In the explosion of decentralized financial solutions, Beradrome has emerged as an ambitious piece, molded to serve the Berachain ecosystem.

Not merely a typical DeFi platform, Beradrome interweaves a creative reStaking mechanism and an optimal liquidity supply model, with expectations of creating a stable, deep, and user-friendly market.

What is Beradrome?

Beradrome is a decentralized financial protocol specifically designed for Berachain – a Layer 1 blockchain using a Proof-of-Liquidity consensus mechanism.

The project aims to enhance capital flow efficiency, helping dApps on Berachain access deeper liquidity, while reducing transaction costs and financial risks for users.

Not stopping there, Beradrome also allows users to borrow HONEY, Berachain's native stablecoin, without facing asset liquidation risks – a significant advancement compared to traditional mortgage lending models.

Highlights of Beradrome

Three-Layer Token Structure: BERO, hiBERO, and oBERO

Beradrome operates around three main digital assets, designed to complement each other:

- BERO: Native token, which can be minted through Bonding Curve using HONEY, playing a role in staking and governance.

- hiBERO: Generated from BERO staking, representing voting rights and receiving diverse profits like swap fees, oBERO, BGT...

- oBERO: An option token allowing BERO purchase at a fixed price of 1 HONEY – serving to stimulate farming and voting motivation.

Differentiation from Solidly ve(3,3) Model

Based on Solidly but not entirely copied. Instead, the project has transformed the traditional ve(3,3) model into a more user-friendly version.

Users are no longer bound to long-term asset locking – instead, they only need to participate in short voting cycles to enjoy benefits and rewards, bringing unprecedented flexibility.

Borrowing HONEY without Liquidation

One of the notable breakthroughs is the feature of borrowing HONEY without interest, without asset liquidation, only requiring maintaining an appropriate collateral ratio with hiBERO.

This solution opens doors for lean leveraged investment strategies, completely eliminating liquidation risks found in classic DeFi platforms.

Bonding Curve – Core of Stability

The entire BERO issuance and withdrawal process is regulated through a Bonding Curve – a smart contract mechanism ensuring each BERO is guaranteed by at least 1 HONEY, establishing a safe floor price for the token.

This not only creates investor confidence but also stabilizes market psychology.

Beradrome's Core Products

Swap

Users send HONEY to mint BERO or burn BERO to receive HONEY through the Bonding Curve. This transaction occurs without intermediaries, ensuring transparency and maintaining a stable floor price at 1 HONEY/BERO.

However, Gas prices can be high – particularly disadvantageous for small-capital investors.

Farm

Provide liquidity to Vaults to receive rewards like oBERO, partner tokens (KDK, xKDK...), transaction fees...

The diverse Vault system offers rich choices but also requires understanding – especially for new users unfamiliar with Impermanent Loss risks.

Vote

Stake BERO to receive hiBERO, then participate in weekly Vault reward distribution voting.

Voters can receive additional Bribes, BGT, Swap fees... However, this mechanism has the drawback of allowing only one vote per week and depends on Bribes – potentially creating capital flow bias.

Staking

Stake BERO to receive hiBERO, not only activating voting rights but also helping users receive attractive rewards. This is a stepping stone to entering the governance system.

Short lock-up time is an advantage, but a minus point is the lack of a clear interface transparently showing rewards before staking.

Borrowing HONEY with hiBERO

Use hiBERO as collateral to borrow HONEY, opening a strategy of "holding tokens while having working capital". No interest, no liquidation – just maintain a safe asset ratio.

This feature is extremely useful for DeFi investors who prefer financial leverage, but comes with complexity in managing voting and debt.

oBERO Options

oBERO is an option token helping to buy BERO at a fixed price of 1 HONEY. If BERO's price rises higher, oBERO holders can perform Arbitrage to profit.

Additionally, oBERO can be burned to increase voting power. However, oBERO's actual value depends on market price – if BERO is near the floor, this option becomes less attractive.

