Author: Frank, PANews

Recently, a former PEPE big shot transformed into a contract whale, frequently opening positions worth hundreds of millions of dollars on Hyperliquid, which has drawn market attention. As one of the few whales with a public identity actively participating in the community on Hyperliquid, James Wynn's daily position changes have become a hot topic among many investors.

What is James Wynn's background, and how does he move the market's nerves through his statements and positions?

The "10U God" Who Rose to Fame with PEPE

According to James Wynn's self-description on Twitter, he was born in a "forgotten small town" in the UK, filled with crime, drugs, alcohol, and poverty. James Wynn stated that he grew up in dire circumstances, "barely making ends meet" every week.

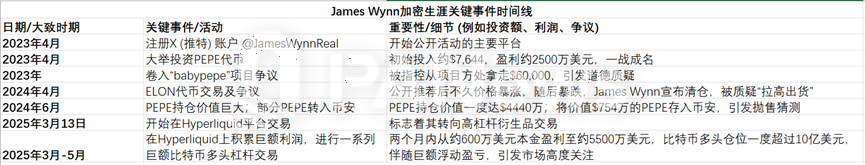

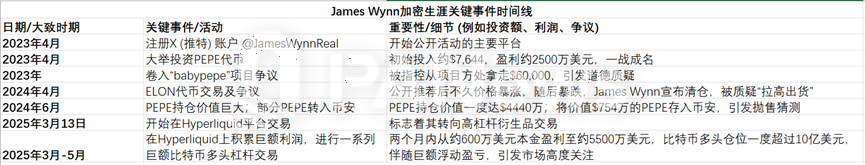

In 2022, after getting involved with cryptocurrency, James Wynn became a 10U god. He often moved between several ultra-small-cap memes until he discovered PEPE on iToken. Subsequently, James Wynn chose to heavily invest in PEPE and earned millions of dollars. Previously, PANews had also verified this through on-chain data.

From social media information, James Wynn joined Twitter in 2023, and his early content was almost entirely focused on promoting and advertising the PEPE token. In April 2023, James Wynn predicted that PEPE's market cap would rise to $4.2 billion when its market cap was only $4.2 million. A year later, this prediction not only came true but even exceeded his expectations. In October 2024, PEPE's market cap peaked at over $10 billion, becoming one of the highest-valued meme coins.

Of course, in this process, as one of PEPE's largest holders, James Wynn also gained enormous profits. According to PANews's previous statistics, James Wynn's initial investment in PEPE was only $7,600, and by April 2024, his earnings had exceeded $25 million. Given that PEPE subsequently rose by about 3 times, James Wynn's total earnings might have exceeded $50 million.

Reputation Damaged After Harvesting Fans, Then Pivoting

By 2024, with the successful establishment of his PEPE guru persona, James Wynn's posts began to involve more meme coins (such as BIAO, ANDY, WOLF), and he often published new token contract addresses and shilled them. In April 2024, James Wynn recommended a token called ELON and subsequently shilled it intensely like he did with PEPE. Meanwhile, he quietly positioned himself in the token using several wallets. Under his highly influential recommendation, many community players began to follow and buy ELON. After the token rose hundredfold, James Wynn claimed the token had issues and stated he had sold out. This operation caused ELON's price to drop 70% in a short time, with many players buried in James Wynn's sell-off slope. This operation severely damaged his reputation in the community, and people began to realize that the meme god was not reliable.

Subsequently, James Wynn's content gradually began to change, slowly transitioning from a community promoter to an investor and analyst. In the latter half of 2024, he began to focus more on Bitcoin trends and market analysis, changing his Twitter name from "James Wynn (The GOAT)" to the current "James Wynn Whale".

12 Billion Dollar Position with High Leverage Gambling

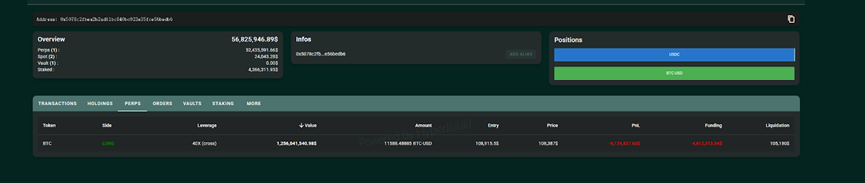

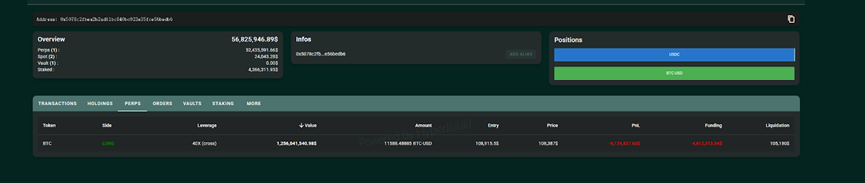

In March 2025, James Wynn officially started trading on Hyperliquid, depositing about $6 million to trade contracts. In just two months, through high-leverage operations on Hyperliquid, he increased his profits to around $48 million by May 24th.

Especially in the past month, through frequent high-leverage and large-position investments, James Wynn not only frequently placed his operations on social media trending lists but also proved his trading talent or luck with a monthly profit of $36 million.

His trading targets on Hyperliquid were surprisingly simple, mainly focusing on Bitcoin and a few meme coins like PEPE, TRUMP, and FARTCOIN. For example, on April 6, 2025, he went long on Bitcoin at an average price of $94,292 with 40x leverage; when Bitcoin's price rose from $94,000 to $100,000, his floating profit reached $5 million. His 10x leveraged long position on PEPE had a floating profit of up to $23 million. TRUMP and FARTCOIN token trades also contributed profits of approximately $5-5.57 million and $4.3-5.15 million respectively.

As of May 24th, James Wynn's total funds on Hyperliquid were about $55.8 million, compared to his 12.5 billion dollar position. His overall leverage ratio was about 22 times, and at such a leverage rate, a market fluctuation exceeding 5% could lead to a complete liquidation. Therefore, this trading style is high-risk and high-reward, not suitable for ordinary traders. Of course, considering that James Wynn had already earned tens of millions from PEPE and other memes, his position was within his controllable risk range. On May 24th, James Wynn closed his $12 billion position, suffering a loss of about $13.39 million, which brought his overall earnings back to around $40 million.

Looking at James Wynn's crypto trading career, from obscurity to MEME leader, to transforming again into a contract trading whale. James Wynn's experience seems to best match people's imagination of a crypto wealth story. He appears unwilling to be low-key, and despite holding massive wealth, remains active on social media. This exposure has indeed brought him benefits - during the MEME shilling period, he could use his influence to ensure his invested MEME coins always had followers. In the contract trading phase, as market attention grows, James Wynn's operations may to some extent influence some traders' market judgments and even create a follow-trading effect (though perhaps not as obvious as during the MEME coin period).

Overall, James Wynn's success seems to be a mixture of market timing, extraordinary courage (or extreme adventurous spirit), and powerful self-marketing ability. Ultimately, what James Wynn's "rise to wealth" leaves the market might be more questions than answers. Is he a trading genius with unique insights, or merely a lucky person who caught a market trend? Will his next stop be massive wealth or total liquidation?

This is far from over. The crypto market has never lacked "heroes" of a specific stage, but becoming an "evergreen" still requires the test of time.