This article is machine translated

Show original

A guide to online and offline account opening for BOCHK cards that even novices can learn:

Easily invest in Hong Kong and US stocks, participate in new Hong Kong stock issuance to earn certainty, and an essential tool for converting stablecoins into Hong Kong dollars

/n

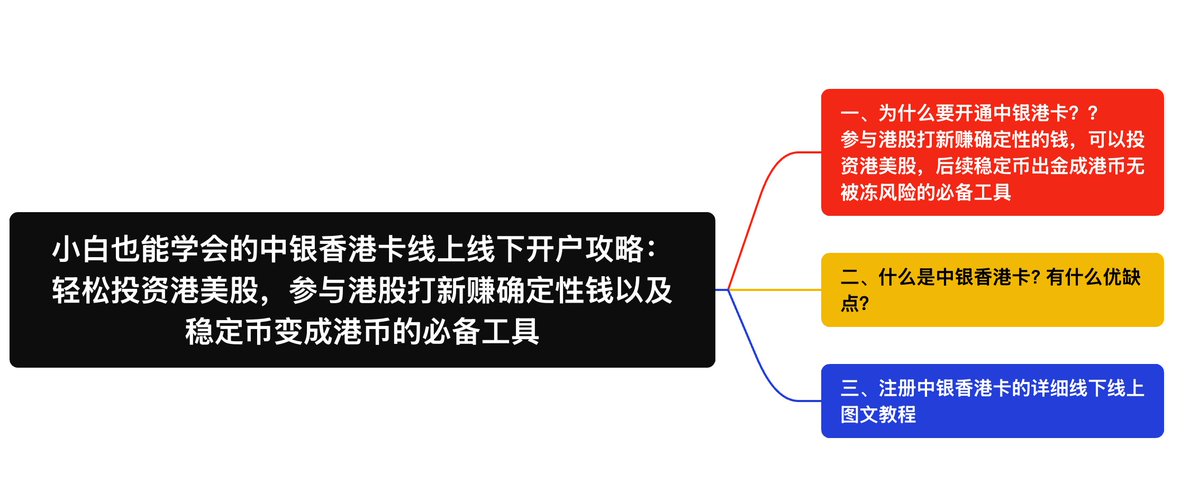

1. Why should you open a BOCHK card?

An important tool for global asset allocation

BOCHK bank card is an important channel for you to participate in the global financial market.

With this card, you can:

Participate in the new listing of Hong Kong stocks to earn certain income:

Hong Kong stock IPO is a relatively low-risk investment method. Through the BOCHK account, you can directly participate in the subscription of new Hong Kong stocks and enjoy the premium income brought by the listing of new stocks.

2. What is BOCHK Card? What are its advantages and disadvantages?

Introduction to BOCHK Card

BOCHK is one of the three major note-issuing banks in Hong Kong. It has strong economic strength and reputation, and provides comprehensive financial services, including personal banking, corporate banking, wealth management and investment banking.

Main advantages

No handling fee for transfers between accounts with the same name: Transfers between accounts with the same name in BOCHK are completely free.

