TL;DR

- Hyperliquid is an ultra-fast onchain perp DEX built on its own custom Layer 1, offering CEX-level performance while maintaining onchain transparency.

- Its native token $HYPE governs the network, reduces trading fees via staking, and captures value through listing auction buybacks.

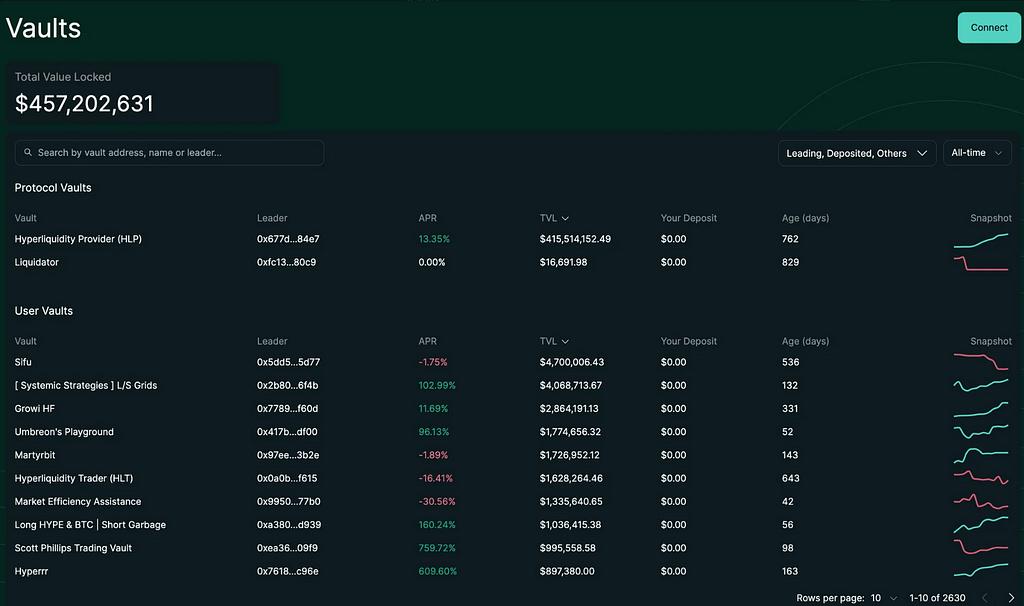

- The protocol’s core liquidity engine is the HLP Vault, a hybrid market maker + liquidator that accounts for over 90% of TVL.

- Hyperliquid faced a major black swan in March 2025 during the $JELLYJELLY incident, where coordinated manipulation nearly triggered a vault-wide cascade liquidation.

- The event revealed centralization in validator governance, as the Hyper Foundation intervened to prevent collapse, raising questions about decentralization but securing survival.

- Despite the crisis, Hyperliquid bounced back with all-time highs in trading volume, open interest, and $HYPE price, largely due to sticky whale usage and expanding ecosystem traction.

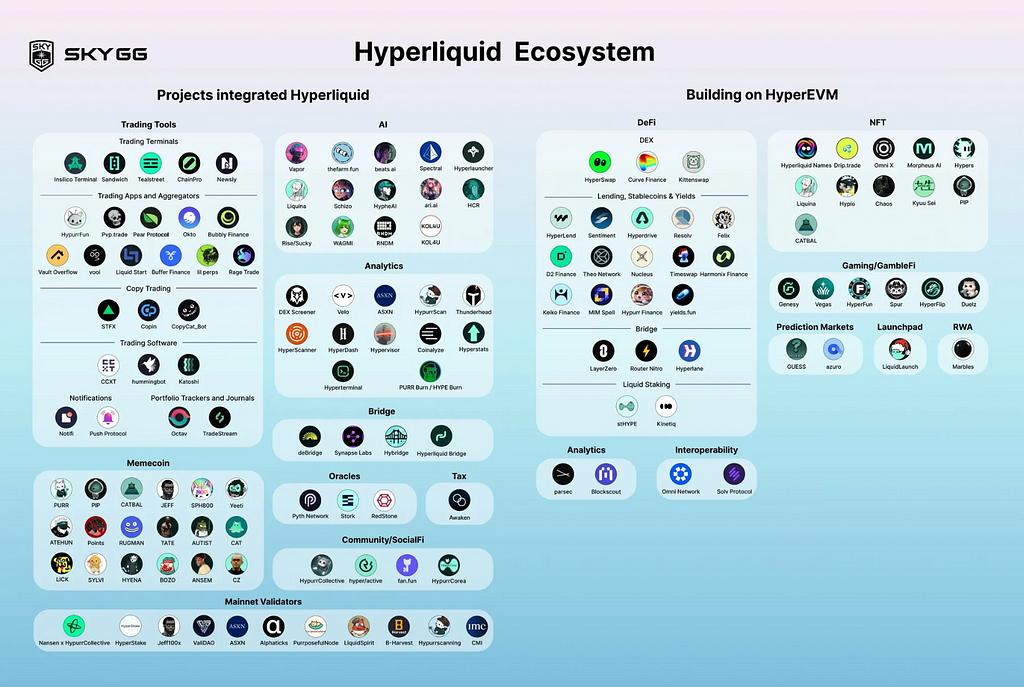

- The platform (HyperEVM) has since added +21 new dApps and now hosts NFTs, DeFi tools, and vault infrastructure beyond trading.

James Wynn is a famous degen, he is an anonymous whale who turned $210 into $80 million in just three years, best known for flipping $7K of $PEPE into $25 million, and swinging nine-figure positions with 40x leverage. [1]

Wynn posts his entries, rides volatility in real time, and ignores eight-figure liquidations like they’re just part of the game. But what matters isn’t just who Wynn is, it’s where he trades.

For Wynn, and a degen, high stake traders: Hyperliquid is the new arena. Anonymous whales like “內幕哥” (insiders) make trades with max-size, and their trades are now tracked across Chinese crypto media as real-time signals of market sentiment and platform dominance. So how did it get here? Why all those high stake traders trade on Hyperliquid?

Let’s break it down.

1. What is Hyperliquid?

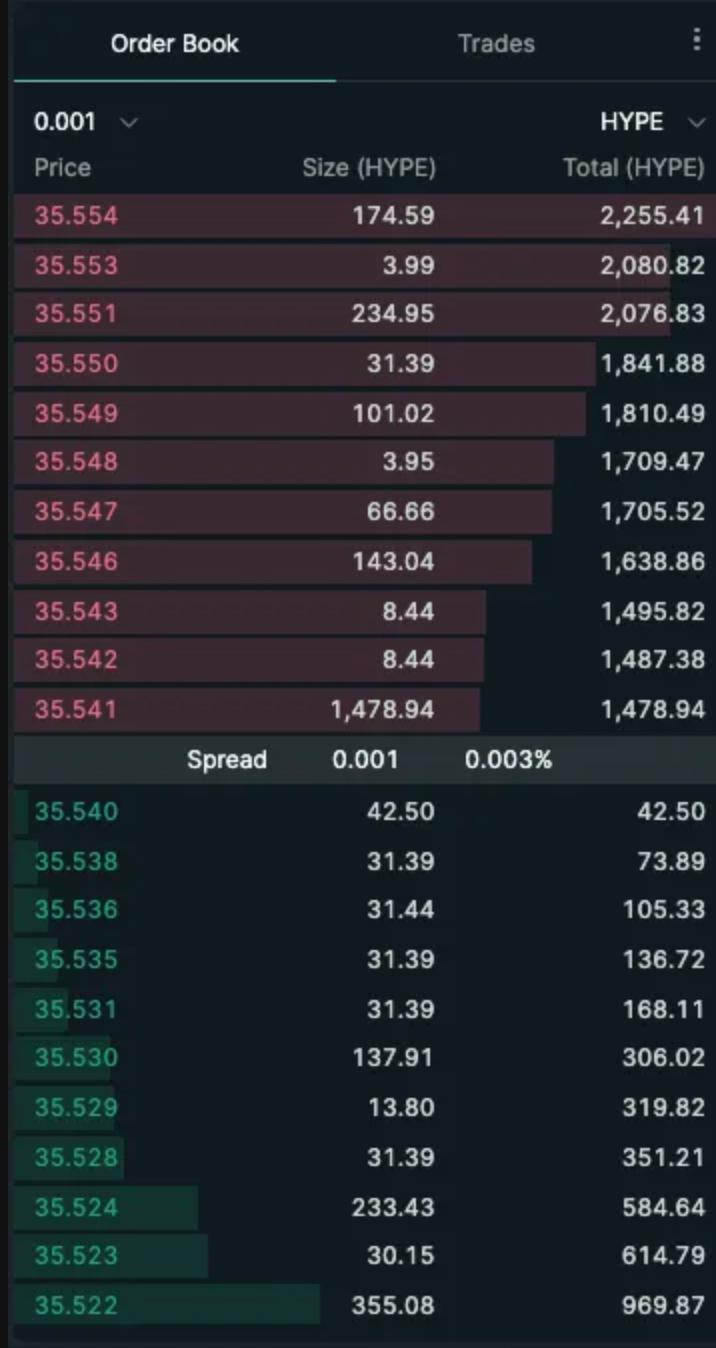

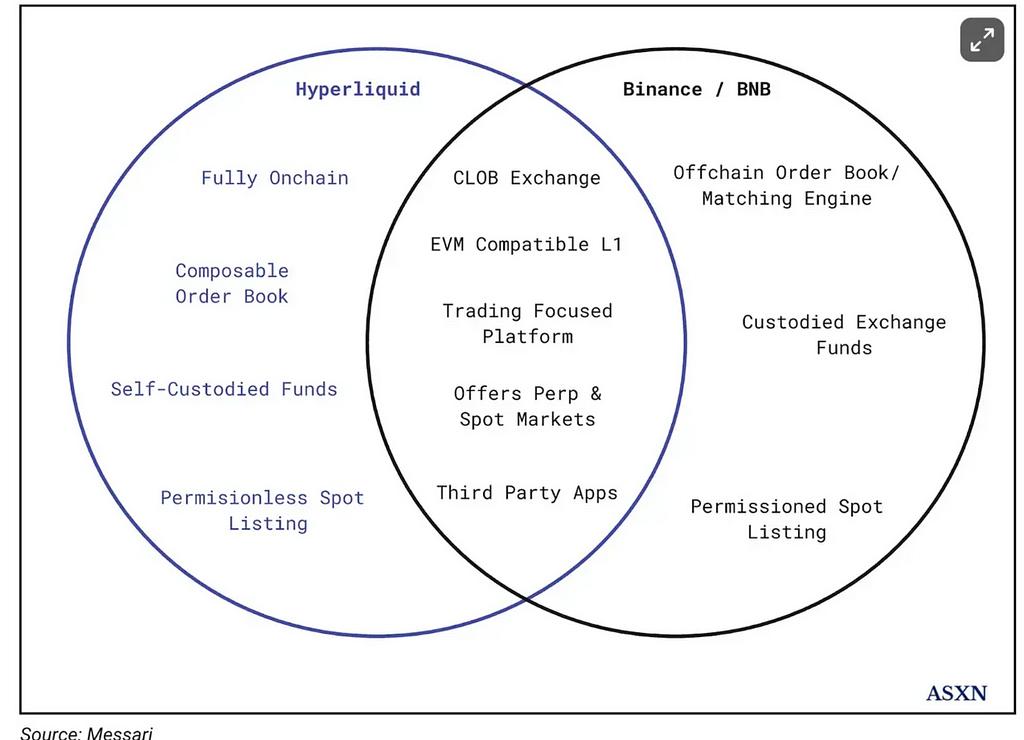

Hyperliquid is a decentralized exchange, but not the kind built on Uniswap-style AMMs. Instead of using liquidity pools to passively set prices, it runs a fully onchain order book, delivering real-time trading with the feel of a centralized exchange, or in a traditional way. Limit orders, trades, cancels, and liquidations all happen transparently and instantly, with finality in a single block.

Hyperliquid runs on its own custom Layer 1 which carries the same name as the exchange, purpose-built for performance. That’s what allows it to execute trades at the speed and reliability that high-volume traders demand.

