Private Credit: The Invisible Hero of RWA Growth.

But wait… What exactly is Private Credit?

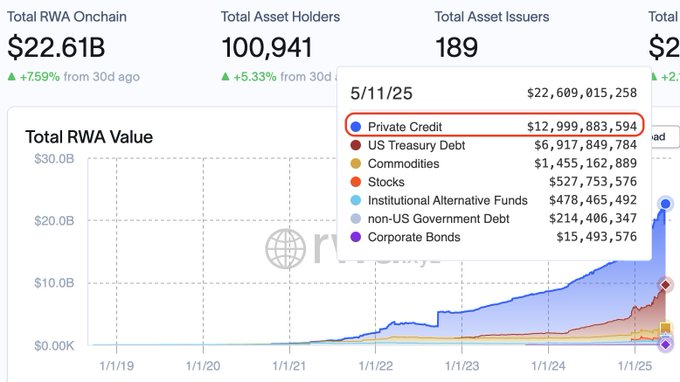

It makes up almost 60% of Total RWA Onchain and is the fastest-growing category. Arguably, it’s also one of the riskiest.

Let's dive into it 🧵

8/ In the past @TrueFi approached the model differently - initially focusing on reputation-based, uncollateralized lending to established crypto firms. Their SAFU protection mechanism aimed to helped mitigate defaults.

However, TrueFi hasn't seen the comeback. Maybe just yet?

9/ In short, on-chain private credit comes with different risks but also a larger potential market size than DeFi collateralized loans.

The crux of private credit is avoiding too many correlated risky bets. As an industry, we need to work towards that future. 🫡

The evolution of private credit in crypto is fascinating—Maple Finance’s in-house underwriting and $SYRUP rewards streamline risk, while WildcatFi’s borrower-led markets with $100M+ TVL empower transparency.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content