III. Detailed process of registering BOCHK card

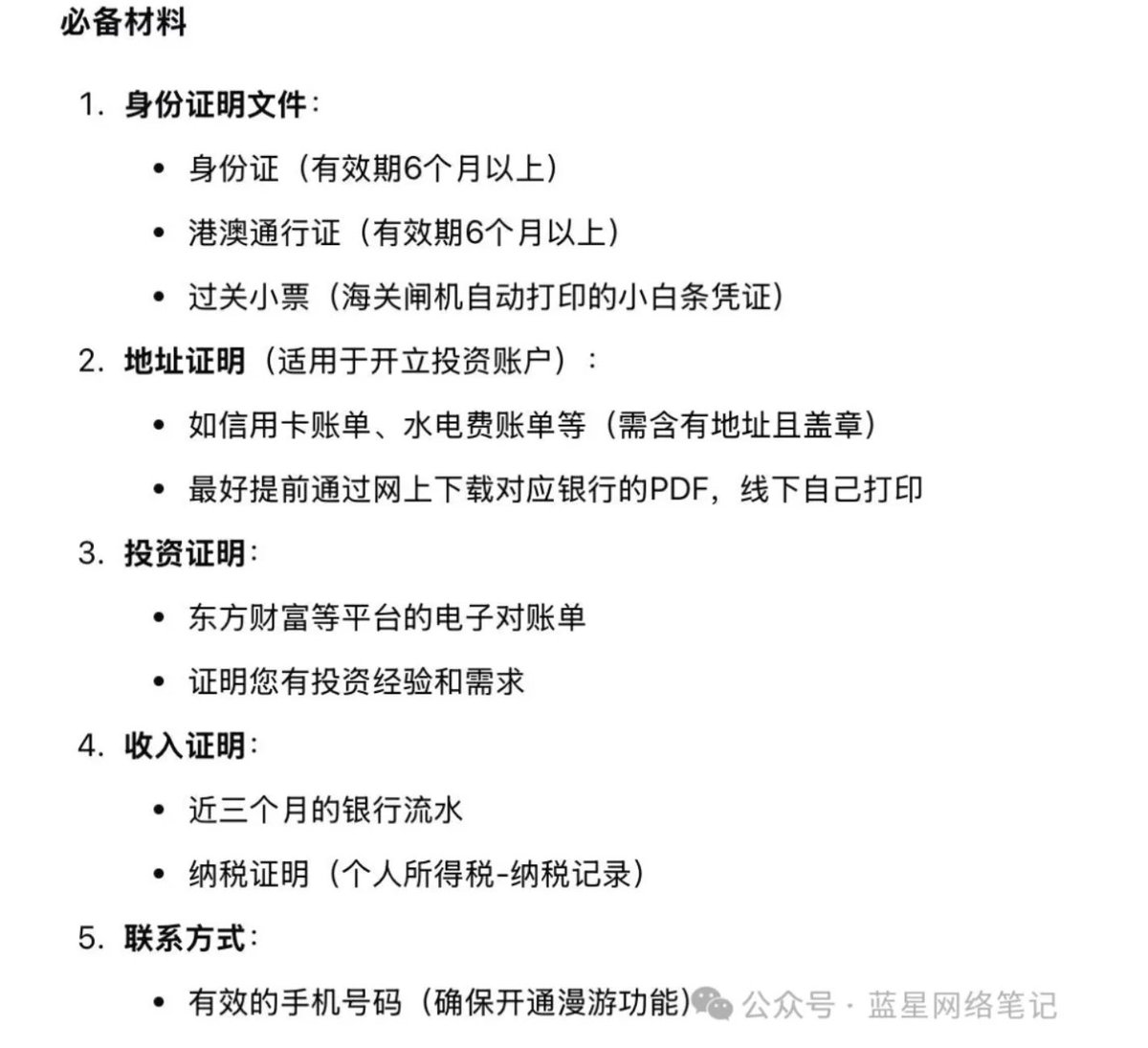

1. Preparation before account opening

IV. Detailed graphic tutorial for offline account opening

2/1 Online appointment

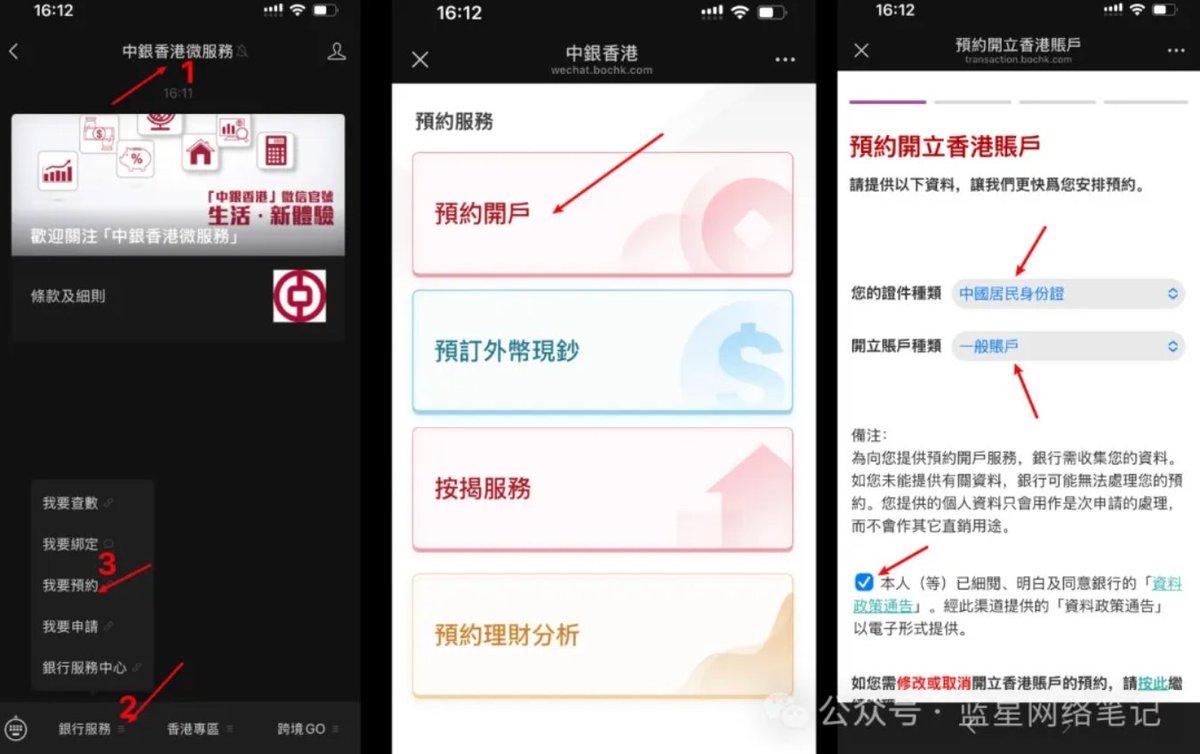

1) Follow [BOC Hong Kong Microservices] Official Account ——> Bottom Menu Bar ——> Banking Services ——> I want to make an appointment ——> Make an appointment for account opening ——> Select the type of certificate according to your own situation, and select [General Account] for account opening

