IPO Market Background: A Benchmark Case of Tech Stock Recovery in 2025

After experiencing a prolonged downturn, the global IPO market saw a strong recovery in 2025. According to data from multiple investment banks, the global IPO count in the first quarter of 2025 reached 291, with financing amounts increasing by 20% year-on-year to $29.3 billion. The U.S. market performed exceptionally well, experiencing the "third strongest first quarter in history" with 59 listings, marking a recent high.

The recovery momentum of tech IPOs was particularly evident. From Circle's 600%+ surge to SaaS companies like Service Titan regaining market favor, this reflects investors' strong interest in high-growth areas such as AI, fintech, and blockchain.

Figma's IPO precisely timed the recovery wave. As one of the few IPO companies raising over $1 billion in 2025, Figma not only benefited from improved overall market sentiment but also became a standout benchmark case in this IPO recovery through its unique AI and Web3 strategic positioning.

Multiple macroeconomic advantages provided a solid foundation for this recovery: stabilizing inflation expectations, enhanced monetary policy predictability, and a relatively clear regulatory environment all created conditions for restoring investor confidence. Particularly, the rapid development of AI technology has become the core narrative for IPO candidates across technology, finance, and life sciences industries.

[The rest of the translation follows the same professional and accurate approach, maintaining the original structure and tone while translating to English.]Figma built a cross-edge network effect: Designers' participation benefits developers, and developers' involvement enhances designers' value. Currently, 67% of monthly active users are non-designers, and this "design democratization" not only expands the user base but also creates a powerful lock-in effect.

The switching cost is extremely high. Design and engineering teams typically integrate core workflows into Figma, and migrating to other platforms is both expensive and disruptive. As team adoption increases, the value of real-time collaboration grows exponentially, forming a moderate to strong network effect.

3. Brand Loyalty and Ecosystem

Figma enjoys a "near-fanatical" brand loyalty among design professionals, with brand power that transcends simple tool attributes and is closer to a cultural identity. Through its plugin system and community ecosystem, Figma created a self-reinforcing cycle where third-party developers' contributions further enhance platform stickiness.

4. First-Mover Advantage in Technical Architecture

Figma's browser-first architecture proved its foresight during the pandemic. Its WebGL-based rendering engine, WebSocket real-time synchronization, and WASM core performance optimization built a technology stack difficult to replicate. This architecture enables Figma to run across platforms while maintaining a native application performance experience.

Core Strategy I: AI-Driven Next-Generation Product Development Platform

Figma is no longer just a design tool; it has evolved into an AI-driven, one-stop product development operating system. In its S-1 prospectus, the word "AI" appears over 200 times, reflecting a shift in strategic focus.

