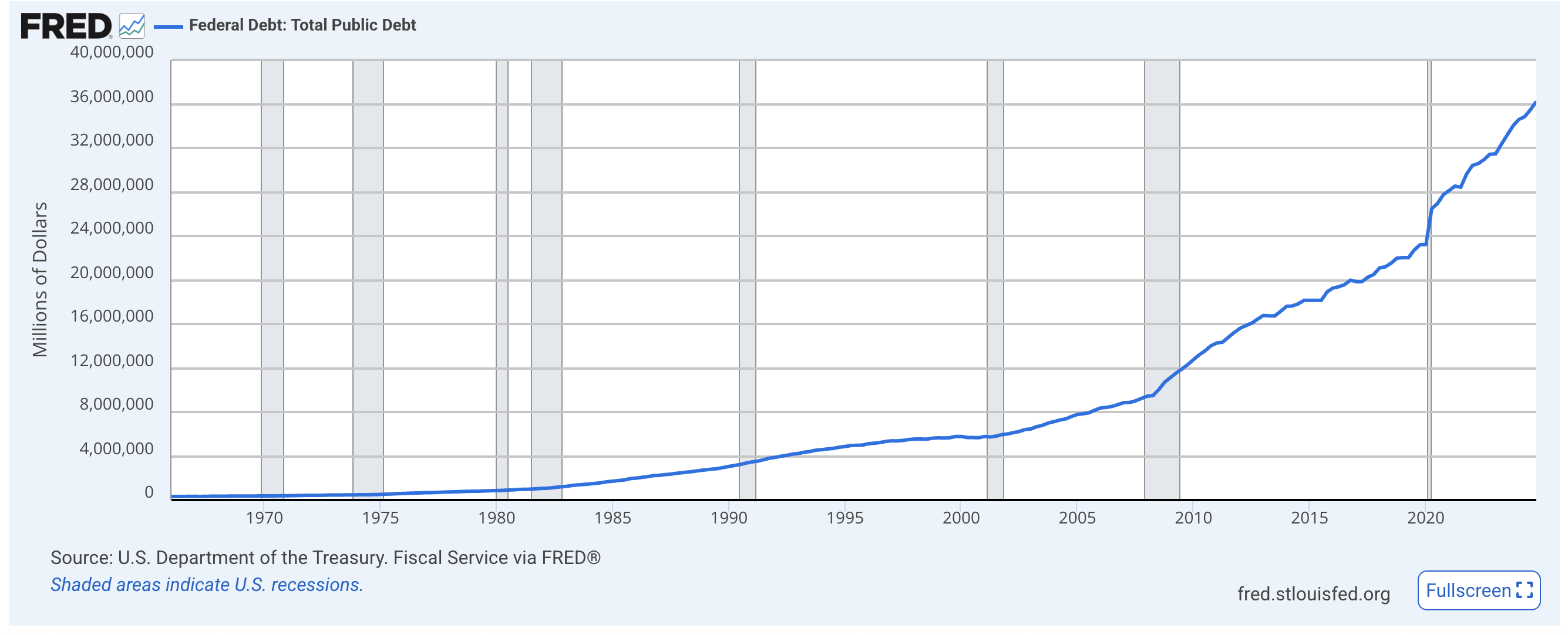

Bitcoin (BTC) is facing a mixed situation with rising signals and short-term uncertainty. Moody's recent US credit rating downgrade has enhanced the long-term bullish sentiment for BTC, strengthening its role as a hedge against increasing debt and fiscal uncertainty.

