Recently, a little-known Web3 fund Aqua1 announced that it has strategically purchased 1 billion dollars worth of World Liberty Financial (abbreviated as "WLFI") governance tokens from the Trump family project.

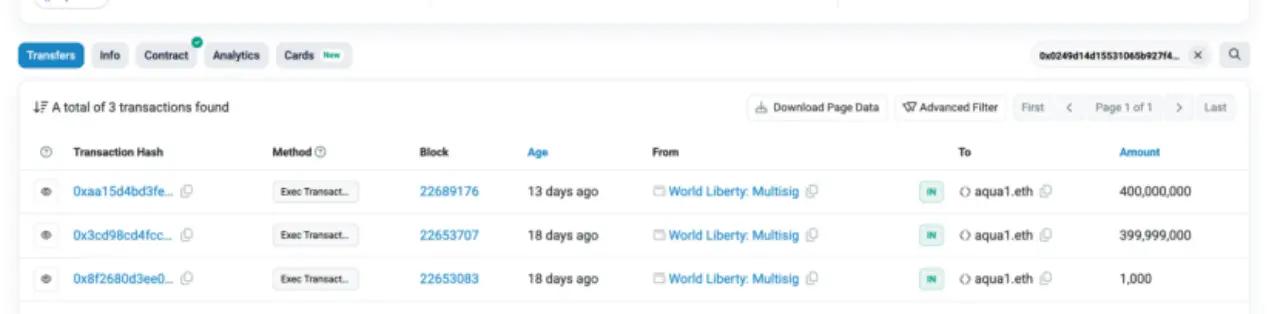

Two weeks before the news was announced, on-chain data had already captured some clues: an ENS address named "aqua1.eth" had cumulatively spent 80 million dollars, purchasing at least 800 million WLFI tokens in batches. However, in this 100 million dollar subscription, the remaining 20 million dollars' subscription address has not yet been discovered.

This fund is quite mysterious, with its official website domain only registered on May 28. Currently available information shows that Aqua1 is headquartered in the UAE, focusing on primary market investments and secondary asset management in the Web3 field.

After investing in WLFI, Aqua1 will also jointly develop and incubate an institutional-level RWA platform BlockRock, and plans to establish another fund Aqua Fund in the Middle East.

Having invested over 100 million dollars in the Trump family project from its inception, what exactly is Aqua1? What hidden connection does it have with the Trump family?

Image source: Reuters

Image source: Reuters

According to the press release, WLFI will also help the Aqua1 team establish another fund in the Middle East called "Aqua Fund". The fund will collaborate with core interest groups in the Middle East, accelerating the digital economic transformation through blockchain infrastructure, AI integration, and Web3 applications, and plans to be listed on secondary markets such as Abu Dhabi Global Market (ADGM), providing liquidity for investors.

Aqua1's smooth investment in WLFI may also be based on the previous collaboration between its backing group and the Trump family in traditional business. By investing in WLFI, Aqua1 quickly formed a strategic alliance with the presidential family in the Web3 arena.

Aqua1's foundation in South America and emerging markets, along with the Trump family's commercial and political influence in North America and globally, create complementary resources for their Web3 layout.

By integrating financial innovation from the Middle East, resource networks from South America, and market influence from North America, Aqua1 and WLFI are potentially building a global Web3 financial ecosystem.

About Aqua1

Official Website: https://www.aqua1.foundation/

X: https://x.com/Aqua1Fndn