How many "U Cards" do you currently have in your possession?

From early Dupay and OneKey Card to Cards launched by exchanges like Bitget and Bybit, and then to crypto payment card services from Infini, Morph, and SafePal, and even Coinbase and MetaMask joining the fray, crypto payment cards (U Cards) targeting the PayFi narrative have almost become a standard for Web3 projects since the beginning of this year.

Under the new round of players staking their claims, promotional tweets and reviews of various U Cards have been overwhelming, momentarily reminiscent of the colorful shared bicycles that once filled the streets. The dazzling array of options has shifted market focus from usability to gradually comparing dimensions such as registration/usage thresholds and rates, attempting to find the cost-performance king in the "sea of cards".

However, when observing over a longer time dimension, it becomes apparent that the U Card track's surface prosperity cannot conceal its underlying fragility. To put it bluntly, the lifecycle of a U Card is sometimes not even longer than some meme coins: cases of running away, shutting down, and card replacement are too numerous to count, with most crypto payment card players from the previous wave having long since disappeared.

The reason is simple: safety and compliance have always been the Sword of Damocles hanging over all U Cards. Besides heavily relying on the compliance willingness of channel banks, U Cards themselves have inherent structural defects - with the fund pool custody rights in the hands of service providers, which is an extreme test of operational capabilities and moral standards. If either the cooperating bank or the service provider encounters issues, users could become innocent casualties...

For the current "battle of a hundred teams", the underlying rate costs of U Cards are mostly similar, and user experience often depends on subsidies and high-interest measures. However, these short-term incentive methods clearly cannot build true long-term competitiveness. Once subsidies decline, facing homogeneous card-binding consumption services, users will find it difficult to maintain long-term loyalty to any particular brand.

Therefore, as the traditional U Card model gradually reveals its ceiling, some crypto payment card services have begun to emerge with new variables, making interesting attempts from multiple dimensions such as wealth management and bank accounts:

For example, the star project Infini's "Card + Wealth Management" format, which provides custody and interest income for users' crypto assets through on-chain DeFi configuration; and the veteran wallet SafePal's "Card + Bank Account" format, allowing users to truly own a personal verified Swiss bank account, achieving overseas broker/CEX deposit and withdrawal experiences under the Euro/Swiss franc framework.

Objectively speaking, whether broader "Card +" services can truly break out of the cycle and become an exception remains to be further verified by the market. However, it can be confirmed that only crypto payment card projects that can balance security, compliance, and user experience may have the possibility of breaking the "short-lived" curse in this "chaotic era".

Crypto Payment Cards: Hardly "Evergreen"

Why have U Cards transformed from a niche track to a hotly contested "hot cake"?

There are essentially two core reasons.

First, against the backdrop of a market that is still bear or bull (at the time of writing it was a "bear market", at the time of publication it was a "bull market", what will it be when you see this?), crypto payment cards are actually a business that generates both hype and traffic: Not only do they have a clear profit model and stable cash flow, but they can also significantly improve user activity and community stickiness.

After all, one of the biggest pain points for Web3 players, especially those from mainland China, is deposits and withdrawals: how to directly use their crypto for daily consumption payments, and how to conveniently and compliantly convert fiat into crypto has always been a naturally high-demand landing scenario.

So for Web3 projects urgently needing to expand their business boundaries, almost all are willing to enter this track, regardless of whether they were originally strongly related to the PayFi track. This has made U Cards a rare "certain business" and the best business expansion channel in the eyes of many Web3 projects.