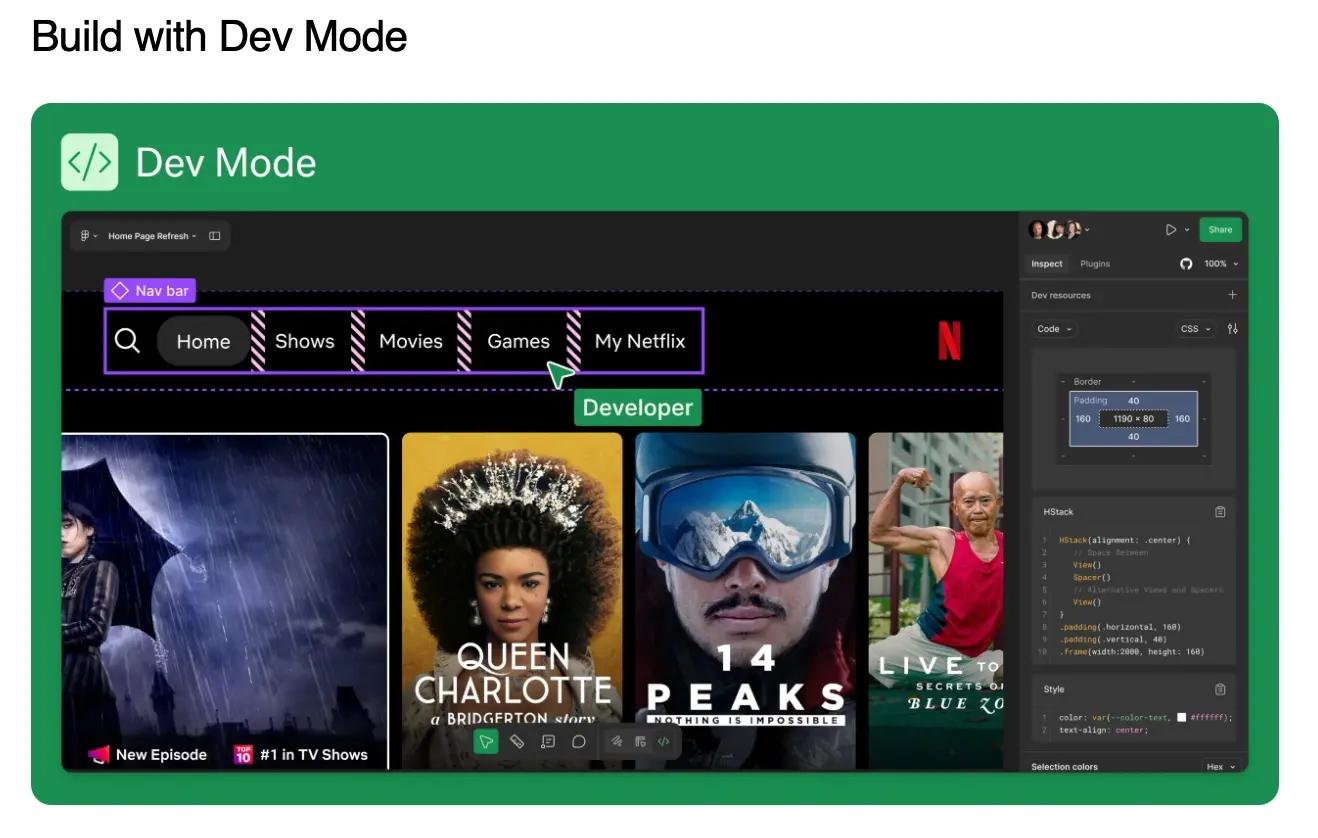

Core Product Matrix: Figma Design (UI/UX design), FigJam (online collaborative whiteboard), Dev Mode (developer mode), and the latest products like Sites, Buzz, Slides.

Deep AI Integration: AI functions are deeply integrated into various platform stages, used for brainstorming, content summarization, design draft analysis, etc. Dev Mode connects design and development through automated code generation, while Buzz provides AI-driven prototyping capabilities.

Revolutionary Figma Make: Represented by the Figma Make generative AI suite, users only need to input a simple text prompt, and AI can generate an interactive product prototype with multiple pages in seconds. This truly achieves a leap from "idea" to "product", greatly improving creative efficiency.

AI-Enhanced Technical Moat: AI integration not only enhances user experience but also strengthens Figma's competitive barriers. Through AI-driven automated workflows, Figma is positioning itself as a full-stack solution targeting the $200 billion AI-driven design market in 2030.

Core Strategy II: Aggressive Web3 Layout, Moving Towards a Chain-Based Future

For ChainCatcher readers, Figma's unprecedented exploration in the Web3 direction is most noteworthy.

