Ethereum (ETH) has increased by more than 58% in the past 30 days, with nearly 40% of that increase occurring in just the last 10 days. Despite this strong increase, some important indicators are beginning to send warning signals.

BBTrend has turned negative, whale accumulation is decreasing, and short-term EMA momentum is slowing down. These signals suggest that Ethereum may be approaching a critical point where new buying pressure is needed to maintain the upward trend – or risk a reversal.

Ethereum's BBTrend turns negative after a month-long increase

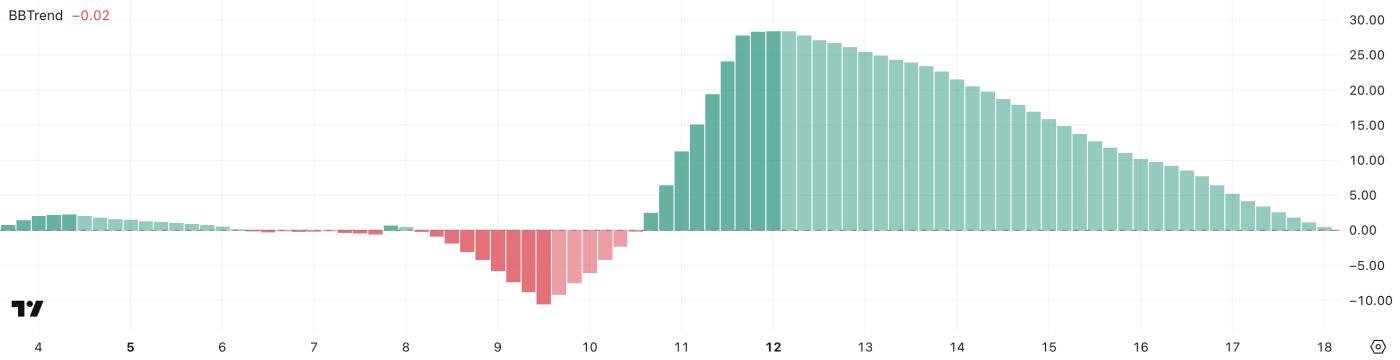

Ethereum's BBTrend has dropped to the negative zone, currently at -0.02 after maintaining a positive trend for about seven consecutive days.

This change occurred after a strong peak of 28.39 on 05/12/2025, signaling the end of the price increase phase.

The drop below 0 comes after Ethereum increased by 58.5% in the past month, raising questions about whether the asset is entering an accumulation phase or facing early signs of correction.

ETH BBTrend. Source: TradingView.

ETH BBTrend. Source: TradingView.BBTrend, or Bollinger Band Trend, measures price momentum relative to volatility by assessing the price deviation from the medium in Bollinger Bands.

When the BBTrend value is positive, it typically indicates price momentum, while a negative value suggests the market may be losing strength or entering a price decline phase.

With ETH's BBTrend slightly below 0, it may signal that buying pressure is decreasing after the recent increase. If this trend continues downward, Ethereum's price may stagnate or correct as traders become more cautious.

Number of Ethereum whales drops below important level for the first time since 04/09

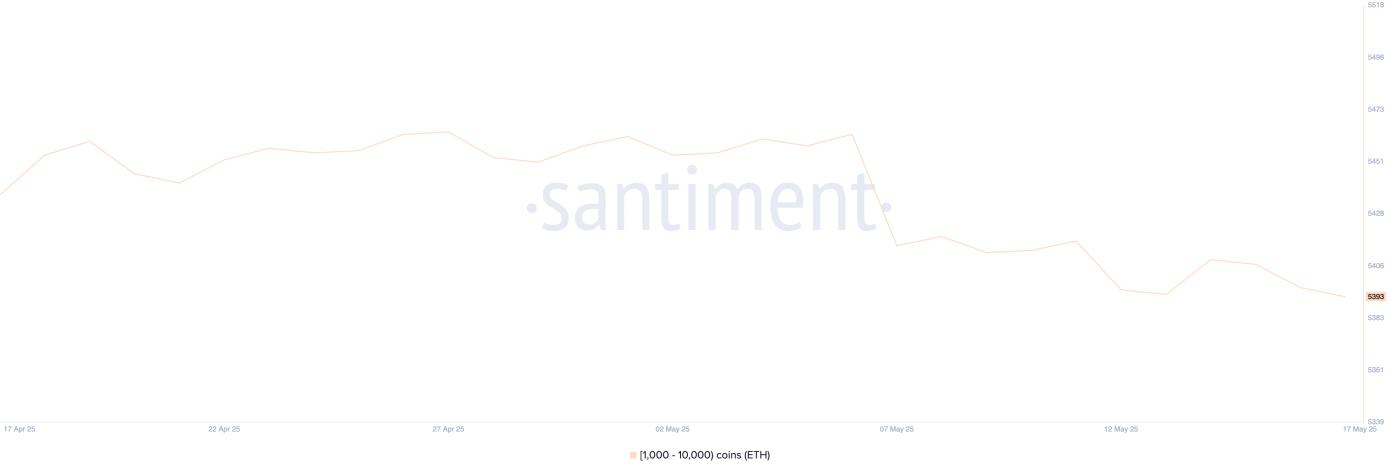

Ethereum whale activity shows signs of decrease after several stable weeks. Addresses holding 1,000 to 10,000 ETH – considered Ethereum whales – had maintained over 5,440 since mid-April, reaching 5,463 on 05/08/2025.

However, in the past 10 days, this number has gradually decreased, despite small fluctuations.

Currently, it is at 5,393, marking the first time it has dropped below 5,400 since 04/09/2025 – an important psychological and historical support level for large investors.

Ethereum Whales. Source: Santiment.

Ethereum Whales. Source: Santiment.Tracking Ethereum whales is crucial because these addresses often play a market-driving role due to their holding size. When whale numbers increase, it typically signals accumulation, reflecting confidence and long-term positioning.

Conversely, a decrease may indicate distribution, profit-taking, or caution among large investors.

The recent decline may imply a decrease in confidence from large investors after ETH's strong increase, potentially leading to increased volatility or a cooling period in price momentum.

This occurs as some analysts point out that ETH could overtake BTC and others are questioning whether ETH is still a good investment in 2025.

ETH struggles near $2,700—Can the bulls reclaim $3,000?

Ethereum's EMA (Exponential Moving Average) remains in an upward trend, with short-term EMAs positioned above long-term ones.

However, momentum seems to be slowing down, with short-term lines flattening and the distance between them narrowing. This pattern often signals a potential trend change, especially if buyers cannot regain control.

Although the overall structure remains positive, the loss of upward momentum introduces short-term uncertainty.

ETH Price Analysis. Source: TradingView.

ETH Price Analysis. Source: TradingView.ETH price has struggled to break through important resistance levels at $2,741 and $2,646 in recent days.

Without new buying pressure, the asset may fail to reclaim the psychological level of $3,000 – a mark it has not touched since 02/01/2025.

If selling pressure increases, Ethereum could return to support at $2,408. If it breaks there, it could lead to further losses, with $2,272 and $2,112 being the next important support zones.