Tether's USDT total supply has first exceeded 150 billion USD, consolidating the stablecoin's dominant position in the rapidly developing stablecoin market.

The total market capitalization of USDT – the world's largest stablecoin issued by Tether – has first surpassed the 150 billion USD circulation mark, marking an important milestone in the development of stable cryptocurrencies. Since the beginning of 2025, USDT has recorded an impressive increase of over 11 billion USD, consolidating Tether's leading position in this market segment.

Tether marked this milestone with an announcement on social media X, emphasizing the company's pioneering role in the stablecoin industry: "Launched in 2014, Tether not only gave birth to USDT — but also gave birth to the entire stablecoin industry. Today, USDT is trusted by over 400 million people & drives the global digital economy."

Stablecoin market shows signs of diversification

With this new milestone, USDT's market share in the stablecoin sector has slightly increased to 62%, thanks to a 3.79% growth rate in the past month, according to data from defillama. Meanwhile, its closest competitor Circle USDC only recorded a 1.23% increase, showing Tether is expanding its distance from its main competitor.

However, the stablecoin market is witnessing the emergence of new competitors with impressive growth rates. Most notably, BlackRock USD (BUIDL) – a US government bond-based stablecoin – with a 19.30% increase in the past month, reaching 2.89 billion USD. Some other stablecoins also recorded significant growth such as MakerDAO's DAI (+12.07%) and PayPal PYUSD (+5.16%).

According to data from Artemis Analytics, most of the new increase in USDT supply comes from minting on the Tron network. Specifically, Tron has recorded a 12.2 billion USD increase in stablecoin supply over the past three months, while BNB Smart Chain increased by 2.3 billion USD and Ethereum by 1.7 billion USD in the same period. This shows that Tron is becoming the preferred platform for USDT circulation.

As of now, the total market capitalization of the entire stablecoin sector has reached a new record: 242.81 billion USD, increasing 3.75% in the past 30 days. While USDT and USDC continue to lead, smaller stablecoins are experiencing higher supply growth rates, reflecting market diversification and expanding competitive capabilities.

With strong development, the stablecoin sector has become one of the largest holders of US government bonds. According to Bitwise's Q1 Report, stablecoins have surpassed Germany, Mexico, South Korea, and Saudi Arabia in the list of largest foreign creditors of the US Treasury – a testament to the growing scale of this sector.