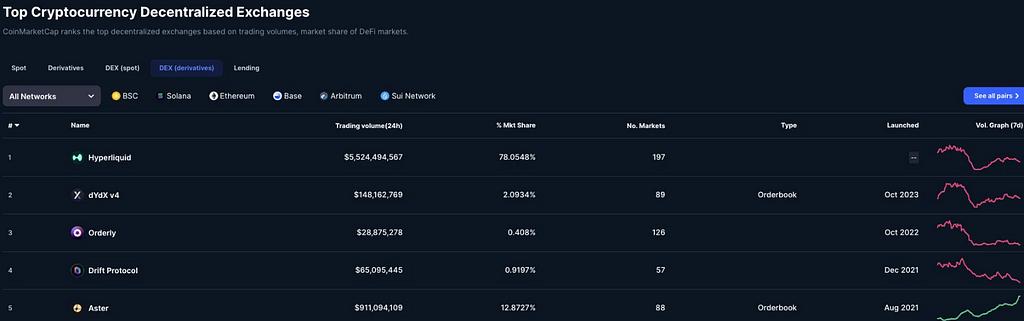

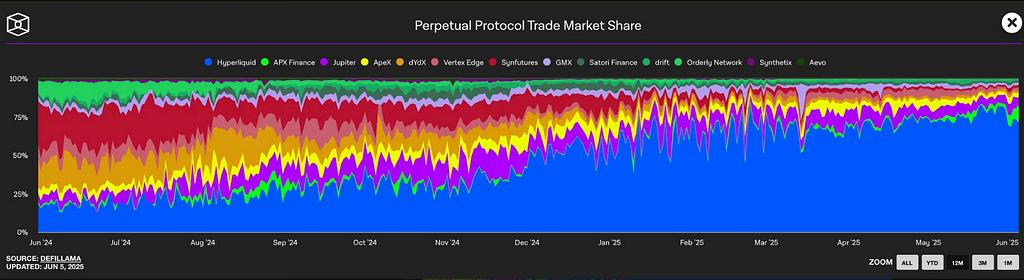

Hyperliquid’s performance isn’t just theoretical, it’s visible in the numbers. As of June 2025, it dominates the onchain derivatives market with over $5.5B in daily trading volume, accounting for more than 78% of total market share among all perp DEXs. That’s not just leading, that’s crushing the competition. The next closest platform, Aster, lags behind with just 13% market share.[2]

2. $HYPE

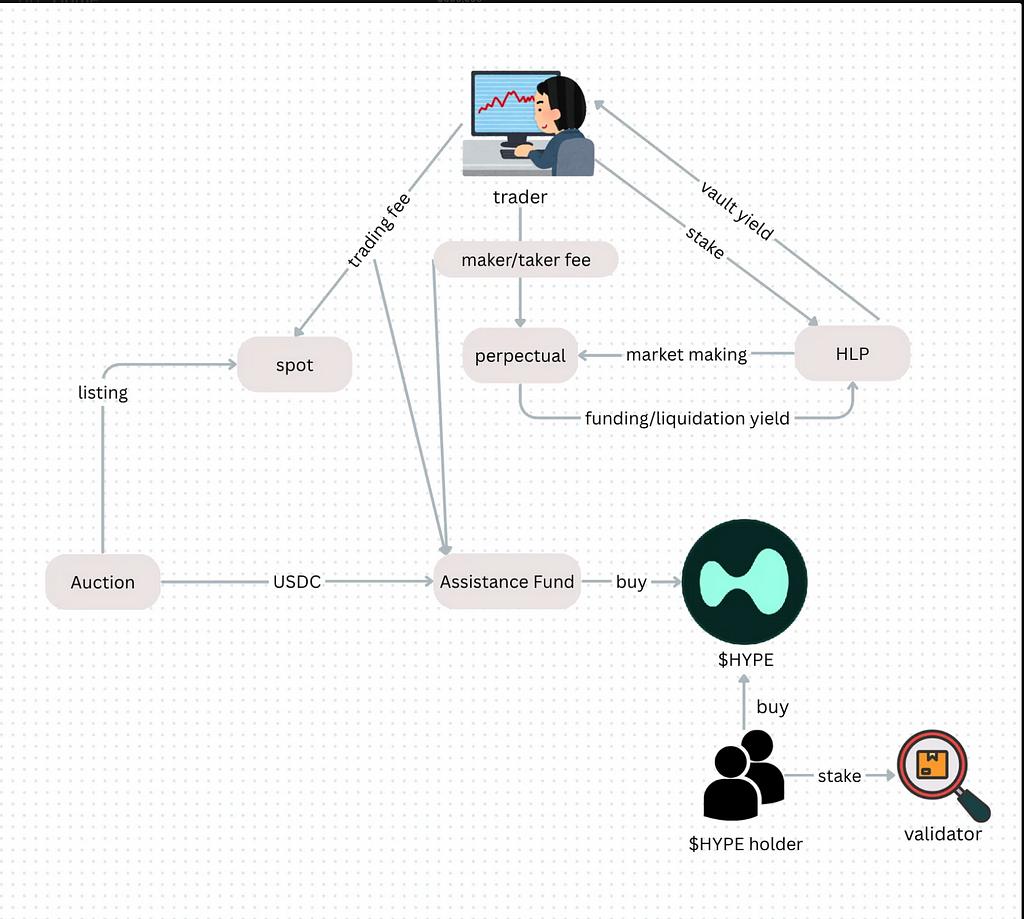

But Hyperliquid isn’t just a trading venue, it’s a fully integrated onchain finance system. And at the center of it all is its native token, $HYPE.

a. Tokenomics & Philosophy

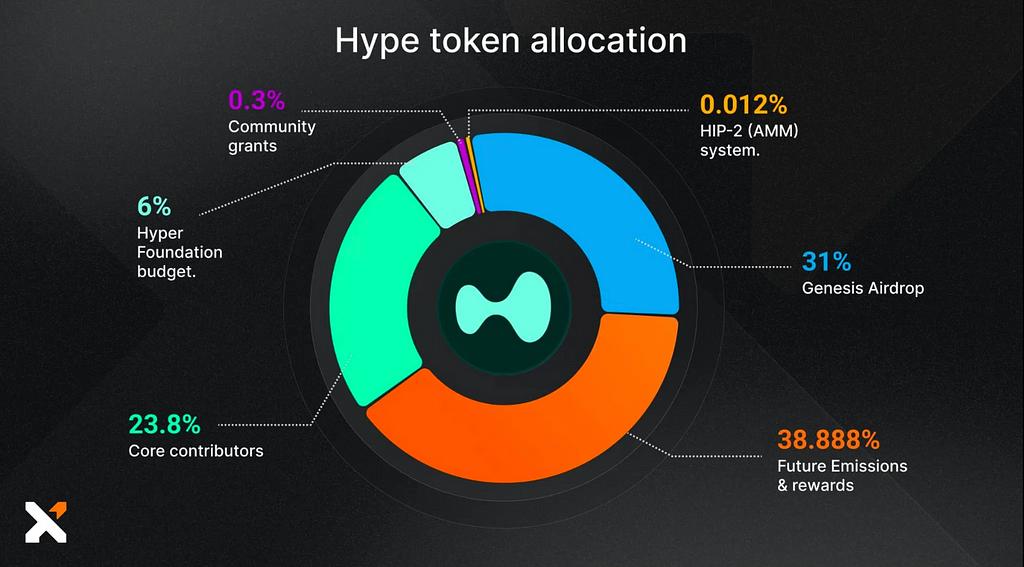

With a maximum supply of 1 billion tokens, $HYPE launched via a major airdrop, distributing 31% of the total supply (310M tokens) to around 94,000 users in Nov 2024.[3] It was one of the largest real-user distributions in recent crypto memory, not just a points grind or farming game, but a genuine attempt to reward the community.

Combined, 70% of the token supply is reserved for airdrops, community rewards, and contributors, but not VCs. This isn’t accidental. It aligns directly with the philosophy of Jeffrey Yan, Hyperliquid’s co-founder, a Harvard math grad and former top-15 high-frequency trading engineer at Hudson River Trading.

Yan has been explicit about what he wants Hyperliquid to be: a place where “all of finance will happen,” built by and for users. In a now widely shared podcast moment, he explained why they avoided outside capital:

“Having VCs control the network would be a scar.” — Jeffrey Yan, When Shift Happens [4]

This positioning : community-first product + protocol-level performance, reflects in the token design. $HYPE isn’t just about emissions and fees. It represents a governance layer for one of the most actively used trading venues in crypto.

b. Utility

While $HYPE serves as the governance and incentive layer of Hyperliquid, it also has a very direct, very real utility: staking $HYPE reduces trading fees.

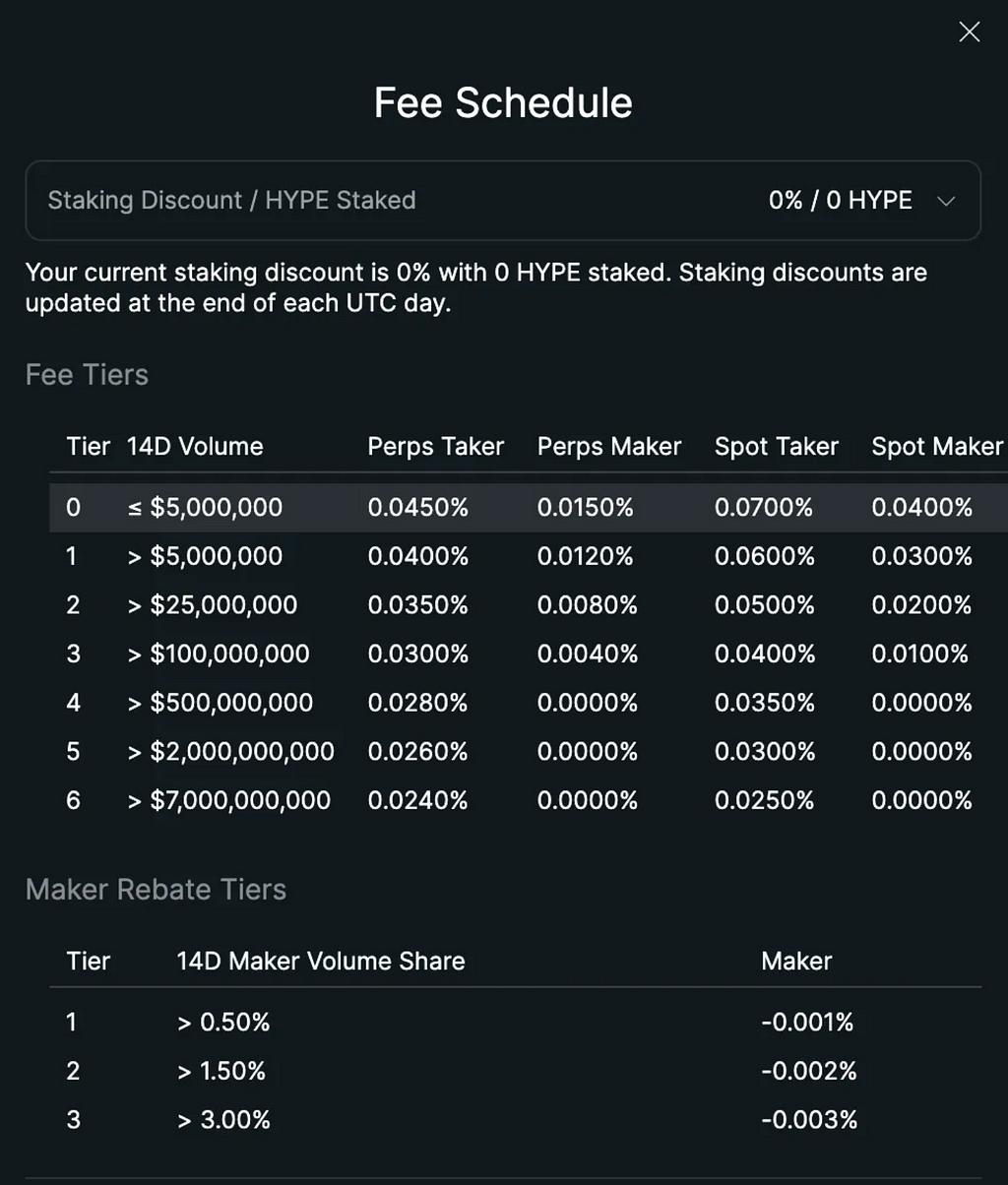

On Hyperliquid, the fee schedule is similar to those CEX, with higher volume, the lower the taker/maker fee.

Hyperliquid offers tiered staking discounts, scaling up to 40% off trading fees if you stake at least 500,000 $HYPE.

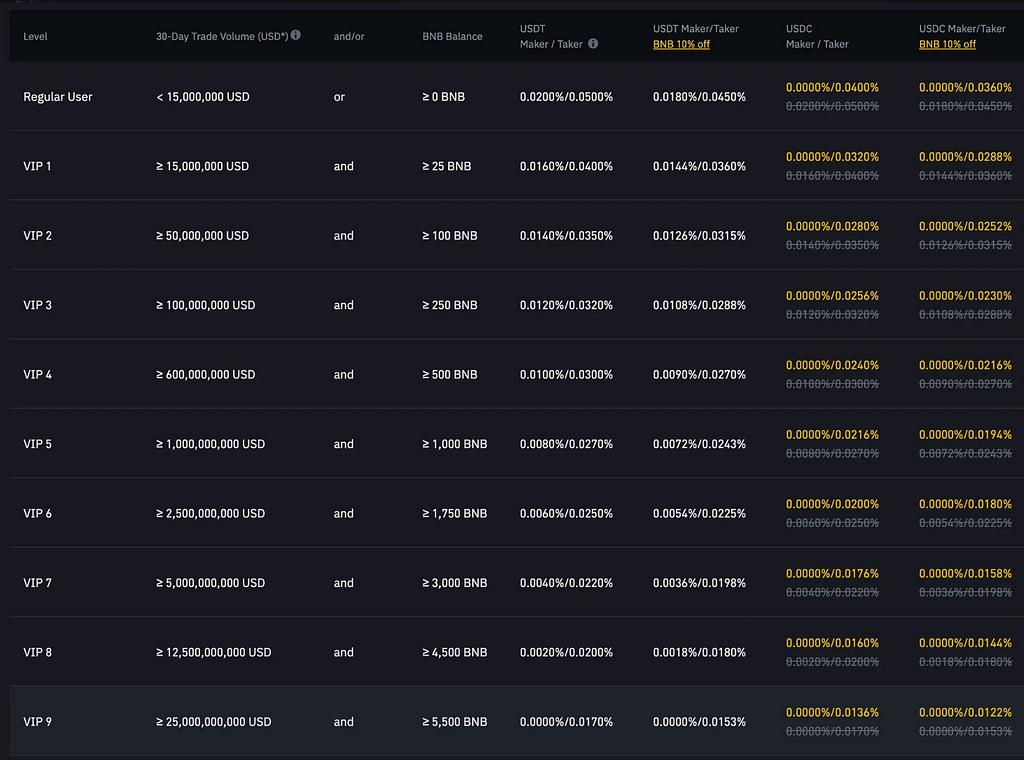

At current prices (~$35.50), that’s a massive $17.75 million stake, clearly not for most traders. But even at much lower tiers, the benefits are meaningful. Staking just 100 $HYPE (~$3,550) gives you a 10% fee discount, which already puts you far ahead of what most CEXs offer if you don’t trade large volume. (for example, VIP 1 for binance requires holding 25 BNB (~$16650) and 15M volume for 20% discount). For regular users, just staking small amount of $HYPE can reduce the trading fee that is relatively smaller than those CEX with same volume. For high-volume traders or funds operating at scale, this kind of cost efficiency directly impacts net returns.