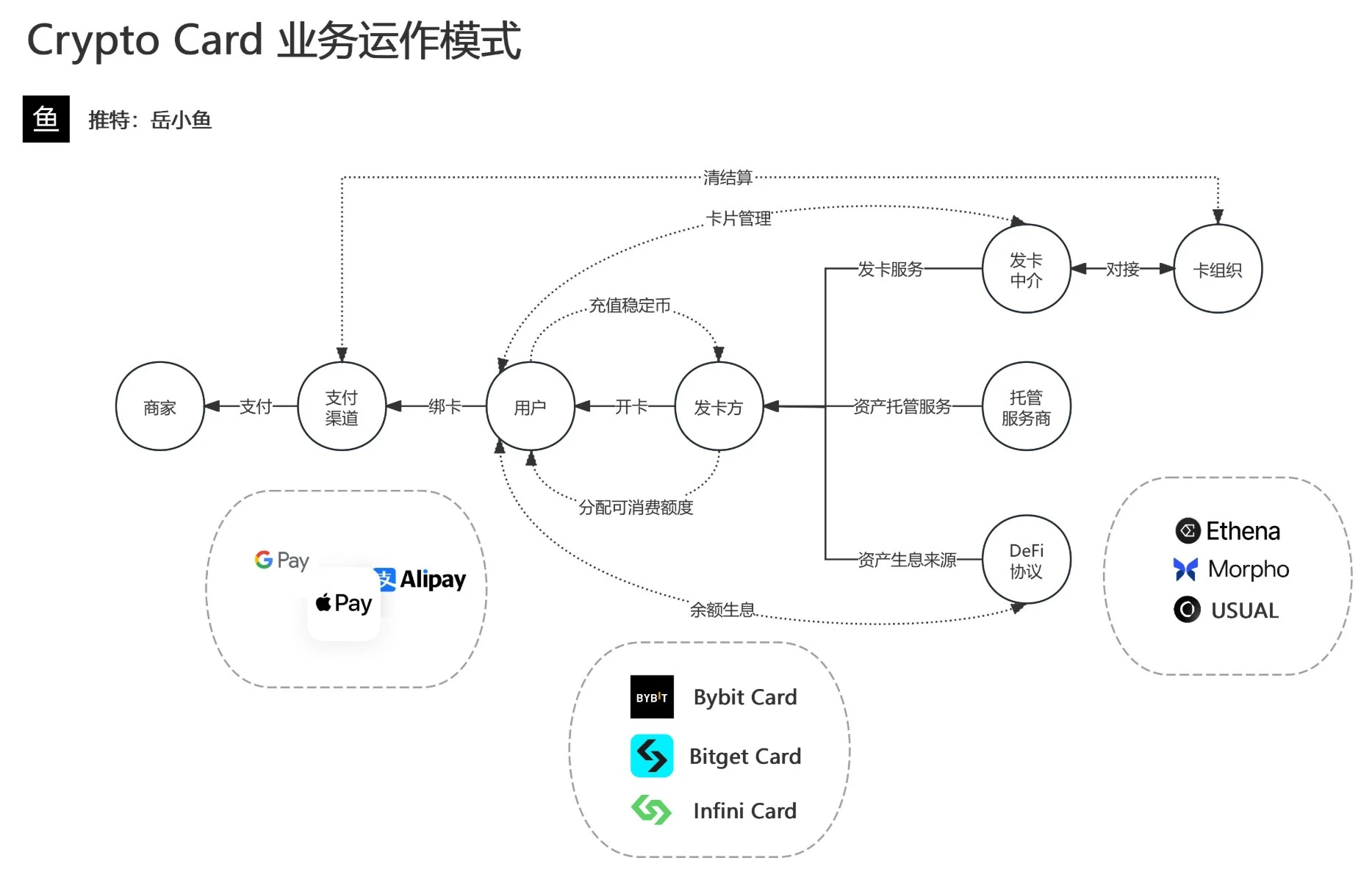

Secondly, in addition to market demand, the low entry barrier for issuing crypto payment cards is also an important factor attracting many project parties. They are typically issued through collaboration between Web3 projects (such as Infini and Bybit mentioned earlier) and traditional financial institutions (like issuing banks), presenting a three-tier architecture of "card organization - issuing institution - Web3 project".

Source: @yuexiaoyu 111

[The translation continues in the same professional and accurate manner for the rest of the text.]In other words, most of the Crypto assets deposited by users directly flow into the project's on-chain account, rather than a real bank account system. The corresponding fiat currency side does not independently open a same-name account for users, but instead allocates consumption quotas through a unified account. Your "quota" is essentially just a string of numbers, and whether it can be cashed out completely depends on the platform's survival ability and willingness to pay. This model means that the safety and stability of the entire system almost entirely depends on the moral standards and risk control capabilities of the project party. When the deposited user funds reach a certain scale, if the project party encounters moral risks (such as misappropriating funds, running away with money), or risk control fails (broken capital chain, hacker attacks, inability to handle large-scale withdrawals), user assets will face the risk of loss or even being unrecoverable (online U card runaway cases are endless). Currently in the market, whether it's U card products launched by exchanges or crypto payment cards from star reputation projects, the vast majority are prepaid cards, making it difficult to sustain long-term business. Of course, U cards issued by platforms with good reputation and compliance capabilities can reduce risks to a certain extent.