The Rise of Prediction Markets

0. Background

Prediction markets are speculative markets designed to aggregate dispersed information by trading contracts tied to future event outcomes. The core idea is that market prices of these contracts can serve as forecasts: under certain conditions, a contract’s price effectively reflects the probability of the event occurring. A wealth of research since the 1980s has shown that such market-based forecasts can be remarkably accurate, often outperforming traditional forecasting methods like polls or expert opinion. This predictive power arises because these markets harness the “wisdom of crowds” — anyone can participate, and those with better information have financial incentives to trade on it, thereby moving prices closer to true probabilities. In essence, a well-designed prediction market efficiently aggregates many individual beliefs into a consensus view of likely outcomes.

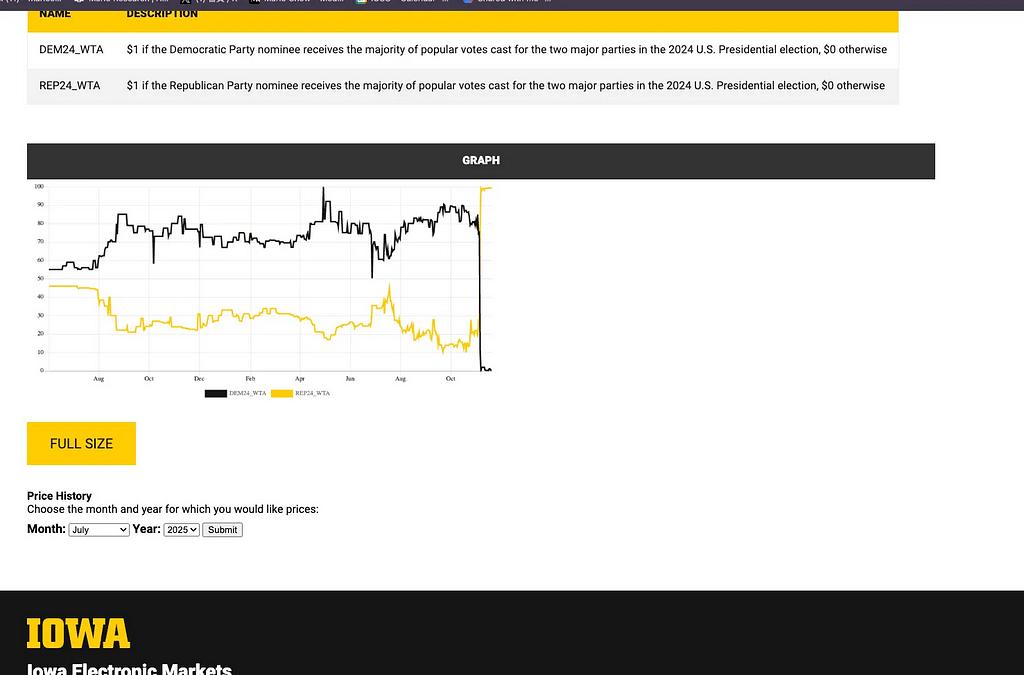

Modern prediction markets trace their roots to pioneering experiments in the late 1980s. The first academic prediction market, now known as the Iowa Electronic Markets (IEM), was established at the University of Iowa in 1988.

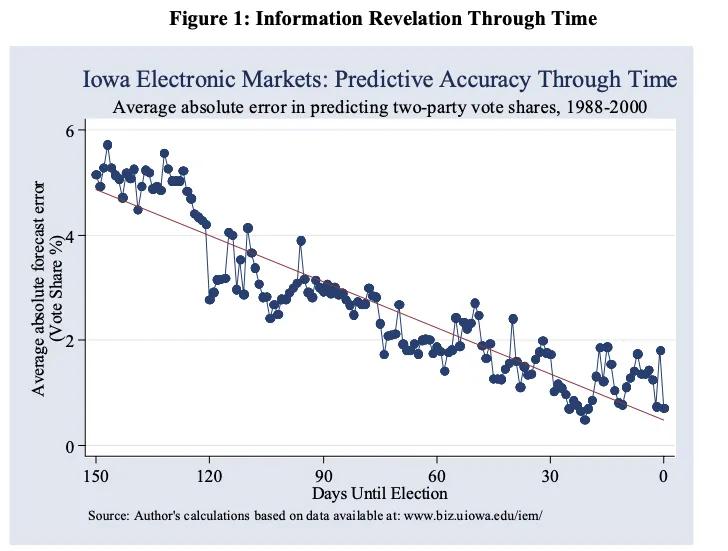

The IEM began as a small-scale real-money market (with stakes limited by regulators to around $500 per person) focusing on U.S. election outcomes. Even with its tiny scale, the IEM consistently demonstrated impressive forecasting accuracy. In the week leading up to the election, these markets have predicted vote shares for the Democratic and Republican candidates with an average absolute error of around 1½ percentage,. By comparison, over the same four elections, the final Gallup poll yielded forecasts that erred by 2.1 percentage points. The graph also shows how the accuracy of the market prediction improves as information is revealed and absorbed as the election draws closer.

Around the same time, visionary ideas about using markets to forecast all manner of uncertain events were taking shape. Economist Robin Hanson in 1990 proposed the concept of “Idea Futures,” a new institution where people would bet on scientific or societal. Hanson argued this could create a “visible expert consensus with clear incentives for honest contribution” by rewarding accurate predictions and exposing incorrect. In effect, he envisioned markets as a tool to combat bias and encourage truth-telling in domains ranging from science to public policy. This idea — essentially a futures market in ideas — was far ahead of its time and laid the theoretical groundwork for broader applications of prediction markets.

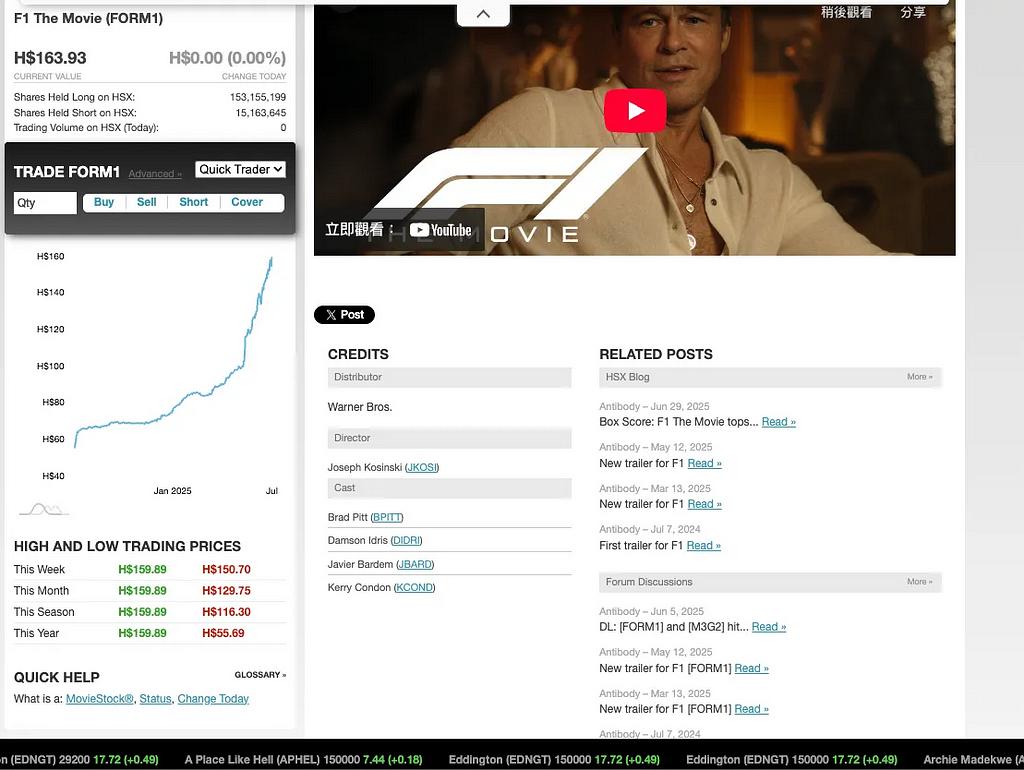

Throughout the 1990s, a few online prediction markets emerged, both real-money and play-money. The Iowa markets remained active in academia, while play-money markets gained popularity with the general public. For example, the Hollywood Stock Exchange (HSX) was founded in 1996 as an entertainment prediction market using virtual currency, allowing traders to buy and sell “shares” in movies and actors.

