Written by: Kyle, Crypto KOL

Translated by: Felix, PANews

Note: Crypto KOL Kyle currently holds FRAX; this article represents Kyle's personal views only.

Key Points:

Market cap of $276 million / Circulating market cap of $304 million; Frax provides an excellent asymmetric opportunity for stablecoin bets, and with the upcoming GENIUS Act, Frax aims to be one of the first payment-type stablecoins compliant with US law

Founder Sam Kazemian is participating in drafting US stablecoin legislation, and FRAX has a certain regulatory alignment

Asymmetric positioning: Favorable regulatory environment + Product - Market - Regulatory fit + Undervalued token (heavily criticized)

FRAX has now become a vertically integrated stablecoin stack: frxUSD (stablecoin), FraxNet (banking interface), Fraxtal (L2 execution layer)

frxUSD is fully backed by US Treasuries and cash

Token restructuring: FXS renamed to FRAX, now serving as Gas, governance, burn, and staking token; old frax dollar discontinued, now frxUSD

Undervalued valuation: Compared to similar projects like Ethena ($6.1 billion), with a circulating market cap of about $304 million, and the best liquidity token exposure in the stablecoin narrative - USDC/USDT have no tokens (private companies), while Maker/Curve are not direct enough

Real-world integration is live: Providing custody services through BlackRock/Superstate, with partners including Stripe and Bridge

This is a fusion of cash flow, utility, and growth. What's most exciting is Sam's efforts to make it compliant with regulations. Currently, no other decentralized stablecoin issuer is taking this compliant, transparent, and legal path.

At a time when everyone is focusing on stablecoins, the next wave of mass adoption (a truly trillion-dollar wave) will come from institutions and consumers who need to comply with the law. They need redemption rights. They need clear rules. They need to be able to walk into a boardroom and say: "Yes, this complies with U.S. law".

This is the embodiment of product, market, and regulatory alignment.

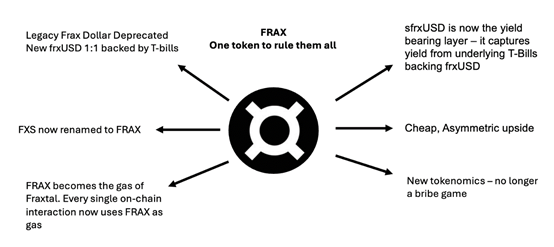

2. FRAX Reconstruction

Let's discuss some subtle changes that FRAX has recently undergone, which add more support to the protocol. This section mainly introduces the changes made in FIP-428.

In short:

The old Frax stablecoin has been deprecated and renamed to Legacy Frax Dollar. The new stablecoin is now called frxUSD.

FXS has been renamed to FRAX—using only one core asset to represent the entire protocol.

veFXS has been renamed to veFRAX, wFXS to wFRAX, and so on.

However, this transition will take time as exchanges are working to support it.

FRAX will become the Gas for Fraxtal, replacing frxETH. Now, all on-chain interactions use FRAX as Gas. And there are plans to ultimately support validator staking using FRAX, which will greatly enhance the token's utility.

New tokenomics: tail issuance plan—8% issuance per year, decreasing by 1% annually until reaching a lower limit of 3%. Issuance is now distributed through FXTL points, a points system that rewards protocol-compliant behavior.

You can use Flox Capacitors to improve conversion rates, which requires staking FRAX. The goal here is clear: reward long-term users who lock, stake, and actively participate in the ecosystem.

This also means no more FXS dashboard—no more mercenary LP mining; no more massive token issuance to maintain TVL—everything is earned.

Frax is no longer a bribery game—now it's more like an L1 token that earns monetary premium, burns, generates yield, and has utility, rather than a bribery + mining token—which makes FRAX eligible for repricing.

sfrxUSD is now the yield-generating layer—it derives yield from the underlying Treasuries supporting frxUSD.

Of course, there are other points. FIP-428 is a brilliant proposal that binds the entire ecosystem to a single token: FRAX. Every part of the Frax system now flows back to the token; Fraxtal fees? Burn FRAX. FXTL issuance? Only users holding and staking FRAX can obtain it. Future validator staking? Requires FRAX. Governance? veFRAX. Most importantly, FRAX is now an L1 token because it's the native Gas token on-chain.

Frax essentially creates a monetary cycle with internal demand, utility, and consumption mechanisms. In my opinion, the key is understanding that this is not just a simple rebranding. Frax is becoming the most regulatory-compliant, yield-generating, vertically integrated dollar stack in the crypto space.