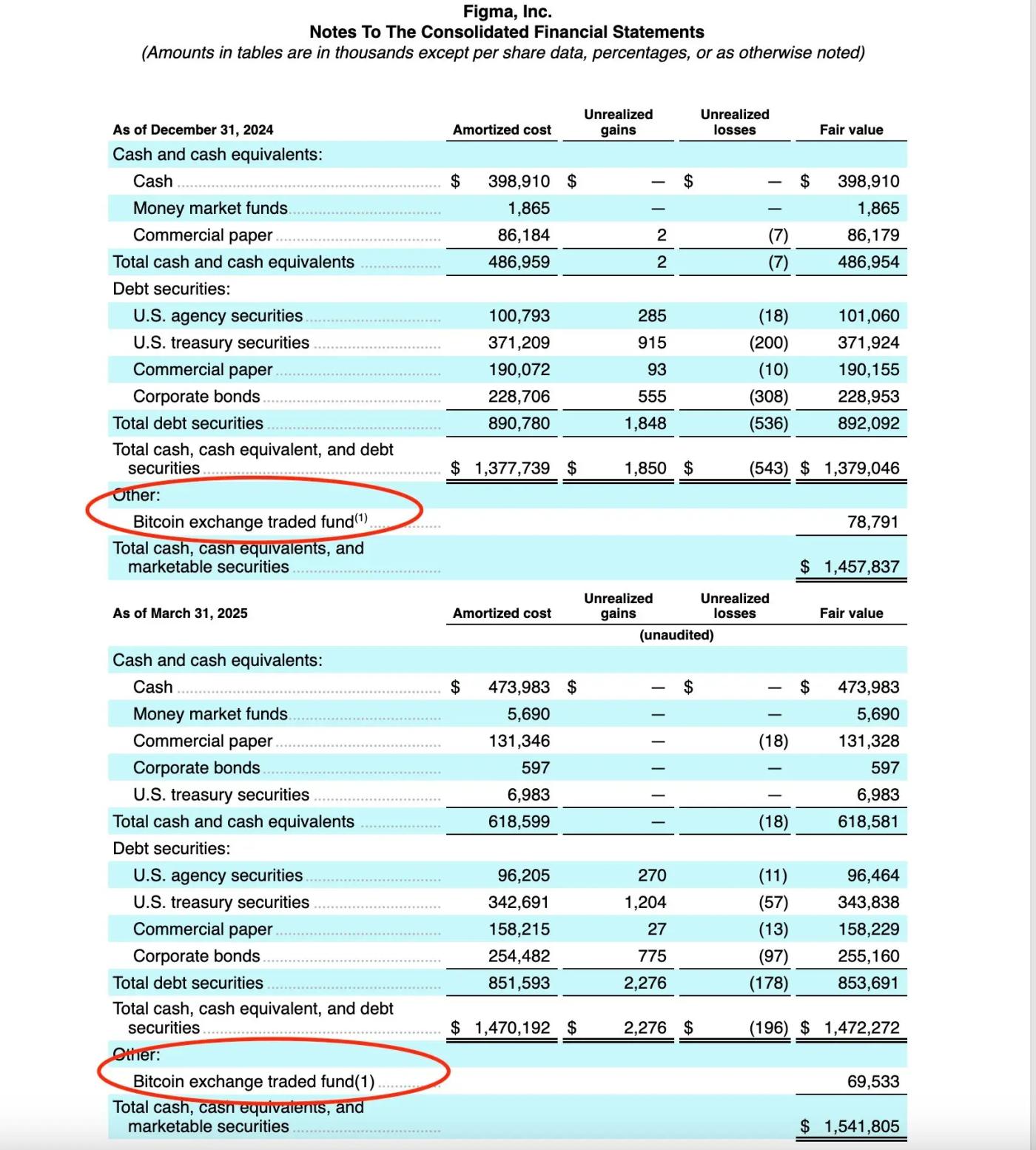

Crypto Asset Holdings: The company's balance sheet holds $69.5 million worth of Bitcoin ETF (invested through Bitwise Bitcoin ETF). This investment began in March 2024, with an initial investment of $55 million, increasing to $69.5 million by March 31, 2025, gaining about 27% returns. Additionally, the company plans to invest another $30 million to purchase more Bitcoin.

More Aggressive Allocation Plan: Figma has authorized a total Bitcoin allocation strategy of $100 million and once planned an ICO through an investment platform supported by Polychain Capital in June 2021. This indicates that Figma does not view cryptocurrencies as short-term speculation but as part of the company's asset allocation.

Establishing "Blockchain Common Stock": The most radical step is that the company's board has officially authorized the establishment of up to 100 million "blockchain common stocks". This is not a symbolic move but lays the legal foundation for future stock tokenization. One can imagine that Figma might use these chain stocks for employee incentives, achieve on-chain governance, or explore entirely new shareholder dividend models.

As a large tech company about to go public, Figma's explicit Web3 strategy in its prospectus is not to be underestimated. This strategic choice reflects Field's deep understanding as an early Crypto investor and firm belief in the long-term value of blockchain technology.

*Figma P/S Based on IPO Issuance Price

Conclusion: The Ultimate Test of a New SaaS Paradigm

Figma's IPO provides the market with an extremely attractive sample: it proves that the most successful software companies today must not only possess an ultimate product experience and efficient growth model, but also demonstrate forward-thinking and execution in embracing cutting-edge technologies like AI and Web3.

Bull Case: Figma becomes the "system of record" and "central hub" for all digital product creation, with its AI and Web3 layout building an insurmountable moat, successfully defining the next generation of software. The successful execution of its internationalization strategy will further expand its global market share, especially gaining a dominant position in the rapidly growing Asia-Pacific market.

Bear Case: The capabilities of general AI models are rapidly developing, which will "commoditize" core design functions, slow growth triggers price wars, and the volatility of its crypto strategy is avoided by Wall Street investors. Meanwhile, the high costs of international expansion may drag down short-term profitability.

Regardless of the future, everyone's eyes will be focused on $FIG. It is not just the listing of a company, but the ultimate test of whether a new paradigm of AI-native, Web3-friendly, product-driven growth can ultimately be recognized in the public market. Against the backdrop of IPO market recovery in 2025, Figma has become an unavoidable benchmark case for tech stock investors.