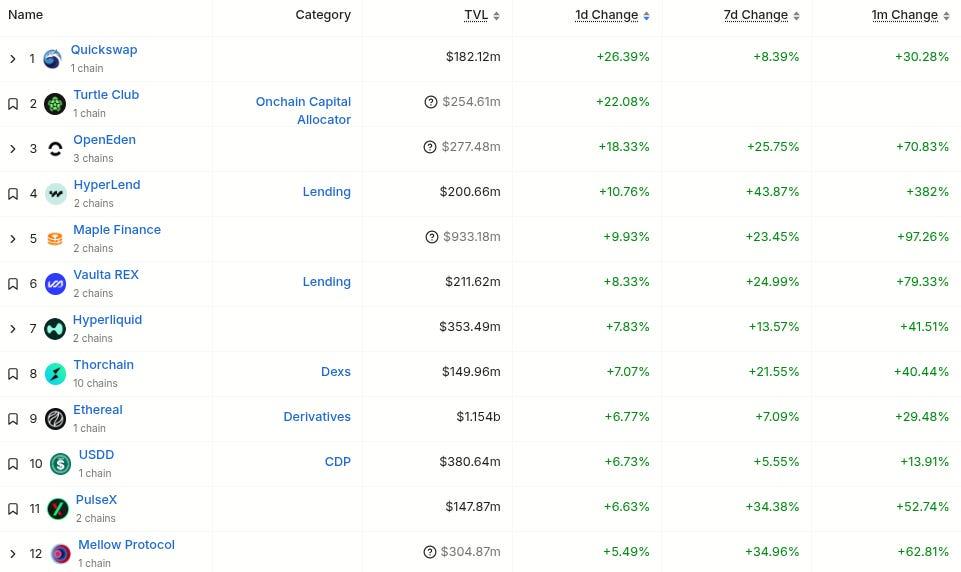

Here’s The Top 12 Best-Performing Protocols By TVL On The Weekly With At Least $100M TVL (from @DefiLlama):

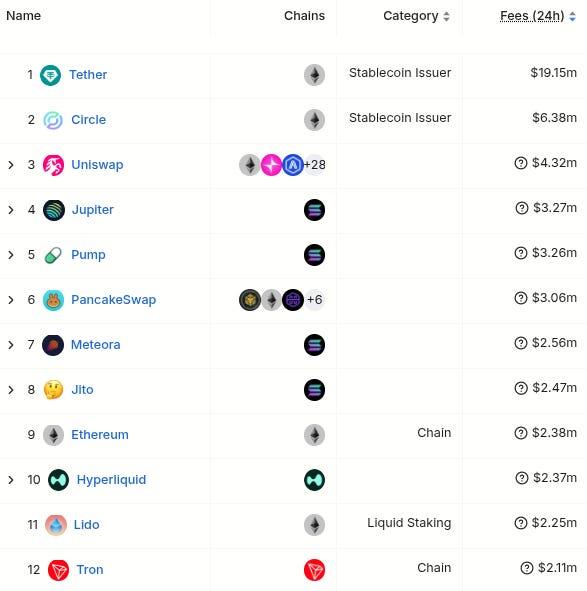

Here’s The Top Entities By 24 Hour Fee Generation (from @DefiLlama):

Bitcoin Fear/Greed Index:

(from @BitcoinFear)

New Projects

(note: this includes new projects we find through combing Twitter each day and going through newly launched protocols added by @DefiLlama, limited primarily to new projects that have at least some TVL or are followed by at least some of our mutuals… Disclaimer: these are not pre-vetted by us so make sure to DYOR!)

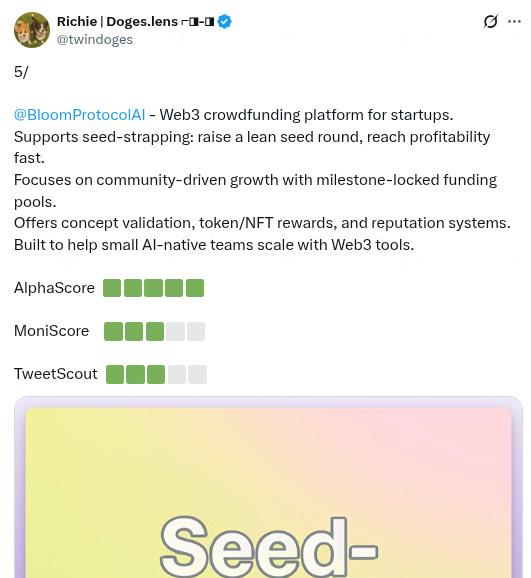

-New project called @BloomProtocolAI. No Twitter bio. Followed by 3 of our mutuals. h/t @twindoges:

-Something new called @MercuryappHL. Twitter bio states “Bringing @HyperLiquidx to mobile for both IOS and Android.” Followed by 5 of our mutuals. h/t @twindoges:

-Something new called @lumefiapp. Twitter bio states “DeFi made simple. Build, stake, and earn with Lume — the non-custodial wallet built for real people, not just crypto pros.”. Followed by 5 of our mutuals. h/t @twindoges and @aeyakovenko:

-Something new called @legenddottrade. Twitter bio states “Become Legend in the Arena. Coming soon... // powered by @gte_xyz”. Followed by 10 of our mutuals. h/t @twindoges:

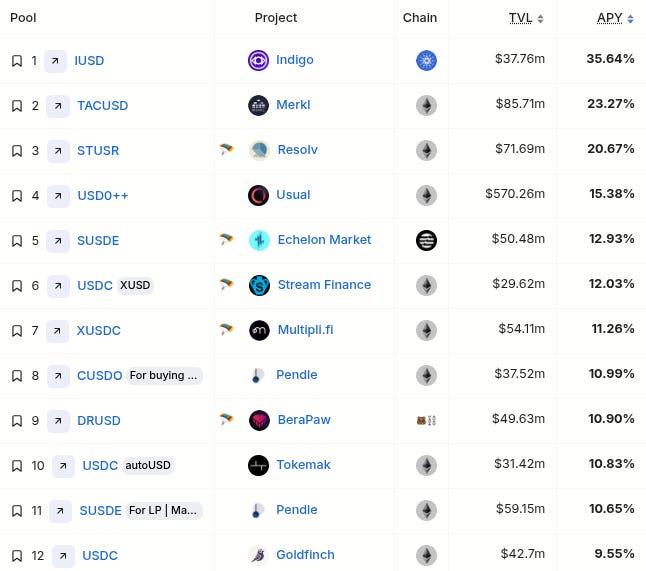

Top Stablecoin Yields

(note: these are the top Stablecoin Yields, sourced from @DefiLlama (single-exposure, no-IL, $25M+ TVL only) - note: these lists are just raw data, make sure to always DYOR before interacting with any/all protocols)

Important News And Analysis

-A week full of bullish headlines accompanied a jump in prices into the weekend, h/t @cindyleowtt:

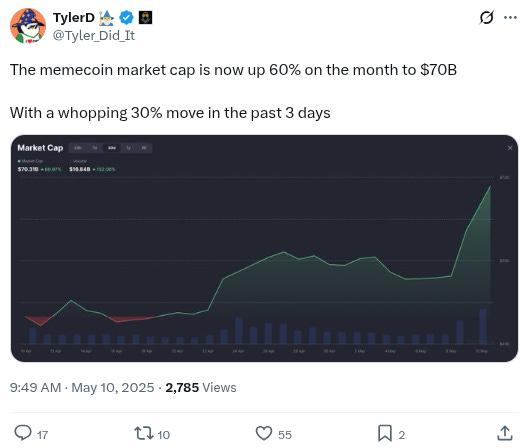

-Memecoin total market cap up 60% on the month and back up to $70B, h/t @Tyler_Did_It:

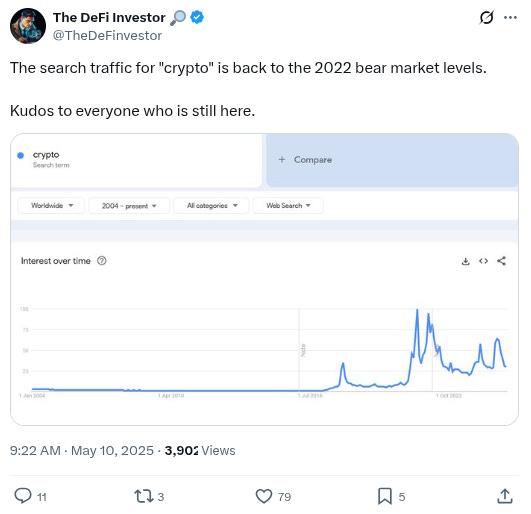

-“Crypto” search volumes still in goblintown (although it seems plausible that the type of people likely to invest in crypto just aren’t on Google anymore nowadays), h/t @TheDeFinvestor:

-Seeing lots of tweets about @ResolvLabs doing a very narrow registration window for their airdrop or something like that, so if you think there’s any chance you qualify it is probably worth looking into now, h/t @phtevenstrong:

-Lots of focus on Trump’s impact on the markets - both downwards and upwards - h/t @theunipcs:

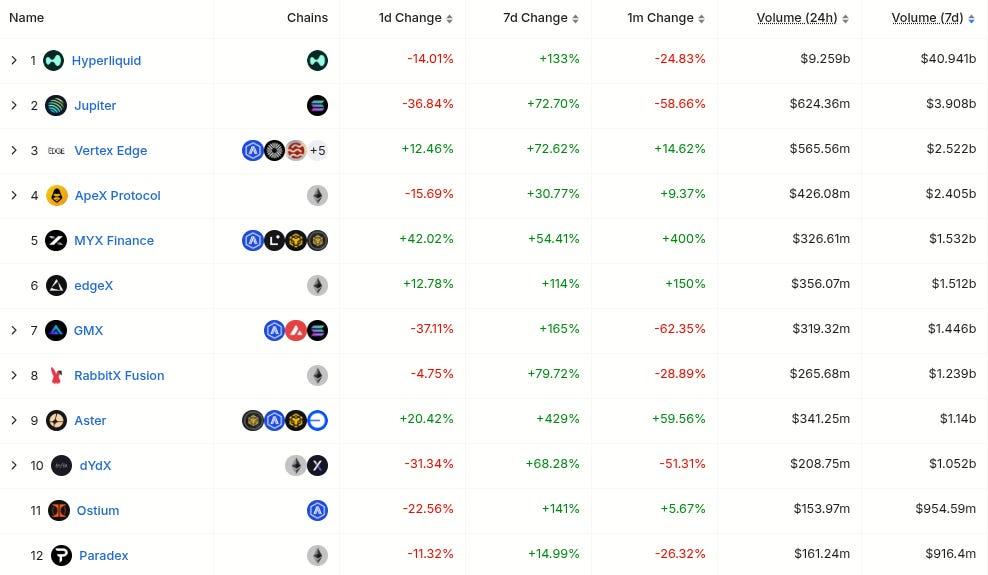

-Slowly but surely the road to global perps dominance marches on:

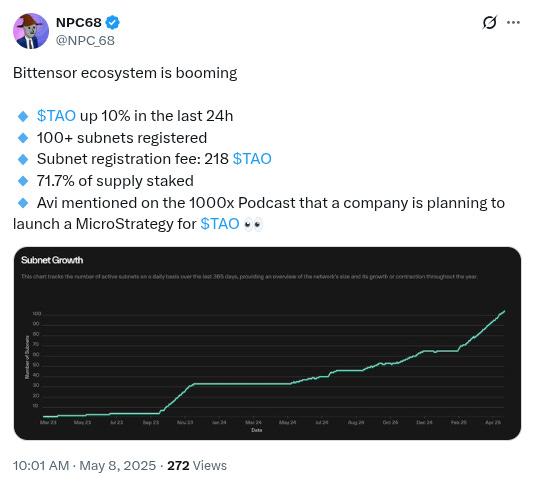

-$TAO/Bittensor ecosystem continuing to heat up, h/t @NPC_68:

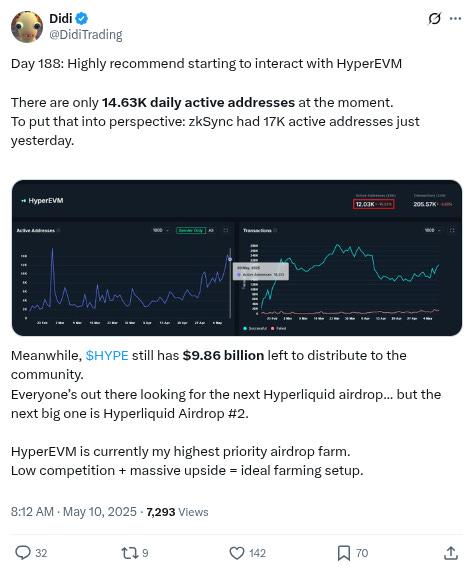

-HyperEVM trenches getting hotter and hotter as well, h/t @DidiTrading:

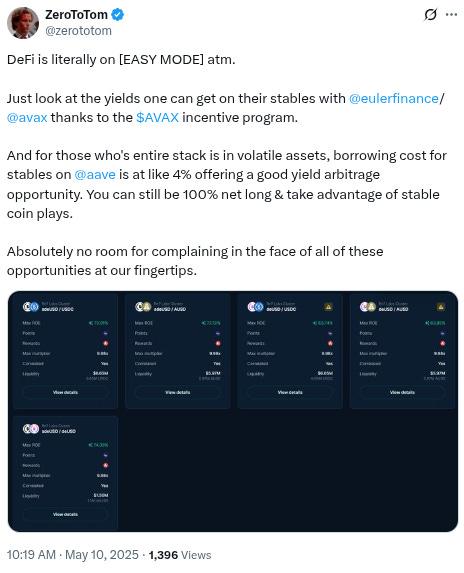

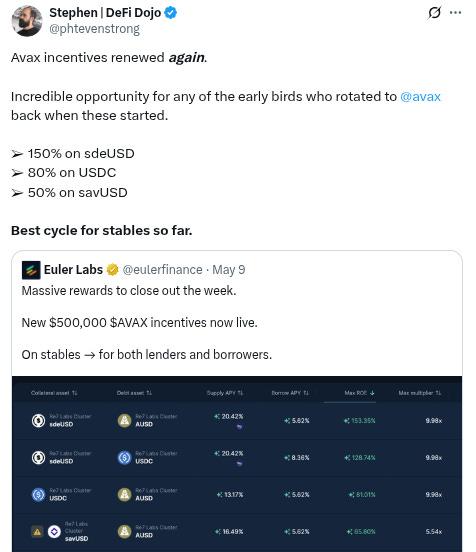

-Seeing lots of excitement around @eulerfinance yields on Avalanche thanks to the AVAX incentives program, h/t @zerototom and @phtevenstrong:

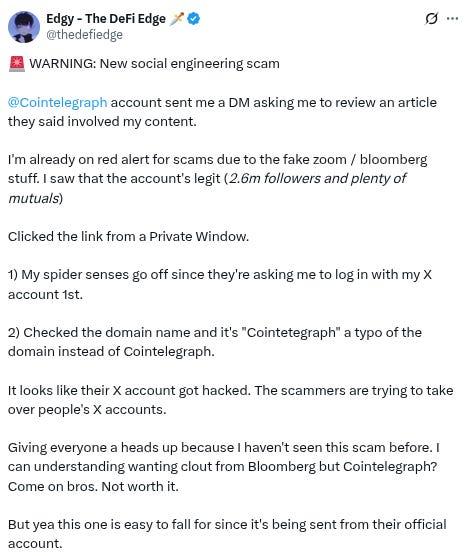

-Important security reminder from @thedefiedge regarding this new phenomenon we’re seeing on Twitter/X of hackers accessing the dm’s of large organizations and then using them for social engineering scams:

-Very long tweet full of alfa from @0xGeeGee (click to read in full), including on the on-chain options space and why @tradeparadex might be the best crypto options platform airdrop to farm, thoughts on the short BERA long BGT trade, thoughts on Ostium Labs, thoughts on Gains Network, thoughts on mPENDLE, and more:

-Great new interview with Doomberg and Michael Every discussing macro, geopolitics, natural resources, demographics, AI, and much else:

-Weekly macro overview from Joseph Wang @FedGuy12:

-Update on everything ETH tech related from @sassal0x:

-New crypto/macro discussion between @fejau_inc and @qthomp:

-Parting wisdom from @redphonecrypto:

Conclusion

Have a great Saturday friends and don’t forget to touch some grass this weekend!

And please RT/subscribe/etc if you found this valuable!

-

-

Note

Big things are happening with @vertex_protocol as our beloved brypto markets start to heat back up!

Their omnichain liquidity system Vertex Edge is currently ranked #3 overall among all perps providers for 7-day perps volume on @DefiLlama (see screenshot below!)…

They are doing an absolutely MASSIVE amount of $VRTX-buybacks…

And they are aiming to be on 25+ EVM chains by the end of 2025!

Visit the Vertex site now to get started trading 60+ perps and spot markets, and stay tuned as we continue shining a light on everything they are doing!

-

-

***Note On Material: The ‘Spotlight’ and ‘Note’ sections and info on our Official Sponsor are the only parts of The Daily Degen that are sponsored/promotional. Everything else is chosen 100% organically based on what info/stories/etc seem likely to be the most newsworthy/important/valuable to readers.