1. Dilemma and Opportunity of the Open Source Movement

Open source was once a great idea that promoted innovation and sharing in the software world. It allowed millions of developers to freely use, learn, and even transform the code of their predecessors, which to a large extent gave rise to the exponential prosperity of Internet technology. However, with the continuous expansion of the ecosystem, the increasingly intense data collection of AI models, and the increasing dependence of enterprises on open source, the principle of "free sharing" began to have a structural conflict with "value return".

Take the famous "Leftpad crisis" as an example. This small JavaScript library with only 11 lines of code was indirectly relied on by countless projects (including Babel and React). Although it is indispensable to the entire front-end ecosystem, its author Azer Koçulu has never received any financial rewards. In 2016, he removed the library due to dissatisfaction with the platform policy, which instantly caused a large number of project builds to fail, revealing the systemic fragility of key open source components in the absence of ownership confirmation and incentive mechanisms.

Similarly, curl is an open source tool that has been maintained by Swedish developer Daniel Stenberg since 1998 and is widely embedded in billions of devices around the world, from iPhones to banking systems. For a long time, Stenberg has relied on small donations and consulting services to keep the project running, and his annual income has been less than $30,000 for a long time until recently. This situation of "global use but no one paying for it" reveals the imbalance of open source labor in the value distribution system.

In the AI era, this inequality has been further exacerbated. Hundreds of millions of open source codes on platforms such as StackOverflow and GitHub have been collected and used for training by models such as ChatGPT and Copilot on a large scale, without informing or compensating the original authors. In 2023, Copilot was sued for allegedly violating the GPL agreement, reflecting that the concept of "open source means free commercial use" is being abused, and the labor of a large number of contributors is "invisibly paid" behind the model generation capabilities, but has not entered the reward path.

While the open source world has achieved technological miracles, it has also left behind a profound question: How can contributors obtain the proper rights and incentives without obliterating the spirit of openness?

In fact, with the continuous improvement of Web3 infrastructure and the widespread dissemination of ideologies such as "rights confirmation, disintermediation, and composability", the content assetization movement is accelerating and becoming an important trend in the next generation of digital economy. However, from the current track classification, the practice of content assetization is mostly concentrated in the fields of creator economy, AI corpus, digital media, etc., and the attention paid to structured content such as code, algorithms, and models is still obviously insufficient, and they are often not included in the category of "content assets" by the system, which largely conceals their true value as core means of production. The emergence of CodexField is bringing new solutions and opportunities to the above structural problems.

As the winning project of the BNB Chain Hackvolution hackathon, CodexField is committed to building a decentralized asset platform for content creators and developers, supporting the standardized confirmation and assetization of structured content including code, AI models, AIGC works, professional knowledge, etc., and regards it as a new generation of on-chain RWA form with income rights and liquidity.

Through the combinable on-chain ownership confirmation mechanism, usage behavior tracking logic and income mapping protocol, CodexField is reconstructing the value path of content, allowing the core means of production of a series to be mapped to the on-chain economic model in a verifiable and divisible manner for the first time, so as to promote the underlying transformation of open source content such as code from "information" to "assets", inject a sustainable incentive engine into the open source movement, and activate the long-underestimated ecosystem of developers and content producers.

This article will provide a comprehensive analysis of the CodexField project to further enhance readers’ understanding of the project.

2. Narrative of CodexField

The narrative direction of CodexField is not complicated. Its core logic is to confirm the ownership and assetization of content on the chain, and connect it to the on-chain financial system as a new type of RWA asset. By building a structured revenue mechanism, the content can have sustainable commercialization capabilities.

CodexField supports multiple forms of content on the chain, including text, images, audio and video, code, algorithms, AI models, etc., and gives them ownership attributes and asset value. Compared with other content assetization platforms on the market, CodexField's differentiated advantage lies in its deeper support for structured content (such as core production materials such as code, models, algorithms, etc.), bringing this long-neglected technical content into the scope of assetization.

From the perspective of the track, CodexField, Story Protocol, Lens Protocol, KNN3 Network, Giza Tech, Lagrange DAO, etc. all belong to the "content assetization" track, but each focuses on different vertical fields. Story focuses on IP derivation, Lens emphasizes social graphs, KNN3 focuses on data relationship graphs, and Giza and Lagrange tend to AI models and data calls. In contrast, CodexField is based on the direction of structured content rights confirmation, covering the key underlying assets of Web3 and AI infrastructure. It not only meets the native needs of developers, but also meets the verifiable path of AI model training and calling. Therefore, it has higher scarcity and value density in the entire content assetization track.

