On the 20th, U.S. stocks, the USDC stablecoin issuer Circle (CRCL) once again hit a historic high, approaching $250, and closed at $240.28, surging 125% in the past 5 trading days, with total market value breaking through $58 billion (close to 95% of USDC issuance).

As market enthusiasm heated up, Cathie Wood's ARK Invest sold a total of 1.25 million shares over three consecutive days, bringing in $243 million, becoming the market's focus of attention.

ARK's Reduction Strategy at a Glance

ARK sold stocks on June 16, 17, and 20: Multiple funds sold 34,270, 30,010, and 60,920 shares respectively, with daily amounts ranging from $44.7 million to $146 million (totaling about $243 million), reducing the original position by approximately 29%.

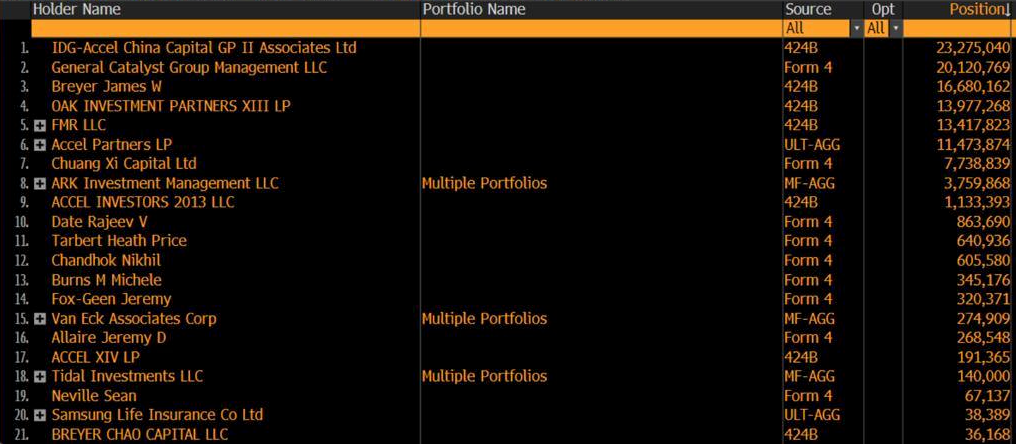

However, according to Bloomberg data, ARK still holds about 3.2 million shares, with a market value of $750 million, ranking eighth among Circle's top ten shareholders, and CRCL remains the largest holding in ARK W Fund, with a weight of about 7.8%.

Locking in Returns While Managing Risks

The market generally interprets ARK's move as "harvesting partial profits and diversifying risks". According to Investing.com, while reducing holdings, ARK increased positions in AMD, TSMC, and Shopify, indicating capital rotation across different sectors.

For ordinary investors, facing a stock that has surged nearly threefold in a short time, finding a balance between growth story and risk management is more important than chasing price increases.