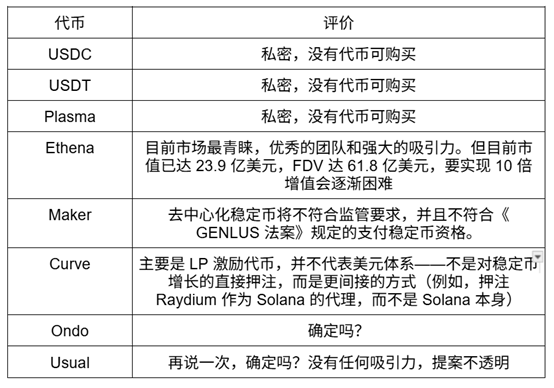

3. Among All Liquidity Tokens, FRAX is the Best Choice

Lastly, let's talk about its advantages. It's well known that stablecoins are the most popular products in the crypto space, serving the largest potential market—the global market. The stablecoin narrative is very clear, however, there are few tokens available for investment to seize this opportunity.

I believe FRAX is the best liquidity token to bet on the stablecoin narrative, with huge upside potential. Besides the "North Star" upgrade and building an entire banking system, Frax is in the best position in the stablecoin value chain.

The reason is simple: compared to other participants (whether DEXs, lending markets, or payment apps), the issuer can obtain the largest economic share. Controlling issuance is a huge value driver that can capture the most lucrative profits—as they say, whoever controls the distribution channel is the winner.

This is why from an investment perspective, USDC/USDT are the most popular products in today's market—unfortunately, they don't have tokens. Below is a comparison table with other liquidity tokens, showing why Frax is the best token in today's liquidity market representing the stablecoin concept:

On the other hand, FRAX is almost fully diluted, with a market cap of $276 million as of May 10th, and a fully diluted valuation (FDV) of $304 million. This is a token that has established partnerships with Bridge and Stripe, with a market cap of less than $500 million.

Secondly, it's a fact that FRAX is undervalued. As mentioned at the beginning, when introducing this project to people, they all show a certain degree of disdain. But everyone is wrong—seeing such a chart, I'm not surprised at all, and this is precisely the reason to buy—at the current price point, this is an asymmetric investment with huge upside potential; if Sam can execute (and he has done so so far, establishing partnerships with all these giants), growth is obvious.

4. Trading Risks

Now that we've discussed the upside, let's talk about risks. Actually, the risks are quite simple:

1. Stablecoin Bill Delayed, Not Passed, or Changes Affecting FRAX

In fact, this is happening—just a few days ago, the bill failed to pass in the U.S. Senate. However, quoting Sam, who has been working with these people for the past few months, Sam says: "It's not as serious as people say. We never expected it to pass three months ahead of the congressional August recess in late July. This is part of the political process and can't pass three months ahead of schedule. I'm an optimist, but not that optimistic. Everything is still on track, expected to pass in July, which has always been my expectation".

July will be a critical month, and if it still hasn't passed by then, start worrying. But until then, maintain a calm attitude.

2. Why Discuss the GENIUS Bill So Much, and Little About the STABLE Bill? What if the STABLE Bill Passes?

Again, according to Sam, this is not the case—both bills may pass in their respective houses, followed by a coordination period during which a compromise final draft will be reached and submitted to the president for signature. The final draft is likely to be more like the GENIUS Bill, rather than the STABLE Bill, and that's the key.

3. What's the Worst-Case Scenario?

Neither bill passes—this would likely only occur in the event of a major global financial collapse, at which point all efforts would be completely shelved.

But the situation doesn't entirely depend on the bill itself—Frax has already shown tremendous influence in improving the protocol, which I believe is a full reason to bet on them.

4. Failure to Deliver on Promises

Given that Sam has been fully committed to playing the founder's role in Washington D.C., the likelihood of this happening is extremely small.

Conclusion

FRAX is no longer the "half-baked" algorithmic stablecoin from 2022. It has evolved into a full-stack monetary system built around regulatory clarity, institutional collaboration, and vertical integration. The founder is assisting policymakers in Washington D.C. The stablecoin is backed by U.S. Treasuries and institutionally custodied. The token is gaining real utility—used as Gas, governance, burn mechanism, and more.

Currently, the purest stablecoin bet in the crypto space—and such opportunities are rare. A token trading below $16, directly pegged to the U.S. dollar, which is the largest potential market in the crypto space. Looking forward to FRAX's future.