HSX proved adept at forecasting opening weekend box-office revenues and even Oscar winners, in some cases beating expert. In 2007, players in the Hollywood Stock Exchange correctly predicted 32 of the 39 major-category Oscar nominees and seven out of eight top-category winners. The Hollywood Stock Exchange is considered a good example of a prediction market.

Theoretical Foundations and Market Design

Fundamentally, prediction markets work by creating incentives for truthful revelation and efficient information aggregation. Because traders literally “put their money where their mouth is” by risking real (or sometimes virtual) money on an outcome, they are motivated to trade based on their true beliefs and private information.

In economic terms, a well-designed market creates an incentive-compatible mechanism: a trader maximizes expected profit by quoting odds (prices) equal to their honest probability belief. Robin Hanson formalized this idea with the invention of market scoring rules, an automated market-making mechanism derived from proper scoring rules that ensures truthful reporting is each trader’s best strategy.

Also, studies have generally found that markets are surprisingly robust to manipulation. Attempts to push prices away from fundamentals create money-making opportunities for other, truth-seeking traders who can take the opposite side of the bet. Documented cases show that manipulative trades tend to be quickly corrected and can even improve liquidity in the process. In other words, a would-be manipulator usually ends up subsidizing smarter traders, and the price soon returns to an information-driven equilibrium.

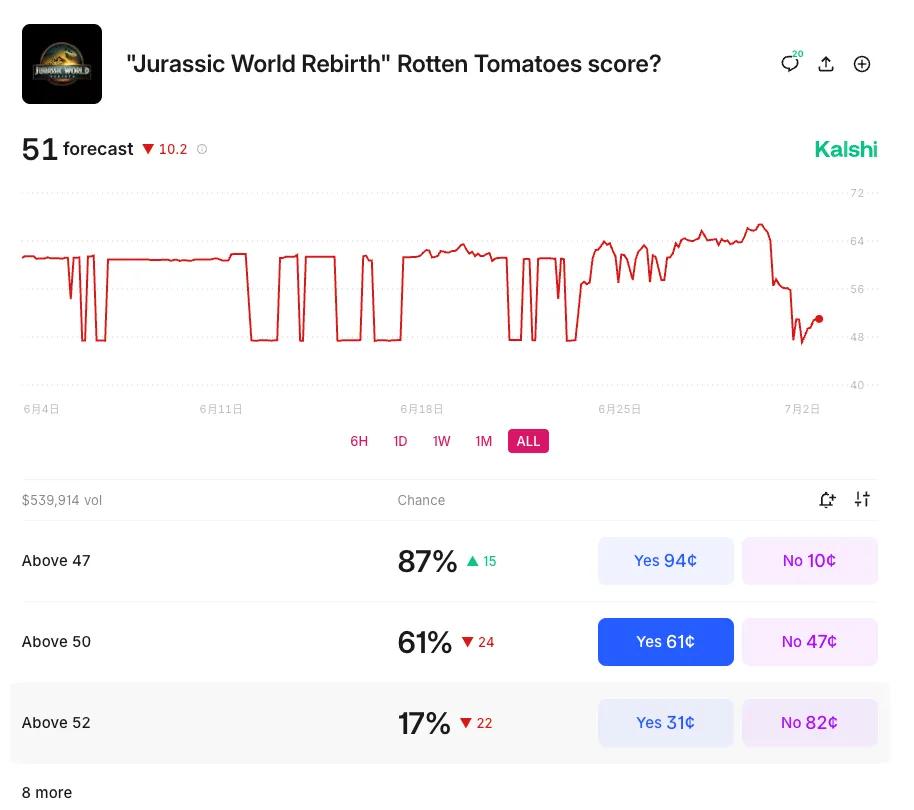

1. Kalshi

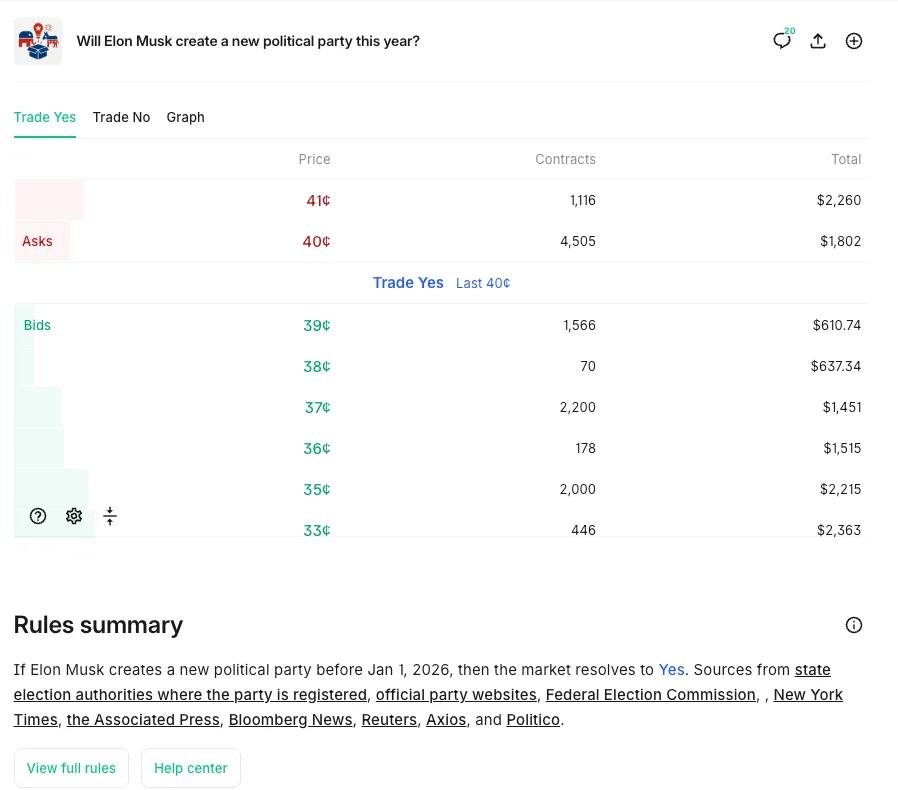

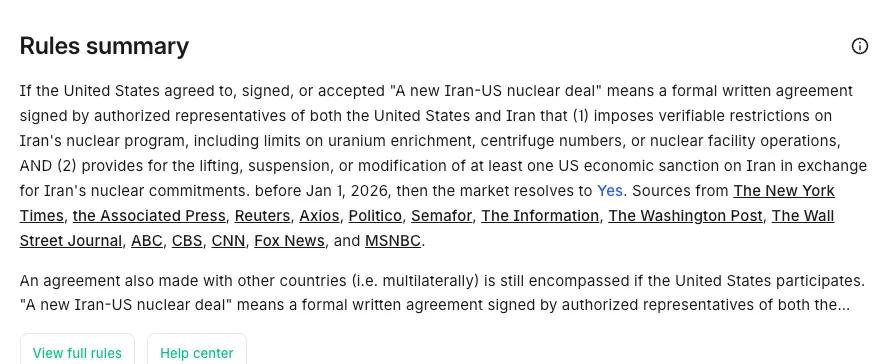

Kalshi operates a federally regulated prediction market exchange where users can trade on the outcomes of real-world events. It is the first U.S. exchange approved by the Commodity Futures Trading Commission (CFTC) to offer event contracts, binary yes/no futures that pay out $1 if the event happens (and $0 if not). Users buy or sell “Yes”/“No” contracts priced between $0.01 and $0.99, with prices reflecting the market’s implied probability of the event occurring.

If the event outcome is predicted correctly, the contract settles at $1, allowing traders to profit from accurate forecasts. Kalshi itself does not take positions (unlike a sportsbook); it matches traders on either side and acts purely as an exchange, charging transaction fees on trades.

a. Market Creation

- Proposal & Approval: New event markets (binary yes/no contracts) are proposed either by the Kalshi team or by user suggestions on their “Kalshi Ideas” portal. Each proposed event undergoes internal review and must meet CFTC regulatory standards, including clear definitional language, objective settlement triggers, and permissible event categories.

- Certification: Upon approval, the event is certified under Kalshi’s Designated Contract Market (DCM) rules, with formal documentation outlining contract specs, trading rules, and settlement criteria .

- Launch: The market goes live on Kalshi’s platform, visible to all U.S. users via the Kalshi app, website, or broker integrations (e.g. Robinhood, Webull).

b. Initial Liquidity & Pricing

- Order Book Mechanism: Markets start with empty order books. Anyone (market makers or regular users) can place limit orders (e.g. buy “Yes” at $0.39/sell “No” at $0.61)

- Maker Incentives: Traders who add liquidity (i.e. place orders that rest unfilled until matched) often pay zero maker fees, small fees in select featured markets.