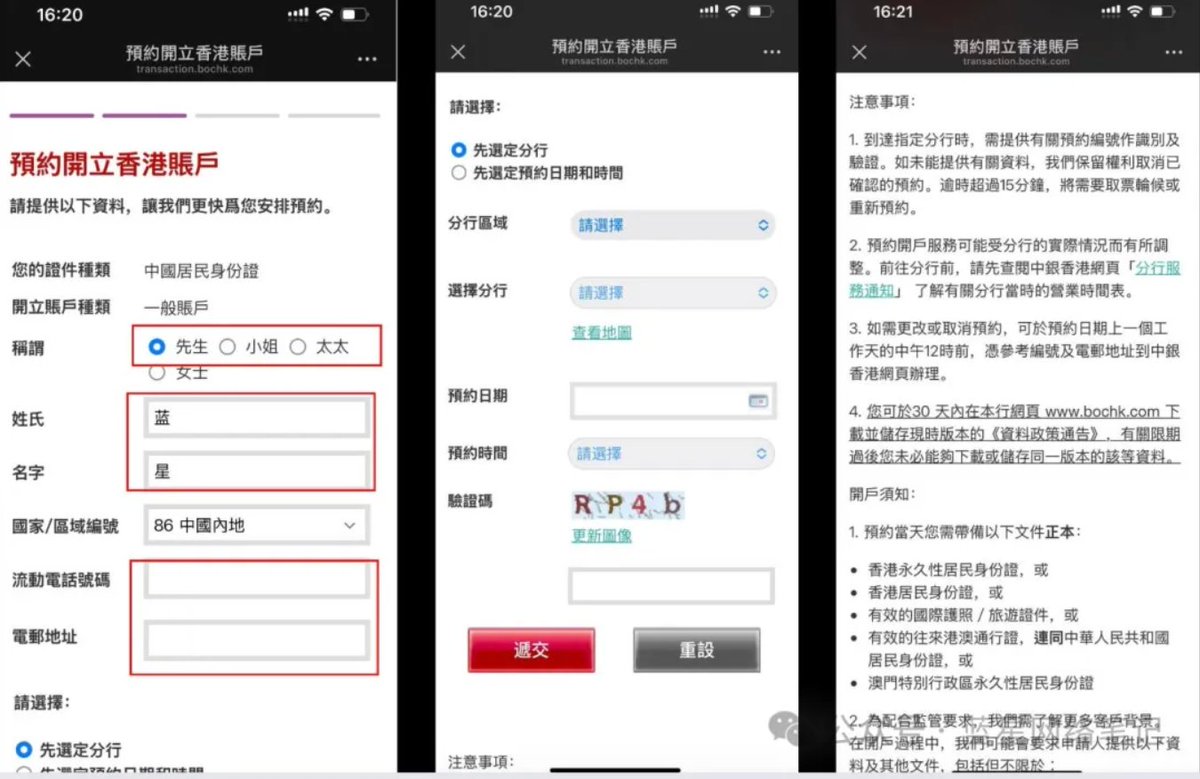

2) Fill in your name, phone number, and other basic information, and select a specific business outlet according to your location

