Another trading scandal has surfaced, this time involving Crypto Beast.

A major KOL with nearly 800,000 followers, simultaneously shilling, pumping, selling, and harvesting.

On July 14, the Altcoin (ALT) token pushed by Crypto Beast plummeted from $0.19 to $0.003, vaporizing nearly $190 million in market value within just a few hours, with 45 associated wallets on-chain simultaneously selling, totaling over $11 million in cash-out.

This article will review the complete process of this harvesting event and reveal the true manipulation behind it.

ALT Collapse: Crypto Beast's Manipulation Maze

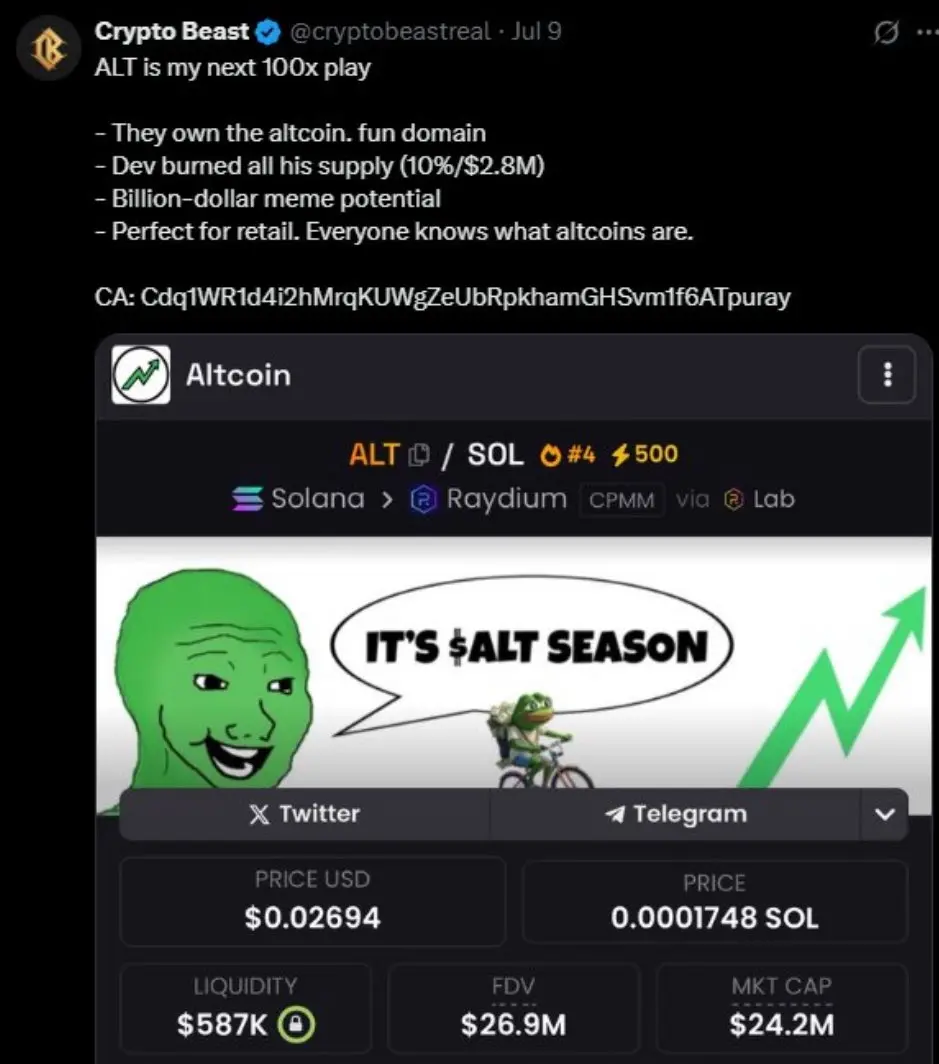

From surge to crash, in just five days. On July 9, Crypto Beast began intensively promoting ALT on X and Telegram. He described the token as the "next 100x coin" with "potential for billions in market value", creating market FOMO emotions with a gradual pumping rhythm.

On July 12, the pumping action clearly accelerated, with $ALT surging from $0.039 to $0.19 in just two days, a nearly 4-fold increase, attracting more retail investors.

On July 14, the harvesting officially began. Within just 4 hours, $ALT plummeted to $0.003, a drop of 94%, almost zeroing out.

Image source: coingecko

On-chain detective ZachXBT conducted an in-depth investigation, unraveling the true nature of the manipulation through a previously publicly disclosed wallet address by Crypto Beast.