TL&DR

The platform generates an on-chain ownership certificate for each piece of content, clearly records the creator's address and timestamp, and supports sub-content-level call authorization, revenue tracking, and combined reuse, so that the content has complete property rights clarity and composability.

All content calls, subscriptions, training and other behaviors will be recorded in real time and mapped to the revenue structure corresponding to the content assets, realizing the closed loop of "use is revenue" on the chain. Developers are not only creators, but can also continue to receive rewards from the content usage path.

Natively integrates multi-chain storage networks such as Greenfield, Arweave, and Filecoin, supports hot and cold data stratification, programmatic permission control, and censorship-resistant distribution of content, ensuring that content is both traceable and flexibly accessible.

The platform launched the Gitd protocol and CodeSync tool, which supports the atomic migration of GitHub projects to the chain and generates traceable ownership certificates and structured authorization contracts for them, helping open source projects to realize on-chain assetization and profitability.

The introduction of AI models can score, recommend and filter platform content, and assist in generating governance labels, thereby improving the identifiability and composability of the content ecosystem and providing an intelligent foundation for the platform's content governance system.

The platform builds a structured revenue pool to support LPs in injecting liquidity into high-quality content assets. The revenue generated by content calls will be dynamically distributed among creators, callers, and investors according to contract logic, opening up the connection path between the content economy and on-chain finance.

And on this basis:

Users can subscribe, quote, and call content within the platform, and all interactive behaviors are recorded and transparently mapped to the revenue structure;

Developers can use the CodeSync tool to migrate open source code projects to the chain with one click, quickly complete property rights confirmation, set authorization scope, and obtain profit sharing from subsequent usage.

3. Technical solution for disassembling CodexField

1. CodexField system structure

In the content assetization protocol system, the design of the system architecture actually determines the depth of content ownership, call efficiency and economic liquidity. In its architecture system, CodexField clearly divides the four major structures of storage layer, protocol layer, content layer and application layer, and injects highly composable and scalable design concepts into each layer to build a complete "content as asset" execution closed loop.

Storage Layer

Storage is usually an important step after content assets enter the system, and how to achieve reliable storage and efficient access becomes a key challenge. Currently, mainstream content asset platforms mostly adopt the method of integrating decentralized storage networks externally, such as Story Protocol integrating IPFS and Arweave, or Lens Protocol relying on The Graph and off-chain CDN for content caching.

CodexField's storage system is based on BNB Greenfield as the main chain, and integrates Arweave, Filecoin, CESS and other protocols to form a distributed aggregate storage system. The platform introduces a hot and cold data stratification mechanism, which dynamically matches paths based on content call frequency and permission levels to achieve fast loading of high-frequency content and stable retention of high-value content. At the same time, combined with the DePIN acceleration network and off-chain CDN mechanism, CodexField can achieve censorship-resistant distribution and low-latency reading on a global scale, ensuring the availability and access efficiency of content in multi-chain scenarios.

CodexField also modularizes and encapsulates this aggregate storage capability through an open interface (it will be further integrated into its Layer2 network in the future). Third-party developers can directly call the underlying storage resources through APIs or SDKs to complete content hosting and distribution on demand. Compared with some protocols that only support closed storage logic within the platform, CodexField's composability and storage elasticity are more suitable for B2B protocol integration and modular nested content construction needs.

Protocol Layer

In terms of on-chain content collaboration and rights confirmation mechanisms, CodexField has built a Web3-native developer collaboration environment through its self-developed Gitd protocol and CodeSync tools .

Gitd allows developers to manage code versions, review merges, and track contributions on-chain

CodeSync supports one-click migration of GitHub projects to the chain, completely preserving submission history, collaboration relationships and identity tags, and realizing seamless conversion of code assets from Web2 to Web3.

In contrast, platforms such as Giza Tech that focus on AI model calls have model verification and reasoning permission control capabilities, but their on-chain tool support at the native collaboration level is still relatively limited. CodexField's Gitd module significantly improves the assetization capabilities of structured content, especially in the confirmation and circulation of open source code and algorithm assets.

In addition, CodexField has introduced programmable authorization contracts, allowing creators to configure asset permissions based on custom parameters (such as readable, callable, trainable, and commercially available), and automatically perform call verification, payment routing, and revenue distribution through on-chain smart contracts to ensure that the entire content usage process is auditable and traceable.