- Price Discovery: Pricing is dynamic and reflects consensus probability, if a buyer of “Yes” at $0.60 matches a seller of “No” at $0.40, the contract is created, and both sides put in a total of $1

c. Market Resolution

- Event Occurrence Determination: Once the event resolves, the outcome is judged using pre-defined external data sources (e.g. government reports for inflation, official sports results).

- Automatic Settlement: “Yes” holders for a successful event are automatically paid $1 per contract. Unsuccessful “Yes” contracts (and winning “No’s” for no events) settle at zero. There are no extra settlement fees.

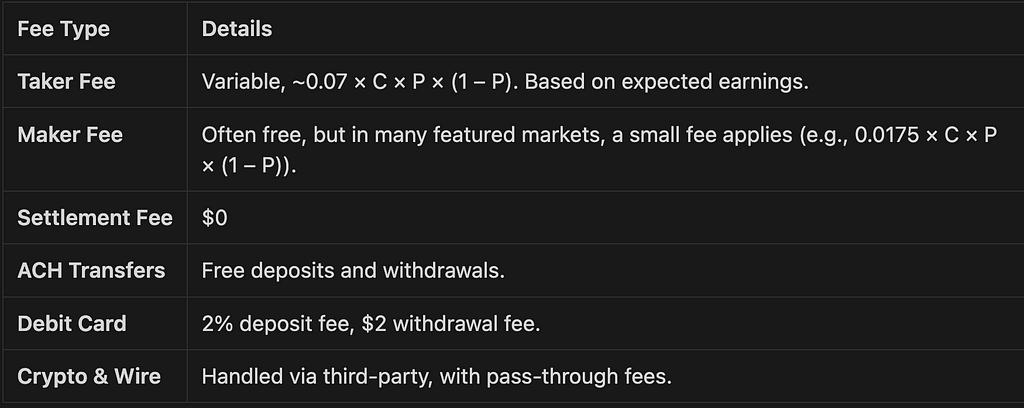

d. Fee Structure

P = price of contract, C = number of contracts

2. Polymarket

Polymarket Overview: Polymarket is a decentralized prediction market platform built on Polygon, where users trade binary outcome tokens (Yes/No shares) representing event outcomes. It leverages a Conditional Token Framework (CTF) to fully collateralize every outcome pair with stablecoins (USDC), and uses a hybrid-decentralized Central Limit Order Book (CLOB) for efficient trading. Settlement of markets is handled via the UMA Optimistic Oracle, a decentralized resolution system with a dispute mechanism.

Conditional Token Framework (CTF) and Outcome Tokens

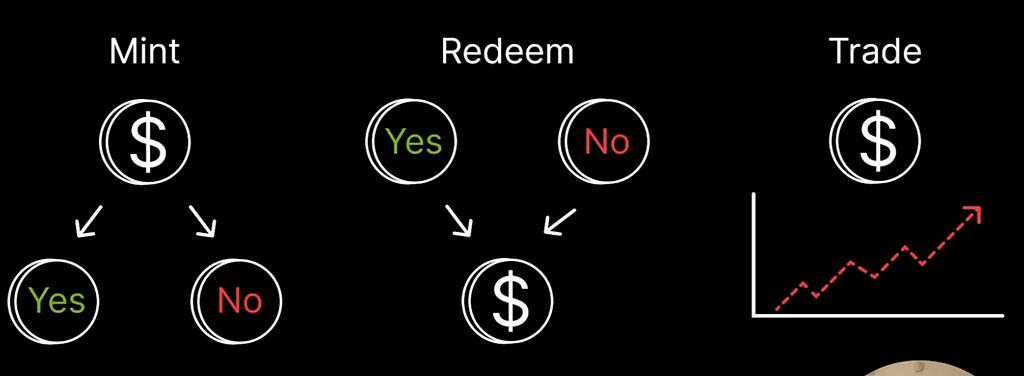

Polymarket represents each market outcome as a conditional token using Gnosis’s Conditional Token Framework (CTF), deployed on Polygon. For a binary market, two ERC-1155 tokens are created (e.g. a “Yes” token and a “No” token), each backed by the same underlying collateral (USDC). Splitting 1 USDC of collateral mints one Yes and one No token, while merging a Yes/No token pair burns them to release 1 USDC.

This ensures full collateralization of every share: at any time, a Yes and No token together are redeemable for $1, and only the correct outcome token will ultimately be worth $1 at resolution

In practice, when users buy shares, they are either obtaining newly minted tokens (if taking the other side of a new position) or existing tokens from another user, and when they sell shares, they either transfer them to a buyer or redeem them (if matched against an opposite sell) via the smart contracts. After the event outcome is decided by the oracle, winning tokens can be redeemed on-chain for $1 each, while losing tokens become worthless.

Hybrid Order Book Architecture (CLOB/BLOB Design)

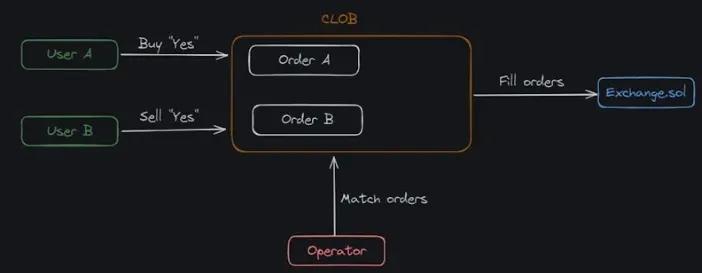

Polymarket’s exchange uses a hybrid CLOB architecture, nicknamed the “Binary Limit Order Book (BLOB)”, combining off-chain order management with on-chain settlement. As shown below, users submit orders off-chain and a designated operator service matches them, but final trade settlement (token transfers) occurs on-chain via smart contract calls:

Order Lifecycle in Polymarket

- User signs an order off-chain

- The user (e.g., User A) signs an EIP-712 order (e.g., “Buy YES @ $0.62”) with their wallet.

- This signed order is not broadcast to the blockchain, it’s sent to Polymarket’s off-chain order relay infrastructure.

2. Off-chain matching engine (operator) handles order book logic

- Polymarket’s off-chain CLOB maintains all active bids and asks.

- When another user (e.g., User B) submits a matching order (e.g., “Sell YES @ $0.62”), the operator detects a match.

3. Only matched orders are submitted on-chain

- The operator constructs a transaction containing the matched trade pair.

- This is submitted to the Exchange.sol smart contract, which validates: Order signatures, Price/time terms and Token balances

4. Atomic swap executes on-chain

- If valid, the exchange contract atomically swaps, USDC ↔ Conditional Tokens (YES/NO tokens from the Gnosis CTF)

- This ensures trustless, final settlement, only occurring after off-chain agreement.

Example of Atomic swaps

On-chain trade settlement is handled by Polymarket’s Exchange contract (often referred to as CTFExchange.sol in code). This contract is the bridge between the off-chain order book and the Conditional Token Framework, facilitating atomic swaps, which is a single on-chain transaction, the two sides of a trade are exchanged simultaneously, either fully executing the trade (transferring tokens (binary tokens) and collateral (USDC) between the parties) or not at all (if any check fails), eliminating counterparty risk. The Exchange contract has built-in logic to handle different matching scenarios:

- Buy vs Sell (Outcome–Collateral trade): This is the common case of one user buying outcome tokens while another sells them. For example, if Alice wants to buy 100 “Yes” shares at $0.40 and Bob wants to sell 100 “Yes” shares at $0.40, the operator will call the contract to swap these assets. The contract verifies both orders’ signatures and that Alice has enough USDC and Bob has enough “Yes” tokens (via allowances), then transfers USDC from Alice to Bob and transfers 100 “Yes” tokens from Bob to Alice.

- Buy vs Buy (Two complementary buys): Polymarket’s system can match two traders who both want to buy opposite outcomes, effectively creating a new outcome pair on the fly. For instance, if one user places a buy order for “Yes” shares and another places a buy for “No” shares (for the same market and quantity), the operator can match these orders even though both are buyers. In this case, the Exchange contract performs a “mint” operation: it pulls the required USDC from both users (each paying their bid price per share, which should sum to $1) and uses the CTF to split that collateral into one “Yes” and one “No” token. Each user receives the outcome they wanted (Yes or No), and the collateral is locked backing those tokens. This is essentially two traders taking opposite sides of a bet and creating new shares between them in one atomic transaction, one user’s USDC becomes the collateral for the Yes/No pair, giving them the Yes token and the other user the No token. The smart contract ensures the prices align (the sum of what each side pays equals 1 USDC per share) so that it mints fully collateralized tokens with no net deficit.

