1. Introduction

In 2013, 19-year-old programmer Vitalik Buterin envisioned a bold vision: he published a white paper titled "Ethereum," outlining a blockchain blueprint that surpassed Bitcoin's capabilities. To make this vision of a "world computer" a reality, he and his team raised approximately $18 million through an initial coin offering (ICO), ultimately launching the Ethereum network in 2015. This revolutionized Web3 smart contracts and decentralized applications (DApps). Over the past decade, it has weathered both booms and busts, experienced technological innovation, the rise of financial applications, and faced numerous challenges from both within and without. Despite these upheavals, it has emerged stronger and stronger. Today, Ethereum is no longer just a bold idea; it has become a mainstay in the blockchain space.

This article will review Ethereum's milestones and technological evolution, analyze its revolutionary journey in DeFi, NFTs, and DAOs, and explore key topics such as Layer 2 scaling, the competitive landscape, and future challenges. Through this series of analyses, we will witness Ethereum's decade-long journey from its vision of a "world computer" to a global decentralized financial infrastructure, and look forward to its possible evolution over the next decade.

2. Review of Ethereum’s ten-year development

Ethereum's ten years have been a significant story in the history of blockchain development. Throughout the decade, Ethereum has weathered numerous ups and downs, gradually evolving from an early "hacker playground" into a new infrastructure supporting hundreds of billions of dollars in value. Each milestone not only fueled Ethereum's own evolution but also reflected the transformation and maturity of the entire crypto industry.

- 2013-2015: Vitalik publishes the white paper, crowdfunding begins in 2014, and the Genesis Block is created on July 30, 2015, marking the official launch of the Ethereum mainnet and the beginning of the era of smart contract platforms.

- 2016 Ideals and Crisis: Smart contract platforms began to take shape, and a major security incident called "The DAO" occurred, triggering a community hard fork and the birth of Ethereum Classic (ETC).

- 2017: Prosperity and Challenges: The ICO craze exploded, and Ethereum became the platform for the issuance of many tokens; in the same year, the ERC-721 standard was launched, and NFT applications such as CryptoKitties appeared for the first time.

- 2018-2019 Winter Dormancy: The ICO bubble burst, and the price of ETH plummeted from a peak of $1448 to $84; the Ethereum community focused on technical upgrades (such as hard forks such as Byzantium and Constantinople) to lay the foundation.

- The rise of DeFi in 2020: Decentralized finance exploded, and “liquidity mining” ushered in the summer of DeFi. Protocols such as Uniswap and Compound grew rapidly, while network congestion and high gas fees became prominent.

- Peak moments of 2021: London upgrade implemented EIP-1559, introducing a fee burning mechanism; Layer2 solutions Arbitrum and Optimism mainnet; the NFT craze swept (BAYC, etc.), and the ETH price hit a historical high of nearly $4878.

- 2022 Turning Point and Transformation: “The Merge” was completed, with Proof of Work transitioning to Proof of Stake and energy consumption reduced by 99%; however, the crypto market cooled that year (Terra crash, FTX incident), and ETH briefly fell below $1,000.

- 2023 Revitalization and Upgrade: Shanghai/Shapella upgrade enables staking withdrawals, marking the completion of Ethereum's PoS transition; Arbitrum and other Rollup ecosystems mature, and ZK Rollup solutions such as zkSync and StarkNet are implemented.

- 2024 Expansion and Integration: The Cancun/Dencun upgrade (including EIP-4844) reduces Layer 2 fees by approximately 90% and improves data availability; the United States approves the ETH spot ETF, and traditional institutions enter the market in large numbers.

- 2025 Moving Forward: Account abstraction introduced (Pectra upgrade, etc.), more flexible wallets and contract accounts; Ethereum’s market capitalization approaches $500 billion, becoming the global decentralized financial infrastructure.

From pioneering smart contract platforms to embracing proof-of-stake consensus, Ethereum has repeatedly surpassed itself at key milestones. The lessons learned from these developments have not only strengthened the resilience of the Ethereum network but also guided the future evolution of the technology.

3. Technological Evolution: From “World Computer” to Sharding and Rollup

When Ethereum was first launched, it was dubbed the "world computer." Its core innovation lies in its Turing-complete smart contract platform, which extends the blockchain into a programmable decentralized computer. Developers can deploy smart contracts on Ethereum, enabling the blockchain to host a wide range of complex applications, extending beyond simple transactions. Since its mainnet launch in 2015, tens of millions of smart contracts have been deployed globally, supporting a thriving application ecosystem. However, Ethereum's early use of a Proof-of-Work (PoW) consensus mechanism, while ensuring decentralization and security, also limited performance. The ICO boom of 2017-2018 and the rise of applications like CryptoKitties led to network congestion and soaring transaction fees, exposing throughput bottlenecks. A single chain's capacity of only a dozen transactions per second struggled to meet growing demand, with gas fees exceeding $50 at peak times. This performance and cost dilemma prompted the Ethereum community to launch the ambitious "Ethereum 2.0" upgrade roadmap, designed to significantly improve scalability and sustainability while maintaining decentralized security.