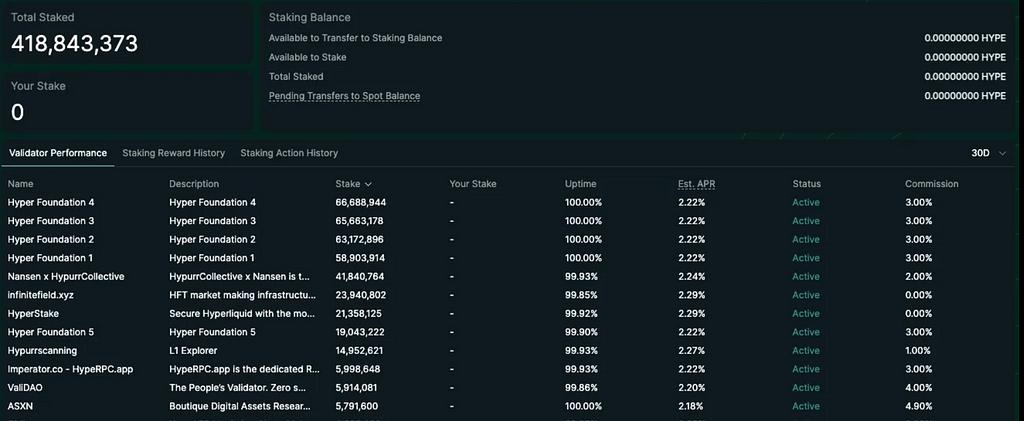

Beyond its utility in trading and governance, $HYPE also secures the network. Hyperliquid operates as a Proof-of-Stake (PoS) chain, and staking $HYPE isn’t just about earning rewards or reducing fees, it’s the mechanism that underpins block production.

Validators play a key role in maintaining Hyperliquid’s custom Layer 1. To become a validator, participants must stake at least 10,000 $HYPE, undergo KYC/KYB, and run a reliable infrastructure setup (including multiple non-validator seed nodes). Performance is monitored, and delegations are managed through the Hyper Foundation’s Delegation Program [5]. Incentives for validators come from the PoS consensus layer, with staking yields currently around 2.5% annually, modeled on Ethereum’s validator rewards curve.

3. Other functions of hyperliquid

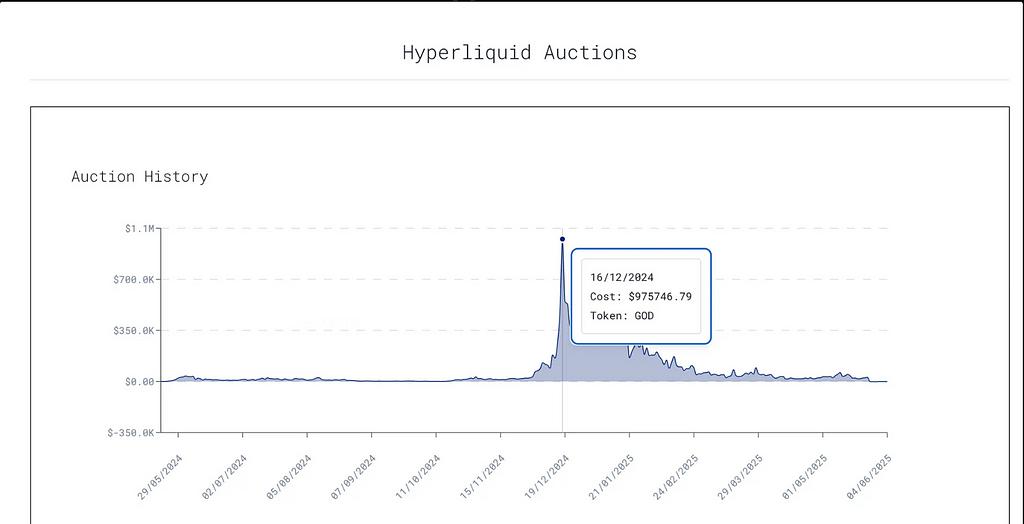

a. HIP-1 Auctions: Decentralized Token Listings

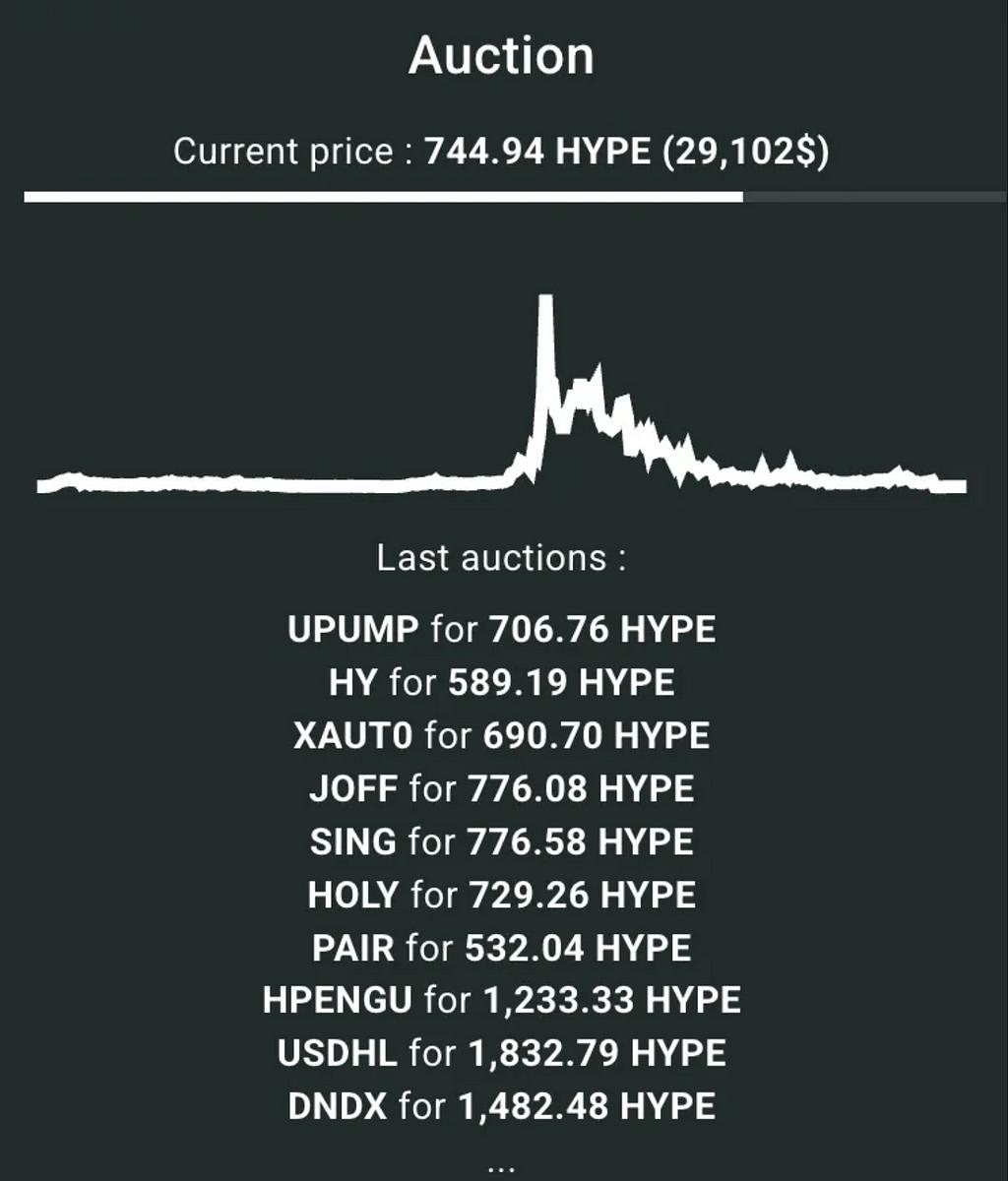

One of the most unique and underappreciated aspects of Hyperliquid is its auction-based token listing system, known as HIP-1. Hyperliquid uses an onchain Dutch auction to determine which tokens get created and listed. Each auction starts at double the previous final price and drops linearly over 31 hours to a minimum of 10,000 USDC. The first address to accept the auction price earns the right to mint and list the token on Hyperliquid’s spot exchange.

This is in stark contrast to centralized exchanges like Binance and Coinbase, which have both faced accusations of requesting massive token payments for listings. In late 2024, Moonrock Capital’s CEO alleged that Binance demanded 15% of a Tier 1 project’s token supply after a year-long listing process, a demand that would equate to $50–100M in token value[6]. While Binance co-founder Yi He denied the claim, multiple high-profile figures including Andre Cronje and Justin Sun corroborated similar experiences, with Coinbase reportedly asking for up to $300 million for a listing deal. Even Binance’s new “Batch Vote to List” campaign, which introduced 2 tokens via community vote but listed 4 without clear process transparency, reflects the persistent opacity in CEX listing pipelines.

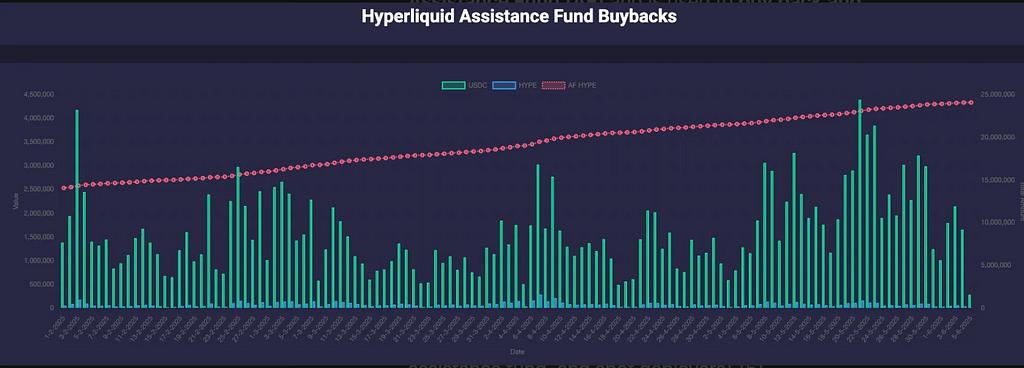

HIP-1 solves this by design. There is no negotiations, no insider allocations. You win the auction, you list the token, just basically follow the smart contract. And the 100% of the listing fee, paid in USDC, goes to the Assistance Fund (AF) and is used to buy back and burn $HYPE, creating long-term value for holders and support the ecosystem. [7]

On most other protocols, the team or insiders are the main beneficiaries of fees. On Hyperliquid, fees are entirely directed to the community (HLP, the assistance fund, and spot deployers).[5]

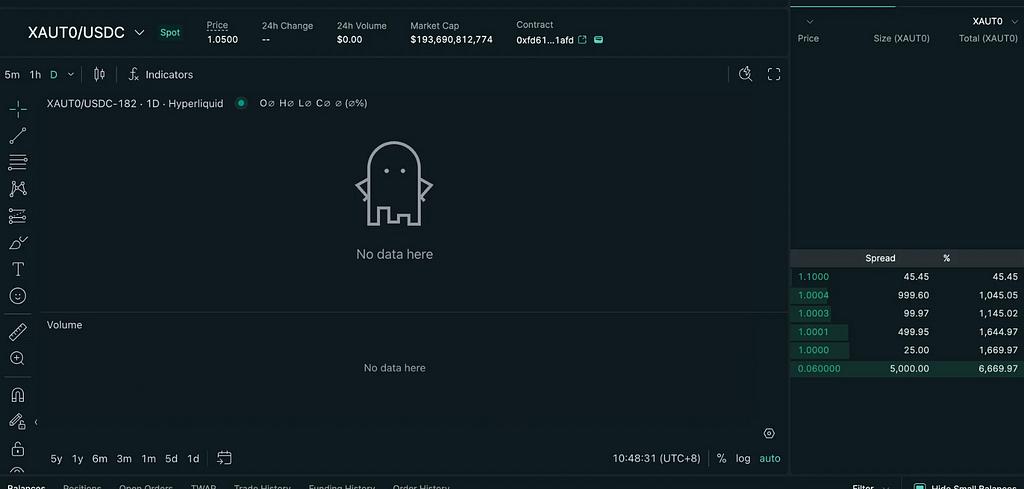

Despite Hyperliquid’s auction mechanism, where projects can list without backdoor deals, bribes, the current setup leaves a lot room to improve when it comes to spot trading. While listings are technically successful, auction prices are near the floor (e.g., 500 HYPE), showing not much demand for spot listing on hyperliquid, volume and trader engagement post-listing also remain underwhelming.