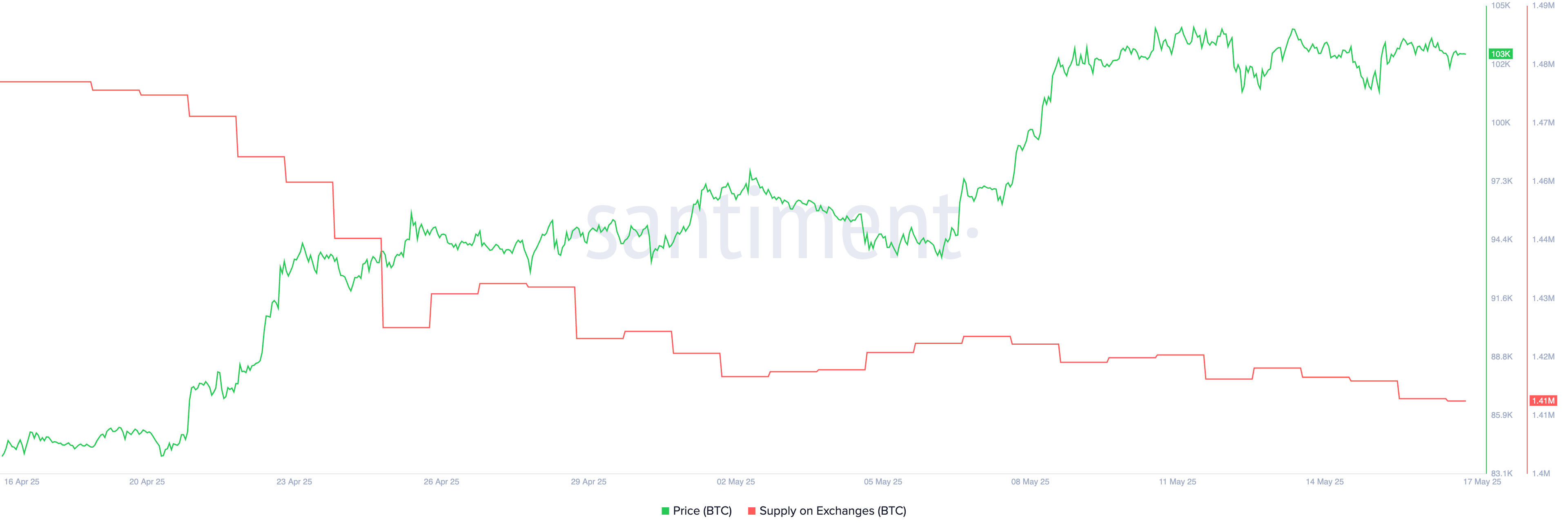

Meanwhile, on-chain data shows that Bitcoin supply on exchanges is decreasing, suggesting that investors prefer holding over selling. Despite these bullish fundamentals, BTC is in a phase of consolidation in the short term and needs new momentum for price appreciation.

Moody's Downgrade Ends 100-Year US Credit Rating Record

Moody's has downgraded the US credit rating from Aaa to Aa1, removing the last perfect score from a major credit rating agency.

This is the first instance where the US has lost top-tier ratings from all three agencies following S&P's downgrade in 2011 and Fitch's in 2023. Increasing deficits, rising interest costs, and the lack of credible fiscal reforms were the reasons behind the decision.

Markets reacted quickly. Treasury yields rose and stock futures declined. The White House dismissed the downgrade as politically motivated, while lawmakers continue negotiating a $3.8 trillion tax and spending package.

Moody's also warned that extending Trump-era tax cuts could deepen the deficit, potentially reaching 9% of GDP by 2035. This scenario could enhance the attractiveness of cryptocurrencies, especially Bitcoin, as a hedge against long-term fiscal instability.

Bitcoin Correction... Decreasing Exchange Supply and Ichimoku Uncertainty

From May 2 to May 7, Bitcoin's exchange supply briefly rose from 1.42 million to 1.43 million before declining again.

This short rise occurred after a larger decline from April 17 to May 2, during which exchange supply dropped from 1.47 million to 1.42 million. Currently, this indicator has resumed its decline, remaining at 1.41 million BTC.

Bitcoin supply on exchanges is a key market indicator. When more BTC is stored on exchanges, it indicates potential selling pressure, which can be a bearish signal.

Conversely, a decrease in exchange balances suggests holders are moving coins to cold storage, which is a bullish signal that reduces short-term selling pressure. The current decline reinforces the possibility that investors are preparing to hold rather than sell.