Content Layer

The content layer is an important foundation for CodexField to build asset standardization. The platform supports various types of structured content including code, models, prompts, policy documents, AIGC content, etc., and designs a unified metadata template and label system around each type of asset to ensure strong consistency and compatibility during indexing, combination, and calling.

The platform also uses a built-in AI scoring and semantic tagging system to automatically annotate and judge the quality of content, and on this basis, it implements recommendation sorting, risk warning and content pricing assistance. This mechanism helps to solve the bottleneck problem of "difficult to evaluate content quality" in current content agreements, and also helps to build the reputation system within the platform and risk management capabilities in financial models.

Application Layer

CodexField's application layer is the interactive port connecting users and assets. The platform has designed a complete closed-loop mechanism around "creation-use-authorization-profit sharing". Users can complete content subscription, model call, training authorization and reference operations on the platform. All behaviors are uploaded to the chain in real time and mapped to the content's reputation and revenue path.

In this regard, CodexField's revenue mechanism relies on the DeFi structured pool designed by the platform, combined with the LP model to achieve accurate mapping of content and funds, and establish a dynamic incentive path between the three roles of creators, callers and investors. In terms of content financialization, this design has actually surpassed some protocols that are still based on NFT single transactions, and further opened up the technical gap for the evolution of content assets from "transactions" to "financialized flows."

2. Content asset type support

The CodexField protocol is relatively broad in its content inclusiveness. Since different content types differ in content format and content standards, the CodexField platform designs content asset types with a modular structure, and further introduces a unified metadata protocol, on-chain behavior tracking system, and revenue mapping mechanism to build an asset abstraction standard across content types.

According to the CodexField technical documentation, the supported content types include:

Original code assets: including function segments, open source modules, smart contract templates, policy scripts, etc., support native version management and collaborative tracking based on the Gitd protocol; generate on-chain ownership certificates through the CodeNFT structure to realize module-based calling, combined deployment and on-chain transactions.

AI models and data assets: including model weights (Weights), training corpus (Corpus), inference API (Inference API), data annotation sets, etc., use ModelNFT and DatasetNFT to represent their ownership and authorization logic, and use the zkAccess protocol to ensure permission verification and privacy protection of calling behaviors.

AIGC generates content: such as text, images, audio and video, which are automatically bound to the original prompt and generation path information after being generated by the AI model. The on-chain snapshot is recorded through hash, supporting the standard process of "generate snapshot → snapshot confirmation → snapshot transaction".

Structured knowledge assets: including courses, tutorials, research reports, trading strategies, etc., can be packaged into a ContentBundle structure for on-chain listing, and support periodic subscription, usage records and revenue mapping based on SubscriptionProtocol.

Prompt templates and generation records: Prompt project assets for large language models and image generation models are authenticated, reused, and tracked through PromptNFT, supporting call version control and the traceability mechanism of the "Prompt → Output" chain structure.

When the content enters the CodexField system, its on-chain content rights confirmation protocol CodexAuth will generate a rights confirmation NFT in the form of ERC-721 or ERC-1155. The NFT will bind the content hash, author identity (DID) and original evidence timestamp (T0) to obtain atomic-level rights confirmation. Based on this, a programmable permission control layer is further constructed, allowing the setting of multi-dimensional permissions such as "viewing/training/commercial use/combined call", and registration and verification on the chain in the form of smart contracts, providing a foundation for the subsequent content to be widely adopted in the commercial ecosystem.

3. Content Authorization

CodexField has proposed a relatively leading solution in content authorization, which is to build a programmable on-chain authorization mechanism to map various content access behaviors into standard operations at the smart contract layer, thereby realizing automated authorization judgment, pricing calculation and revenue settlement path.

Unlike the "open permissions by NFT holders" or "subscription model within the platform" commonly used in traditional content protocols, the CodexPermission Layer proposed by CodexField is a permission structure that supports multi-level, multi-dimensional, and multi-time configuration. Creators can flexibly set permission labels such as "readable", "callable", "trainable", "combinable", and "commercially available" for uploaded content assets, and set price ranges, call frequencies, open time periods, and secondary derivative authorization boundaries. The permission rules are embedded in the Content NFT through structured metadata and stored on the chain in a verifiable manner, ensuring that the authorization behavior has clear traceability and cannot be tampered with.