- Sell vs Sell (Two complementary sells): Same with buy vs buy but merge.

- Partial Fills and Multi-Order Matching: The Exchange supports one-to-many matches as well. A large taker order can be matched against multiple maker orders and filled in parts, if needed. For example, if Alice wants to buy 1000 Yes shares, and there are multiple sell orders (from different users) at the target price, the operator can aggregate those sell orders and execute them against Alice’s order in a single batch (using the fillOrders() function) The contract will transfer from each seller and to the buyer accordingly. All partial fills that are bundled in one transaction still execute atomically as a group. If only a portion of an order is filled, the remaining size stays on the order book off-chain as an open order (or gets canceled if user revokes it). Price improvement is automatically given to takers: if a matching order offers a better price than the taker’s limit, the taker receives the favorable price difference. The contract never fills an order at a worse price than specified by its signer.

UMA Optimistic Oracle: Resolution and Dispute Mechanism

Unlike traditional exchanges that rely on an internal referee or central data feed, Polymarket resolves markets via the UMA Optimistic Oracle (OO), a decentralized oracle system that determines the outcome of arbitrary events through a community-driven process. This allows Polymarket to be credibly neutral in how market outcomes are decided, since the result comes from an external decentralized protocol (UMA) rather than Polymarket itself.

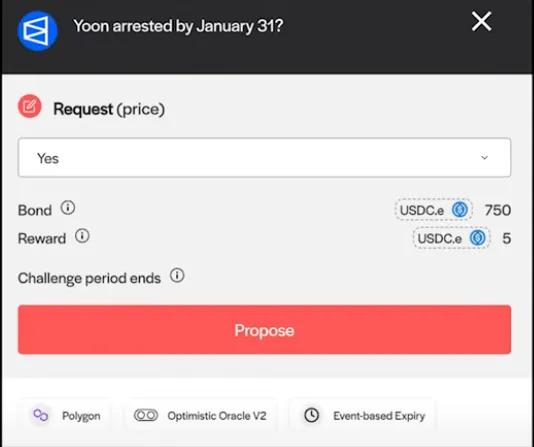

After the event’s end date, anyone can propose an outcome value for the market to the UMA Oracle (via the adapter). This “proposal” is a transaction that states what the result should be (e.g. 1 if Yes happened, or 0 if No) and locks up a proposal bond in UMA tokens or the specified reward token.

In Polymarket’s setup, typically the market creator or Polymarket’s team will propose the outcome immediately once it’s known, to speed up resolution (they offer a small reward for doing so).

- Initialize (CTFAdapter) -> Propose (OO) -> Resolve (CTFAdapter)

- Initialize (CTFAdaptor) -> Propose (OO) -> Challenge (OO) -> Propose (OO) -> Resolve (CTFAdaptor)

- Initialize (CTFAdaptor) -> Propose (OO) -> Challenge (OO) -> Propose (OO) -> Challenge (CtfAdapter) -> Resolve (CTFAdaptor)

No single party (including Polymarket) unilaterally decides the result, it’s a community-governed outcome with crypto-economic guarantees. This makes the system more trustless, albeit with some delay for disputes.

