River Research Shows Nearly 50 Million Americans Own Bitcoin, the Highest Globally, with 32 Public Companies Holding BTC Worth $1.26 Trillion.

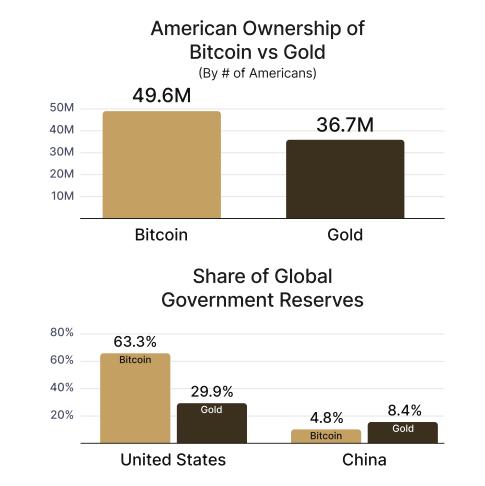

A new research report from River reveals that nearly 50 million Americans, equivalent to 14.3% of the population, currently own Bitcoin. This rate is higher than any other region in the world and exceeds the North American ownership rate by over three percentage points at 10.7%.

The report points out two main factors - accessibility and culture - as reasons why Americans are more likely to own Bitcoin compared to other developed economies. River notes that the entrepreneurial culture, personal investment, and financial freedom deeply rooted in the United States have led to early BTC adoption. Bitcoin's widespread popularity and lack of investor certification requirements, unlike many other asset forms, also facilitate access for Americans.

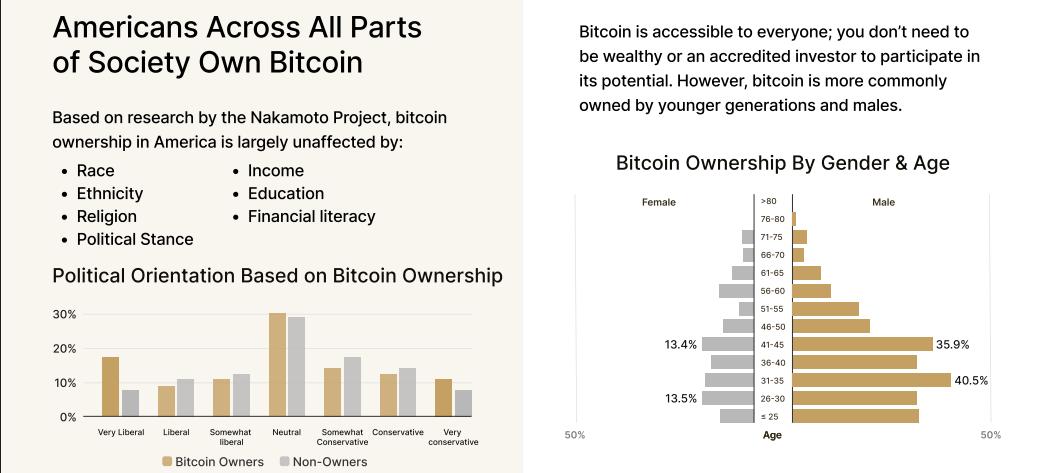

The study shows that BTC interest or ownership is not influenced by political ideology, race, ethnicity, or religion. However, data indicates that males and younger Americans are the demographic groups holding the most BTC.

US Businesses Dominate the Bitcoin Market

River emphasizes that US businesses, including many listed companies, increasingly view Bitcoin as a legitimate corporate treasury asset. Currently, 32 US public companies with a total market capitalization of $1.26 trillion are holding Bitcoin as a treasury asset, accounting for 94.8% of the total Bitcoin owned by globally listed enterprises.

The launch of Bitcoin Exchange Traded Funds (ETFs) in early 2024 has expanded BTC access for both individual and pension fund investors. The report indicates that over half of the 25 largest US investment funds and advisory companies now own Bitcoin through ETFs.

Bitcoin also plays a crucial role in job creation, with over 20,000 Americans working at more than 150 Bitcoin-related companies. In mining activities, the US currently accounts for 36% of the global hashrate, more than twice that of China. Since 2020, the US hashrate has increased by over 500%, confirming its global leadership in cryptocurrency mining.