BERO Token

Basic Information

- Token Name: Beradrome

- Symbol: BERO

- Blockchain: Berachain

- Contract: 0x7838cec5b11298ff6a9513fa385621b765c74174

- Initial Supply: 2,000,000

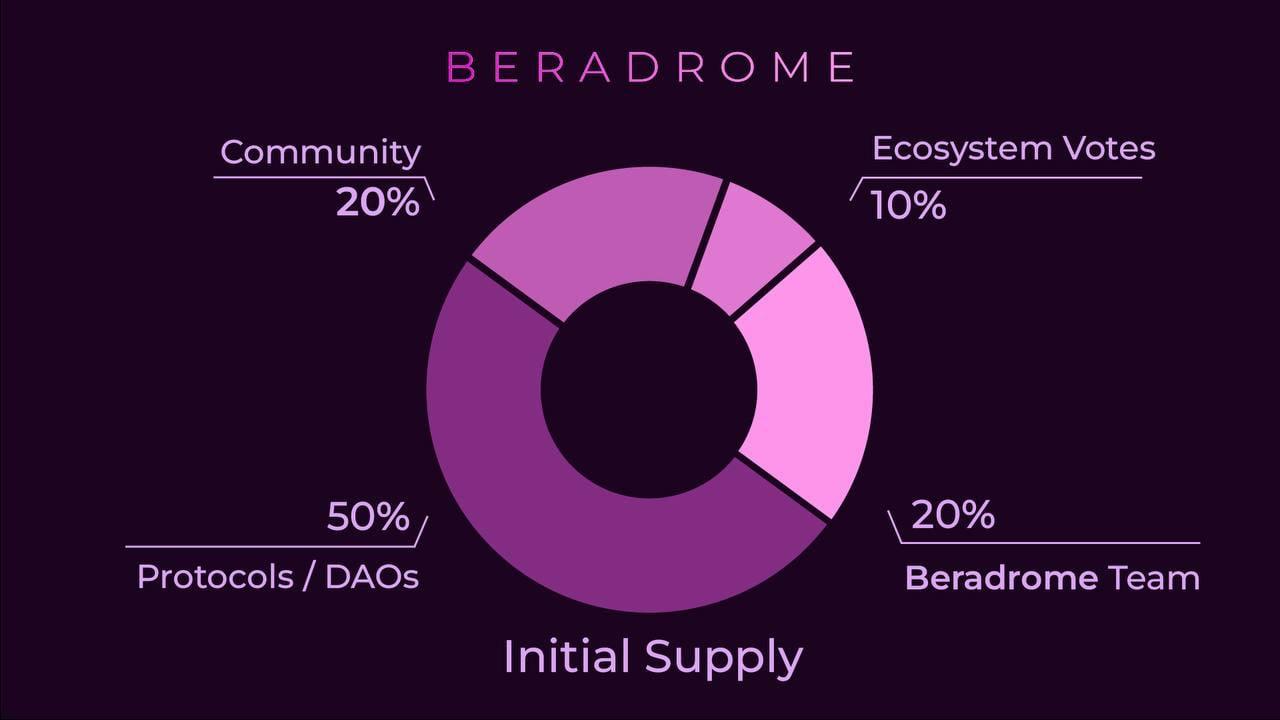

Token Distribution

Exchanges

BERO token can be traded on decentralized exchanges. The most popular exchange for buying and trading Beradrome is Kodiak V3, where the most active trading pair BERO/WBERA has a trading volume of $278.28 in the past 24 hours.

Investors

Currently Updating Information

Currently, some important content in the Beradrome ecosystem is still in the process of being completed and updated.

Development Roadmap: The project has not yet disclosed details of upcoming development stages, including the timing of new feature launches, product expansion, or integration with other protocols in Berachain. Updating this roadmap will help the community grasp the long-term vision and operational strategy of the platform.

Team: Information about the founders, advisors, and developers of Beradrome has not yet been revealed. Disclosing the team will play a crucial role in building trust and increasing transparency for the user and investor community.

These sections are being updated by the project team and are expected to be announced soon. Interested users should follow Beradrome's official channels to receive the latest information.

Project Information Channels

- Website: https://www.beradrome.com

- Twitter: https://x.com/beradrome

Conclusion

Beradrome is not simply a DeFi protocol. It is a harmonious blend of liquidity, staking, and governance elements - all fine-tuned to serve the Berachain ecosystem.

With financial models such as Bonding Curve, ve(3,3), non-liquidation lending, and convertible options - Beradrome builds an attractive and flexible DeFi space for both investors and dApps.

The flexibility in staking, the ability to expand profit-generating assets, and long-term growth potential make Beradrome a noteworthy destination for anyone interested in decentralized finance.