The official announcement page doesn’t even clearly flag spot listings, and newly listed tokens often see zero trading volume, as shown in XAUTO’s case.

The broader issue is clear: Hyperliquid’s spot market lacks visibility, and follow-through. Without stronger secondary market activity, user incentives, traders and projects will continue to prefer CEXs like Binance, even if they’re less transparent or more expensive. If Hyperliquid wants to compete seriously as a listing venue, it must back its fair launch ethos with better UI visibility, and giving more attention to their own spot market, as now the spot market is only 2% of the total spot dex market, with 84% are $HYPE/USDC pair.

b. HIP-3 Auctions: Decentralized Perp Listing

HIP-3 (Builder-Deployed Perpetuals) is a major step toward decentralizing the listing process for perpetual markets on Hyperliquid. Now live on testnet, HIP-3 allows anyone to permissionlessly deploy perpetual markets on HyperCore with their own onchain orderbooks. Deployment fees are paid in $HYPE via a Dutch auction every 31 hours. Deployers can configure up to 50% fee share and are responsible for defining the oracle, contract specs, leverage parameters, and ongoing market operations. To ensure market quality and user safety, deployers must stake 1M $HYPE, which can be slashed by validator vote in case of malicious activity. HIP-3 lays the foundation for a permissionless, builder-led perpetuals ecosystem on Hyperliquid.

c. Vaults

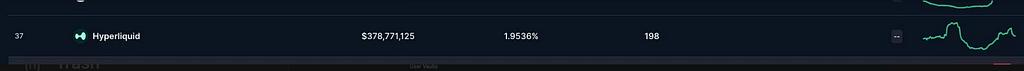

Hyperliquid isn’t just for active traders, it also offers a vault system that allows users to earn passively by allocating funds to algorithmic trading strategies.

There are two types of vaults:

- User-created Vaults: Anyone can launch a vault and trade with pooled capital. Investors share in profits (or losses), while the vault manager earns 10% of profits as a fee. To align incentives, managers are required to stake at least 5% of the vault’s TVL themselves. So it is like copy trading in CEX.

- HLP: The Hyperliquidity Provider (HLP) vault runs market making strategies on Hyperliquid. The strategy itself currently runs offchain but the positions, open orders, trade history, deposits, and withdrawals of HLP are visible in real time onchain for anyone to audit. Anyone can provide liquidity for HLP and share in the pnl. HLP doesn’t collect any fees, and pnl is shared proportionally based on each depositor’s share of the vault. [8]

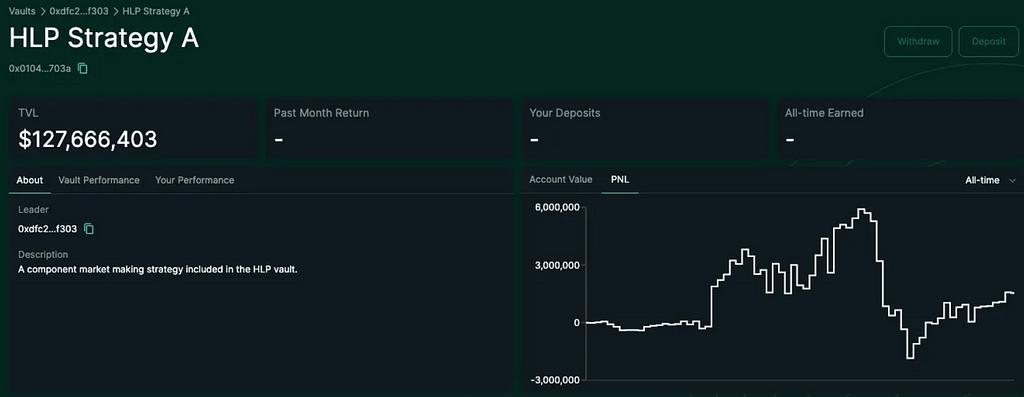

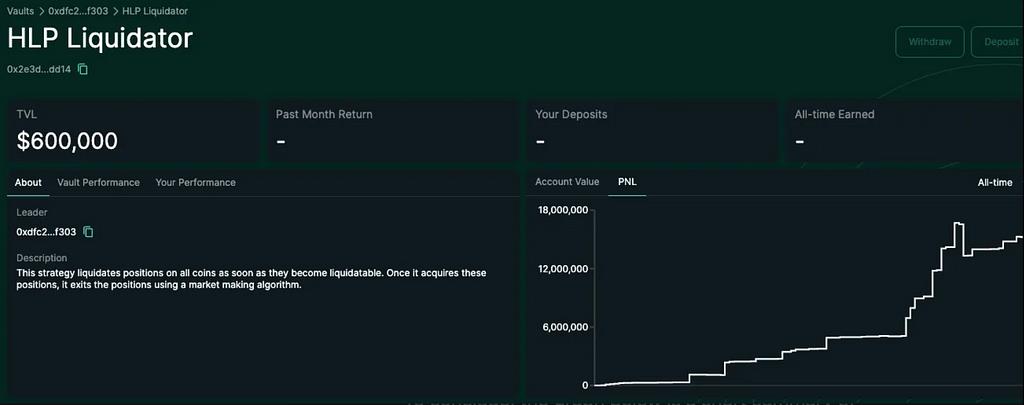

Right now, you can see HLP take up 91% of TVL, it is composed with 2 strategies

a. Market Making strategy: constant ask for bid and ask, try to earn the spread between them.

b. Liquidator [5]

- If the user hits the maintenance margin, the platform will try to send limit order to close the position.

- Position falls below 66% of maintenance margin and the position is not entirely closed

- Liquidator Vault steps in and takes over the position.

- HLP tries to close the position using limit orders to reduce slippage and risk.

- If the position is too risky or unmanageable, Auto-Deleveraging (ADL) is a backup failsafe.

In general, we can say HLP = Market Maker + Liquidator.

As a market maker, HLP continuously provides both bid and ask quotes. As a liquidator, HLP inherits positions from traders who get liquidated.

To conclude, the graph below is a short summary of how hyperliquid works.

- Market/taker fees → shared with HLP depositors

- Listing auction fees/ spot trading fee → go to Assistance Fund (all used to buy $HYPE)

- No treasury fee cut (unlike most DEXs)

3.1 Performance of HLP

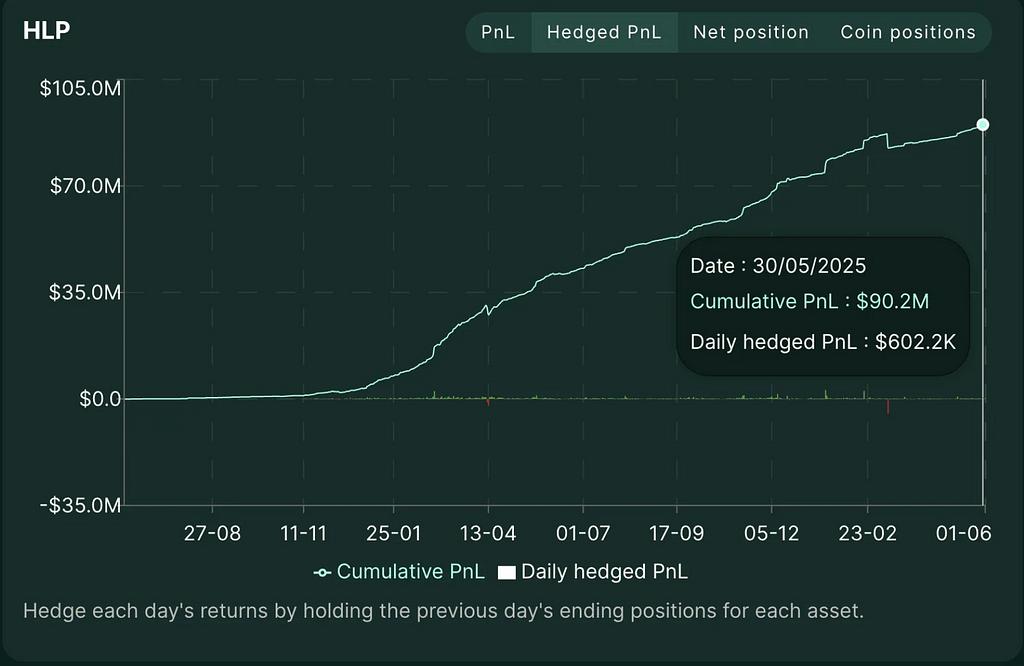

For revenue part, Hedged PnL, it represents pure protocol earnings. It doesn’t include PnL from market price movements, but only accounts for market/maker-taker fees, funding rate income, liquidation fees, etc. In short, it reflects alpha.

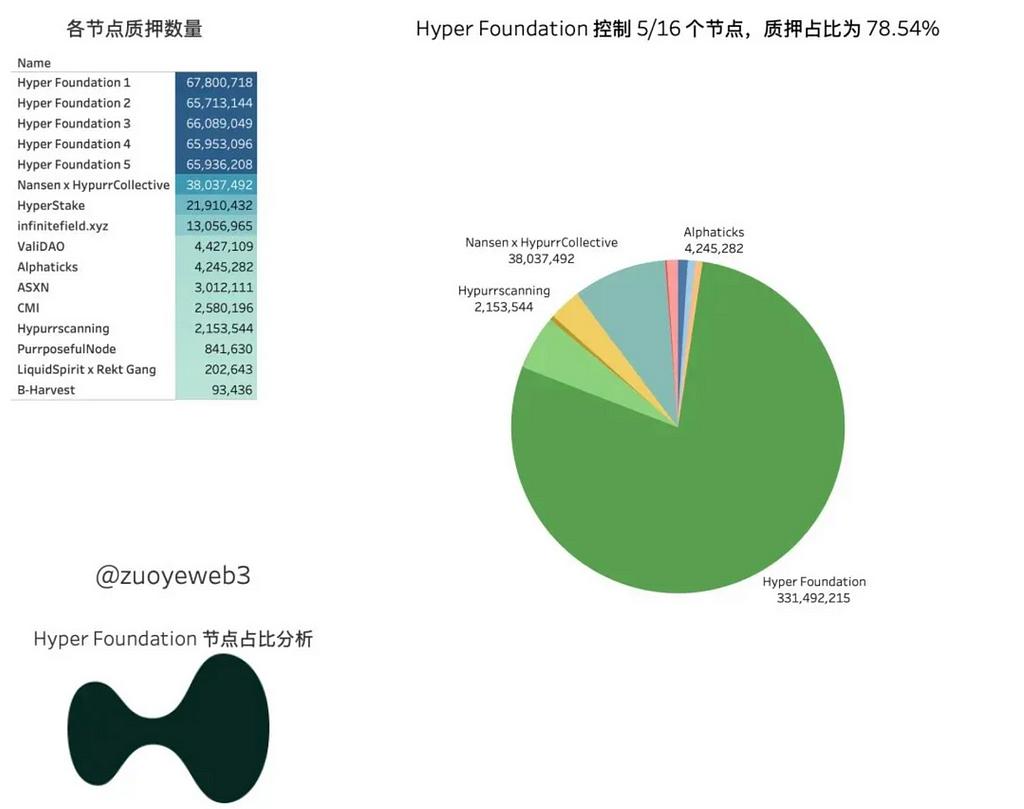

During the bull market this year, we can see the HLP’s daily net exposure to the market is usually negative, which means HLP will always hold short positions as there are already many limit order for buying.

You can see a big spike in March, showing a net notional position of nearly -$50M. That day was a disaster for Hyperliquid, one they won’t forget: $JELLYJELLY accident.

4. Risk of hyperliquid

a. Risk of HLP

As mentioned earlier, HLP accounts for over 90% of TVL on Hyperliquid and acts as the primary liquidity engine for the platform, functioning as both market maker and liquidator. But that level of concentration creates a dangerous truth: if HLP collapses, the entire Hyperliquid system could go down with it. As we can see the HLP TVL takes up around 75% of the total TVL of the entire hypeliquid chain.

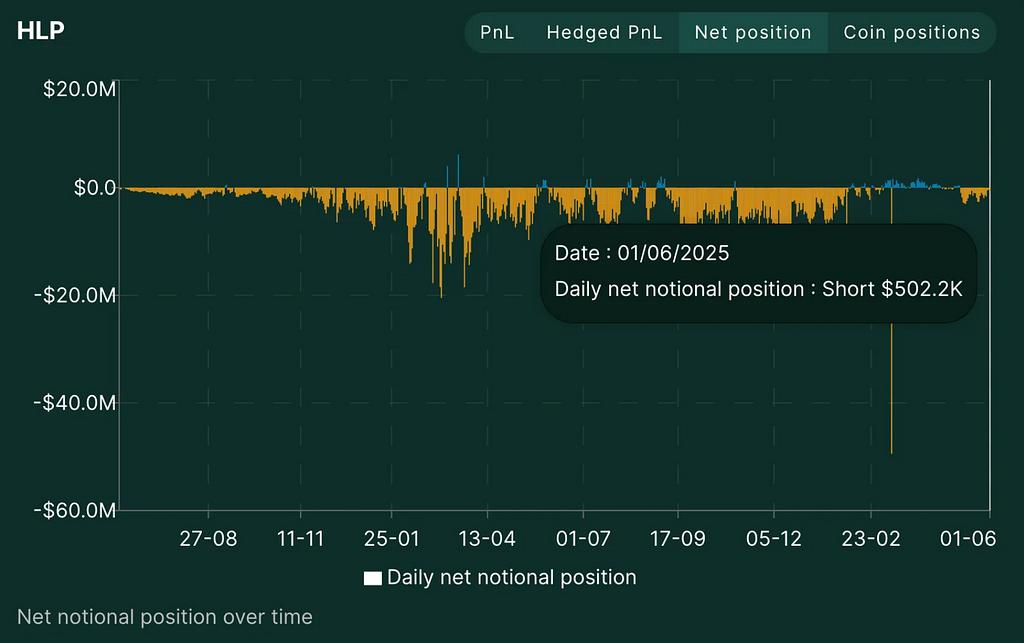

This fragility was brutally exposed during the infamous $JELLYJELLY incident in March 2025, a coordinated exploit that pushed HLP to the brink of systemic failure. The graph below shows the timeline of accident[9].