2/2 Offline branch handling

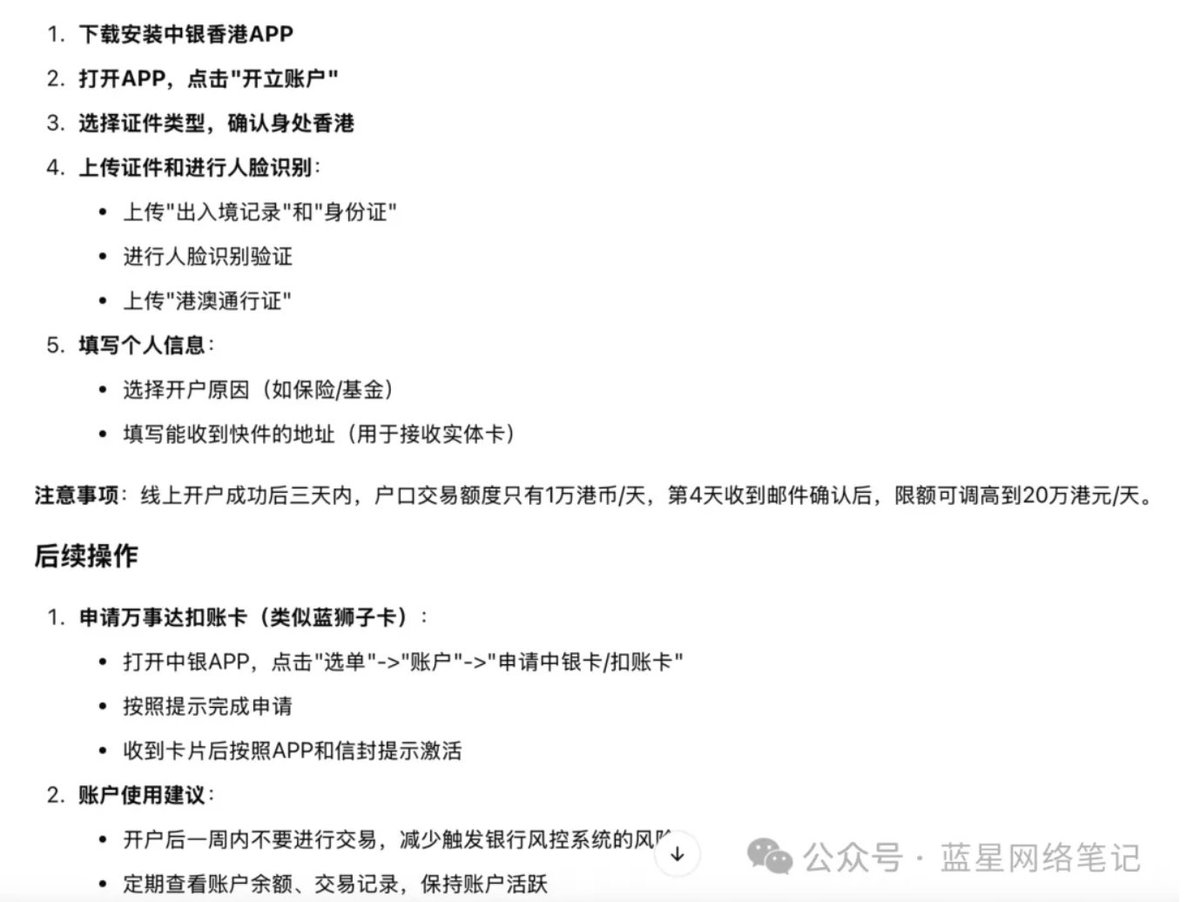

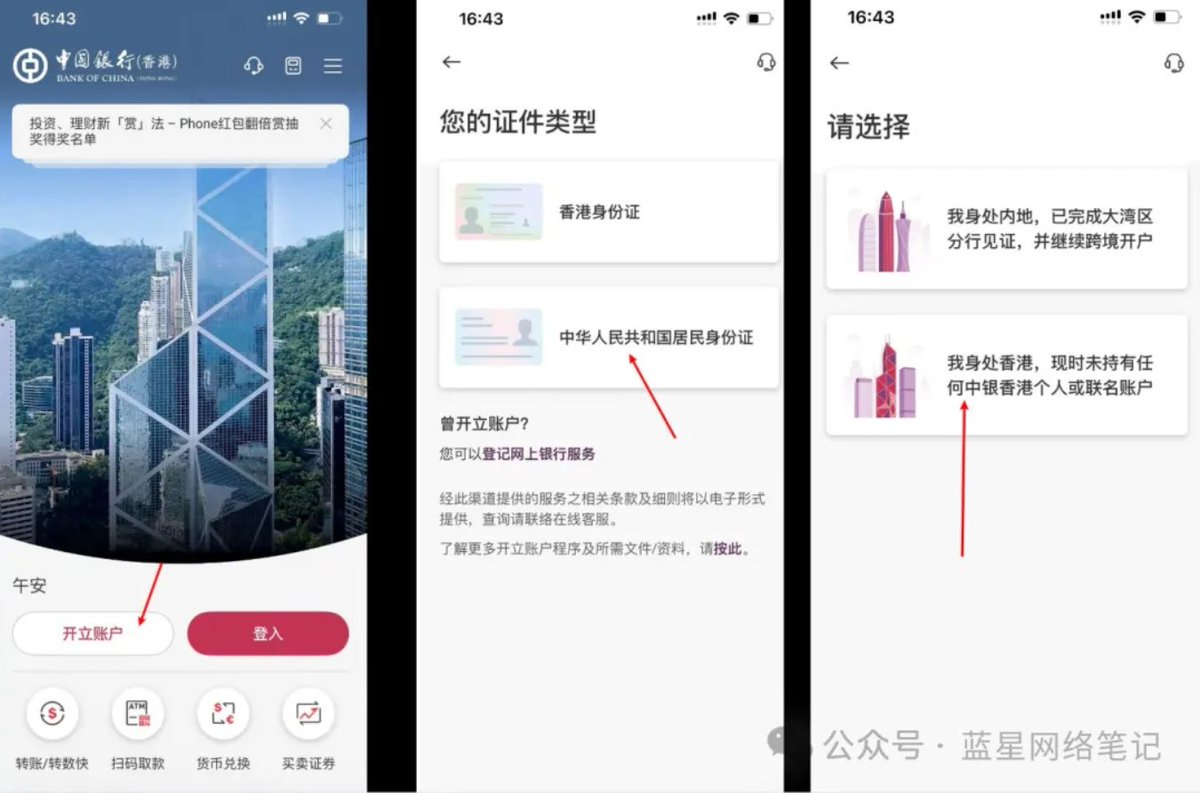

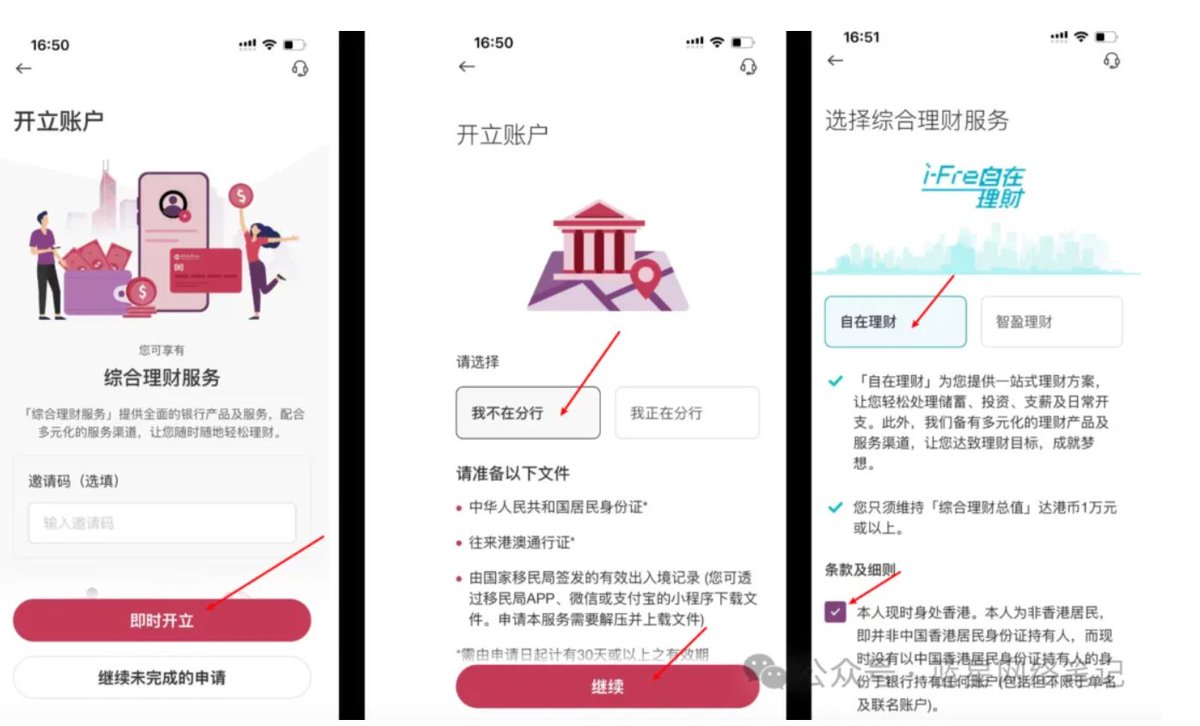

5. Detailed graphic tutorial for online account opening (you must be physically in Hong Kong)

1) Install the BOCHK APP through the App Store. For iPhone, download it from the App Store and then connect to Hong Kong wifi

Search for "BOCHK" in the App Store and download and install the App (you can also download it in advance in the Mainland). After arriving in Hong Kong, connect to Hong Kong wifi and open the BOCHK App, but you cannot use the Mainland mobile phone card for roaming (some group friends have tested it and it doesn't work)

5) Select the reason for opening an account: such as insurance/funds/securities, etc.