1. Change of consensus mechanism: PoW to PoS

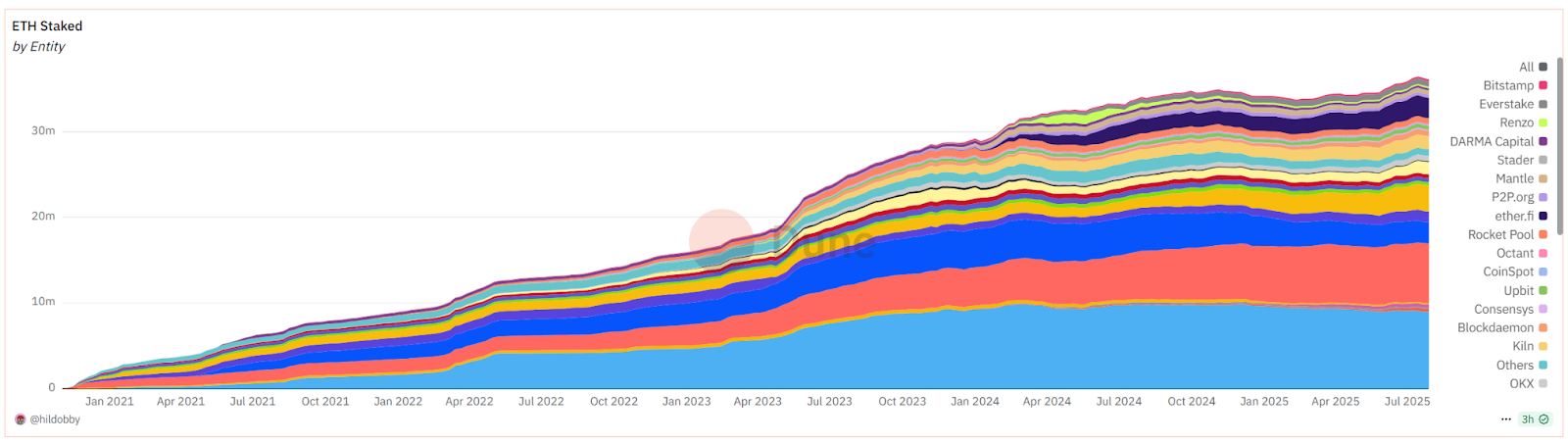

After years of research and preparation, Ethereum ushered in its epic upgrade, The Merge, in 2022. Prior to this, the Ethereum team launched an independent PoS Beacon Chain as a trial in 2020 and repeatedly postponed the PoW chain's "difficulty bomb" to buy time for the switch. Finally, on September 15, 2022, the Ethereum mainnet successfully completed the merge without downtime, transitioning from the energy-intensive PoW consensus to the efficient Proof-of-Stake (PoS) consensus. This transition reduced Ethereum's energy consumption by 99.95% and introduced a staking mechanism: users holding ETH could stake their tokens to earn an annualized return of approximately 4%, participating in network validation and security. This made ETH assets "productive" and enhanced network security. As of July 31, 2025, over one million validators on Ethereum had staked, locking approximately 36.11 million ETH (approximately 29.17% of the circulating supply) to secure the network. The PoS mechanism also significantly reduces Ethereum’s new coin issuance rate by about 90%. Combined with the fee burning mechanism, ETH even exhibits net deflation during busy periods.

Source: https://dune.com/hildobby/eth2-staking

2. Key Proposals and Protocol Upgrades

Concurrent with the consensus transition, a series of Ethereum Improvement Proposals (EIPs) were implemented, shaping the network's economic and performance characteristics. The most impactful of these was EIP-1559, which introduced a basic fee burning mechanism during the London upgrade in August 2021. This proposal directly burns a portion of each transaction fee. Since its implementation, over 4 million ETH have been burned, optimizing the fee market while also reducing ETH supply growth, fostering deflationary expectations. Furthermore, EIP-4844, deployed in March 2024, significantly boosted Ethereum's data throughput. By introducing "blob" transactions, it reduced the cost of submitting data to Layer-2 Rollups. According to statistics, its implementation directly reduced Rollup gas costs by more than half. These EIPs not only improve Ethereum's user experience but also lay the foundation for even larger-scale expansion in the future.