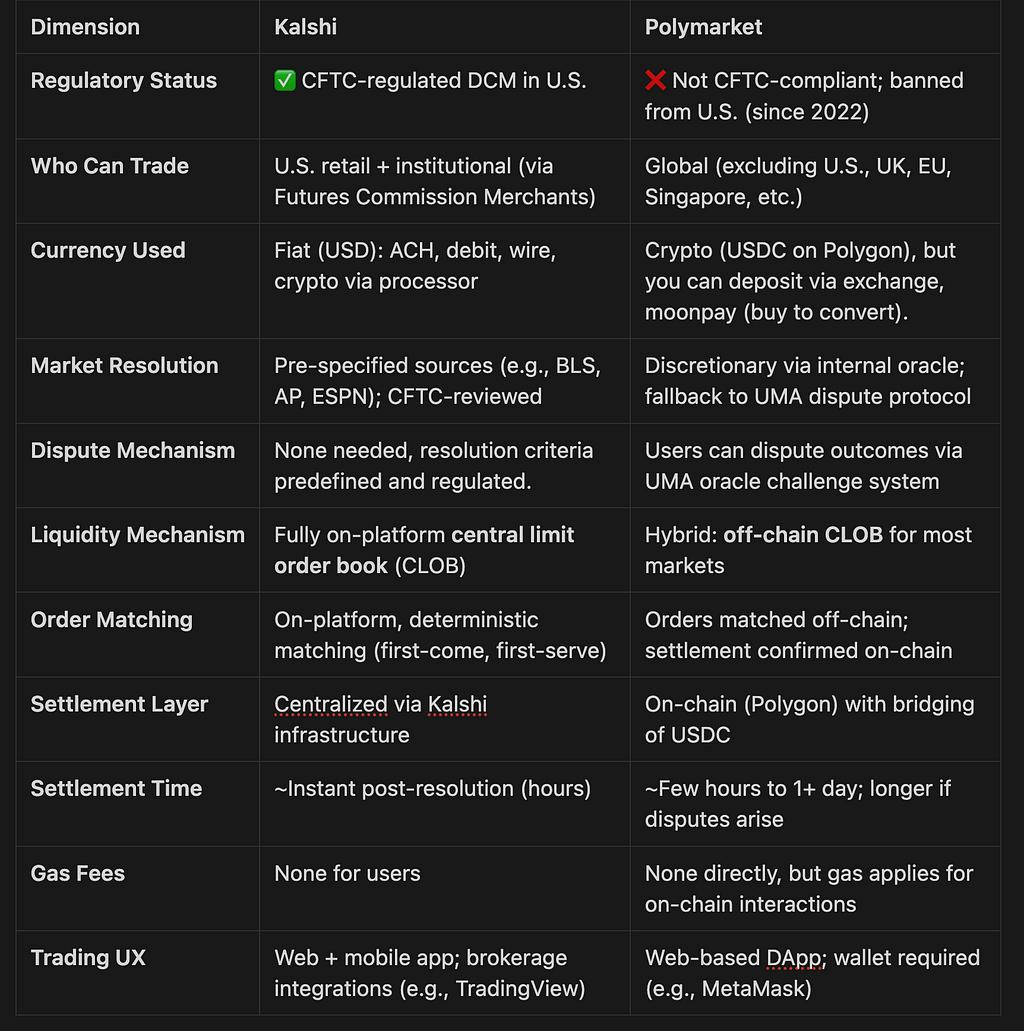

Kalshi vs. Polymarket: Structural & Technical Comparison

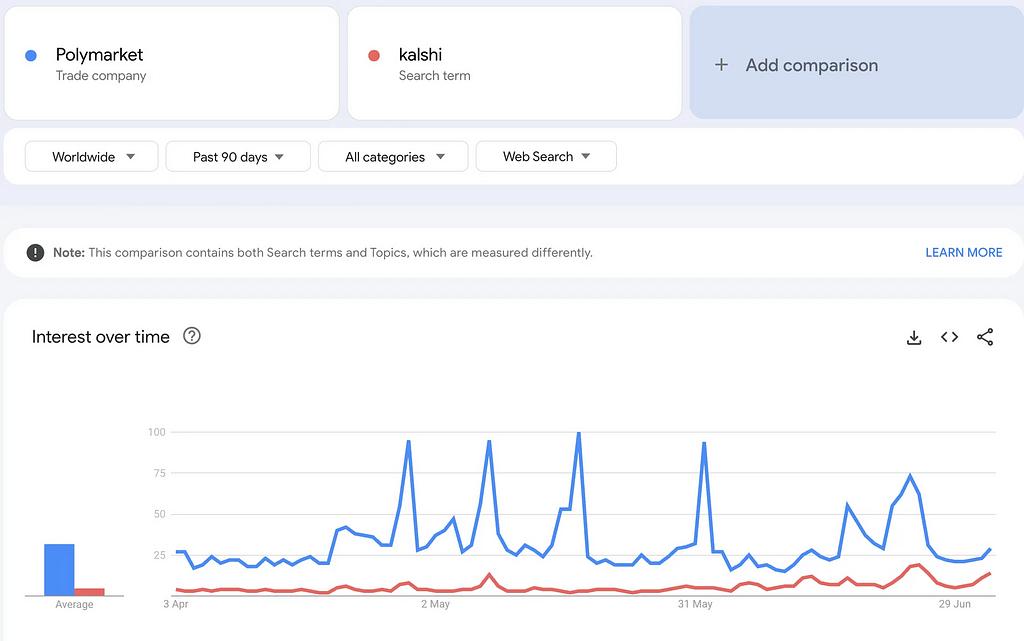

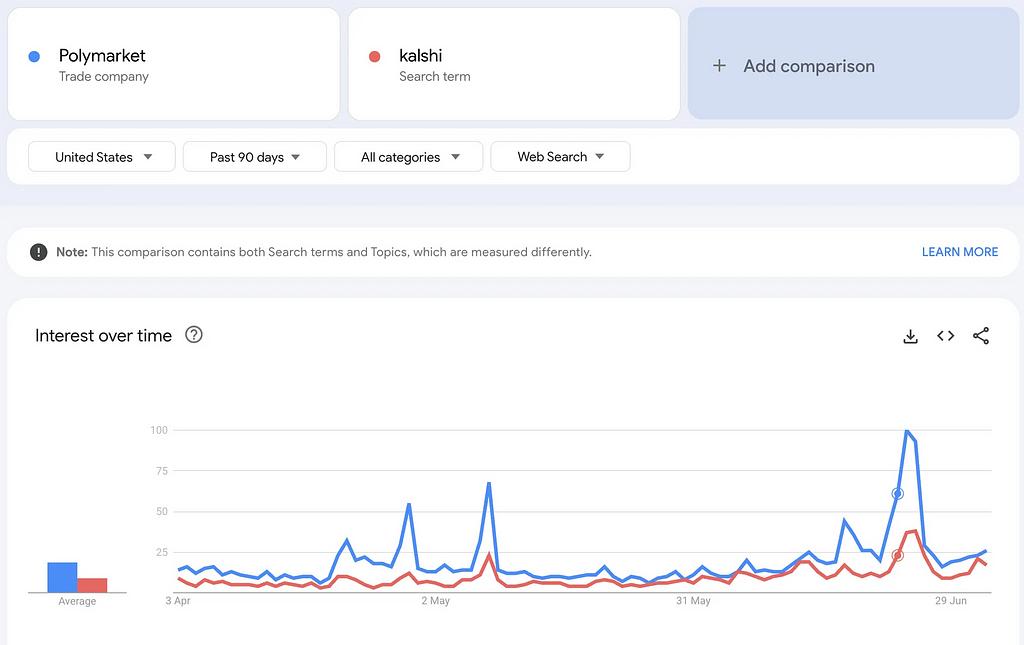

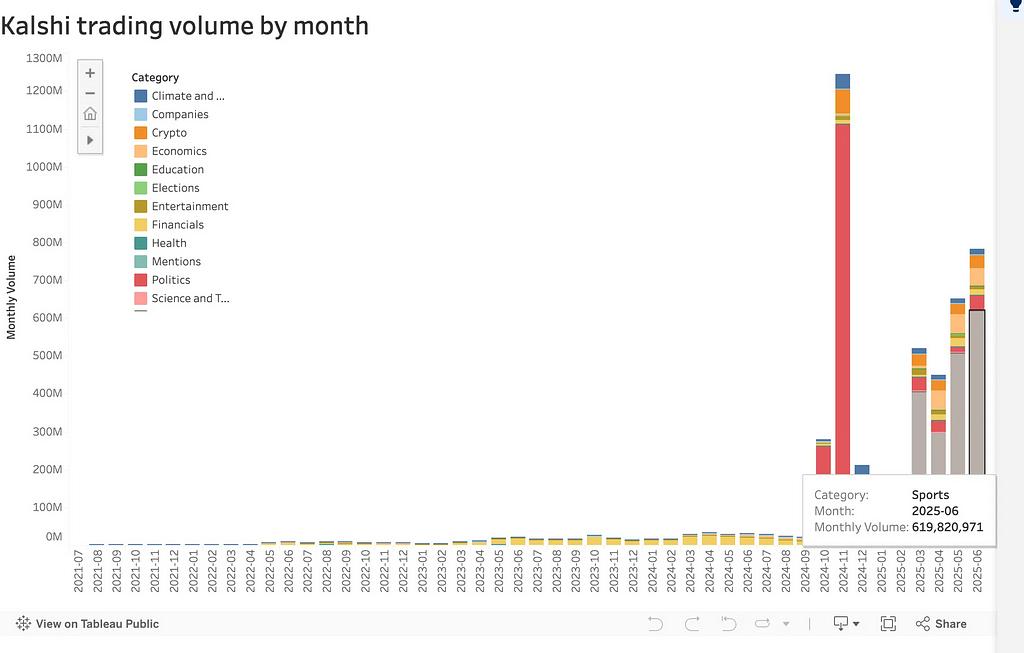

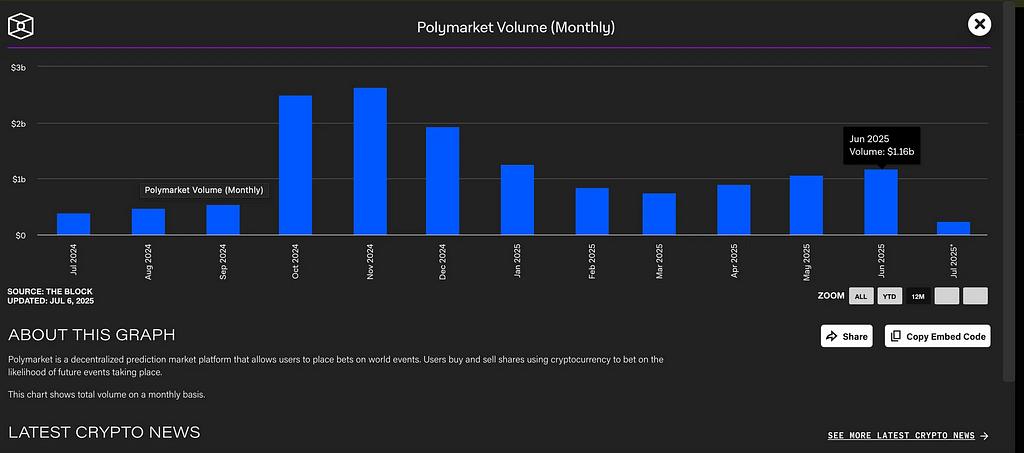

3. Go-to-Market Strategy/Traction

Academic Insight: “Gambling on Crypto Tokens”

