Original | Odaily (@OdailyChina)

Author | Wenser (@wenser 2010)

Last night, the L1 blockchain Stable, supported by USDT, was officially launched, which means that the USDT ecosystem now has its own dedicated blockchain. On the other side, the USDT issuance in the TRON ecosystem broke through 80.6 billion on the 22nd of last month, accounting for 51.6% of the global USDT total supply, setting a new historical high.

Undoubtedly, with the epic good news in the stablecoin track, even Tether, with an annual net profit of over $13 billion, cannot remain indifferent and is handing over the USDT settlement layer interests to ecosystems like TRON. With Stable using USDT as the native gas and offering free peer-to-peer USDT transfers, can it replace TRON's dominant position in the USDT issuance network? What is Stable's future development direction? Odaily will provide a brief analysis of these questions in this article.

[The rest of the translation follows the same professional and accurate approach, maintaining the original structure and meaning while translating to English.]Although TRON has dominated the stablecoin track with the largest USDT issuance market share, the emergence of Stable as an L1 public chain means that TRON's "stablecoin business strategy" may face a major test. Specifically, this includes the following aspects:

Test One: Sharp Decrease in USDT Issuance

After Stable's launch, Tether will likely intentionally or unintentionally control USDT issuance on TRON and other blockchain networks, shifting the primary issuance to the Stable ecosystem.

After all, USDT in the Stable ecosystem has cross-chain interoperability supported by USDT0 and LayerZero, allowing more flexible and free circulation across blockchain networks without affecting USDT's use cases.

Test Two: USDT vs USD1 Competition

Previously, under Justin Sun's mediation, TRON became the third-largest ecosystem for USD1, a stablecoin launched by the Trump family's crypto project, to some extent reflecting the "distribution channel competition" between the established USDT and the new-generation USD1—

The former is TRON's fundamental base and one of its main income sources; the latter is backed by Trump and various American asset management institutions.

Stable's emergence will further intensify the market share battle between USDT and USD1, and TRON, as the "ecosystem intermediary," may soon face a "team selection moment".

Test Three: Protocol Revenue May Be Affected

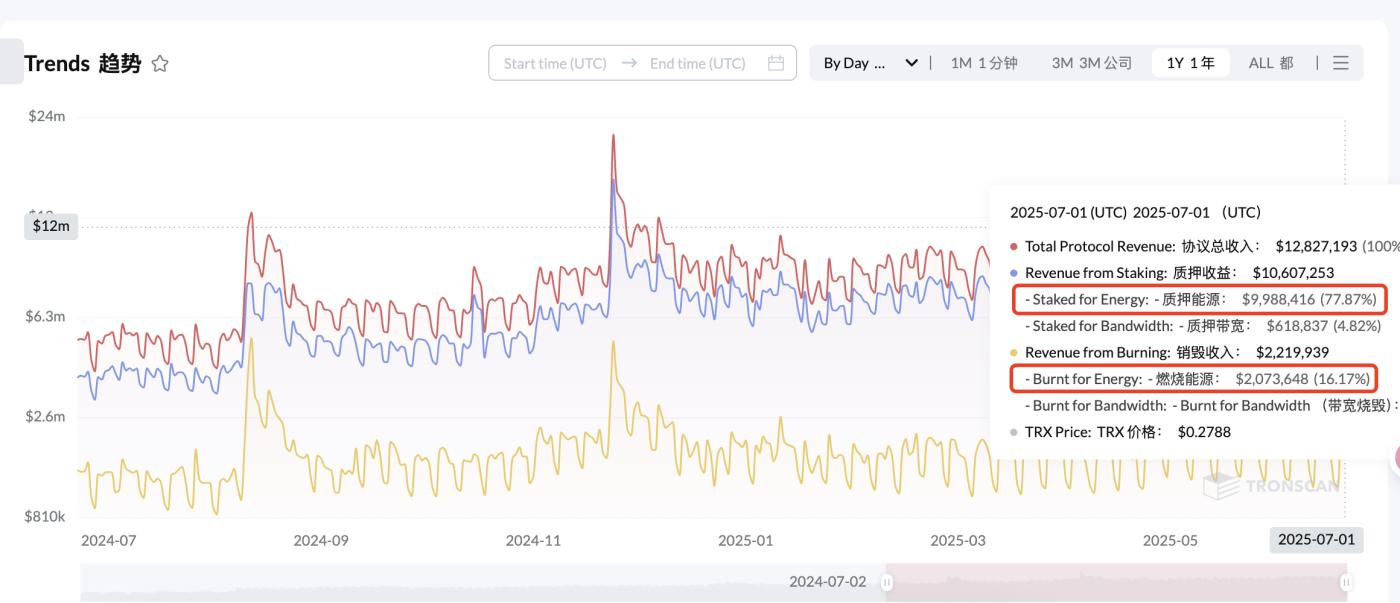

According to Tronscan's official data, in the past year, TRON's protocol revenue reached $3.15 billion; in the past 30 days, total protocol revenue was $343 million; on July 1st alone, protocol total revenue was $12.83 million. Among this, energy pledge and burning income related to stablecoin transfer transactions like USDT accounts for approximately 94%, and with USDT's 99.02% share in the TRON ecosystem, it has made almost equivalent contributions to its protocol revenue.

Whether their future cooperative relationship can continue will primarily depend on Stable's development trajectory.

From a commercial perspective, Stable and TRON's business ecosystems undoubtedly have significant overlap, and a confrontation between them is inevitable. For more details about TRON, please refer to the article 《Left Hand Plasma, Right Hand Stable, Tether is Building Its Own "TRON"》 on Odaily.