Recently, the market has recovered strongly, with people in various groups sharing their profits and battle reports daily, and FOMO emotions are at their peak.

I have gradually reduced my positions, waiting for the next pullback opportunity. Even if the market continues to rise, I would only earn less. Since I have reached my expected profit, it's better to secure the gains.

This is my fifth year in the crypto, transforming from a naive young man with no investment experience to someone who can now manage positions with knowledge and action. My greatest feeling is not about making money in the crypto, but about becoming calm in the market and experiencing a true sense of investment achievement.

During these idle days, I've been finding scattered wallet addresses and scanning them on data websites.

As an old crypto veteran, from the DeFi Summer of 2020 to now, I have at least several hundred wallet addresses. Those addresses from early participation, token launches, and airdrop farming - I can't even remember their original purposes now.

I once seriously created a spreadsheet specifically to record each wallet's purpose and asset situation. But over time, without timely updates, the data became invalid.

One-click Scan, Unexpectedly Discovered 500U

Originally just trying it out, I scanned several addresses using the tool Creditlink recommended by a friend.

Unexpectedly, in an old wallet untouched for a long time, there was actually a liquidity pool asset worth about 500U in stablecoins!

These assets came from an early liquidity mining project I participated in. After the project cooled down, I forgot about it.

Creditlink not only identified the LP assets but also clearly marked the LP composition, liquidity pool, and the number of redeemable stablecoins.

Without its automatic scan and structured display, I might not have remembered this money until the next bull market.

Creditlink can also analyze multi-chain wallet assets and interaction records, and mark risk addresses and Sybil behaviors. I didn't have high hopes initially, as I've tried many such tools that basically just check balances. But Creditlink's experience completely exceeded my expectations.

I haven't touched this wallet for almost two years. If the system hadn't automatically identified and displayed the LP details, I wouldn't have remembered there were assets there.

I can say Creditlink is the most detailed and intelligent wallet analysis tool I've used, suddenly giving me a sense of security that my assets can be traced.

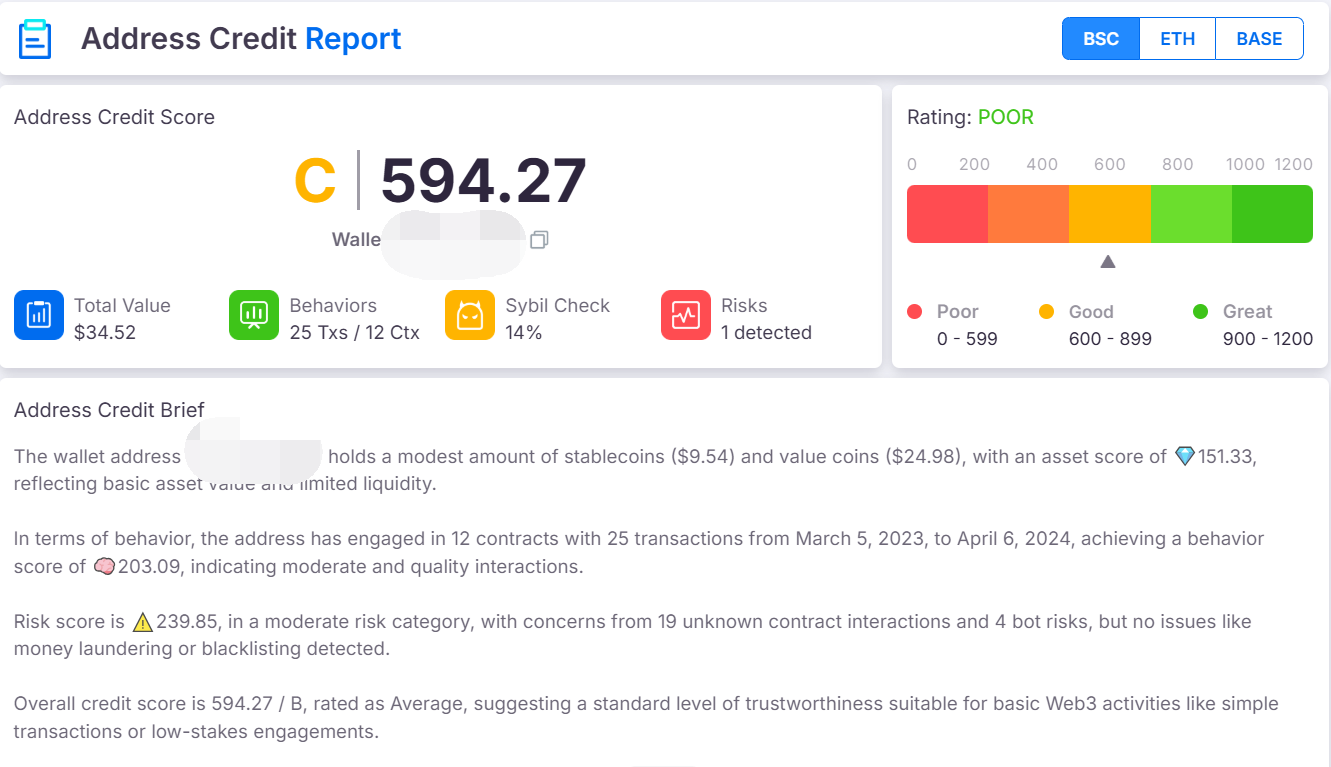

Although wallets like in the image only have a few dozen dollars, when these small asset fragments accumulate, they can total thousands of dollars. For ordinary users, this recovery experience is very practical.