3. Towards Sharding and Modular Architecture

To fundamentally overcome performance bottlenecks, Ethereum has developed the "sharding" technology. Sharding splits the blockchain state and transaction load across multiple parallel shard chains, enabling parallel scalability. Ethereum's consensus layer coordinates these shards, ensuring shared security while independently processing transactions. This approach is expected to boost Ethereum's transaction throughput to over 100,000 and reduce the cost of individual transactions to a fraction of a cent. According to the roadmap, full sharding may be gradually introduced between 2025 and 2026. While full sharding has not yet been implemented, its concept is partially implemented in the current Rollup scaling solution. Rollup is a second-layer network built on Ethereum that reduces mainchain load by moving large numbers of transactions off-chain and then submitting the resulting data in batches to the mainchain. Over the past few years, the Optimistic Rollup and ZK Rollup technology approaches have advanced in parallel, giving rise to numerous second-layer networks such as Optimism, Arbitrum, zkSync, and StarkNet. The Ethereum mainnet is gradually transforming into the settlement layer for these second layers: the mainnet is responsible for providing ultimate security and data availability, while Rollup is responsible for high-throughput transaction processing. Together, these two enable the Ethereum architecture to evolve from a single-layer chain to a multi-layered modular network.

4. A leap in performance and scalability

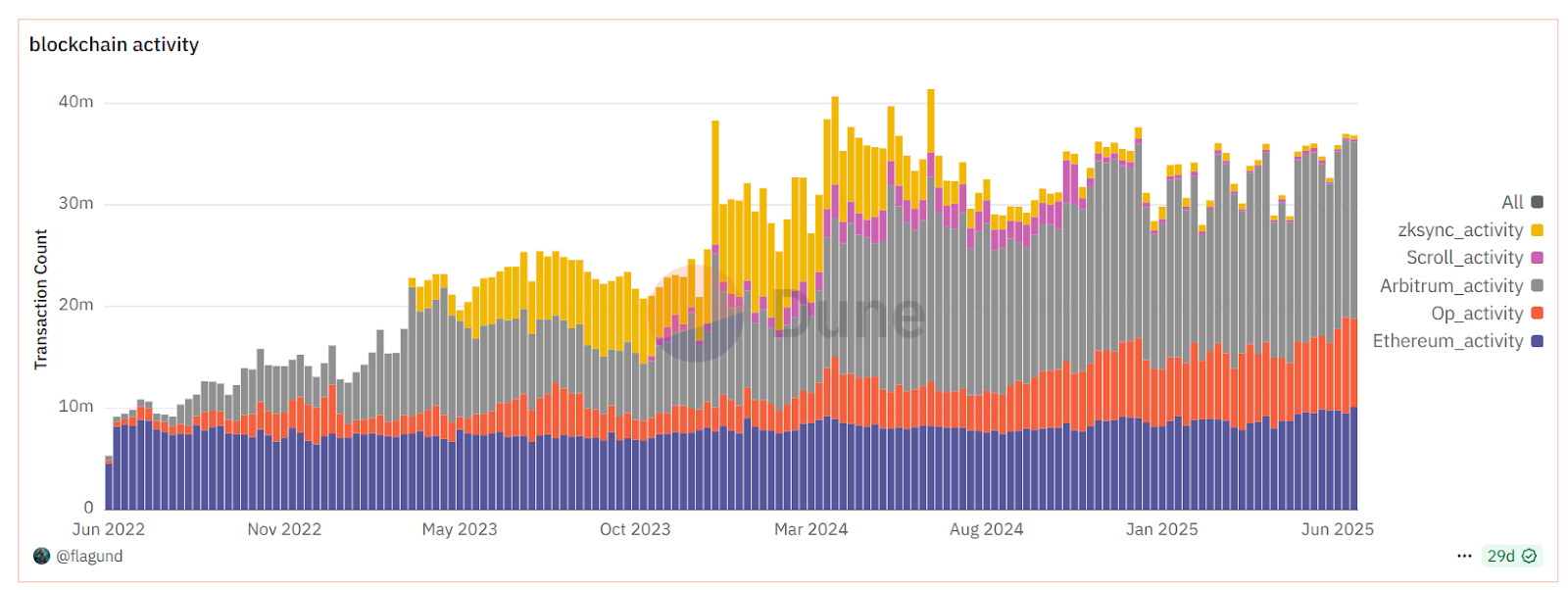

Through PoS upgrades and Layer 2 scaling strategies, Ethereum's technological evolution over the past decade has consistently revolved around the core goals of improving performance and lowering barriers to entry. Today, the mainnet and various Layer 2 networks operate in tandem: the mainnet processes approximately 1.8 million transactions daily while maintaining a high degree of security and decentralization. Meanwhile, the total transaction volume of Layer 2 networks has surpassed the mainnet by several times, with over 5 million transactions executed daily across various Ethereum Layer 2 networks. Thanks to Layer 2 offloading, congestion on the Ethereum mainnet has been significantly alleviated, and gas fees for regular operations have dropped from tens of dollars per transaction at peak times to a few cents on the mainnet and less than one cent on Layer 2. As a result, the on-chain interactive experience is approaching the speed and cost of Web2 applications. From consensus mechanism upgrades and virtual machine optimizations to sharding and Rollup scaling, each technological upgrade has made Ethereum more powerful and efficient while maintaining decentralization.