$JELLYJELLY was a memecoin/ICM narrative token launched on Solana. Before the incident, its market cap had fallen from $250M to around $10M, a low-liquidity, highly manipulable asset.

On March 26,

- The attacker deposited 3.5M margin on hyperliquid

- The attacker shorted $4.08M $jellyjelly on hyperliquid at $0.0095

- The attacker bought spot $jellyjelly, then its price exploded.

- At the same time, they withdrew margin, forcing their own short to get liquidated by HLP.

- HLP inherited the short position as there are not enough liquidity(no enough counterparty to buy $jellyjelly)

- HLP was left exposed to a $10M unrealized loss, with price momentum threatening to cascade into chain liquidations across the vault.

- Eventually, Hyperliquid issued an emergency notice. Citing “suspicious market activity,” the validator set voted to de-list the JELLY contract mid-trade. Positions were forcibly settled — but not at market oracle price (~$0.05). Instead, Hyperliquid used an internal final price of $0.0095, manually marking JELLY down 80%.

Although HLP narrowly avoided collapse and even recorded a small net gain due to the low settlement price, the event raised uncomfortable questions about decentralization and governance.

b. Validators: Decentralized in Name?

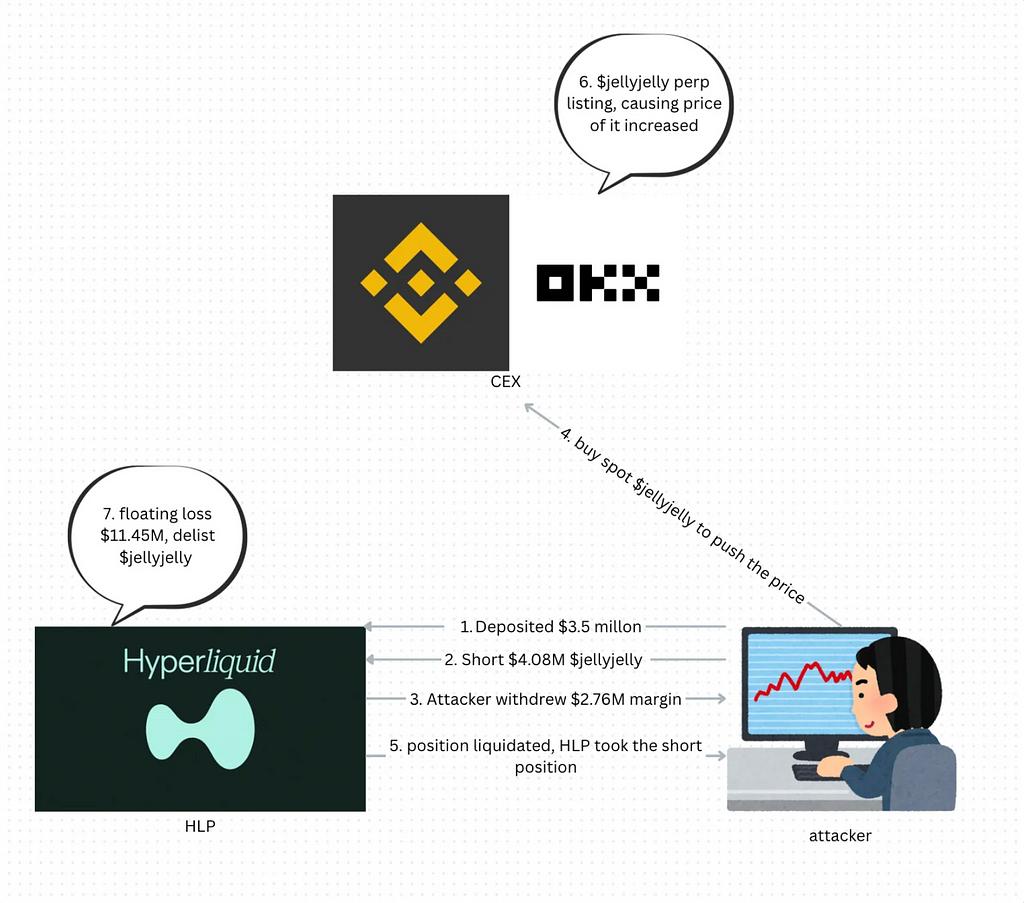

The JELLYJELLY exploit didn’t just test the limits of HLP’s design, it tested the core of Hyperliquid’s decentralization claims. In response to the event, Hyperliquid validators were able to quickly coordinate and alter system behavior: pausing contracts, overriding oracle data, and forcibly de-listing assets.

But here’s the catch: the majority of validators are closely affiliated with the Hyperliquid Foundation. This means validator votes can function more like internal decisions than decentralized governance. Hyper Foundation controls 5 of 16 validators, and 78.5% of total stake across.[10]

This reality came to light as the platform settled $JELLYJELLY at a price far below market rates, raising alarms in the community.

If oracles can be manually overridden and assets force-settled off-chain logic, then we must ask: is Hyperliquid a DEX in architecture, but a CEX in execution? Following the incident, HLP TVL dropped sharply, as users pulled funds out of the vault. The dip is clearly visible in onchain data.

The protocol’s ability to act decisively might have saved it from disaster, but it also exposed the limits of its permissionlessness. Going forward, decentralization of validators and on-chain governance transparency remain critical challenges for Hyperliquid’s long-term credibility.

Even now (5 June), Hyperliquid still controls around 65.3% of current validator stake, which hold a majority.

5. But why Hyperliquid can still recover from that loss?

In crypto, being criticized isn’t fatal. Being replaceable is.

After narrowly surviving the $JELLYJELLY short squeeze in March 2025, an exploit that nearly wiped out its vault and triggered a decentralization crisis, many assumed Hyperliquid was done for. On April 7, $HYPE dropped as low as $9, shaken by FUD and vault risk concerns.

Yet by late May, $HYPE rebounded above $35, hitting a new all-time high and reclaiming its spot among the top 20 crypto assets by fully diluted valuation (FDV).

So how did it bounce back?

a. Whales never left

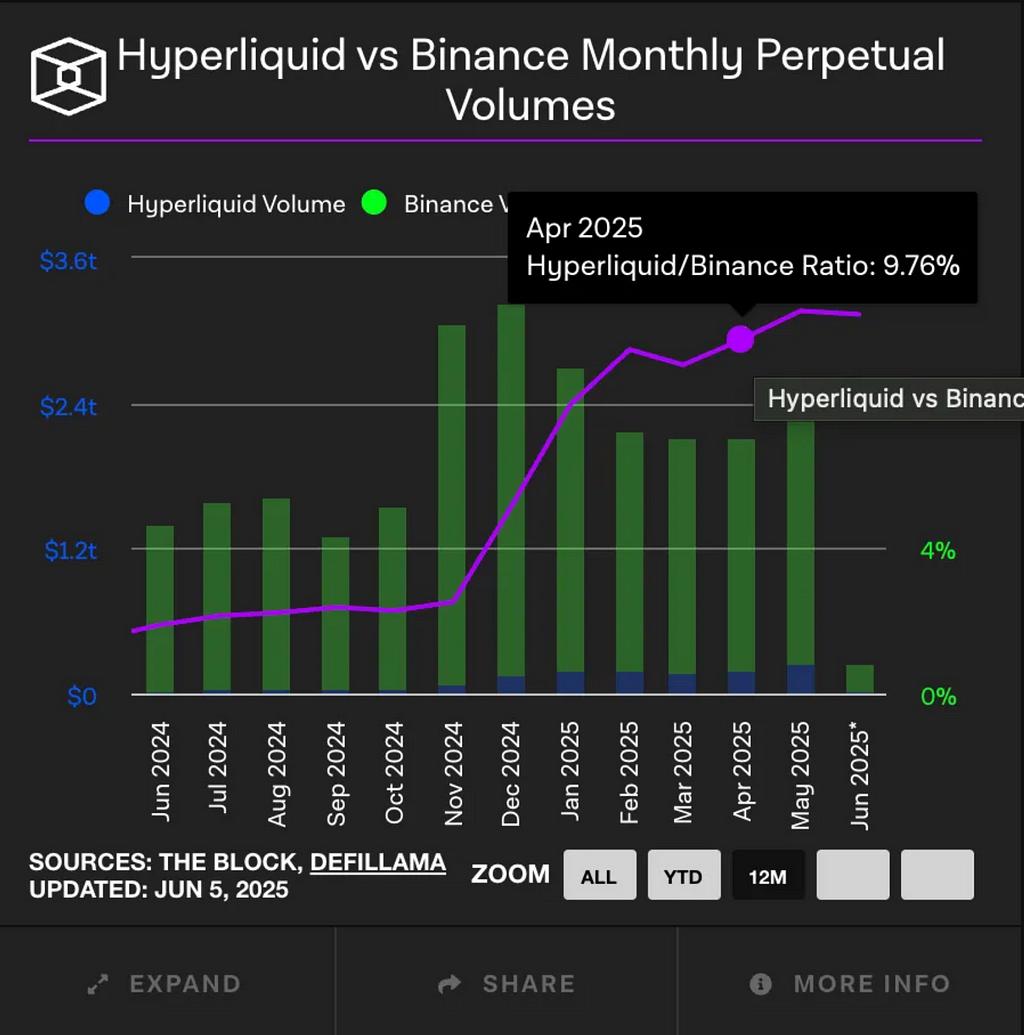

Even during the $JELLYJELLY crash, Hyperliquid consistently held ~9% of Binance’s perpetual volume, according to data from The Block . That’s not just a statistic, it’s a signal.

Despite facing a credibility crisis, institutional traders, whales, and influential KOLs continued to use Hyperliquid. Why? Because the platform solves a core need in today’s market: high-performance derivatives trading without KYC.

In contrast to fully centralized exchanges like Binance or OKX, which demand identity verification, restrict access in certain jurisdictions, and sometimes freeze funds. Hyperliquid offers some kind of freedom and capital efficiency, while still delivering comparable execution quality. It blends the speed and depth of a CEX with the permissionlessness of DeFi.

That makes it uniquely valuable, especially to:

- Whales seeking privacy and unrestricted leverage

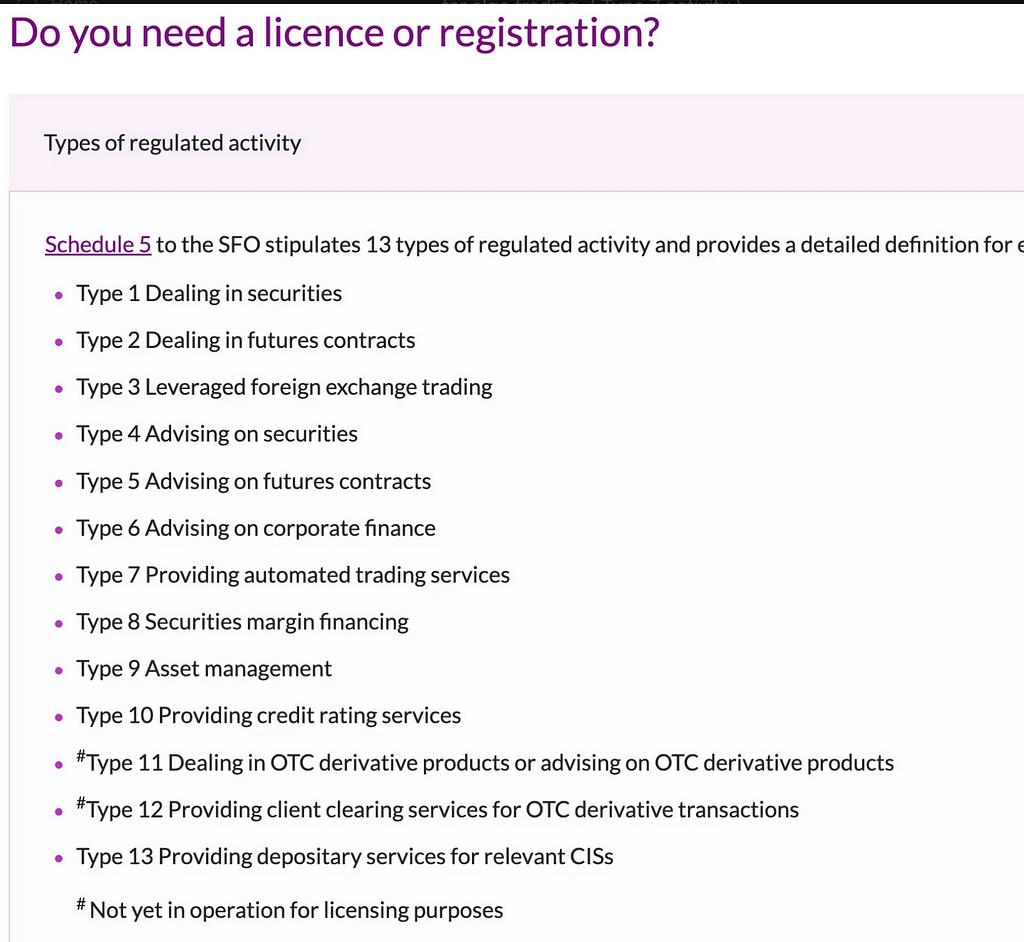

- Crypto-native institutions who need programmatic execution without legal entanglement, for example for Binance in HK, we cannot actually request api for algo trading. ( Type 7 activity )

3. Influencers (KOLs) who leverage the platform’s public trade history to. build social clout, creating a “money + influence flywheel”

Even post-crisis, these users never left. On the contrary, whale activity increased. New memecoin rallies, like those led by James Wynn, turned Hyperliquid into the epicenter of on-chain speculation.