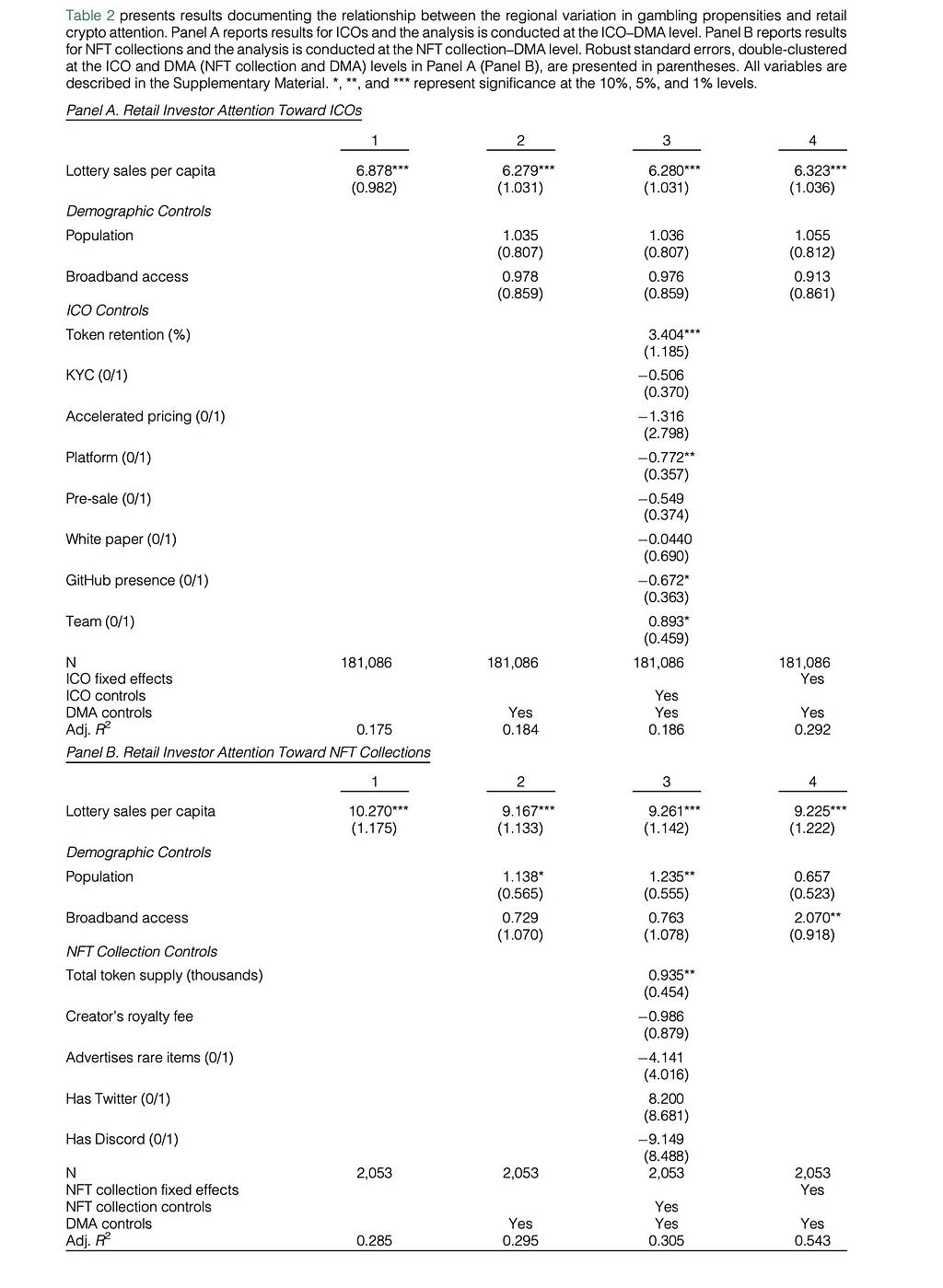

A recent peer-reviewed study titled “Gambling on Crypto Tokens?” provides hard evidence of the gambling-crypto connection. Using Google Trends to proxy retail investor attention, the researchers uncovered several notable patterns:

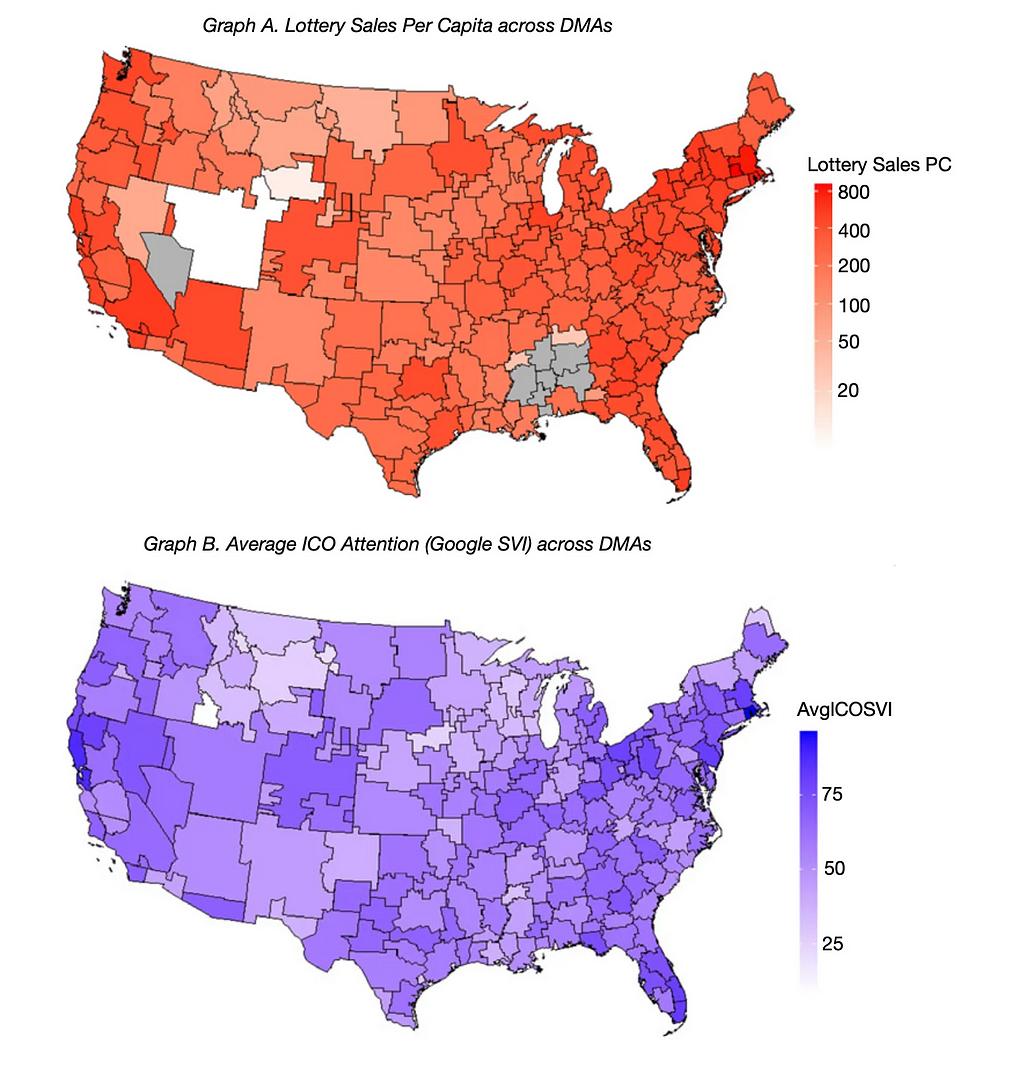

1. Lottery Sales per Capita Predict Crypto Attention

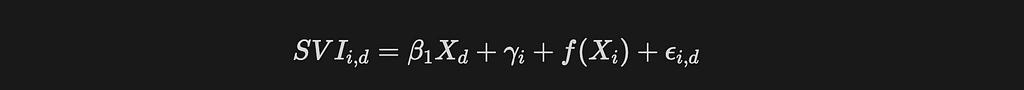

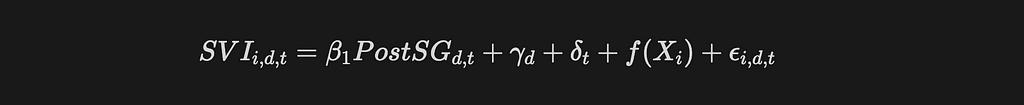

Google Search Volume Index(SVI i,d) represents the attention received by ICO/NFT collection i in designated market areas(DMA) d at the time of the offering. The coefficient of interest, β1, identifies the impact of DMA-level gambling propensities on the attention received by crypto tokens. f(Xd) represents a vector of DMA-level controls that could influence ICO or NFT collection attention.

X_d includes the primary regressor of interest: Lottery sales per capita, plus interaction terms with token-level features.

Regression results show that U.S. regions (DMAs) with higher lottery sales per capita generate significantly more Google Trends activity around:

- Initial Coin Offerings (ICOs): Coefficient ranges from 6.28 to 6.88, p < 0.01

This suggests a strong behavioral overlap between gamblers and retail crypto investors.

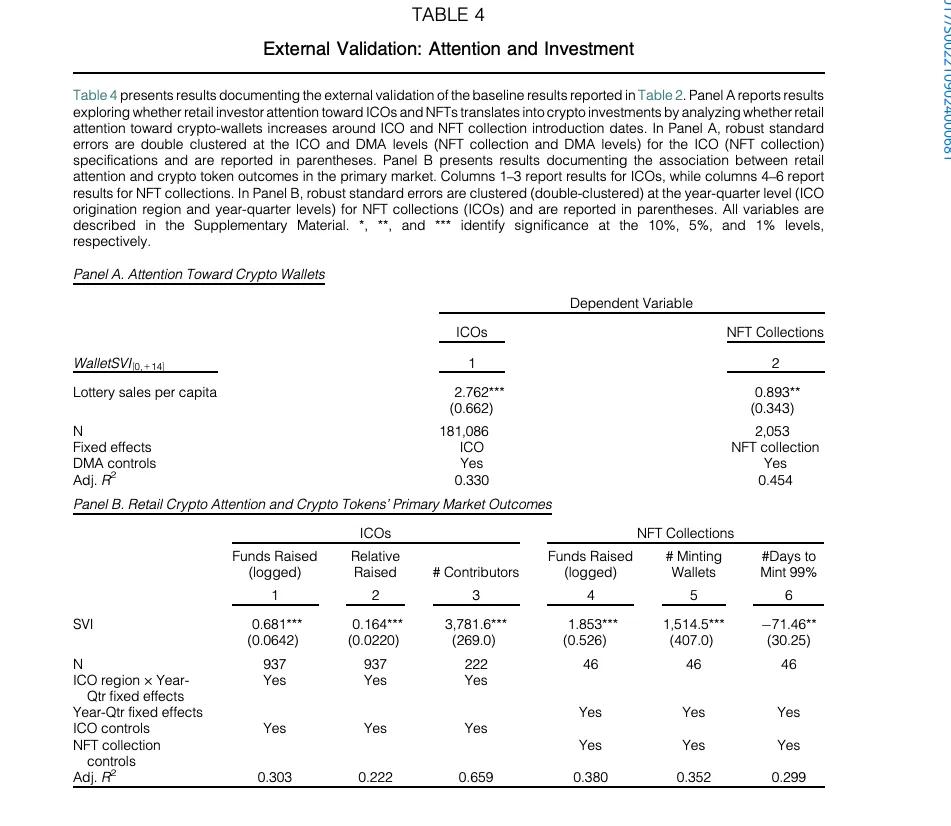

2. Wallet Attention and Investment Outcomes

- Wallet attention spikes in high-lottery regions immediately after ICO or NFT launches.

