Strategy (previously MicroStrategy), the business analytics company and the largest publicly traded Bitcoin (BTC) holder, has recorded a new All-Time-High (ATH) in quarterly short-term interest rates.

Analysts remain divided on the significance of this for MSTR's price. Some believe the ATH in short-term interest could be a sign of a short-term squeeze. Meanwhile, others suggest this might reflect market makers protecting their positions in derivative products.

MSTR Stock Short Selling Reaches Record Level

To clarify, short-term interest refers to the total number of a stock's shares that investors have borrowed and sold, expecting the stock price to decline. An increase in short-term interest often signals growing pessimism about a company's prospects.

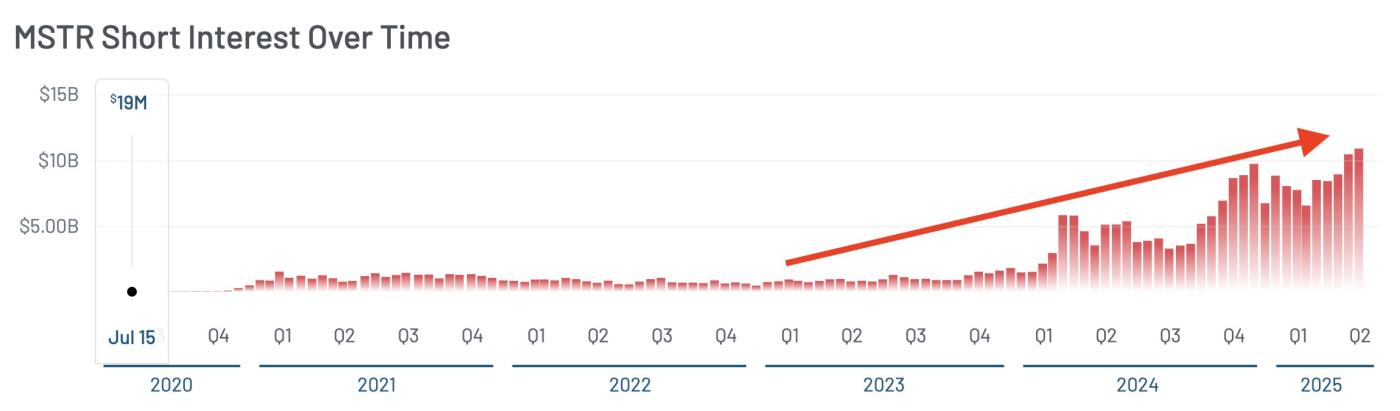

Meanwhile, the ATH in short-term interest indicates particularly high bearish sentiment. A market watcher, Luke Mikic, recently shared a chart on X (formerly Twitter), revealing that MSTR's short interest reached ATH in Q2 2025.

MSTR's Short Interest Peak. Source: X/ LukeMikic

MSTR's Short Interest Peak. Source: X/ LukeMikicHowever, Mikic predicts this could trigger a "large short squeeze." A short squeeze occurs when a heavily shorted stock suddenly increases in price.

As the price rises, short sellers are forced to buy back shares to cover their positions. This creates a feedback loop and pushes the stock price even higher.

Interestingly, another analyst pointed out that MSTR is forming a Cup and Handle pattern. This is a continuation price pattern in technical analysis. It typically signals that the stock is preparing for a price increase.

"MSTR needs a bit of patience here… The cup & handle pattern will appear… and when it starts, it will be fast and strong… Important levels to watch: 393, 404, 416, 432, 455, 481," the post read.

MSTR Stock Price Prediction. Source: X/InvestXOS

MSTR Stock Price Prediction. Source: X/InvestXOSSo, if the price truly breaks out, it could be a catalyst for a short squeeze. This, in turn, could push MSTR higher.

However, the story of an imminent MSTR short squeeze has met skepticism from another user.

"This is just market makers protecting their positions in derivative products… that is, options… we are near an area with a high concentration for delta heading. MSTR has the largest options market, thinking market makers don't play a role in its price action would be naive," Peter O wrote.

Peter explains that as the stock price approaches important price levels, such as $390 for Strategy, market makers adjust their positions to maintain "delta neutrality" (meaning they try to avoid exposure to price fluctuations).

This process involves active hedging, which can create buying or selling pressure on the stock. Peter further emphasizes the importance of understanding options flow and gamma exposure—concepts explaining how market makers' actions affect stock price dynamics.

His more technical perspective suggests that Strategy's stock movements are not just a result of short interest but are significantly influenced by complex options strategies.

Meanwhile, trading strategies may also be influencing the high short interest in MSTR stock. Jim Chanos, an investment manager and founder of Kynikos Associates, has pursued a Bitcoin/MSTR trading strategy. According to CNBC, Chanos buys Bitcoin while shorting MicroStrategy's stock.

"We are selling MicroStrategy stock and buying Bitcoin and essentially buying something for a dollar and selling it for two and a half," Chanos said.

The reason behind this strategy is that MSTR stock often trades at a higher price compared to the value of Bitcoin it holds. If this gap narrows, Chanos believes it could provide a profitable opportunity.

Currently, whether MSTR's stock price will increase remains to be seen. According to the latest data from Google Finance, the stock closed at $387.1, down 1.04%.

MSTR Stock Performance. Source: Google Finance

MSTR Stock Performance. Source: Google FinanceIn after-hours trading, the stock price further decreased to $385.0, representing a 0.55% decline.