Batch Address Filtering: A Precise Airdrop Tool for Project Teams

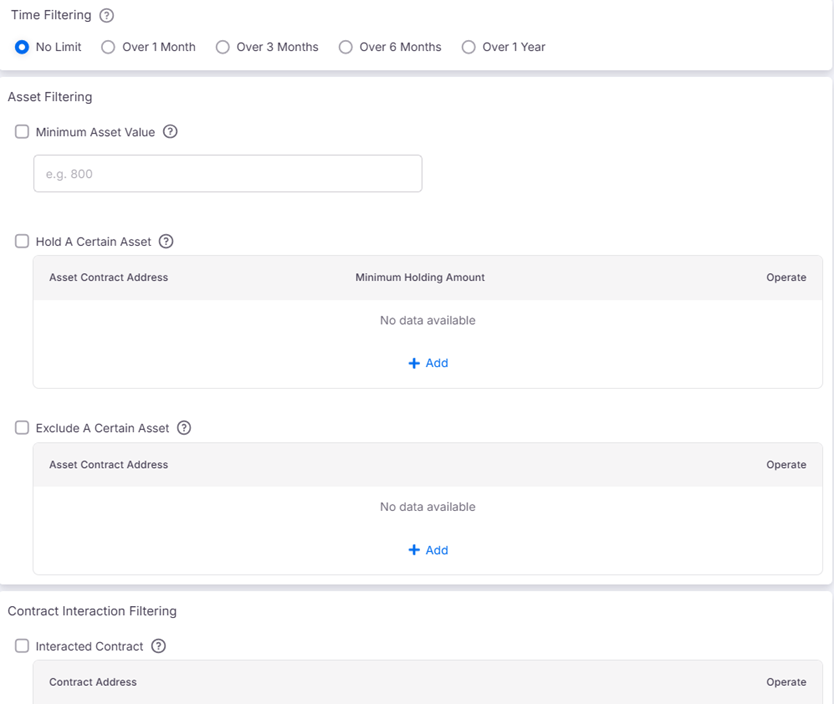

Creditlink provides a powerful and flexible batch address filtering system where users can directly upload a txt file to batch import wallet addresses and achieve efficient screening and analysis through multi-dimensional conditions. The core filtering dimensions supported include:

● Wallet creation time filtering

● Asset holding and exclusion conditions

● Specified asset holding situation

● Minimum asset threshold

● Contract interaction record filtering

Batch address filtering is suitable for various application scenarios, including precise airdrop targeting, community growth and user profile analysis, hacker and risk address screening, marketing channel conversion tracking, and identifying veteran chain users!

Through Creditlink's batch filtering, complex wallet data is transformed into an actionable insight tool, greatly improving the efficiency and precision of Web3 project teams and users in data-driven decision-making, and is a key component in building an on-chain credit system and identity profile.

From Tool to Infrastructure: Creditlink is Reshaping the Web3 Credit System

My personal experience of recovering 500U is just a small case, but at a deeper level, what Creditlink is building is actually a more intelligent and refined on-chain credit and identity infrastructure.

As Web3 user behavior data grows exponentially, on-chain information becomes richer, but most protocols are still at the stage of judging by balance - unable to effectively identify the real value and risk behind addresses, and difficult to achieve more inclusive financial services.

Creditlink is born for this purpose.

The project's core vision is to build an AI-driven on-chain identity authentication and credit scoring system, promoting Web3 finance from collateral-heavy and KYC-focused to behavior-centric and uncollateralized.

Currently, Creditlink has launched its Beta version, supporting:

● Single address multi-dimensional behavior analysis

● Batch address filtering (supporting airdrops, Sybil prevention)

● Risk interaction detection and reputation tagging system

● Credit score (CredScore) soon to be integrated, credit Non-Fungible Token soon to be released

From the underlying data engine and AI scoring model to credit Non-Fungible Token and behavior incentive system, Creditlink's modular architecture will serve the entire Web3 application ecosystem: including decentralized lending, DAO governance, Sybil-resistant airdrops, reputation-driven incentive mechanisms, identity systems, GameFi strategies, and more.

Summary

If you're an ordinary user, Creditlink can help you recover forgotten assets, organize wallet behaviors, and avoid potential risks.

If you're a project team or developer, Creditlink is the best partner for precise airdrops, user screening, behavior modeling, and credit incentives.

The future of Web3 needs not just addresses with assets, but addresses worth trusting. Creditlink is providing infrastructure support for this trust revolution.

Official website: app.creditlink.info/

Sometimes, a good on-chain tool can help you recover a forgotten asset.

Check now - maybe the coin forgotten in your wallet has already risen tenfold, and you're now a millionaire!