- Wallet SVI (attention to MetaMask, Coinbase Wallet, etc.) spikes around ICO/NFT launches more in high-lottery regions.

- These regions also show more funds raised, more contributors, and faster NFT minting.

3. Gambling Legalization as a Natural Experiment

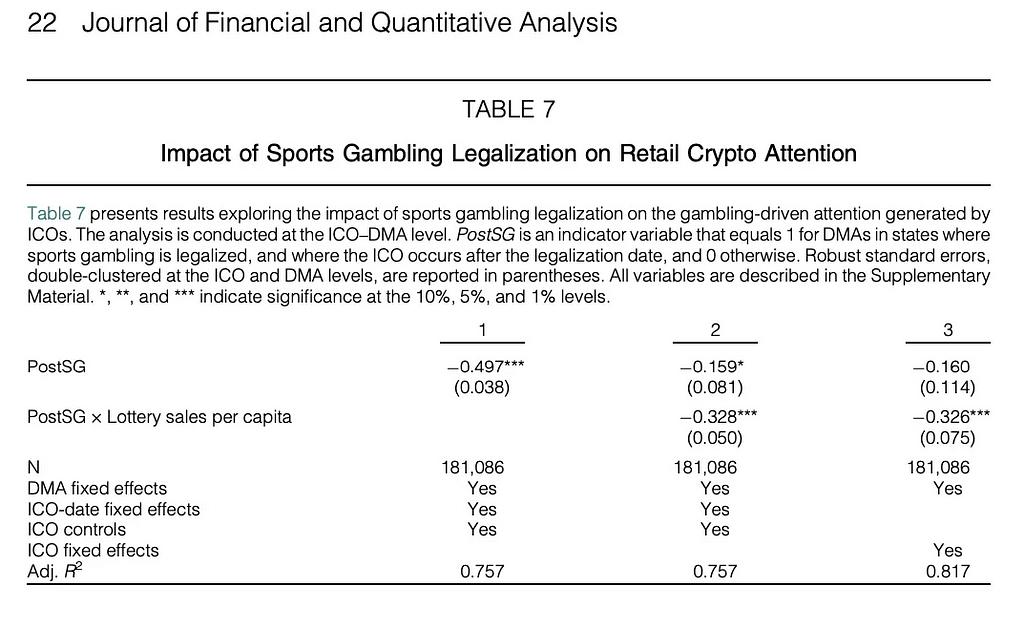

Table 7 of the same paper uses the staggered legalization of sports betting across U.S. states to show that when gambling becomes legally available, crypto attention drops significantly in high-lottery regions:

The interaction term (PostSG × Lottery Sales) is strongly negative and highly significant. This implies that crypto tokens and gambling are substitutes, if a legal way to gamble exists, speculative attention toward crypto falls.

Overall, the paper’s conclusion is unequivocal: “gambling preferences strongly predict retail investor interest in the crypto market.” Crypto trading isn’t just like gambling — for a sizable subset of users, it is gambling. These findings validate the comparisons and highlight a pool of users who exhibit high risk tolerance and chase speculative thrills, whether in casinos or on Coinbase.

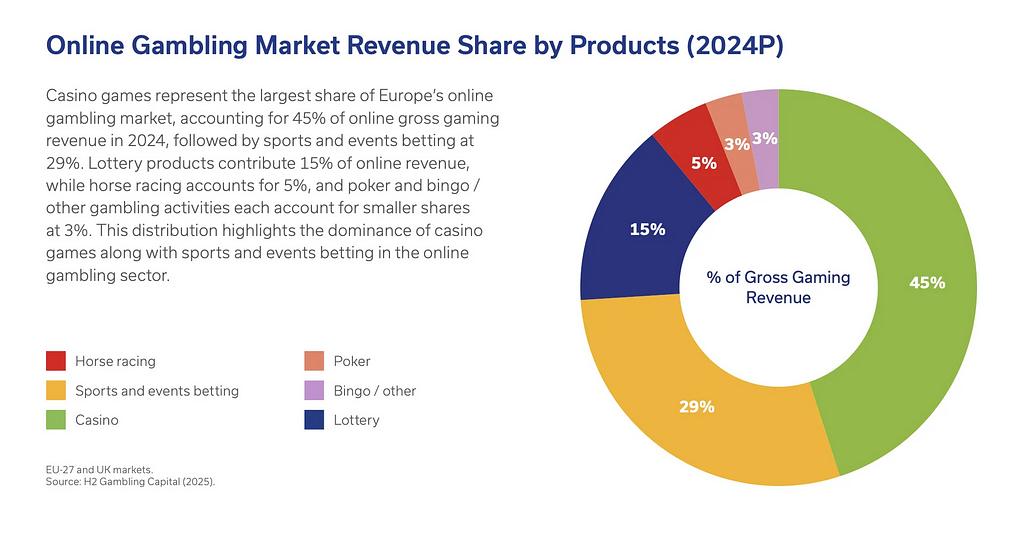

The Crypto Gambling Market: Stake.com as a Proxy

To size the opportunity, consider the rise of crypto-native gambling platforms (Only crypto deposit is allowed) like Stake.com.

In just a few years, Stake has tapped into the appetite for high-risk, high-reward entertainment on a massive scale:

- Massive Revenues: Stake generated roughly $2.6 billion in gross gaming revenue in 2022 (up from just $105 million in 2020), making it one of the world’s largest gambling companies. Growth has continued explosively — Stake’s revenue jumped to about $4.7 billion in 2024, an ~80% increase since 2022. For context, this puts Stake in the same league as major traditional betting groups (Entain reported ~$5B in 2024 revenue, Flutter ~$14B).

- User Base & Reach: The platform has 600,000+ regular users as of 2023, despite being officially inaccessible in markets like the U.S. and UK. Its user base is concentrated in jurisdictions with looser online gambling rules (Southeast Asia, Japan, Brazil, etc.). The fact that half a million people globally flocked to a crypto betting site, even in the face of geo-blocks, speaks to the tremendous latent demand.

- Top Global Competitor: Stake’s meteoric rise made it the 7th-largest gambling group worldwide by revenue, surpassing well-known traditional sportsbooks. Notably, DraftKings (a major U.S. sportsbook) lags behind Stake’s revenue, underscoring how crypto-enabled betting has unlocked a new total addressable market (TAM) beyond the reach of legacy gambling firms.

I think prediction markets have an edge over sportsbooks:

- In-Game Trading (Early Cashouts):

Kalshi-style prediction markets allow users to lock in profit/loss mid-event by buying or selling their position (similar to “派彩快” in Hong Kong’s HKJC). This enables:

- Active hedging during uncertainty

- Dynamic portfolio rebalancing

- Risk-managed speculation

Sportsbooks (Stake, Bet365, etc.):

While many modern sportsbooks offer early cashout features, these are:

- Discretionary and limited, often determined by the bookmaker

- May involve significant price slippage or penalty

- Typically unavailable on multi-leg bets or exotic bets (e.g. total threes in basketball)

Industry-Wide Scale: Stake is just one player in a larger crypto betting arena. Industry reports show that crypto casinos collectively generated over $81 billion in revenue in 2024, despite regulatory crackdowns in many countries. This figure, gross gaming revenue from crypto-denominated bets, highlights how big the crypto-gambling intersection has become. It represents a huge pool of users and capital that, until now, has primarily flowed into offshore or unregulated platforms.

The success of Stake.com demonstrates a massive market of users who are comfortable speculating with crypto and crave betting opportunities beyond traditional venues. These users are effectively engaging in prediction markets (betting on events) but doing so on unregulated platforms.

A regulated exchange like Kalshi, with proper market structure and oversight, is well positioned to capture a slice of this audience by offering a similar adrenaline rush in a compliant package. Stake’s scale suggests the TAM for “crypto-flavored” betting in the U.S. could be measured in the billions of dollars annually, if those users migrate to legal alternatives.