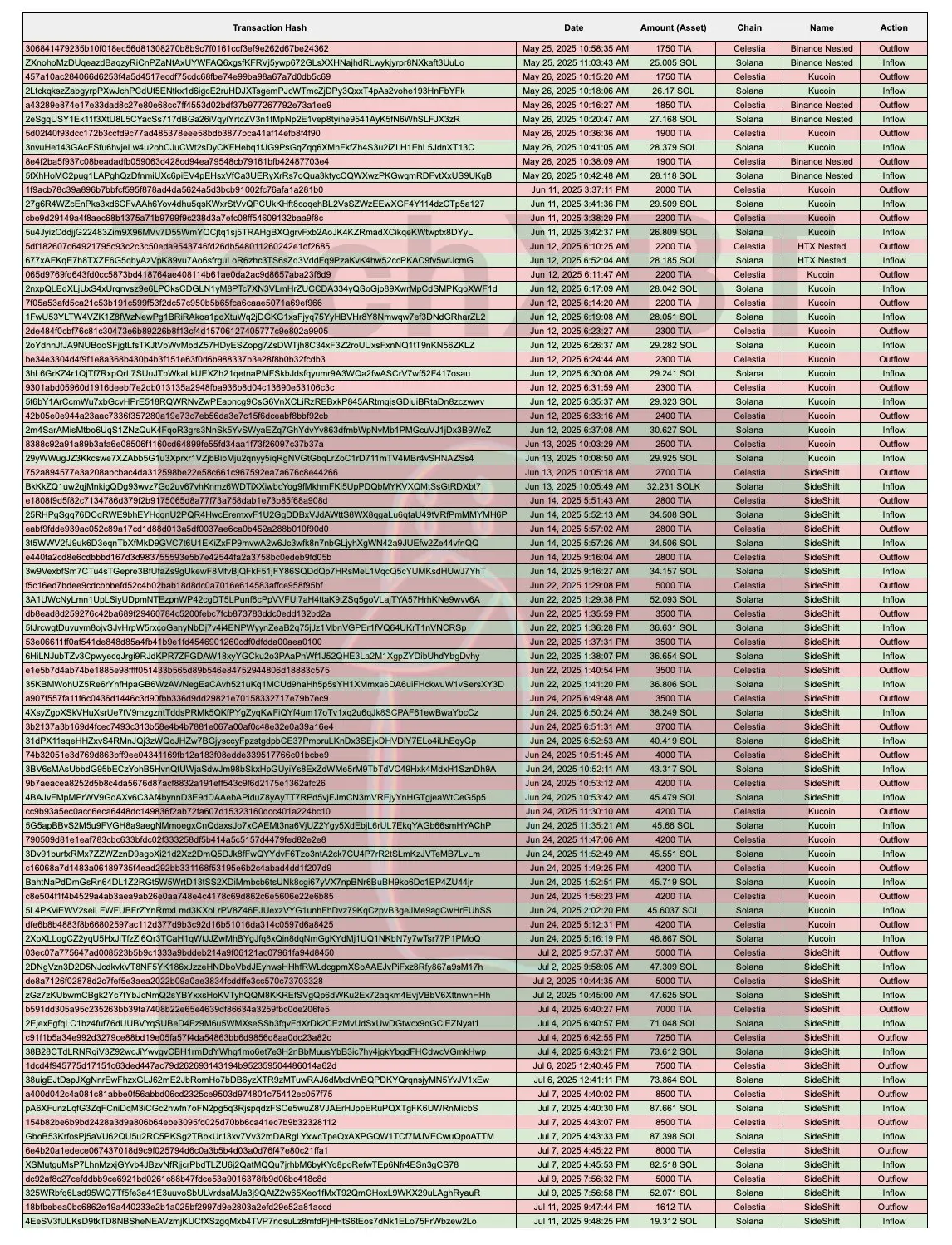

This wallet was initially funded through an instant exchange platform. ZachXBT further analyzed the fund transfer path, ultimately tracing it to a key Celestia address:

celestia1chflqywwp0k8rjzgp3w4447fquyk9ynnc6zws5

The investigation showed that this address sent small amounts of funds to multiple instant exchange platforms (such as KuCoin Nested, SideShift, Binance Nested, HTX Nested, etc.) between May and July 2025, used to fund "side wallets".

These side wallets were not unrelated accounts, but a "bundled wallet cluster" confirmed by ZachXBT through on-chain analysis. They simultaneously sold $ALT on July 14, cashing out over $11 million in total.

Below is a table of instant exchange transactions from Celestia to Solana identified through time analysis:

Besides these 45+ wallets highly financially linked to Crypto Beast, an independent "sniper cluster" sold over $2.6 million, with connections to the $ALT deployment party. However, in terms of influence and fund scale, Crypto Beast seems to be the main character.

Currently, multiple wallets associated with Crypto Beast still hold over 89 million $ALT, approximately 10% of the total supply. After the incident, Crypto Beast deleted the tweets promoting ALT and deactivated the X account.

ZachXBT pointed out that this is not the first time Crypto Beast has operated this way, having used similar "bundled pump and cash-out" modes in multiple previous projects, including $ALPHA, $RICH, $YE, $RUG, $ACE, $JOHN, causing severe losses to many early followers.

The KOLs Who Have "Collapsed"

Crypto Beast's approach is not an isolated case, but a microcosm of a frequently seen "trading script" in the Web3 world.

With massive follower counts and influence, KOLs can easily trigger a wave of hype, while potentially being deeply connected with project deployers and initial token holders, quietly capturing retail investors.

In recent years, ZachXBT has consecutively exposed multiple similar harvesting cases:

BitBoy (Ben Armstrong): A famous crypto YouTube blogger who long received "soft advertising fees" to promote air coins and Altcoins, including pushing rugged tokens like MYX, DISTX, ETHY, LOCK.

Logan Paul: A famous internet celebrity boxer who used his wallets to buy low-priced tokens or Non-Fungible Tokens in advance, promoting and then selling at high prices on social media.

Lark Davis: With 1.4 million followers, frequently recommending low-market-cap projects to followers and quickly selling, including tokens like SHOPX, DOWS, UMB.

Laurent Correia: A famous French internet celebrity and reality show star who manipulated the Non-Fungible Token project "Billionaire Dogs Club", with the team running away within a week of issuance.

ALT's devastating collapse to zero within four hours is just an "ordinary" "harvesting" script in the Web3 world.

Projects can collapse, personas can fall, but lessons must be remembered.