This article is machine translated

Show original

🚨 IS PRINTING MONEY THE 'CULPRIT' OF INFLATION?

During a period of market volatility, the term "printing money" always returns as a haunting keyword. From investors to ordinary people, everyone fears a future where currency loses value, prices skyrocket, and assets evaporate.

But have you ever asked yourself:

🔻 Why did the US print thousands of billions of dollars after 2008 while maintaining low inflation for an entire decade?

🔻 Why has Japan been printing money for over 30 years while prices remain stagnant?

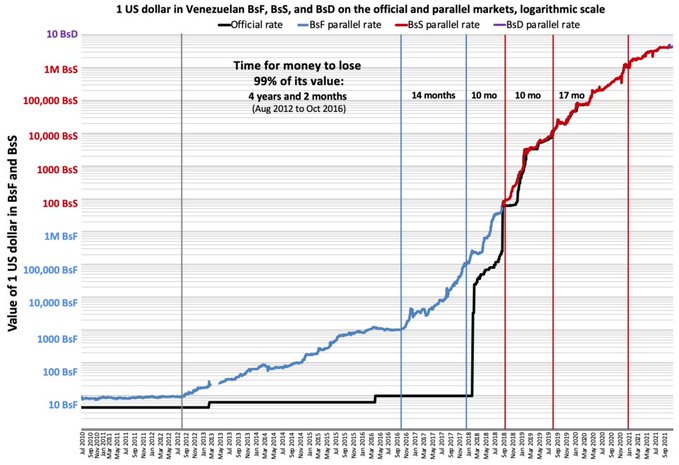

🔻 And conversely, why have Venezuela and Zimbabwe sunk into hyperinflation?

🧵👇

🇻🇪 VENEZUELA: Printing money to finance the budget – a total failure

+ The government has a budget deficit, prints money to spend → money supply increases rapidly.

+ No collateral, no control, no trust.

+ The currency collapses, prices increase by thousands of percent, hyperinflation.

👉 It is not important to print money but what it is for and whether the system has the capacity to control it.

Printing money is not the culprit of inflation – it is a powerful tool that needs to be used properly. The world has no shortage of countries that have successfully printed money, but also many lessons of catastrophic failure. The difference lies in policy thinking and market confidence 🫡

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content