- Cardano plans to convert part of its $1.2 billion treasury into Bitcoin and use the profits to buy back ADA

- Can the market absorb the initial selling shock?

Volatile price movements, increasingly thin liquidity, and fading confidence. Despite Charles Hoskinson's continuous optimism, Cardano [ADA] is currently facing a not-so-bright reality in the cryptocurrency market.

However, behind the scenes, things are subtly moving. In a recent interview, Charles Hoskinson confirmed Cardano's new treasury strategy.

In theory, this is a wise move that could support ADA's long-term price. However, risks remain, pushing ADA into the ultimate test during a near-stagnant growth phase.

Cardano Redirects $1.2 Billion to Bitcoin

Not only large financial institutions or states, but Bitcoin is now also seen as a store of value by an unexpected competitor – another Layer-1 blockchain. The reason: the ability to generate stable profits in a volatile interest rate environment.

In fact, Charles Hoskinson just announced a plan to reshape how Cardano operates its treasury. Specifically, using part of the $1.2 billion ADA treasury to buy Bitcoin, then using BTC yields to reinvest in ADA itself.

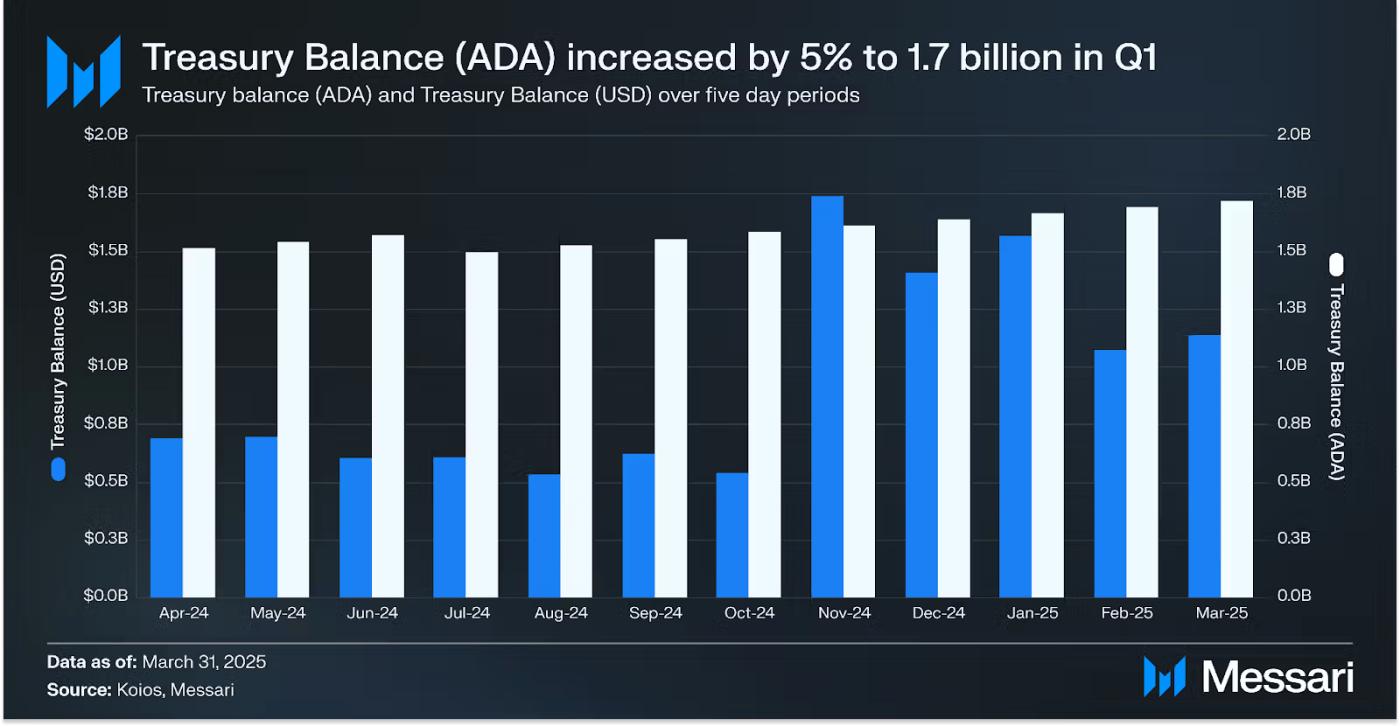

Source: Messari

A scenario creating a feedback loop – gradually reducing supply, naturally driving price growth. With the current fund, Cardano can buy around 11.32K BTC at the spot price of $106,000/BTC.

If Bitcoin exceeds $110,000, this investment would achieve an unrealized gain of about $40 million. If converted to ADA, Cardano could buy back around 66.67 million ADA at $0.60/ADA.

The result is a further reduction in ADA supply, creating price support. The strategy has not been implemented yet, but it is expected to reshape the long-term value trend for ADA, opening a new standard for Layer-1 fund management.

Can the Market Absorb the Initial Shock?

Cardano's $0.60 support zone is very fragile, with clear selling pressure from "whales", and the ADA/BTC pair dropping to election-era lows – a signal of weakening growth momentum.

In the derivatives segment, the futures contract order book shows weak buying pressure, thin speculative liquidity, making ADA's price easily influenced by short-term strong fluctuations.

Overall, Cardano is stuck in a "pump and dump" loop. Institutional capital is not ready to buy at the bottom, and even takes profits when prices recover, creating increasing selling pressure.

As a result, ADA has recorded two lower lows just this month, with a high probability of entering a deep correction.

Source: TradingView (ADA/USDT)

With such high volatility, even a small selling wave can trigger panic psychology – especially for small retail investors.

Therefore, if institutional capital does not quickly accumulate large amounts of ADA, this treasury strategy will be an extremely risky bet, especially in the short term.

Nevertheless, this proposal is a comprehensive transformation. Cardano no longer places trust in traditional DeFi staking, but aims for real profits. If successful, this will be a new precedent not only for ADA but also for sustainable value management for Layer-1 platforms.