Author: William Nuelle

Translated by: TechFlow

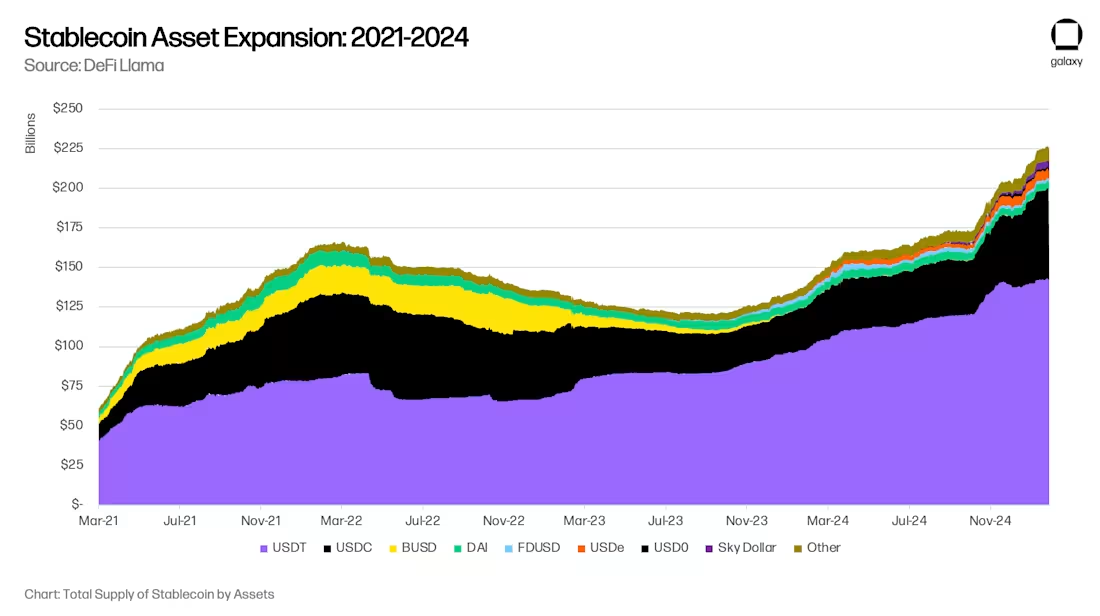

After experiencing a significant decline over 18 months, stablecoin adoption is accelerating again. Galaxy Ventures believes there are three long-term driving factors for stablecoin re-acceleration: (i) adoption of stablecoins as a savings tool; (ii) adoption of stablecoins as a payment tool; and (iii) DeFi as a source of above-market yields, which absorbs digital dollars. Therefore, stablecoin supply is currently in a rapid growth phase, expected to reach $300 billion by the end of 2025, and ultimately $1 trillion by 2030.

The growth of stablecoin AUM to $1 trillion will bring new opportunities and transformations to financial markets. Some changes can be predicted now, such as bank deposits in emerging markets shifting towards developed markets, and regional banks moving to global systemically important banks (GSIB). However, some changes are currently unforeseeable. Stablecoins and DeFi are foundational, not marginal innovations, and may fundamentally change credit intermediation in entirely new ways in the future.

Three Driving Trends: Savings, Payments, and DeFi Yields

Three adjacent trends are driving stablecoin adoption: using them as a savings tool, as a payment tool, and as a source of above-market yields.

Trend One: Stablecoins as a Savings Tool

Stablecoins are increasingly being used as a savings tool, especially in emerging markets (EM). In economies like Argentina, Turkey, and Nigeria, with structurally weak local currencies, inflationary pressures and currency depreciation have created organic demand for dollars.