In contrast, for example, Lens Protocol’s content control system mainly stratifies permissions around “following relationships + token thresholds”, which is suitable for the dissemination incentive logic of social content; while Story Protocol relies more on off-chain authorization registration and manual licensing processes. CodexField’s advantage lies in its stronger behavior granularity and on-chain execution closed loop, making it more suitable for high-value, precisely controlled content usage scenarios such as AI model calls, B2B training licenses, and policy interfaces.

To support the on-chain execution of the above structure, CodexField's CodexAuth protocol standard has features such as lightweight interface, state caching and cross-chain compatibility, allowing external systems (such as AI platforms, data trading platforms, etc.) to quickly integrate CodexField's content permission verification capabilities and trigger the payment logic bound to it. For each authorization request, the platform generates a corresponding Usage Receipt on-chain for storage, and writes it into the event log as an auditable credential to establish a complete call track.

In addition, in order to avoid the common problems of "empty calls" and "pseudo calls" in the on-chain content ecosystem, CodexField introduced a pre-authorization + real-time triggered payment mechanism in the transaction process. Before initiating an interaction, the caller needs to lock the required payment voucher through a pre-authorization contract. After the operation is completed, the contract triggers the revenue distribution logic of the content provider to ensure that the calling behavior and revenue transfer have atomic execution guarantees, effectively avoiding the gray behavior of "using without paying", and greatly enhancing the platform's performance under complex interactions.

4. Operational Mechanism

The operation process of CodexField can be roughly summarized as follows:

During the content creation and uploading stage, creators can upload a variety of content assets including code modules, AI models, graphic materials, training data, etc. to the decentralized storage network through the platform. CodexField natively integrates mainstream storage protocols such as Greenfield, Arweave, and Filecoin to achieve censorship-resistant hosting and global access to content. At the same time, the platform provides the Gitd protocol and CodexSync tools to support developers to migrate GitHub repositories, model documents, and knowledge assets with one click, significantly simplifying the on-chain access process.

In the stage of rights confirmation and structural standardization, the platform automatically generates on-chain rights confirmation certificates for each content and binds them to the creator's on-chain identity. CodexField uses a unified data structure and metadata standard to standardize content types, version relationships, calling methods, and dependency paths to ensure that assets are identifiable, composable, and capable of subsequent trading and circulation, laying the foundation for the financialization of content.

Creators can customize multi-level permission strategies such as "view", "reference", "call", "train", and "commercial" based on different usage scenarios, and set access time, call frequency, and pricing range. All authorization behaviors are executed through smart contracts to ensure automatic billing of calls and full-chain records of the usage process, forming a structured and measurable usage path. Users can flexibly interact with content assets through subscriptions, pay-per-visit, or combined calls.

In the revenue circulation stage, CodexField converts all content usage behaviors into on-chain data streams and maps them to the platform's native revenue structure in real time. The revenue generated by the call will be automatically distributed according to the preset logic, and can be attributed to uploaders, collaborators, and holders, or can be remitted to the platform's structured revenue pool to incentivize high-quality content production and liquidity provision.

Through the above process, CodexField can achieve a deep binding between content usage and economic incentives, ensuring that every real call can bring measurable returns to content creators and ecosystem participants, and truly promote the implementation of the on-chain content financial logic of "use is monetization".

4. Content Economy System

The "content as an asset" paradigm proposed by CodexField is essentially an attempt to map content usage behavior into a structured financial system with measurable economic value. All content behaviors (calling, subscription, training, combination) will be converted into on-chain payment events through contracts and enter the corresponding structured income pool. These income will be split and distributed among creators, collaborators, platforms and LPs according to the preset logic. Through the behavior-driven economic system, a multi-participation mechanism based on real use and financial structure will be further introduced.

In fact, unlike the separation structure between content and revenue in traditional platforms, CodexField hopes to build a complete set of behavior-driven content finance models through a new closed loop of rights confirmation + authorization + use + revenue, and introduce an LP participation mechanism to enable DeFi liquidity to effectively access the content consumption path.

4.1 Three types of structured income pools

One of the core designs of CodexField is to divide content usage behavior into three clear revenue paths according to frequency, periodicity and business scenarios, and map them to the three structured revenue pools of FastYield, SubFlow and Endurance respectively.

