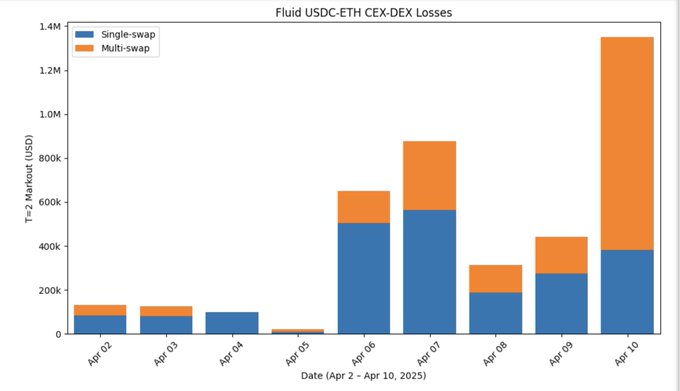

The $USDC - $ETH @0xfluid pool lost a staggering 1.2M to 2M during Apr 02–10 to CEX-DEX arbitrage.

Here’s why those losses happened, why Fluid’s proposed fixes will make things worse, and how @angstromxyz fixes this.

🧵👇

DefiMoon

@DefiMoon

05-15

UPDATE #3: Cumulative losses to $USDC - $ETH LPs on @0xfluid are $19m due to rebalancing 😱😬

https://dune.com/queries/4855794/8043079…

Fluid devs are now offering 500,000 of $FLUID tokens vested over a year to cover losses of LPs.... 500k fluid at current price is $2.6m 😁🤡

So what's the solution?

@angstromxyz

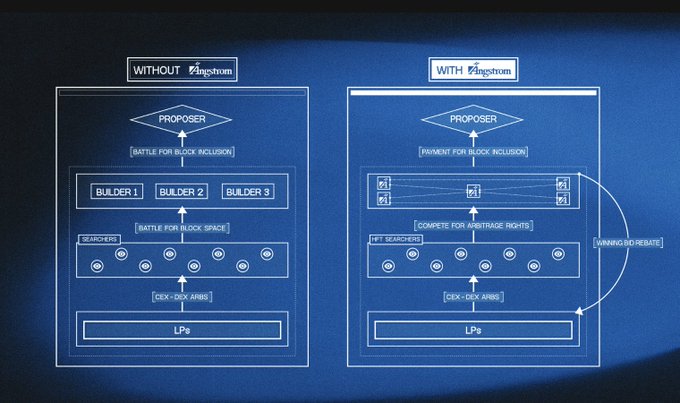

To recapture CEX-DEX arbitrage, Angstrom runs an auction each block.

Arbitrageurs bid directly for the right to rebalance the pool fee-free, and the winning bid goes straight to LPs instead of builders/proposers.

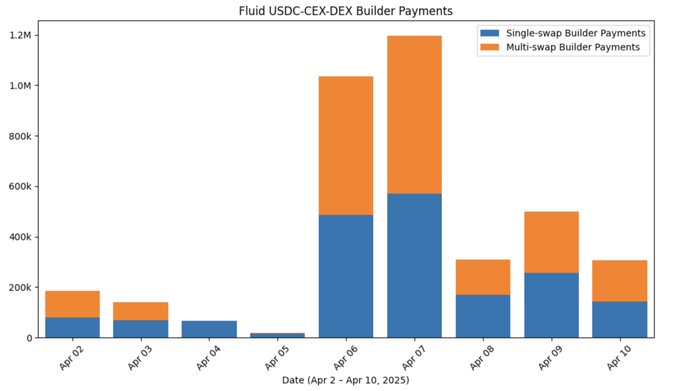

Builder payments for the Fluid pool mirror its arbitrage losses almost exactly.

CEX–DEX is so competitive that most MEV flows to block builders/proposers.

If arbitrageurs bid just as competitively on @angstromxyz, LPs would have recaptured essentially all of their losses.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content