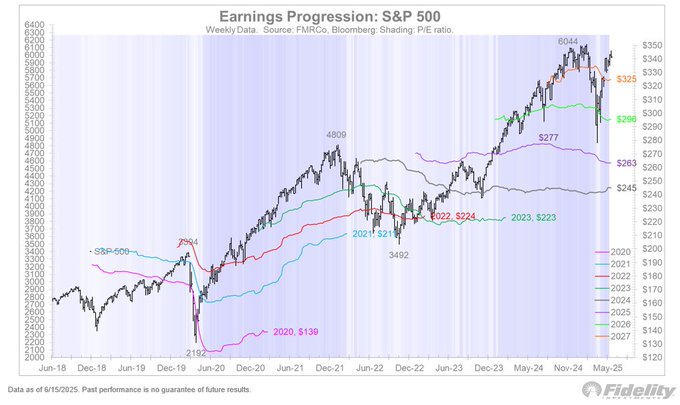

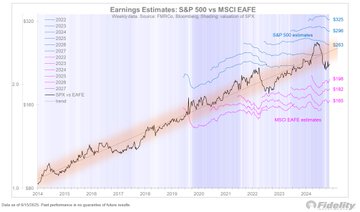

For equities, an important regime change appears to be underway between US and non-US markets. We all know the valuation story, with US equities trading at a 21x P/E-multiple while the rest of the world is at 15x. That spread has been justified by the superior fundamentals of the S&P 500 (driven by the Mag7), in the form of better earnings, better margins, and higher payouts. We have all been waiting for that mean reversion to kick in, but that requires a catalyst (in the form of earnings) that until recently had been missing. But a regime change appears to have begun. Below we can see the markdowns in US earnings estimates in recent months, as analysts priced in modest tariffs. Those estimates are now starting to improve a bit as the market has swung from left tail to right tail. But look at the estimates below for the MSCI EAFE index. They are being marked up at a significant pace, much more so than US estimates. The next chart shows both sets of estimates on the same scale. A clear convergence is underway, amplified by the above mentioned valuation spread as well as the falling dollar. TAMA indeed.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content