FastYield Pool: This pool mainly serves immediate behaviors such as AI reasoning, AIGC generation, and code snippet reading, and is characterized by high frequency, low latency, and instant settlement. The smart contract module CodexMicroBilling.sol supports the coordinated operation of off-chain pre-authorization and on-chain settlement, and performs dynamic pricing by comparing behavior labels with resource consumption. Similar scenarios are also used in AI model protocols such as Giza Tech, but the advantage of CodexField is that its "composable call + LP support" mechanism improves payment sustainability.

SubFlow Pool: This pool is used for medium-frequency scenarios such as API subscription, periodic calls, model reuse, etc., to build a revenue accumulation mechanism based on time windows. The pool records the frequency of use and content popularity through the CodexStreamVault.sol contract, and combines the exponential weighting rules to split the revenue. Its "behavior-driven + reputation-linked" design is structurally similar to Story Protocol's creator incentive strategy, but the former focuses more on the behavior itself, while the latter tends to the IP derivation path.

Endurance Pool: This pool uses a periodic release and discount mechanism to convert future revenue tokens into revenue bonds for scenarios with long-term revenue expectations, such as training data, model authorization, and RWA content licensing. In conjunction with the CodexValuator protocol module to perform risk pricing on the value of authorization, CodexField will place more emphasis on "tradable revenue rights" and their linkage mechanism with LP investment preferences.

4.2 LP Role

CodexField introduces the LP role in its DeFi structure. Unlike most DeFi protocols where LP only acts as a matching liquidity provider, CodexField defines LP as a basic collaborator in the content economy system. The main function of the LP role is to inject stablecoin assets into the structured income pool as a source of funds for the real payment path in the platform content usage scenario.

These funds will be directly used to support the settlement of users' calls, training, subscriptions and other behaviors on the platform, and are considered to be the infrastructure elements that promote the implementation of content-as-economy behaviors. At the same time, LP's capital participation is also fed back to the content pricing and incentive model through behavioral data, promoting the operation of the value discovery logic within the platform.

The platform establishes a dynamic parameter adjustment mechanism based on indicators such as call popularity, content quality, and revenue fluctuations to adjust the distribution of funds in each pool and the payment rhythm, thereby balancing the matching relationship between the content user end and the fund supply end. In a sense, LP is more of a payment endorser of the content financial network, directly serving the content structure through the capital structure.

As for LP users, they will receive a share of the protocol revenue from the pool according to their asset share due to the above contributions. CodexField also calls this process PoA (Proof of Asset) mining.

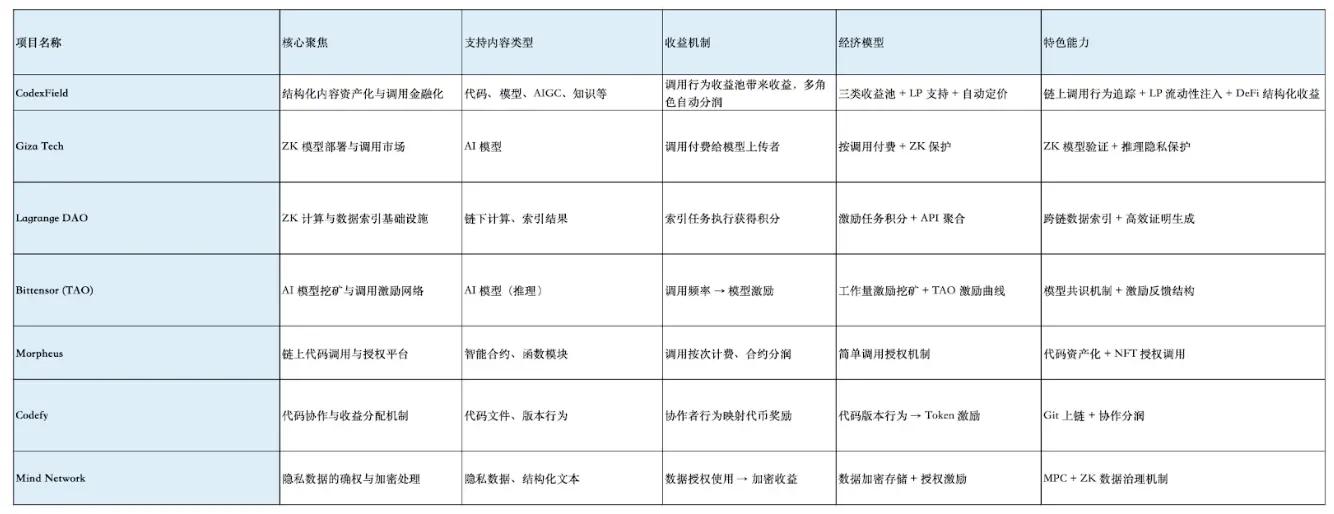

5. Track Analysis

In fact, a number of potential projects have emerged in the content assetization track, especially in the sub-direction of AI big models and code assetization, but they actually show significant differences in product form, protocol mechanism, incentive path, etc., and have different representativeness in their respective directions.