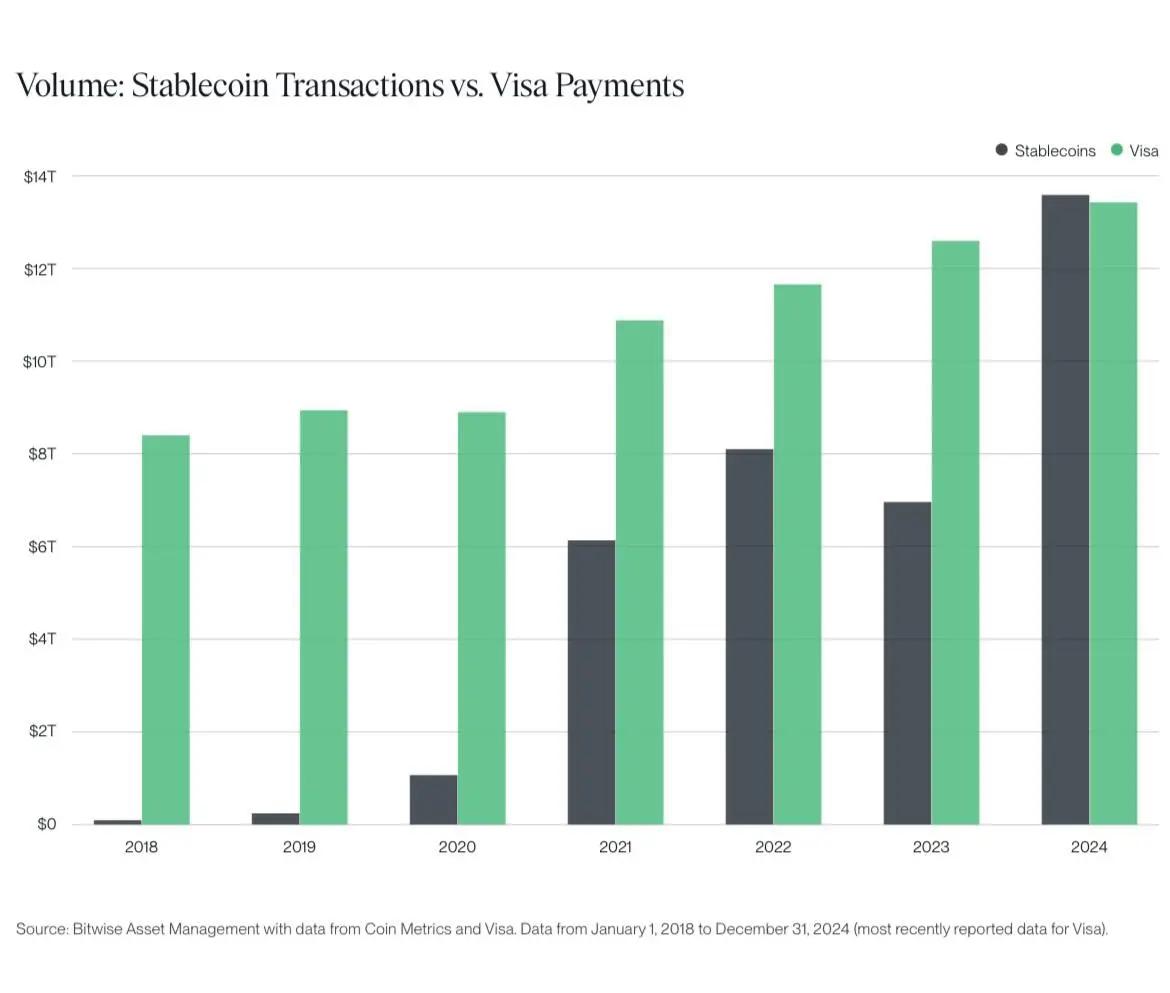

USDT supply growth reflects the increasing influence of stablecoins in global payment activities. Data from Bitwise shows stablecoins first surpassed Visa in total annual trading volume in 2024, and this trend continues strongly in 2025.

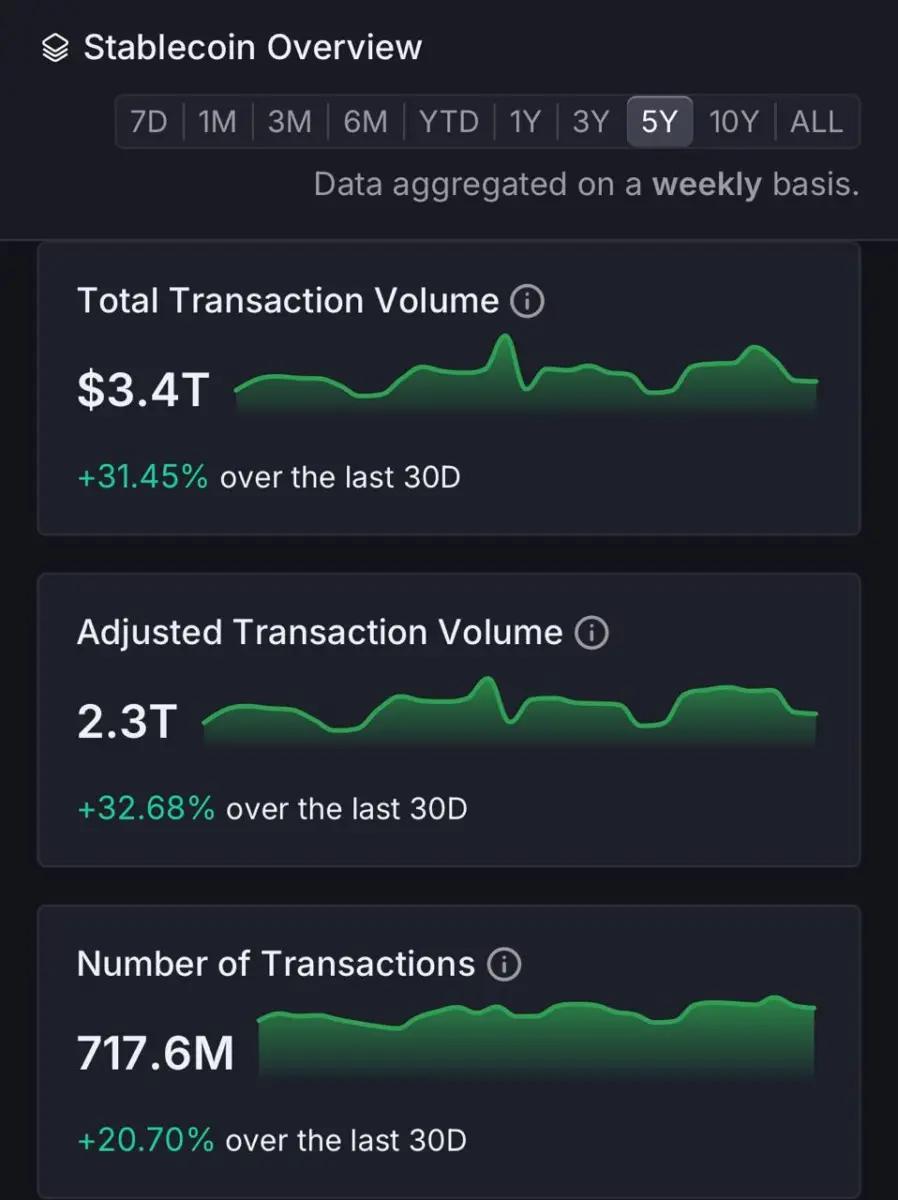

In the past 30 days, stablecoin on-chain trading volume reached 3.4 trillion USD, increasing 31.45%. After removing internal transactions and MEV, the net figure still reaches 2.3 trillion USD, equivalent to an average of 75 billion USD per day. Notably, the number of transactions also increased significantly, with 717.6 million on-chain transactions (up 20.70%) across 28.7 million unique wallet addresses.

Facing increasing competition from stablecoins, traditional payment corporations are also beginning to integrate stablecoins into their service ecosystems. Stripe has launched stablecoin accounts for businesses in 101 countries and plans to issue business cards using stablecoins in collaboration with Ramp. Previously, Stripe acquired Bridge, a stablecoin infrastructure company.

PayPal is also accelerating the development of its PYUSD stablecoin, approaching the 1 billion USD market cap. The recent increase may come from PayPal offering a 3.7% annual yield for PYUSD holders. Meanwhile, Visa has just announced an investment in BVNK, a startup specializing in stablecoin payment infrastructure – showing Visa officially views stablecoins as part of the global payment network in the future.