In fact, the $JELLYJELLY event only proved one thing: Hyperliquid is the only onchain trading venue that can actually take hits like a CEX.

The message? Even bearish whales are stuck, because the only venue deep enough to support them is still Hyperliquid.

b. The Tradeoff: Decentralization vs. Control

Hyperliquid didn’t pretend to be “pure DeFi.” It only aims for user-friendly, or user-first dex. It made a pragmatic tradeoff: slightly centralized validator governance, in exchange for high-throughput, low-latency execution.

Controversial? Absolutely. But it worked.

As Foresight News put it: “To survive black swans, someone has to hold the sword.” Hyperliquid is unapologetic about being that swordholder. [12] It believes that surviving protocol-level risks, like exploit-induced cascades, sometimes requires human coordination and top-down intervention. That’s not censorship resistance; it’s operational resilience.

And it’s not alone.

On May 22, Sui Network validators voted to forcibly reclaim funds from a $220M exploit on Cetus, its DEX aggregator. The proposal allowed validators to override wallet control and reverse the hacker’s access to $160M in frozen funds. The maneuver, “hacking the hacker”, sparked intense debate. Critics argued it violated the trustless ethos of DeFi; defenders claimed it was a justified exception to save the ecosystem.

So… is Sui decentralized? Not really. But that’s the point: every performant blockchain makes tradeoffs. Speed, liquidity, UX, protocol safety, these don’t come for free. The real question is: are the tradeoffs transparent and effective? Optimizing one aspect often compromises the others, making it difficult to achieve all three simultaneously.

In Hyperliquid’s case, the validator set is majority-controlled by the Hyper Foundation, a centralization risk, yes, but one that enabled a rapid response to the $JELLYJELLY attack. And clearly, users (and whales) are voting with their wallets. Hyperliquid’s open interest, USDC TVL, and fee revenue hit all-time highs in May, even after the FUD.

Sometimes, people don’t ask whether a system is decentralized, they just want to know if it works. If you were the one whose liquidity got drained in the Cetus exploit, would you really care whether the Sui network was “properly” decentralized? When incentives collide and real money is on the line, ideals take a backseat to outcomes. In moments like these, the principle of decentralization often matters less than the ability to act.

c. Expanding use cases — not just a DEX anymore

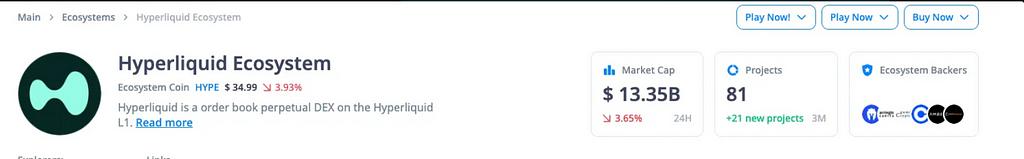

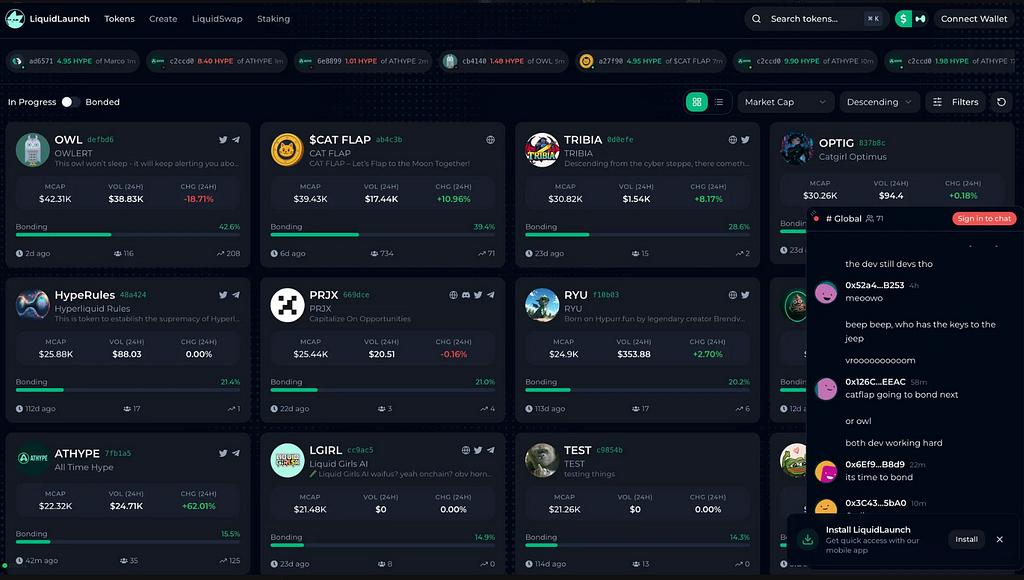

Despite its centralization tradeoffs, Hyperliquid is increasingly being adopted as a blockchain ecosystem, not just a derivatives DEX. As shown in the Cryptorank, Hyperliquid has onboarded +21 new projects in the last 3 months, bringing the total to over 80 across DeFi, gaming, NFTs, tooling, and analytics

[13]

[14]

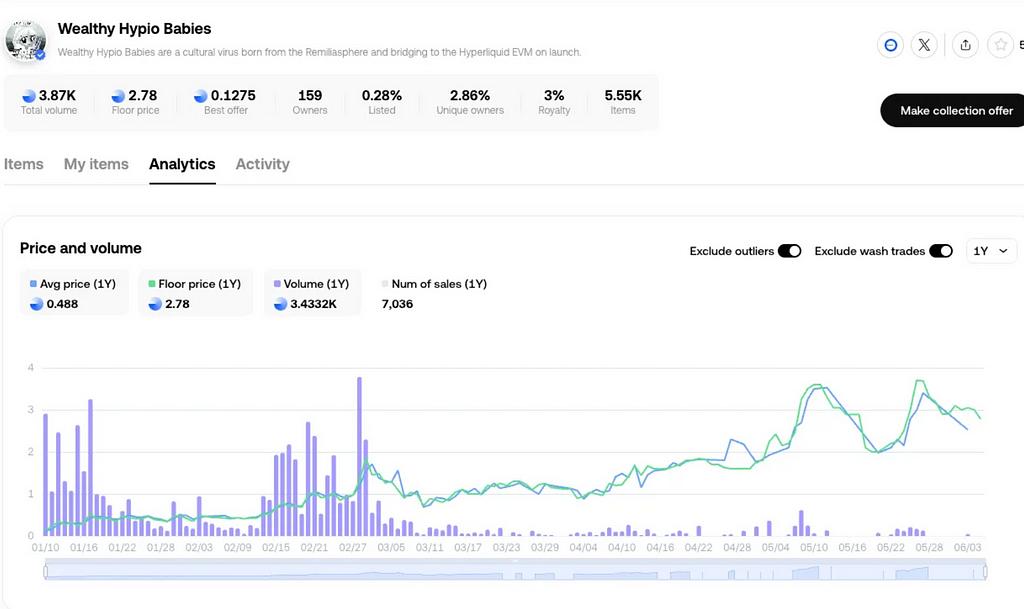

Milady-themed NFT collection are now launching NFTs on Hyperliquid’s native chain, named Wealthy Hypio Babies, and their floor price shows a consistent uptrend, suggesting sticky liquidity and organic interest. It’s clear that even after the JELLYJELLY exploit and decentralization criticisms, developers and users are still betting on Hyperliquid as a viable, performant L1.

[15]

6. Real traction of hyperliquid

a. Why DEX

High-profile failures of CEX have shaken user confidence and accelerated a migration to DEX. The collapse of FTX in late 2022 showed how even a top exchange can implode overnight and trap customer funds. Over the past decade, 118 exchange hacks have led to $11 billion in losses, vastly more than losses from on-chain exploits, reinforcing the adage “not your keys, not your coins.”

Each new breach or withdrawal freeze has reminded users that custodial platforms carry inherent third-party risk. This erosion of trust ignited an exodus toward self-custody solutions. With the improving technology of payment, some may even don’t require to off-ramp payment in the future.

In fact, active self-custody wallets surged 47% in 2024 (to over 400 million addresses), and DEX trading volumes hit all-time highs by January 2025. Users are clearly “voting with their feet”, seeking greater control and security by keeping custody of assets in their own wallets while trading on DEXs.

The original promise of blockchain was rooted in decentralization, giving individuals sovereign control over their assets through non-custodial wallets, free from the oversight of governments or central banks. Yet for years, most users prioritized convenience over self-custody, treating CEX as their own wallets. This sidelined the very essence of blockchain: user ownership and trustless systems.

However, that paradigm is now shifting. As blockchain infrastructure matures and more opportunities emerge on-chain, users are beginning to re-evaluate their dependence on CEXs. Self-custody is being rediscovered not just as a security principle, but as a gateway to early, high-upside participation in crypto: such as airdrops, memecoins. For example, while tokens like $TRUMP were already priced above $20 by the time they listed on major CEXs, on-chain users had access far earlier, often at a fraction of the price.

This growing realization, that convenience often comes at the cost of opportunity and autonomy, is gradually eroding the dominance of centralized platforms. As more users awaken to the upside of being early and self-sovereign, the shift from CEX to on-chain participation becomes not just ideological, but practical.

b. Why hyperliquid not others?

Even after the $JELLYJELLY incident, where trust was temporarily shaken, users didn’t give up on Hyperliquid. Other DEXs like dYdX or GMX barely saw an uptick. Why? Because Hyperliquid had already done three key things exceptionally well:

1. Community-First Token Design

Hyperliquid is one of the few platforms in DeFi to launch without any VC backing. There were no early investor allocations, no private rounds. Instead, over 70% of $HYPE supply was reserved for the community, with a record-sized airdrop (31%) going to 94,000 users, averaging ~$45K per wallet.

This created:

- A sticky user base farming rewards through Season 1 & 2 point systems

- constant buyback program (dydx don’t)

- No constant “VC dump” overhang, unlike dYdX (50%+ to insiders) or GMX (30%)

In essence: Hyperliquid users didn’t just use the product they owned it.

2. CEX-Grade Trading Without the CeFi Risks

Other perps DEXs suffer from AMM inefficiency (GMX), off-chain matching (dYdX v3), or slow UI/UX. Hyperliquid matched the speed of Binance, but on-chain.

This attracted whales (e.g. James Wynn’s $1B positions), market makers, and HFTs. Even post-crisis, Hyperliquid retained deep liquidity and tight spreads (~0.05%) that no other DEX could rival. That’s why whales stayed, because execution quality still mattered.

3. Product Depth: Not Just Perps Anymore

Hyperliquid didn’t stop at perps. By early 2025, it had:

- Launched BTC spot (promptly after feedback from users and analysts)

- Deployed HyperEVM for DeFi builders

- Built HLP vaults + copy trading infrastructure

- Issued meme tokens (HIP-1 standard), complete with native spot/perp support

- Rolled out a real-time fee-backed Assistance Fund (buying/burning HYPE)

This expansion created a “one-stop DeFi exchange”:

- Trade BTC spot, ETH perps, or meme tokens all on one UI

- Stake in HLP or follow top traders

- Use the same wallet for everything — fast, cheap, gasless

Whereas dYdX or GMX feel like one-trick protocols, Hyperliquid evolved into an ecosystem.

