The major US financial company Cantor Fitzgerald officially launched a $2 billion Bitcoin-backed loan service today. This service was initiated for key clients FalconX and Maple Finance. This represents another aspect of Cantor's new cryptocurrency-centered strategy.

The cryptocurrency loan industry has seen reduced attention compared to last year. However, centralized institutions may be able to inject new vitality. While few details have been disclosed about Cantor's plans, the company appears to be significantly committed to cryptocurrencies.

Cantor Fitzgerald Bitcoin-Backed Loan

Cryptocurrency-backed loans are a large and growing sector of the industry. Significant investments have been made in recent months. Token loans are typically a paradigm of the DeFi ecosystem, but major institutions are beginning to accept cryptocurrencies as collateral.

Today, the investment bank Cantor Fitzgerald is joining this trend with its own $2 billion Bitcoin-backed loan protocol.

Cantor Fitzgerald first announced this Bitcoin-backed loan plan last July. The vision is finally bearing fruit. While the company's press release did not provide details about specific clients, other reports mentioned two emerging stars as the first participants.

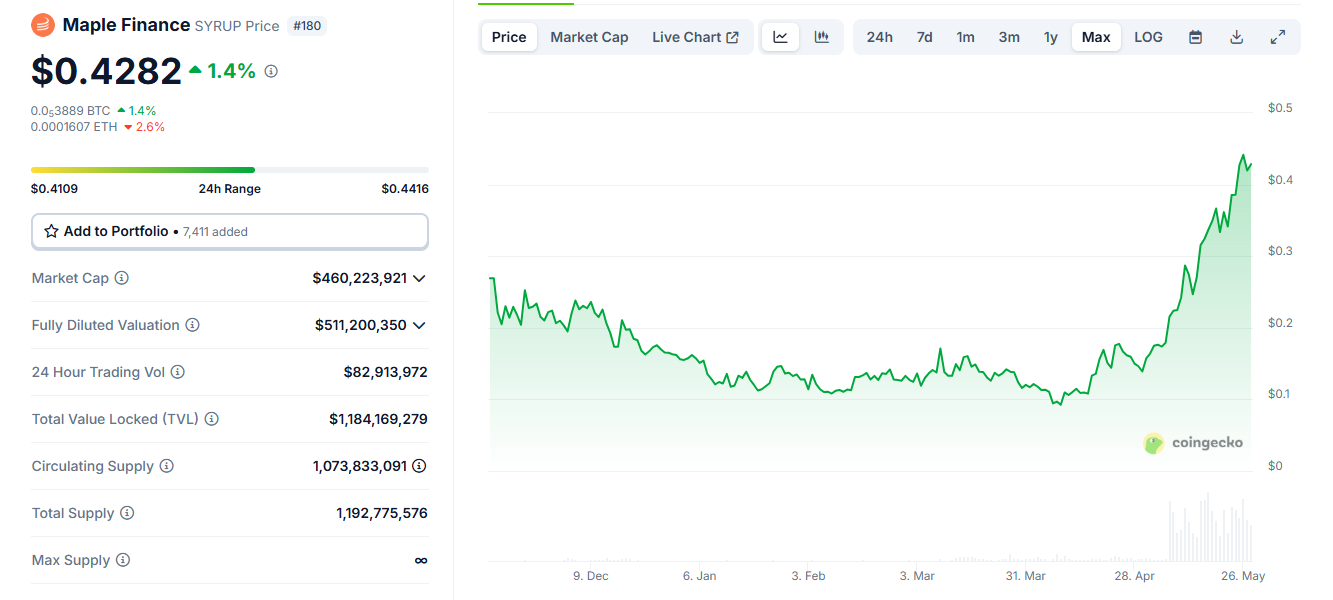

FalconX is a well-known cryptocurrency brokerage, and Maple Finance is another cryptocurrency lending platform that is reported to have closed a deal with Cantor.

FalconX appears to have agreed to be part of a "broader credit framework" with Cantor Fitzgerald. They plan to receive over $100 million in loans. The company has been generating substantial revenue and plans to expand into the derivatives market.

Maple Finance completed its first transaction, with its new token recording top performance, though the loan size was not specified.

Brandon Routnick, son of Commerce Secretary Howard Routnick, has been significantly expanding the company's operations in recent months.

In addition to Bitcoin-backed loans, Cantor Fitzgerald has partnered with Tether and is leading a new Bitcoin investment company. These efforts represent the bank's comprehensive new cryptocurrency strategy.

"Cantor recognized the transformative impact digital asset financial services will have on the global economy. This achievement highlights how the combination of Cantor's deep expertise and entrepreneurial spirit creates a unique advantage on Wall Street, further solidifying our position as a leading investment bank for cryptocurrencies." – Chairman Brandon Routnick

Unfortunately, Cantor Fitzgerald's press release does not provide many specific details about this Bitcoin-backed loan program. While it is stated that loans are only available to institutional investors, the company is using general language.

In the "initial stage", loans up to $2 billion are possible, but future expansion remains uncertain.

Nevertheless, Cantor Fitzgerald's loans can provide a good way for DeFi native companies to secure new liquidity and better integrate with traditional financial markets.

This program further confirms the growing importance of cryptocurrency-backed loans. Although the entire cryptocurrency loan market significantly contracted between 2023 and 2024, traditional investment banks may lead in a new direction.