1. Giza Tech

Giza is an on-chain platform focused on AI model deployment and invocation, focusing on the "ZK + model invocation" route. Developers can upload trained models to the chain as callable assets, and users can initiate inference requests through the on-chain authorization mechanism, and the model party will receive income. Giza uses zero-knowledge proof to ensure the privacy and verifiability of model execution, and mainly serves high-security scenarios such as AI SaaS, B2B data modeling, and on-chain risk control.

2. Lagrange DAO

Lagrange is a decentralized ZK Coprocessor network that focuses on data indexing, model calling, and off-chain computation verification. Although it does not build a model asset market itself, the data calling protocol and ZK infrastructure it provides have become the core dependency for the assetization of model-based applications. Lagrange's technical focus is on efficient proof generation and cross-chain composable computing.

3. Bittensor

Bittensor is a neural network market protocol that supports global developers to contribute AI models. The system distributes native tokens $TAO based on the model's call frequency and performance. Its consensus mechanism is a "decentralized AI mining" path formed by incentive-based scoring and call feedback, which provides a new incentive framework for large models and training data, and is a representative project in the current direction of model assetization.

4. Morpheus

Morpheus is an on-chain code publishing and calling platform, focusing on code assetization. Developers can upload smart contracts, algorithm functions and computing modules. The platform supports on-chain call billing and call traceability, and combines NFT and licensing contracts to provide developers with a revenue channel. Although the current size is not large, the path has certain similarities with CodexField.

5. Codefy

Codefy focuses on code version confirmation and collaboration, attempts to put Git behavior on the chain, and supports a profit-sharing mechanism for code usage behavior. The project is still in the testing phase, but has proposed a tokenization model for developer contributions, which has received initial attention in the developer community.

Overall, the boundaries of the content assetization track are expanding rapidly at this stage. We have seen an accelerated extension from traditional content forms such as pictures, texts, audio and video with "consumption as the end point" to structured assets such as models, codes, algorithms, and corpora that have calling properties and reuse value.

This type of content is naturally composable and programmable, and is often directly embedded in application logic or AI computing tasks. Its calling behavior itself is accompanied by resource consumption and value creation, and has a significant "use is value" feature. Therefore, compared with traditional UGC, structured content is more suitable for access to the on-chain pricing, authorization and settlement mechanism in the Web3 ecosystem, becoming a more financial component of the new generation of content economy.

At present, the representative projects of this track can be roughly divided into three technical directions:

AI model publishing and calling platforms (such as Giza and Bittensor): They focus on the “Model-as-a-Service” route, focusing on the on-chain deployment, authorized calling and incentive settlement of model assets, and emphasizing verifiable reasoning, on-chain revenue distribution and incentive models driven by usage frequency;

Off-chain computing and data verification platforms (such as Lagrange): focus on the application of zero-knowledge proof technology in cross-chain indexing, model execution and off-chain data verification, and provide a trusted execution environment and infrastructure guarantee for structured content calls;

Code ownership and collaboration protocols (such as Codefy and Morpheus): Try to combine Git collaboration behavior with content ownership systems, explore the sustainable financialization path of code assets by chaining code assets, recording call relationships and revenue distribution.

Despite their different directions, we see that the common goal of these projects is to incorporate structured content with functionality and reuse value into the on-chain property rights system and establish a sustainable incentive mechanism.

However, judging from the current productization level, most projects are actually focused on the two primary links of "rights confirmation" and "access control", and have not yet formed a complete path for the attribution of revenue, value splitting and fund flow mapping around the calling behavior. The monetization of calling behavior, the pricing mechanism for content use, and the participation path of liquidity providers are still generally missing, and the financial expression of the entire structured content is still in the early stages of exploration.