7. More in-depth on HyperEVM ecosystem

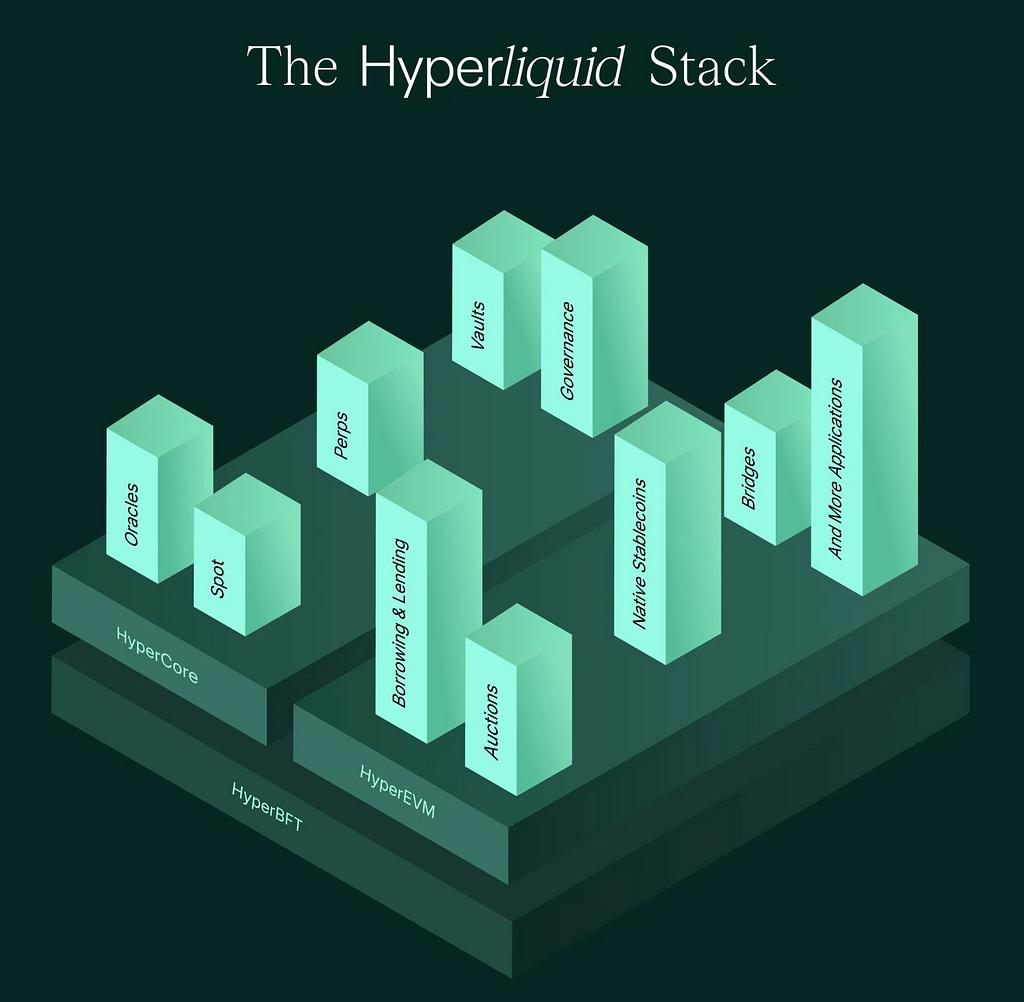

What Is HyperEVM?

HyperEVM is Hyperliquid’s EVM-compatible smart contract layer, designed to bring composability, programmability, and DeFi innovation onto its high-performance Layer 1. It is part of a three-layer architecture:

- HyperCore: The central trading and custody layer. All assets (deposited or bridged in) first land here. Think of it as Hyperliquid’s “exchange balance sheet.”

- HyperEVM: A separate EVM environment for smart contracts, where dApps like DEXs, lending protocols, and NFTs live. Assets must be manually moved from HyperCore to HyperEVM to interact with smart contracts.

- HyperBFT: a custom consensus protocol based on the HotStuff BFT model. Validators produce blocks proportionally to $HYPE stake, similar to most Proof-of-Stake (PoS) chains. However, HyperBFT is specifically optimized for low-latency, high-throughput trading execution.

This separation ensures performance. Trading activity happens on HyperCore (ultra-fast, consensus-driven), while programmable DeFi logic lives on HyperEVM (gas-paid-in-HYPE).

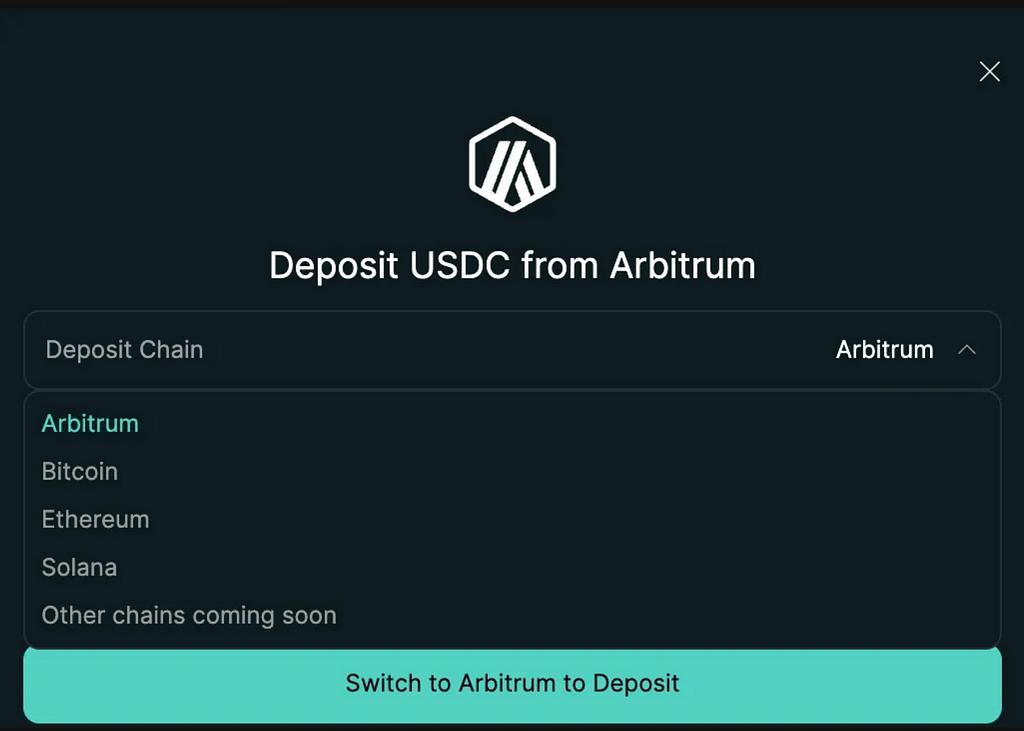

How to enter the HyperEVM ecosystem

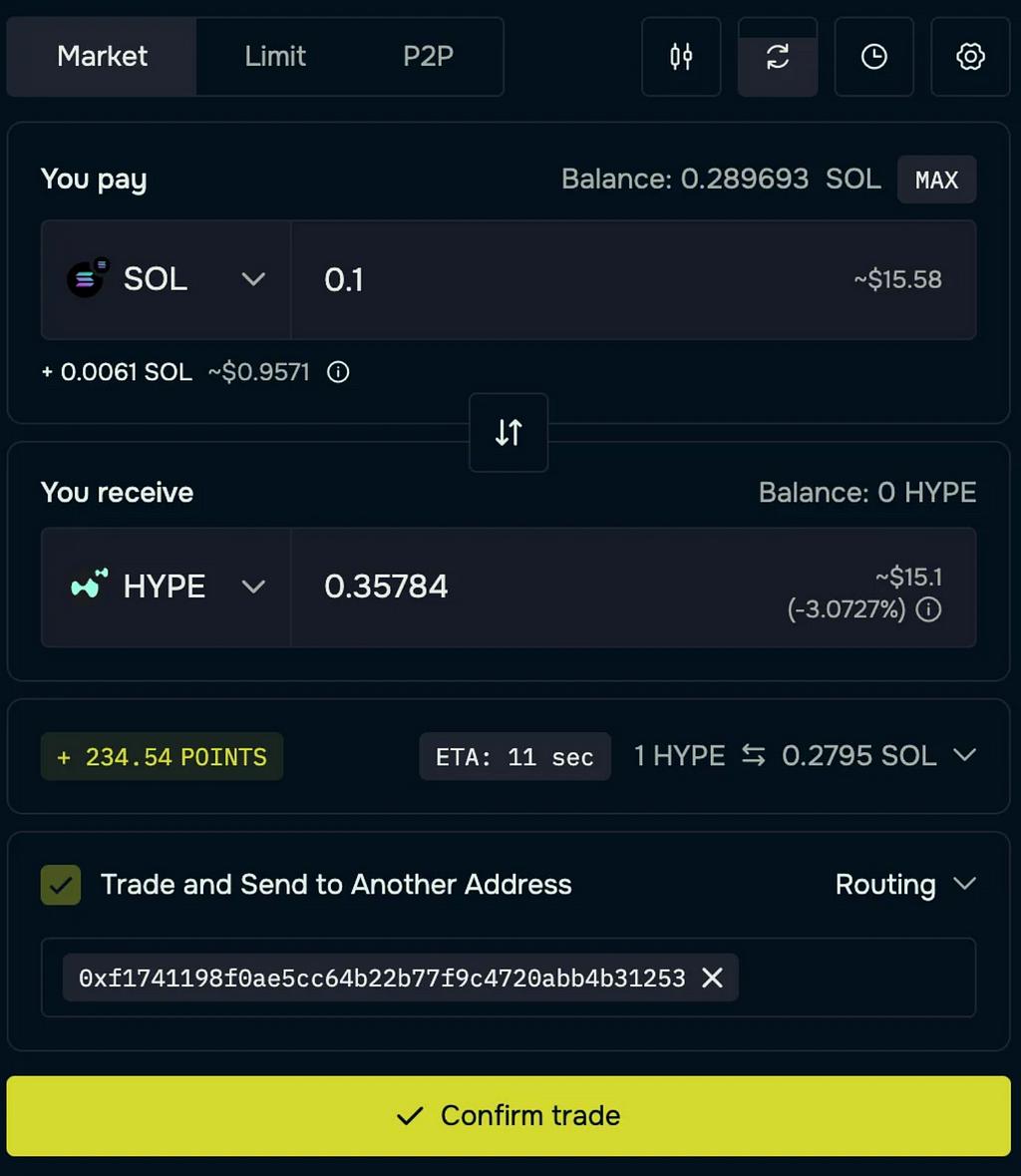

1. Bridge from External Chains → HyperCore → HyperEVM

- Use a cross-chain bridge (e.g., deBridge)

- Source chains supported: Ethereum, Arbitrum, Solana, Bitcoin

- Assets: USDC, USDT, ETH, BTC, USDe, SOL, FARTCOIN

- The tokens first land in your HyperCore Spot balance (not directly in HyperEVM).

- Transfer from HyperCore → HyperEVM:

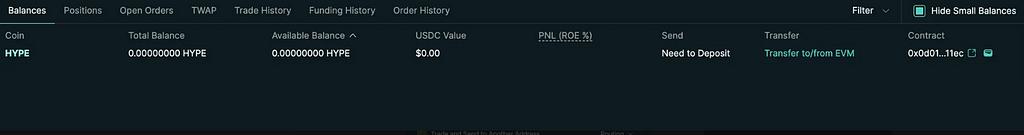

- On the Hyperliquid Balances page, click “Transfer to/from EVM”.

- Select the token (e.g., HYPE, USDC) and amount to send to HyperEVM.

- Confirm the transaction (gas is paid in HYPE).

2. External Chains → HyperEVM (Direct Transfers)

- Use a cross-chain bridge (e.g., deBridge), higher slippage

Some projects on HyperEVM

- DEX (non-perp)

difference between spot market on hyperliquid and hyperswap: Some tokens havn’t launched on the platform, LP incentive

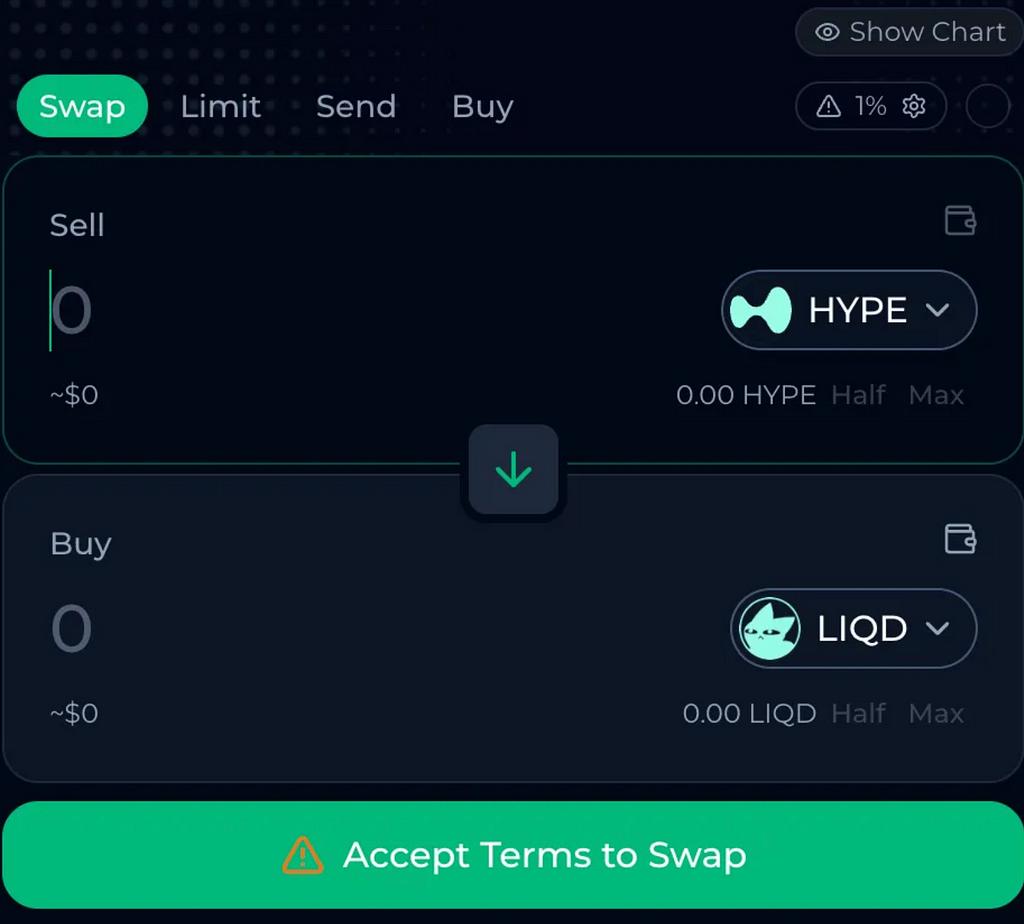

- Hyperswap

- Liquidswap (DEX aggregator)

