Do not dwell on picking winners, take a broader perspective, and seize industry development opportunities through diversified investment.

Written by: Matt Hougan, Chief Investment Officer of Bitwise

Translated by: Luffy, Foresight News

Last week, a significant event occurred in the crypto market: Ethereum began a strong recovery.

After experiencing a difficult period and dropping nearly 60% in price, the second-largest crypto asset by market cap saw a substantial rebound. It rose 53% from its low point on April 12, with an astonishing 37% increase in just the past week.

The surge in Ethereum's price has multiple reasons, including the successful implementation of major blockchain upgrades and a shift in overall market risk appetite.

This rise has prompted many investors to consider: Besides Bitcoin, should they allocate other crypto assets to diversify their investment portfolio?

This is indeed a question worth exploring.

Bitcoin is the king of crypto assets, with the highest market cap, best liquidity, and most solid market foundation. In my view, Bitcoin is like "digital gold" and the only crypto asset with potential to become a globally important currency.

Nevertheless, I still believe most investors should not limit their focus to Bitcoin but should also allocate other crypto assets.

What are the reasons? Looking back at history might provide some answers.

Internet Investment in 2004

Imagine you wanted to invest in the internet sector in 2004. At that time, search was dominant, and Google was the industry leader.

You might have thought: The internet has enormous future potential, so I'll buy shares in this core sector's leading company.

From the perspective of that time, this seemed like a wise decision. Over the past 20 years, Google's stock price has risen cumulatively by 6,309%, rewarding its investors handsomely.

But the internet is a general-purpose technology. It can be used not just for search, but also for retail, social media, video, and enterprise-to-enterprise software, among many other areas.

This means that in 2004, besides buying Google, you could have also bought leading companies in various vertical sectors, such as e-commerce giant Amazon, streaming pioneer Netflix, enterprise software service provider Salesforce, and so on.

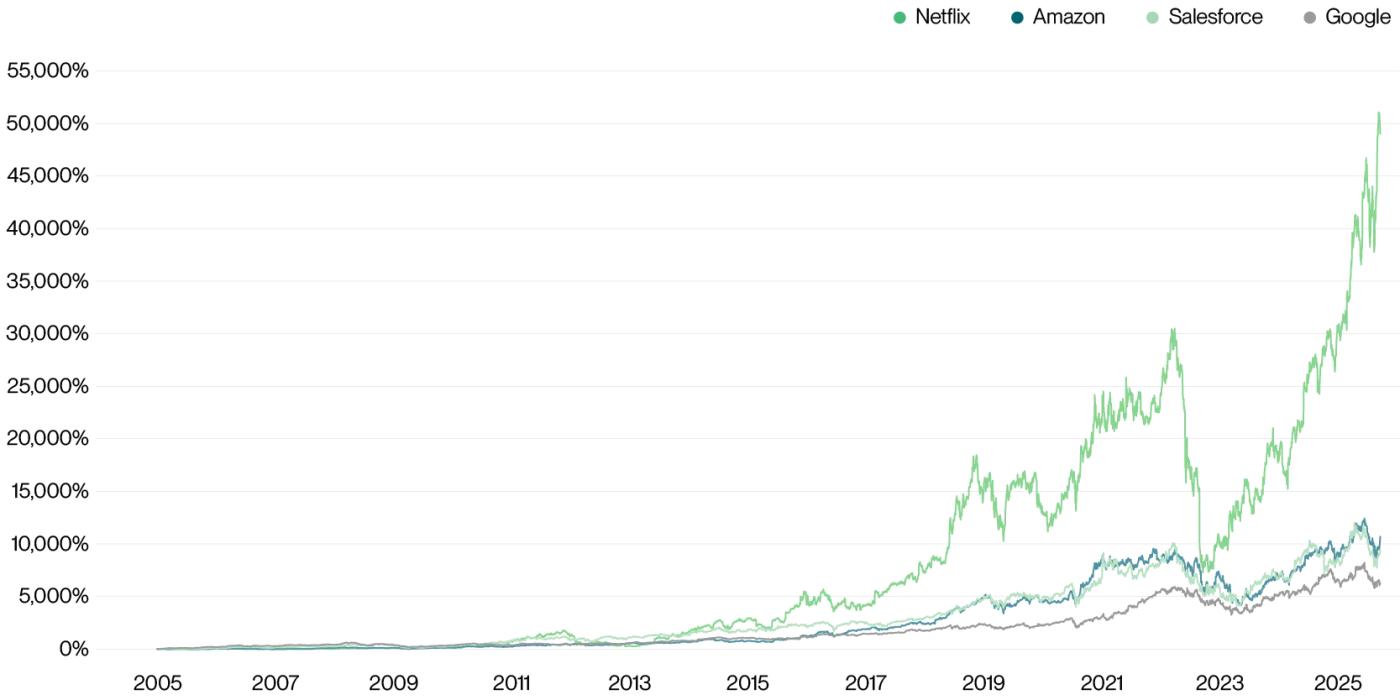

Let's see what returns this diversified investment strategy would have yielded:

Performance of Tech Giants (2004 to present), data source: Bitwise, Yahoo Finance

Google's performance was indeed impressive, now ranking among the world's most valuable assets. However, companies in other sectors also performed remarkably, with Netflix being the most unexpectedly successful, becoming the company with the highest returns - a result that almost no one could have foreseen in 2004.

Blockchain is a General-Purpose Technology

Like the internet, blockchain is a general-purpose technology.

Using blockchain technology, people can create new forms of currency like Bitcoin; build programmable networks for transferring real-world assets, such as Ethereum and Solana; develop innovative applications like DeFi and DePin; or construct middleware that provides services for other blockchains, like Chainlink. Additionally, blockchain technology has given rise to traditional companies supporting the crypto economy, such as Coinbase, Circle, and Marathon Digital.

I believe blockchain will continue to generate applications we cannot currently imagine.

Due to the diverse application scenarios of blockchain technology, different crypto assets can yield vastly different returns in long-term investments. Here's the annual return performance of Bitcoin, Ethereum, Solana, and Chainlink over the past five years:

Crypto Asset Performance (2020 - 2024), data source: Bitwise Asset Management

So, which crypto asset will perform best from now until 2030? That's a good question.

What This Means for Investors

This doesn't mean everyone should invest beyond Bitcoin.

If you believe blockchain's value is solely as an alternative to fiat currency, mitigating potential risks in the traditional monetary system, then investing only in Bitcoin might be sufficient. After all, in the "digital currency" track, Bitcoin's leading position is difficult to shake, and it's almost impossible for other crypto assets to replace it.

However, if you agree that blockchain is a general-purpose technology and are optimistic about its future prospect of gradually bringing various assets on-chain, then based on historical experience, diversifying crypto asset allocation is a better choice. You might consider building a portfolio that includes Bitcoin, Ethereum, Solana, Chainlink, and other crypto assets.

Finally, I'd like to share a piece of data that, even after years of working in ETFs and the crypto industry, still impresses me: Over the past 20 years, actively managed US stock funds underperformed the benchmark index 97% of the time.

In the crypto asset field, which is rapidly changing and full of uncertainty, this data is also worth every investor's careful consideration.

My advice is: Do not dwell on picking winners, take a broader perspective, and seize industry development opportunities through diversified investment.