Relatively speaking, CodexField's positioning is more inclined to the middle-layer structure design of "content behavior financialization" compared with other track projects. CodexField itself actually attempts to build an asset logic closed loop with call behavior as the core, that is, starting from content rights confirmation, connecting call behavior through authorization mechanism, and mapping call records into a profit path that can be shared in a structured DeFi way, and finally connecting liquidity support and multi-dimensional incentive mechanism.

Similarly, CodexField itself also emphasizes the on-chain expression and financial mapping capabilities of "calling is value". It incorporates developers (content providers), callers (content users) and LPs (financial supporters) into a unified protocol framework, giving economic attributes to calling behavior, so that the process of "content use" can transition from information exchange to value transfer, thereby forming a Web3 native incentive model based on structured content.

Of course, we believe that the future success of this model will still depend on multiple prerequisites, including a sufficiently broad content ecosystem foundation, an available developer tool stack, a sustainable liquidity injection mechanism, and clear market demand drivers.

Although the path constructed by CodexField is still in the early stages of verification, the "structured content + financialization of behavior" logic it proposed has certain differentiation and systematic exploration significance in the current content assetization track. It is expected to promote the transition of "content assets" from static rights confirmation to dynamic incentives, and become the key layer for the next stage of content economic evolution.

6. Team

From the information currently disclosed by CodexField, its core team spans multiple technical fields such as Web3, AI, and crypto infrastructure, and the overall structure is an engineering-oriented one dominated by technology research and development. Most members have practical experience in large technology companies and top crypto projects, covering key modules such as smart contract architecture design, AI model development, distributed system construction, and visual interaction, and have strong technical depth and cross-domain collaboration capabilities.

In terms of on-chain protocols, the core development members of the team have led the development and deployment of multiple mainnet protocols, including smart contract systems with a TVL of over 100 million US dollars, and have participated in the design and promotion of EIP standard proposals. Such experience provides CodexField with a solid underlying engineering foundation in content rights confirmation, on-chain authorization mechanism design, composable contract interface construction, and financial module nesting.

In the field of artificial intelligence, team members also have a strong academic and industrial integration background. Many of them have worked in core positions such as model development and training optimization in first-tier AI companies such as Amazon, Meta, and Nvidia. Some members have master's and doctoral degrees from universities such as MIT, Tsinghua University, and Harvard. This background enables the team to directly implement functions such as model calling, content semantic labeling system construction, and privacy protection computing, and has a deep understanding of large model application scenarios.

In addition, the team has also recruited technical personnel from C-end content platforms such as TikTok, who have the ability to design front-end architecture and interactive products, and can abstract complex on-chain processes into more usable user interaction interfaces. In the user experience and adoption path of the content asset platform, this type of capability has certain practical value in lowering the threshold and improving developer friendliness.

In general, the technical composition of the CodexField team covers multiple key links in the content assetization system, from the protocol layer, AI model layer to the front-end interaction layer, providing a relatively solid execution capability guarantee for its exploration in the direction of structured content rights confirmation, call authorization and revenue financialization.

VII. Ecological Development Progress

List of important events:

700,000+ active users have used CodexField Wallet in the Telegram ecosystem

CodexField Wallet has now taken the lead in completing deep integration with Telegram Bot and mini-program systems, providing users with a Web3 wallet experience that does not require plug-in installation and is ready to use.

According to platform statistics, there are currently more than 700,000 active users who have accessed CodexField Wallet through the Telegram ecosystem, widely distributed in emerging markets such as Southeast Asia, Latin America, and Central Asia. The wallet not only supports conventional asset management and transfer functions, but also integrates functions such as content asset browsing, call authorization, and on-chain payment. It is an important traffic entrance and user-bearing interface for the CodexField on-chain content system. In the migration path from Web2.5 to Web3, CodexField has achieved good results in terms of user reach and education paths built through instant messaging tools.

1,000,000+ weekly transactions have been running stably on the BNB Chain network

CodexField is currently mainly deployed on BNB Chain. With its low gas cost and high-performance block processing capabilities, it provides a stable operating environment for on-chain interactions such as content calling, access authorization, and revenue distribution.

According to on-chain data statistics, CodexField's related contract system currently supports more than 1 million transactions per week, covering core operations such as content upload and confirmation, call authorization, and revenue distribution. At present, CodexField's transaction density is at the leading level among content protocols, which fully demonstrates that CodexField has achieved a transition from a functional prototype to a high-frequency interactive system in terms of its on-chain operation structure, and also reflects the gradual increase in the participation of content assets in real usage scenarios.