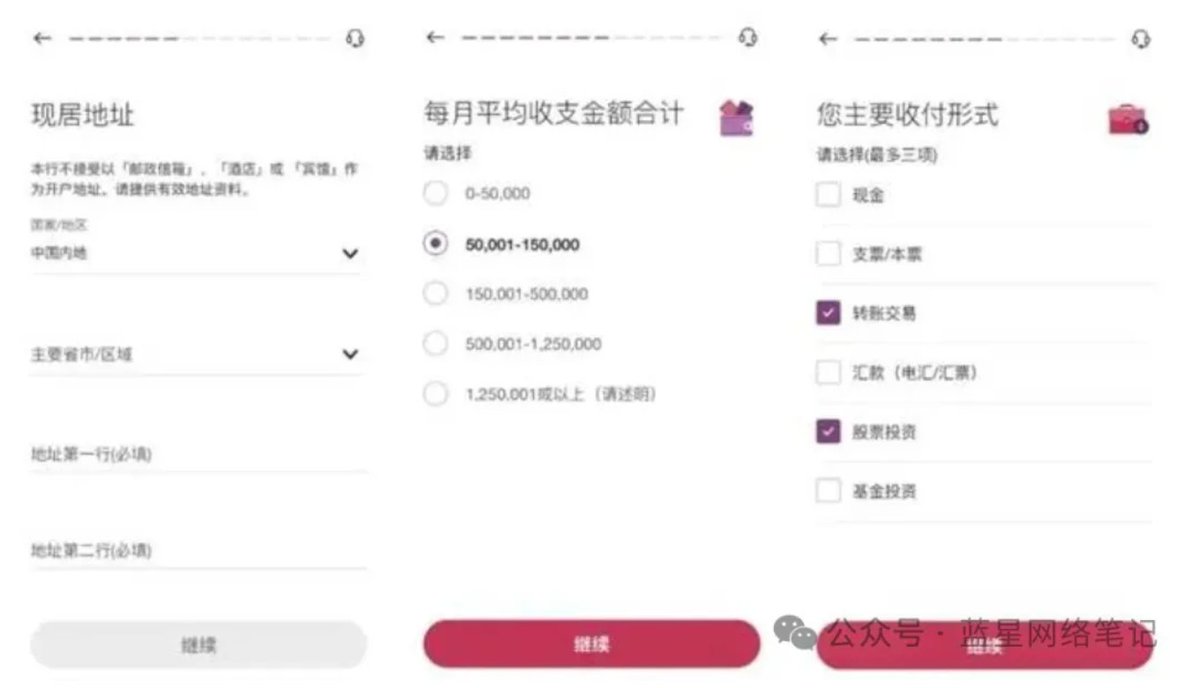

6) Fill in the address (it must be an accurate address that can receive express mail so that you can receive the physical card).

7) Fill in the payment channel - confirm that you are not a BOC employee - statement settings.

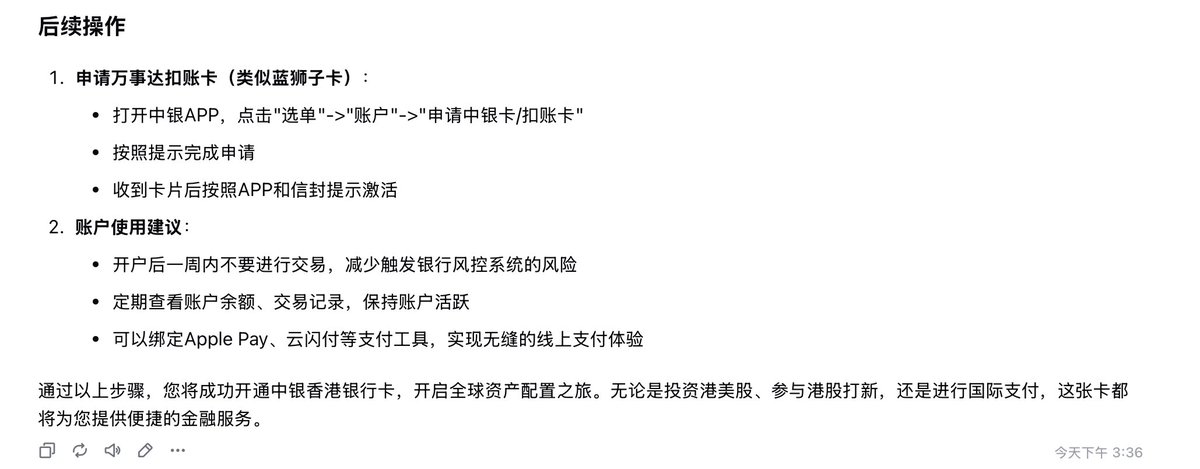

VI. Purpose after account opening

After opening a Hong Kong card, there are generally several uses, and asset allocation can be made separately:

Card opening period: Hong Kong deposits generally have an interest rate of 3%~4%, which is suitable for short-term capital turnover and low-risk capital allocation;

Buy Hong Kong insurance: The long-term interest rate is generally 5%~6%, which is used to maintain and increase the value of long-term assets;

VII. How to find Blue Star

Twitter: x.com/lanxing4

YouTube: www.youtube.com@lanxing7288 (More practical process than articles)

Free Telegram alpha channel: http:/t.me/lanxingnote (Real-time updated wealth codes and inner strength techniques)

WeChat public account: Blue Star Network Notes (with surprise entrances, 100 past practical cases of making money with 0 capital cost)

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content