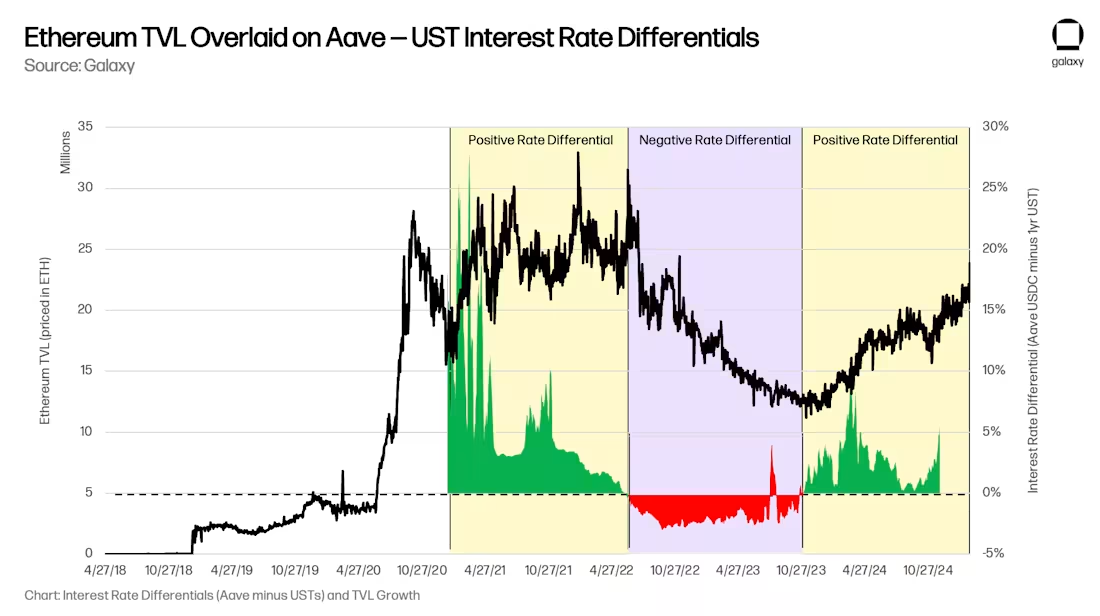

[The rest of the translation follows the same professional and accurate approach]Here's the English translation: Because the "native language" of DeFi is stablecoins rather than US dollars, any "arbitrage" attempt to provide low-cost dollar capital to meet this specific micro-market demand will produce an effect of expanding stablecoin supply. Narrowing the interest rate spread between Aave and US Treasury bonds requires stablecoins to expand into the DeFi field. As expected, during periods when the interest rate spread between Aave and US Treasury bonds is positive, the Total Value Locked (TVL) will grow, and during periods when the spread is negative, TVL will decline (showing a positive correlation):

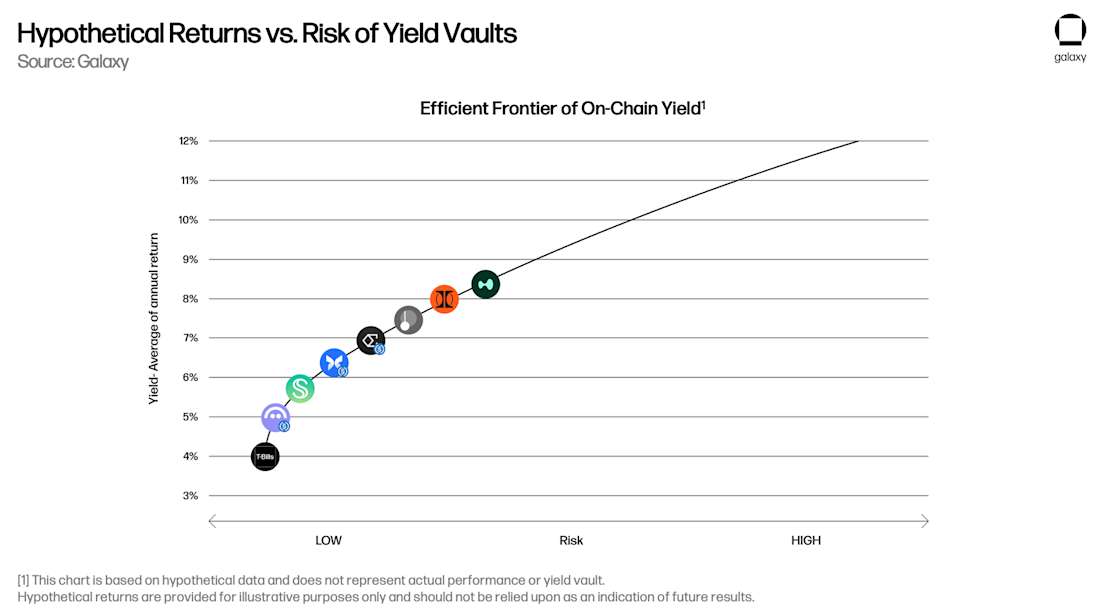

On-Chain Yield's Efficient Frontier

Finally, lending is not limited to basic bank deposits. Each stablecoin is both a claim on the underlying US dollar and a value unit on the chain itself. USDC can be lent on-chain, with consumers seeking yields denominated in USDC, such as Aave-USDC, Morpho-USDC, Ethena USDe, Maker's sUSDS, Superform's superUSDC, and so on.

"Vaults" will provide on-chain yield opportunities for consumers with attractive rates, thus opening up another asset management channel. We believe that in 2024, portfolio company Ethena initiated the "Overton window" of dollar-denominated on-chain yields by integrating basis trading (TechFlow note: the difference between spot and futures prices of a commodity at a specific time and place) into USDe. In the future, new vaults will emerge, tracking different on-chain and off-chain investment strategies, competing for USDC/T holdings in applications like MetaMask, Phantom, RedotPay, DolarApp, DeBlock. Subsequently, we will create an "efficient frontier of on-chain yields" (TechFlow note: helping investors find the optimal balance between risk and return), and it is not difficult to imagine that some of these on-chain vaults will specifically provide credit for regions like Argentina and Turkey, where banks are at risk of massive loss of this capability:

Conclusion

The convergence of stablecoins, DeFi, and traditional finance represents not just a technological innovation, but a restructuring of global credit intermediation, reflecting and accelerating the shift from banks to non-bank lending post-2008. By 2030, stablecoins' assets under management will approach $1 trillion, thanks to their application as a savings tool in emerging markets, efficient cross-border payment channels, and DeFi yields above market rates. Stablecoins will systematically draw deposits away from traditional banks and concentrate assets in US Treasuries and major US financial institutions.

This transformation brings both opportunities and risks: stablecoin issuers will become important participants in the government debt market and potentially new credit intermediaries; regional banks, especially in emerging markets, will face credit contraction as deposits shift to stablecoin accounts. The ultimate result is a new asset management and banking model where stablecoins will serve as a bridge to the frontier of efficient digital dollar investments. Just as shadow banking filled the gaps left by regulated banks after the financial crisis, stablecoins and DeFi protocols are positioning themselves as the dominant credit intermediaries of the digital age, which will have profound implications for monetary policy, financial stability, and the future architecture of global finance.