BNB Chain top protocol, won the first place in BNB Chain Hackathon

CodexField won the first place in the Hackvolution hackathon officially hosted by BNB Chain, and received recognition from ecological funds, developer communities and on-chain infrastructure institutions. Its innovations and narratives in "content asset structured processing", "on-chain programmable authorization mechanism" and "DeFi and content economy integration" were highly recognized.

CodexField was subsequently listed as a key support project of BNB Chain and received technical support and resource docking. As the fastest growing content dApp on BNB Chain, CodexField has maintained its leading activity on multiple platforms such as DappBay and DappRadar, and its ecological expansion capabilities and protocol maturity are gradually entering the next stage.

Obtained investment support from leading institutions such as Gate.io Ventures, Web3 Labs and KuCoin Labs

CodexField has received joint investment from multiple industry-leading venture capital firms in the early stages of financing, including well-known crypto funds such as Gate.io Ventures, Web3 Labs, and KuCoin Labs. These institutions have extensive investment and research resources and ecological layout experience in the fields of blockchain infrastructure and Web3 applications. Their investment not only represents recognition of CodexField's business model and technical architecture, but also provides key support for the project's subsequent exchange docking, global market expansion, and compliance strategy planning. The entry of such funds is usually seen as an important signal that crypto projects have the ability to "move from technical prototypes to market execution", which helps to attract more ecological resources and subsequent capital attention.

- Obtained strategic support from industrial capital such as YZi Labs (formerly Binance Labs) and CMC Labs

CodexField has also received in-depth support from a number of industrial capitals, including YZi Labs (formerly Binance Labs) and CMC Labs, etc. Among them, YZi Labs has rich incubation experience and BNB Chain ecological background. The support of YZi Labs is expected to help the project further open up a compatible adaptation path with the on-chain infrastructure.

As a strategic capital extended by CoinMarketCap, CMC Labs has significant resource advantages in content dissemination, community diversion and crypto market education. CodexField was able to introduce multi-dimensional capital support at an early stage, indicating that its comprehensive potential in the on-chain content finance track has been verified by multiple circles and has laid a good foundation for subsequent ecological landing and business expansion.

8. Future Development Potential

With the rapid development of AIGC, digital content is actually evolving from static consumer goods to structured assets that can be called, combined, and traded. According to a joint forecast by Grand View Research and McKinsey, the global digital content market will exceed $500 billion in 2027, with AI-driven content generation, management, and trading becoming the main growth engine. This trend has not only changed the logic of content production, but is also reshaping its performance in the on-chain economic system.

Also in the context of Web3, content units such as models, algorithms, codes, and corpora that have "calling value" are naturally adapted to the on-chain rights confirmation and transaction mechanisms. Compared with traditional graphic or video content, this type of structured content has stronger programmability, composability, and economic mapping capabilities, becoming the most financially-focused component in the content assetization track. According to tracking data from Messari and Outlier Ventures, in the first half of 2024 alone, Web3 project financing around "model as a service", "ZK reasoning", and "code collaboration" has exceeded US$320 million, which also shows that the market continues to be optimistic about the direction of structured content assetization.

On the other hand, AI-driven code creation and collaboration methods are undergoing profound changes. We have seen that tools such as GitHub Copilot, Cursor, Replit, and Smol.ai have spawned a "development is generation" construction paradigm, which has transformed developers into contributors and value nodes of native assets. This trend is reflected in Web3 as the accelerated rise of the Vibe Coding track, which has spawned a number of projects that build new content financial protocols around code collaboration, model calls, and on-chain pricing.

Therefore, economic incentive systems for structured content such as CodexField are expected to become the key link between AI construction and blockchain assetization, and stand at the forefront of multiple trends.

CodexField itself builds an extensible structured framework that connects content creation and economic behavior, and connects developers, users and fund providers. Through the "call-as-transaction" approach, it integrates the discovery, use and redemption of content value into a complete on-chain closed loop. This model is still scarce in the current project landscape, but it has clear application imagination space.

In the longer term, CodexField reflects a more infrastructural significance, namely, how to transform the output path of human creativity into an open, traceable, collaborative and incentivized system in the era when AI and blockchain intersect. This is not only a reconstruction of the content production relationship, but also has the potential to become the economic engine of the next stage of the open source movement.

For open source to move from "non-commercial" to "sustainable business", it actually requires an institutional mechanism, and the CodexField path provides a new experimental field for this institutional mechanism.