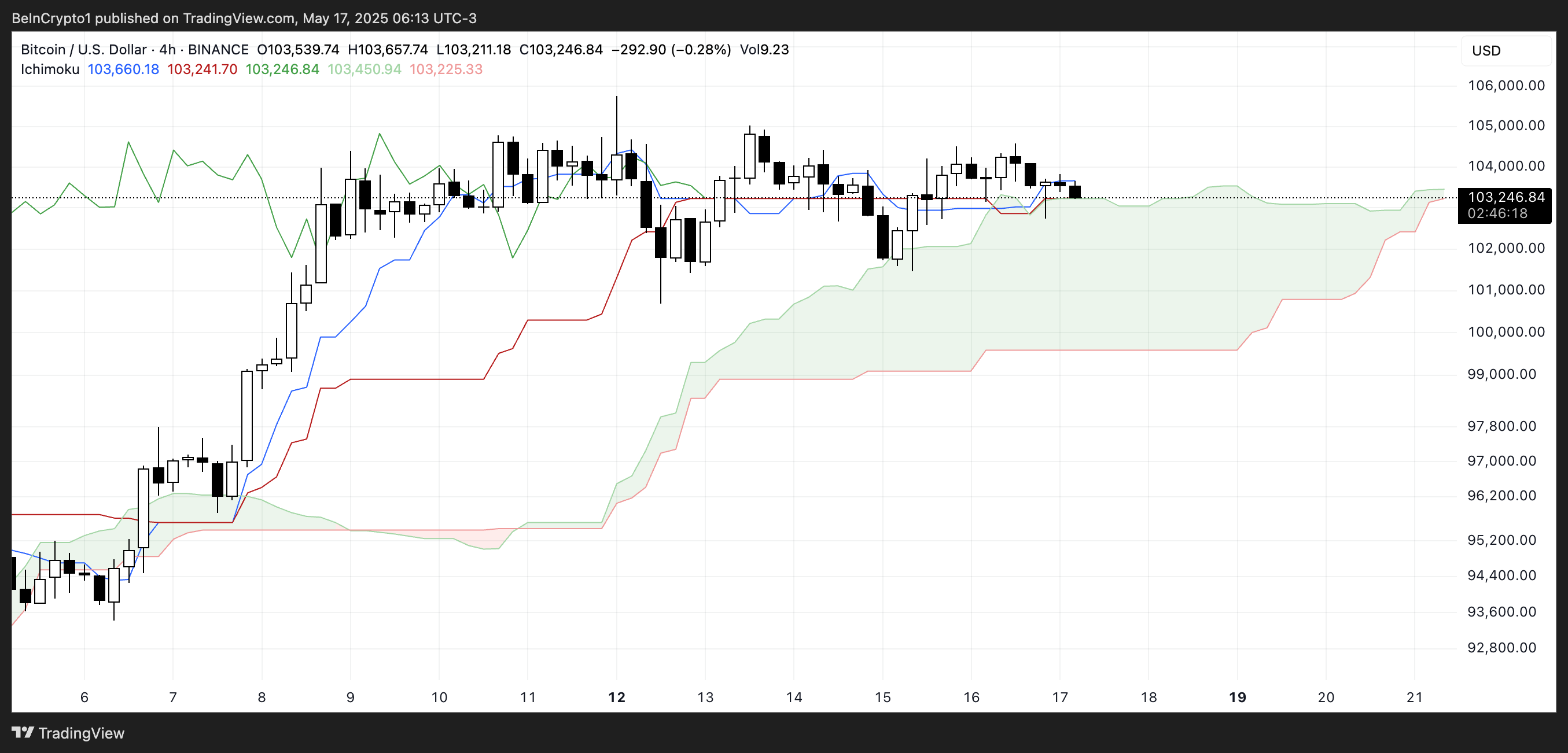

Bitcoin's Ichimoku chart shows a correction period with neutral to slightly bearish signals. The price is currently located around a flat baseline (red line), indicating a lack of strong momentum.

The conversion line (blue line) is also flat and closely tracking the price, further reinforcing this sideways movement and short-term uncertainty.

Senkou Span A and B lines (forming the green cloud) are also relatively flat, suggesting market equilibrium. The price is moving near the top edge of the cloud, which typically acts as support. However, the cloud is not expanding and has a flat structure, indicating no strong trend confirmation currently.

The lagging span (green line) is slightly above the price candles, suggesting a slight bullish bias, but overall the chart indicates uncertainty and requires a breakout to confirm the next direction.

Moody's Downgrade Strengthens Bitcoin's Long-Term Bullishness... Short-Term Correction

Moody's downgrade, with the US losing its last perfect credit rating, could be a major long-term catalyst for Bitcoin.

While it may not cause immediate price movements, the downgrade reinforces the narrative of increasing fiscal instability and debt concerns. This enhances Bitcoin's appeal as a decentralized, hard-capped asset.

In the medium to long term, more investors might choose BTC as a hedge against sovereign risk and weakening trust in the traditional financial system.

In the short term, Bitcoin price has entered a correction after breaking $100,000. Moving averages still show strength, with short-term averages above long-term averages, but flattening.

To resume bullish momentum, BTC needs to overcome the $105,755 resistance.

On the downside, maintaining the $100,694 support is crucial. Losing this could lead to a decline to $98,002 and potentially $93,422.