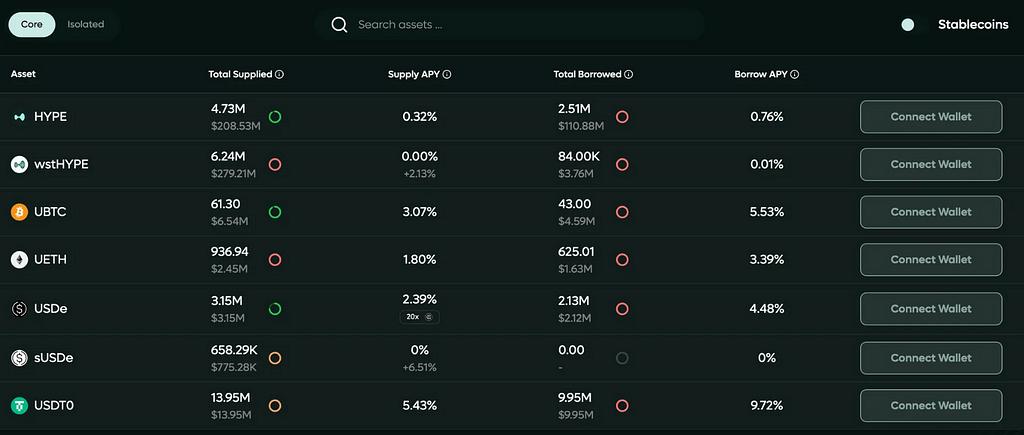

2. Defi

- Hyperlend

- Felix

- Hypurr.fi

3. Launchpad

- Liquidlaunch

Why HyperEVM Matters

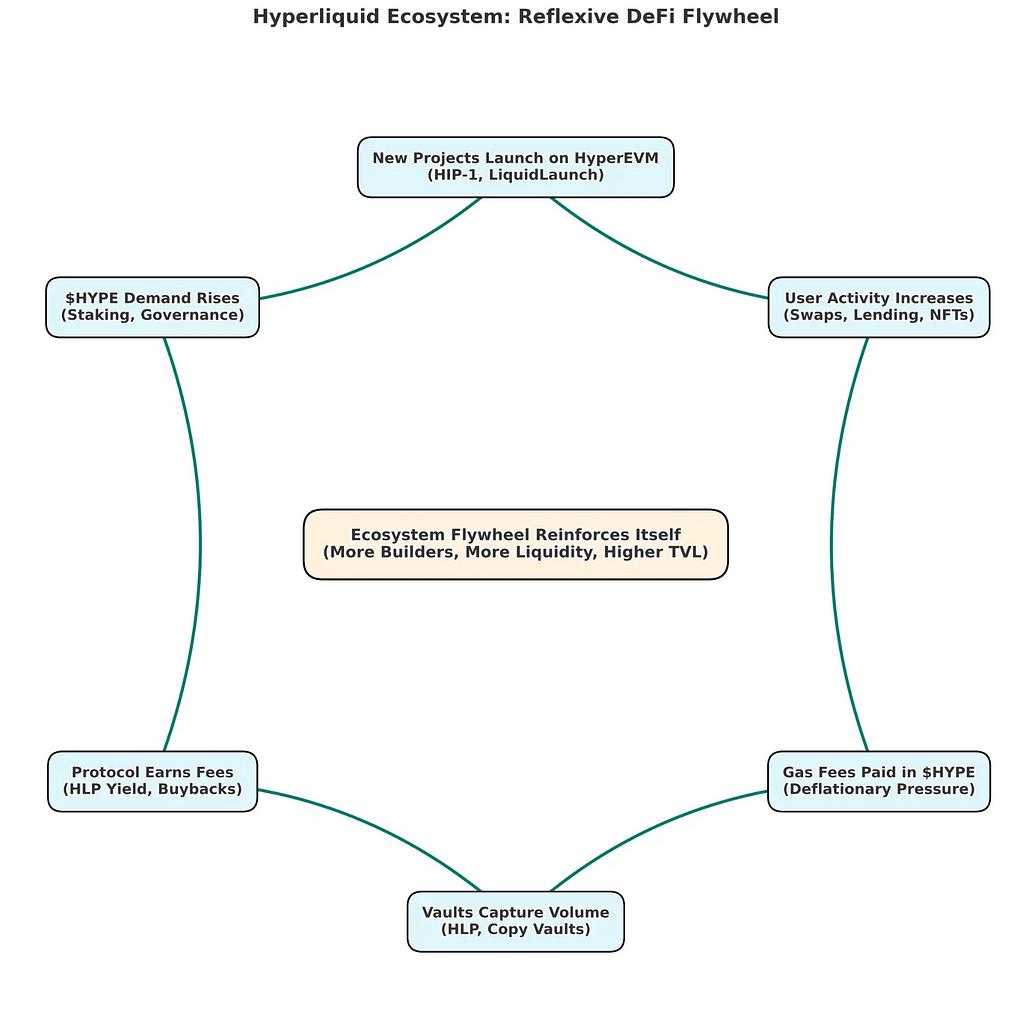

As more protocols launch on HyperEVM, across DEXs, lending, stablecoins, and on-chain tooling, on-chain activity continues to grow. This results in increasing gas transactions paid in HYPE, directly contributing to HYPE’s deflationary burn model. (all gas fees, base+priority fee, are burnt)

The rising usage of HyperEVM not only supports token value but also signals strong organic developer interest and community traction. Combined with the potential for future airdrops tied to EVM activity, HyperEVM strengthens the narrative that Hyperliquid is a truly community-driven, self-sustaining ecosystem.

Potential HyperEVM Projects with Asymmetric Upside

While $HYPE remains the central asset capturing Hyperliquid’s system value, emerging tokens within HyperEVM: such as $LIQD (a governance and reward token for the LiquidSwap eco, which distribute $HYPE to stakers) and others, offer higher beta exposure to the ecosystem’s growth. These tokens often represent localized revenue share models, DeFi primitives, or early-stage liquidity mining opportunities. As $HYPE appreciates, these tokens may benefit from:

- Increased transaction volume and user inflows, boosting their utility and fee capture.

- Higher APYs in HYPE-denominated rewards, as seen with $LIQD staking.

- Speculative upside as traders rotate into smaller-cap ecosystem plays.

- Possible airdrops or governance incentives tied to early adoption.

In a rapidly compounding ecosystem like HyperEVM, these “picks and shovels” tokens, gas-powered by $HYPE, but uncorrelated in token design, may outperform $HYPE on a relative basis, especially in early cycles.

🔍 Example: While $HYPE may 2× from here, a project like $LIQD, with <$100M FDV and rising fee volume, could 4× if liquidity and usage deepen alongside $HYPE’s rally.

These projects are not just parasitic; they are amplifiers. Their growth feeds back into HYPE via gas burn and on-chain demand, creating a reflexive flywheel between ecosystem expansion and token value.

8. Conclusion

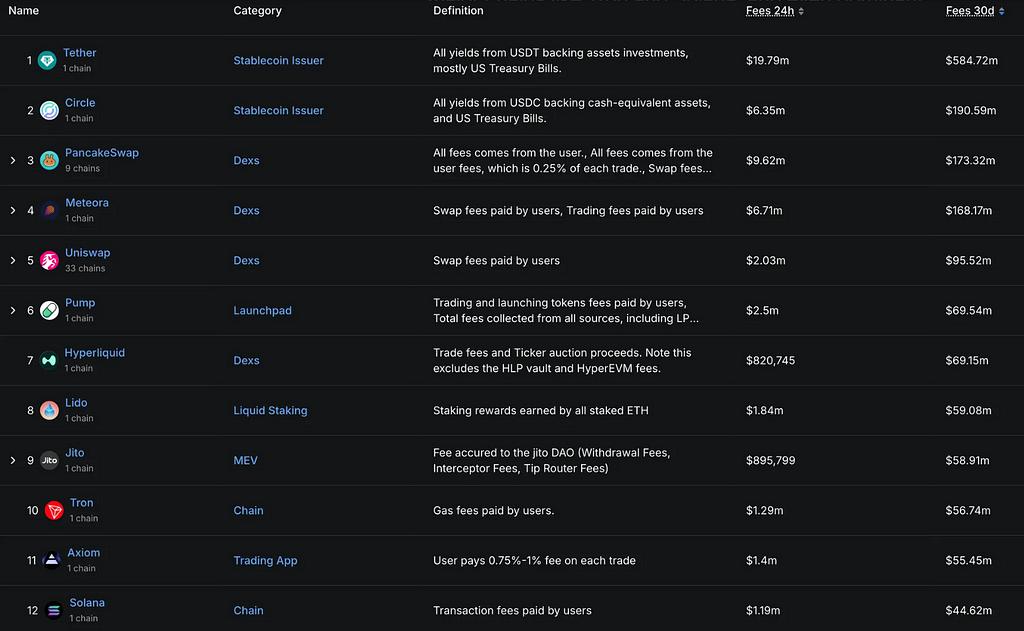

While it’s often bucketed as “just another DEX” or sometimes as an emerging L1, fee data tells a different story. Hyperliquid now ranks 7th across all crypto protocols in 30-day fees ($69.15M), outperforming major chains like Tron and Solana, and even dominant staking platforms like Lido. Importantly, this fee figure excludes revenue from the HLP vault and HyperEVM, meaning its full monetization potential is still understated.

From a valuation lens, Hyperliquid’s fundamentals are already priced like a top-tier L1, but the real upside is in becoming the first DeFi-native exchange that rivals CEXs on experience, fees, and execution. While most DEXs still rely on clunky swap interfaces with poor liquidity on some pairs, Hyperliquid runs a true order book, and thanks to the HLP2 mechanism, it offers up to 0.3% max slippage across chains, no wallet switching needed. We believe Hyperliquid is positioned to become the only on-chain trading platform users need, from spot to perp, and even the entire ecosystem.

In that sense, Hyperliquid isn’t fighting Uniswap, it’s coming for Binance. With better spot market attention, I think the future of hyperliquid controlling CEX is coming.

[16]

Why It’s Unlikely Another “Hyperliquid” Can Be Recreated

Despite the attraction of betting early on the next breakout perpetual DEX, we believe the window for building another “Hyperliquid” has likely closed. Key reasons:

- Dominant Market Share Hyperliquid now controls over 80% of on-chain perp volume and consistently processes >$60B in weekly trading. Its dominance has become self-reinforcing, liquidity attracts traders, which attracts more liquidity. A new entrant would have to bootstrap tens of billions in daily volume just to matter.

- Unreplicable Economic Setup The no-VC, self-funded model was not just a meme, it created unmatched trust and long-term alignment. This structure is extremely rare and difficult to imitate, especially in a capital-intensive sector like trading infra. Most new DEXs will need VC funding, leading to token dilution, community skepticism, and a different incentive dynamic.

- Elite Founding Team Hyperliquid’s founding team includes ex-HFT engineers from Hudson River Trading, MIT, and Caltech, giving them the technical and product edge to deliver CEX-grade infra. In a podcast interview, founder “Jeff” shared that their personal networks included elite traders who became early users and feedback loops, a moat that can’t be copied.

- Mature ecosystem Hyperliquid is no longer just a DEX, it’s a performant Layer 1 protocol underpinning a fully integrated trading and DeFi ecosystem. Its unmatched product-market fit, sticky user base, and sustainable token model position it as the first DeFi-native platform capable of challenging Binance at scale.

Reference

[1] @0xNonceSense, “The $PEPE flip that made him a god.” https://x.com/0xNonceSense/status/1928105523502796848

[2] CoinMarketCap, DEX Derivatives Ranking https://coinmarketcap.com/rankings/exchanges/dex/?type=derivatives

[3] Xverse, $HYPE tokenomics, https://www.xverse.app/blog/what-is-hyperliquid-blockchain

[4] When Shift Happens E95, https://www.youtube.com/watch?v=WeRh589I76o

[5] hyperliquid gitbook, https://hyperliquid.gitbook.io/hyperliquid-docs/validators/delegation-program

[7] https://assistancefund.top/

[8] https://hyperliquid.medium.com/hyperliquidity-provider-hlp-democratizing-market-making-bb114b1dff0f

[9] Attack process ai_9684xtpa

[10] https://x.com/zuoyeweb3/status/1905667783431700854

[11] https://www.theblock.co/data/decentralized-finance/derivatives

[12] https://x.com/Foresight_News/status/1925509022343377104

[13] https://x.com/SKYGG_Official/status/1879862273814204486

[14] https://cryptorank.io/ecosystems/hyperliquid

[15] https://web3.okx.com/nft/collection/base/hypio

[17] https://defillama.com/protocol/dydx

Degen Arena for Battle: Hyperliquid was originally published in IOSG Ventures on Medium, where people are continuing the conversation by highlighting and responding to this story.