Author: Cookie, BlockBeats

A month ago, we reviewed the "points airdrop" projects on Binance Alpha, attempting to analyze market preferences for different concept tokens based on their price performance after the airdrop.

This time, we've switched to a new perspective - examining the projects listed on Binance Alpha that have been listed on Binance Spot. Can we find any effective information and interesting conclusions by observing these projects from multiple data angles?

Is Binance Alpha Still the "Outpost" for Binance Spot Listings?

Initially, Binance Alpha was the "outpost" for Binance Spot listings. However, after Binance announced the upgrade to Binance Alpha 2.0 in March, the correlation between projects being listed on Binance Alpha and being listed on Binance Spot has significantly weakened.

After the Binance Alpha 2.0 update, there were 88 listed projects, with 71 projects having conducted "points airdrops". Ultimately, only 15 projects were listed on Binance Spot, representing about 17% of all listed projects and about 21% of projects that conducted "points airdrops".

Are All Spot Listings "Fresh Regular Troops"?

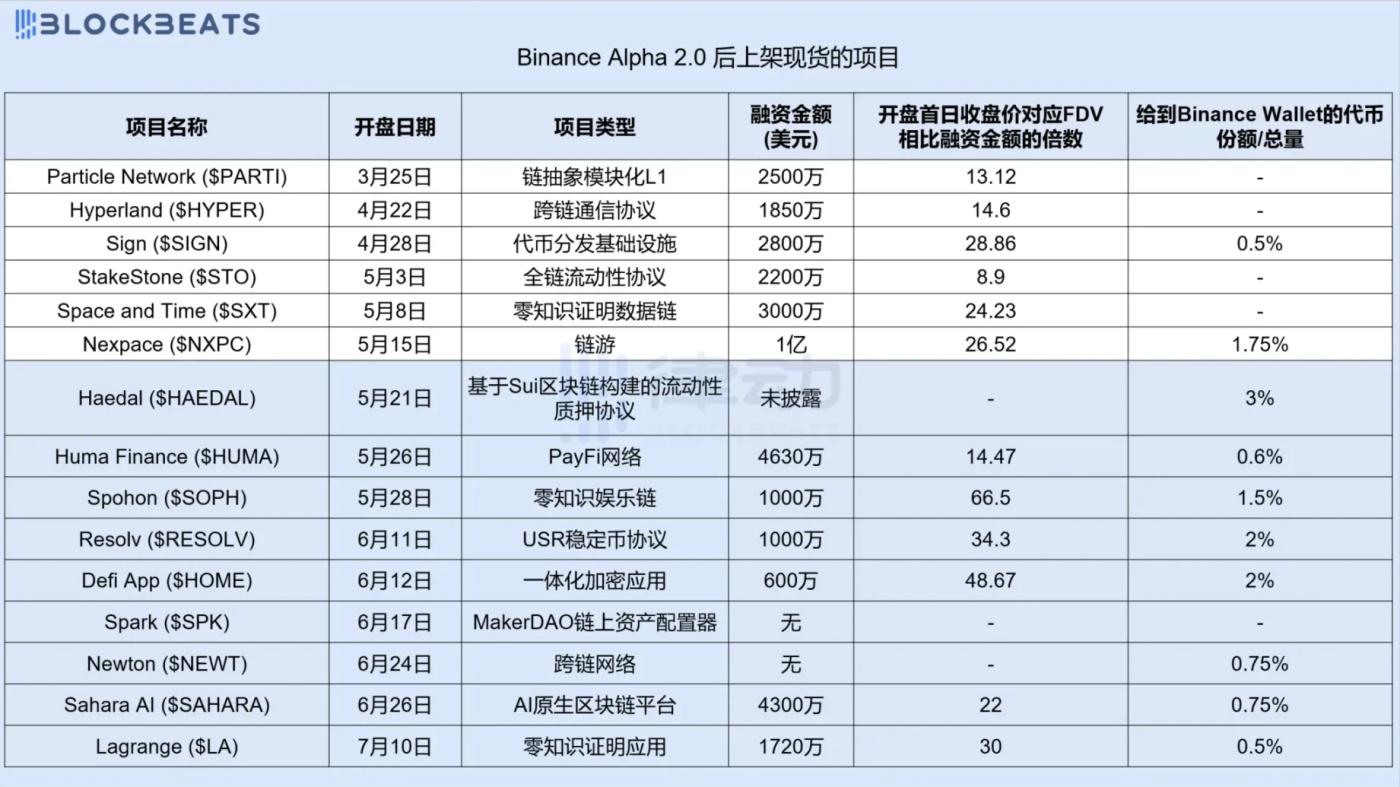

After the Binance Alpha 2.0 update, among the 15 projects listed on Binance Spot, 13 projects received funding. Based on disclosed data, the highest-funded project was the blockchain game "MapleStory Universe" $NXPC, with funding reaching $100 million, while the lowest-funded was the DeFi App $HOME, with $6 million in funding. Excluding the Haedal project with undisclosed funding, the total funding for the remaining 12 projects reached $356 million.

The two projects without funding information are not small players. Spark $SPK comes from MakerDAO, and Newton $NEWT comes from Polygon Labs.

Does Binance have a "preference" for projects invested by Binance Labs/Yzi Labs? Actually, no. Among these projects, only 4 projects - StakeStone, Sign, Sophon, and Sahara AI - received investments from Binance Labs/Yzi Labs.

In terms of project types, Binance also did not show a particular "preference", covering a wide range of types including modular blockchain, chain abstraction, Payfi, blockchain games, full-chain liquidity protocols, zero-knowledge proofs, and more. These types generally require significant funding for research and development.

It can be said that in the Binance Alpha 2.0 era, the path to Binance Spot is filled with "regular troops", and it's difficult to see projects like $AIXBT from the chain.

These projects are not only "regular troops" but "fresh regular troops" - all conducting Token Generation Events (TGE), opening airdrop claims, and almost simultaneously listing on Binance Spot. The exception is Lagrange, which was listed on Binance Spot more than a month after being listed on Binance Alpha and its TGE. Looking purely at the connection between these projects and Binance Alpha airdrop activities, 10 projects conducted "points airdrops". The token allocation to Binance Wallet varied among these projects, with Haedal allocating the most at 3% of its total supply, and Sign and Lagrange allocating the least at 0.5% of their total supply.

Compared to Funding, How Successful Are These New Coins?

Taking the maximum diluted market value at the closing price on the first day of trading, among the 12 projects that disclosed specific funding amounts, only 4 projects' maximum diluted market value did not exceed 15 times their funding. The lowest was StakeStone, which still had a multiple of about 8.9 times.

The remaining 8 projects' maximum diluted market value at the first day's closing price exceeded 20 times their funding. Among these, Sophon had the highest multiple at about 66.5 times, while Sahara AI had the lowest at about 22 times.

This is not directly related to project types but is influenced by the market environment at the time, the project's own operations, and market understanding of the project. For example, despite the relatively low market attention and optimism for blockchain game tracks, "MapleStory Universe" still reached about 26.52 times, which is related to factors such as the game's strong IP and high expectations in the blockchain game track.

Conclusion

From the overall trend, projects listed on Binance Alpha wanting to successfully progress to Binance Spot still face quite strict scrutiny from Binance. Having a narrative and funding has become a "standard", but project types are not limited to market-favored hot concepts.

Among the projects we could statistically analyze, over 75% had a maximum diluted market value at the first day's closing price exceeding 20 times their funding, which has somewhat become the "passing line" for new projects.