Overlapping Demographics and Behaviors

It’s not just theoretical overlap, numerous studies and surveys confirm that crypto traders and gamblers share key demographic and behavioral traits.

In many cases, they are the same people or at least the same type of people. Some salient overlaps:

- Young, Male, Risk-Seeking: Both retail crypto trading and sports/casino gambling skew toward young adult males who exhibit high risk tolerance. These individuals are drawn to high-volatility assets and big payoff bets. A Rutgers University study, the first to examine crypto trading among regular gamblers, found that over 50% of monthly gamblers had traded cryptocurrencies in the past year, More than 75 percent of high-risk stock traders also trade cryptos*.* The researchers concluded that “cryptocurrency trading appeals to people struggling to manage their gambling participation,” i.e. those prone to addiction or impulsive betting. In other words, the prototypical Robinhood crypto day-trader (young, thrill-seeking, perhaps trading meme coins on a hunch) closely mirrors the profile of a sports bettor or poker player chasing a win.

- Always-On & Online: Crypto markets never close, operating 24/7 globally, and online gambling is available at any hour, a constant dopamine trigger. Gamblers who migrate to crypto trading often cite the appeal of an asset that can be traded on weekends and through the night. For individuals with high Internet use and possibly compulsive tendencies, both online gambling and crypto provide endless engagement — there’s always another match to bet on or another token price moving.

The demographic that Kalshi can target, retail users who love speculation, likely spans both the crypto trading community and the sports betting/gambling community. They are already engaging in similar activities; the key is to provide a product that scratches the same itch in a safer, regulated environment. The overlapping behavior also suggests marketing messages that emphasize the thrill of prediction markets (appealing to gamblers) as well as the sophistication and market-driven nature of event trading (to appeal to the investor self-image of crypto traders).

Shifting Crypto Narratives: From Wild West to Regulated Market

The crypto industry’s storyline has undergone a pronounced shift in the past few years, moving from a “Wild West” ethos of unregulated innovation toward an emphasis on institutional adoption and regulatory compliance. This evolution creates a more favorable landscape for regulated platforms like Kalshi and underlines Kalshi’s competitive moat (CFTC approval) as a key asset.

- Embracing the Establishment. More recently, the narrative has pivoted. Major TradFi institutions and governments are now entering the crypto space, bringing credibility and regulatory frameworks. For example, in 2023 the world’s largest asset manager BlackRock filed for a Bitcoin ETF, sparking optimism that the SEC would finally approve a spot Bitcoin ETF after a decade of rejections. Lawmakers also stepped in: in June 2025 the U.S. Senate passed a landmark bill to regulate stablecoins (the GENIUS Act), establishing the first federal rules for these crypto tokens. Even on the geopolitical stage, crypto is becoming institutionalized: Trump’s team floated ideas like a strategic bitcoin reserve and other pro-crypto policies, a stark contrast to the outright bans or hostile stances seen elsewhere. All of these developments signal that crypto is no longer an outlaw frontier but is being pulled into the regulatory and institutional fold.

- Regulation as a Moat: In this transformed landscape, compliance is a competitive advantage. The industry’s focus has shifted from “move fast and break things” to “build to last within the rules.” A platform that already has regulatory blessing, like Kalshi with its CFTC-regulated status, holds a significant moat. Kalshi spent six years navigating approvals to become a designated contract market (exchange) under the CFTC, meaning it can legally offer event contracts in all 50 states (even places like California or Texas that prohibit conventional sports betting). This is incredibly hard to replicate. For instance, Kalshi’s closest crypto-native competitor, Polymarket, operates in a regulatory gray zone and is not authorized in the U.S., a vulnerability as the U.S. cracks down on unregistered platforms. In the new narrative of institutional adoption, Kalshi’s federally regulated status is a huge selling point: it provides the trust, legal clarity, and nationwide access that align with where the crypto/gambling industry is headed. Put simply, Kalshi has a running start while others are now scrambling to get on the right side of regulation.

Kalshi’s Strategy: Framing as Trading (Not Gambling) and Robinhood Integration

Kalshi has been careful to distance itself from the “gambling” label, instead pitching its platform as a new category of trading or investment, “event trading”, with the legitimacy of a regulated exchange. This positioning is deliberate and strategic:

- “We’re Not a Sportsbook” — Language & Model: Kalshi’s founders and executives go out of their way to emphasize that their platform operates like a financial exchange, not a casino. Unlike a sportsbook that takes the opposite side of bets, Kalshi merely matches traders and charges a transaction fee (like a stock exchange commission) on each trade. “We are simply an exchange… We don’t win by people losing. We simply sit in between the transaction,” explains a Kalshi representative. There is no “house” with a built-in edge, and this structure appeals to more sophisticated bettors who are wary of traditional bookmaking. CEO Tarek Mansour even questioned why Kalshi’s product would be considered gambling at all: “If we are gambling, then I think you’re basically calling the entire financial market gambling.” This quote encapsulates Kalshi’s branding message, they liken event contracts to other financial derivatives, implying that buying a contract on, say, “Will July be the hottest on record?” is akin to buying an oil futures contract or an earnings option, not a roulette spin. By using the lexicon of trading (“contracts”, “markets”, “exchange”) and avoiding words like “bet” or “wager” in user-facing materials, Kalshi is crafting an image closer to CME or NASDAQ than DraftKings. This not only helps with regulatory perception but also attracts a broader audience that might shy away from “betting apps” but are open to “investing in outcomes.”

- Integration with Robinhood — Mainstream Distribution: A major strategic move for Kalshi is its partnership with Robinhood, announced in early 2025. Robinhood, with its 15+ million active users, is synonymous with the retail trading boom (stocks and crypto) and has a young, financially curious user base. Through this collaboration, Robinhood integrated Kalshi’s event contracts into its platform, creating a “Prediction Markets” hub. Users of Robinhood can now seamlessly trade Kalshi markets (for example, on economic indicators or even sports outcomes) from within the Robinhood app. This is huge for Kalshi’s reach — rather than relying solely on direct signups, Kalshi can tap into Robinhood’s massive audience of U.S. retail traders. Early results suggest strong interest; in fact, Robinhood’s own stock price jumped ~8% on news of the Kalshi partnership, indicating that investors see adding event trading as a value-add for the platform. By embedding into Robinhood’s ecosystem, Kalshi essentially sidesteps the costly process of user acquisition and instantly appears in front of millions of potential customers who are already comfortable trading. It positions event contracts as just another asset class alongside stocks, options, and crypto — normalizing the product.

- Avoiding the “G-word”: As a final note on strategy, Kalshi’s marketing and PR conspicuously avoid framing the platform as a gambling outlet. For instance, Kalshi markets are described as “Yes/No contracts” on future events. The company’s blog and educational content emphasize how prediction markets can forecast events and provide insight, rather than emphasizing the gambling thrill.

- Even the integration with Robinhood was pitched as “bringing event trading to the masses” rather than using any casino terminology. This careful branding is aimed at regulators (to strengthen the case that Kalshi is distinct from sports betting) but also at users who might otherwise feel stigma around gambling. By making the experience feel like trading, Kalshi can attract a wider audience, including those who do like gambling but prefer to tell themselves they are “investing,” not just playing games of chance. It’s a clever positioning that aligns with human psychology and the current regulatory climate.

There has always been a blurry line between gambling and trading. As a student of quantitative finance, I’ve been taught to see sudden price movement as a stochastic drift, most market fluctuation as a random walk. But that raises a question: is trading, driven by volatility, speculation, and emotion, really different from gambling? If you’re placing a high-risk, positive expected value bet, is it still gambling? By gambler’s ruin, A persistent gambler who raises his bet to a fixed fraction of the gambler’s bankroll after a win, but does not reduce it after a loss, will eventually and inevitably go broke, even if each bet has a positive expected value. And if so, does that make all of us just sophisticated gamblers?

The data is clear: retail crypto investors and gamblers aren’t just similar, they often are the same people. Kalshi doesn’t need to choose between these audiences. It can serve both. Whether it’s a sharp trader deploying cross-platform arbitrage, or a degen betting on sports outcomes, Kalshi offers a venue where both behaviors can coexist under the legitimacy of a regulated financial market.

By abstracting away the gambling stigma and embracing the language of markets, Kalshi bridges two massive user bases, those who want to play and those who want to trade. And in doing so, it doesn’t dilute either, it empowers both.

Prediction market was originally published in IOSG Ventures on Medium, where people are continuing the conversation by highlighting and responding to this story.