After Linea Postpones Token Issuance, Are the Founders Constantly Leaking Information?

Written by: Pzai, Foresight News

On May 14th, MetaMask co-founder Dan Finlay stated in a podcast that the wallet team is still considering launching a native token. Although there are currently no clear plans, Finlay noted that under a more relaxed Trump administration regulatory framework, "more types of token issuance would be safe".

As early as 2021, MetaMask engineer Erik Marks proposed the idea of token issuance, and ConsenSys CEO Joseph Lubin also tweeted hints that sparked market attention. Now, the market is more focused on the Token Generation Event (TGE) process of ConsenSys' Layer 2 product Linea. On March 8th, Linea announced that it would not issue tokens in the first quarter of 2025, raising community doubts about the TGE progress. In such a public opinion environment, will ConsenSys take an unexpected approach for wallet users?

Token Issuance as Differentiated Competition in Wallet Wars?

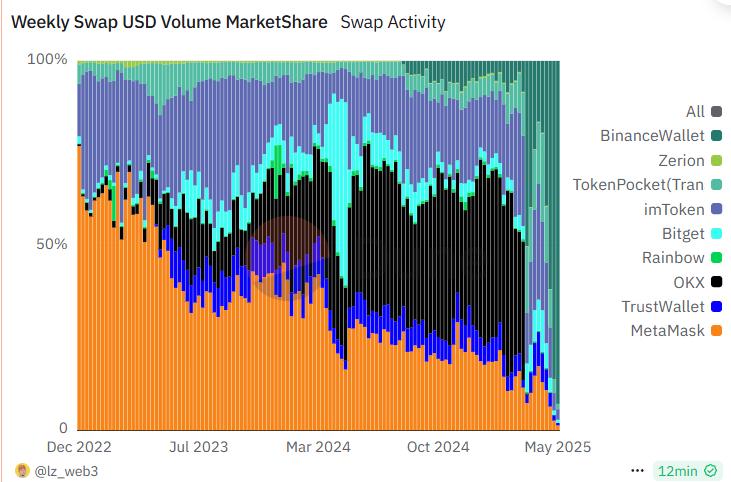

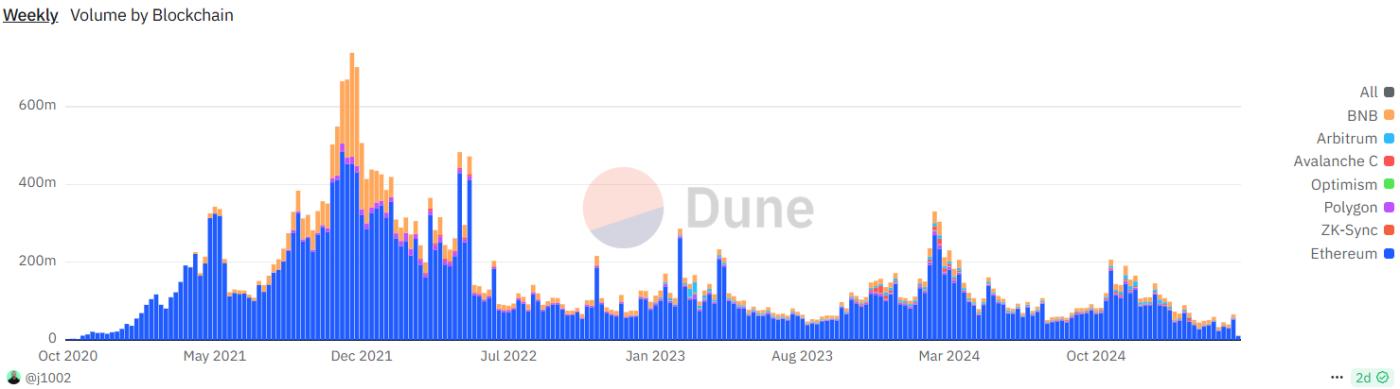

As the top wallet in the Ethereum ecosystem, despite repeated token issuance delays, MetaMask's massive scale of 3 million monthly active users keeps the token airdrop expectation a community focus. From trading data, MetaMask Swap's trading volume is relatively small, with daily trading volume not exceeding $100 million for a long time, far lower than Solana platform trading volumes. With market liquidity trending heavily towards Solana, MetaMask is gradually losing market share, from 77% in late 2022 to less than 3% now. Although MetaMask is actively integrating with developers through tools like Snap to introduce cross-chain wallets like Solana, it still can't match the rapid growth of exchange wallets in trading products.

In the current market environment, MetaMask might achieve decentralized operations through a DAO governance token, deeply binding token functions with cross-chain interactions and even cashback fees to strengthen its multi-chain hub positioning. This "delayed gratification" strategy, though seemingly manipulative, keeps the community continuously using Swap functions and participating in cross-chain transactions, hoping to increase airdrop weight. With exchanges actively expanding wallet product lines and on-chain liquidity gathering, token issuance could be an opportunity for differentiated competition, aiming to reclaim liquidity while enhancing user activity.

Additionally, as the market environment warms and regulatory environment loosens, it provides a compliant basis for token issuance. For example, the U.S. Securities and Exchange Commission (SEC) sued ConsenSys last June, accusing MetaMask of being an unregistered securities broker and allegedly illegally offering securities offerings and trading services, but on February 28th, the SEC proposed to withdraw enforcement litigation against ConsenSys and MetaMask.

Under Linea's Delay Syndrome, Wallet Token Issuance Expectations Are Slim?

As ConsenSys' Ethereum Layer 2 project, Linea has attracted users to participate in ecosystem tasks since its mainnet launch in 2023 with the "backed by MetaMask" star halo, promising to airdrop tokens to early supporters through the LXP (Linea Experience Points) point system. However, the originally scheduled Token Generation Event (TGE) in the first quarter of 2025 was postponed to the second quarter, with official reasons including "token economics need improvement" and "complex legal processes". The community generally believes these statements lack substantial evidence and suspect they are excuses for "infinite delay". Moreover, as other Layer 2 projects (like Starknet and zkSync) have successfully issued tokens, Linea's delayed progress has caused user funds to be locked in the ecosystem, dramatically increasing opportunity costs.

From a data perspective, Linea's on-chain assets are continuously flowing to other ecosystems, with cross-chain asset scale now less than $300 million. Linea product head Declan Fox stated that TGE will occur after the market transitions from bear to bull. Under current market trends, for blockchain projects with pre-market trading FDV stabilizing around $200-300 million, we can anticipate Linea's TGE.