Source: https://dune.com/flagund/l2-stats-vs-ethereum

4. Ethereum Ecosystem Application Development

The evolution of technical architecture has laid the foundation for a thriving application ecosystem. Over the past decade, an unprecedented world of open finance and digital assets has emerged on Ethereum, with breakthroughs in various fields, from decentralized finance (DeFi) to non-fungible tokens (NFTs) to decentralized autonomous organizations (DAOs).

1. DeFi Revolution: Ethereum’s New Financial System

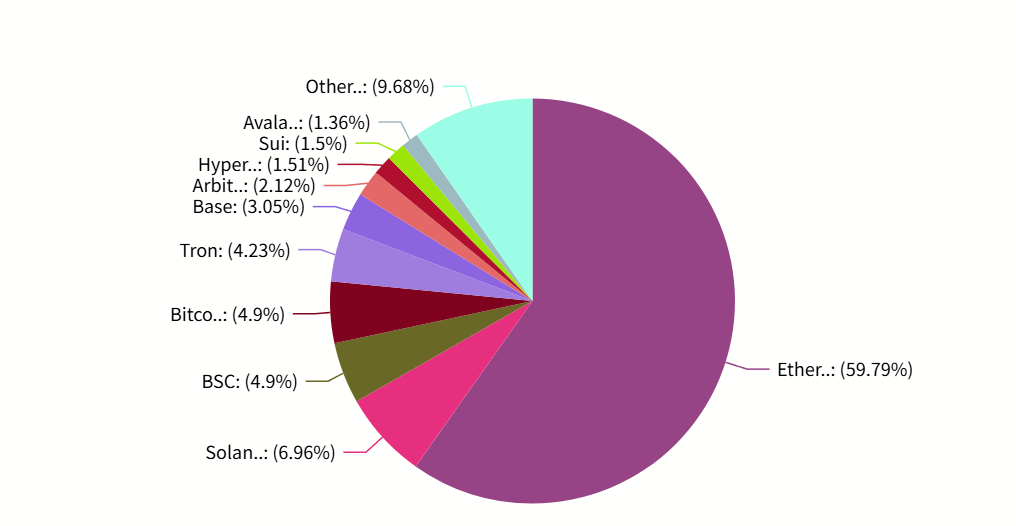

In 2017, rudimentary decentralized financial applications emerged on Ethereum. MakerDAO launched the over-collateralized stablecoin DAI, laying the foundation for digital currency lending. Launched in 2018, the decentralized exchange Uniswap introduced the automated market maker (AMM) model, enabling token swaps without intermediaries through code, revolutionizing trading models. Between 2019 and 2020, protocols like Compound and Aave further expanded the on-chain lending market. The real explosion began with the "Summer of DeFi" in 2020: Compound's issuance of a governance token sparked a liquidity mining craze, with users eagerly depositing assets into various protocols to earn incentives. Within a few months, the total value locked (TVL) on Ethereum soared from less than $1 billion to tens of billions, translating into a surge in network transaction volume and fees. By the end of 2021, the DeFi landscape reached an all-time high, with the combined TVL across protocols exceeding $100 billion for the first time. Although the market has experienced volatile adjustments since then, as of mid-2025, the DeFi ecosystem has regained its upward momentum, with global TVL rebounding to approximately US$150 billion, of which nearly 60% (approximately US$85 billion) is achieved on the Ethereum network, firmly ranking as the largest DeFi public chain.

Source: https://defillama.com/chains

A number of representative DeFi projects have emerged on Ethereum, each creating a new financial model:

- Uniswap decentralized exchange: The first automated market maker (AMM) model, which automatically matches transactions using a constant product formula without the need for order books and centralized intermediaries, enables peer-to-peer asset exchange. At one point, the trading volume on Ethereum exceeded that of many traditional exchanges.

- Sky (formerly MakerDAO) stablecoin system: Introduces an over-collateralization mechanism to issue decentralized stablecoin DAI. Users can pledge crypto assets to borrow stablecoins, which creates a loan and stablecoin issuance model that does not require banks, providing a basic value anchoring tool for the DeFi ecosystem.

- Aave Lending Protocol: Provides a permissionless lending market with algorithmically adjusted interest rates in real time, allowing users to deposit assets to earn interest or collateralize other assets for lending. Aave also introduces innovative features like flash loan, allowing users to borrow and repay uncollateralized assets in a single transaction, significantly expanding the use cases of decentralized finance.

Through these protocols, many traditional financial services (currency exchange, lending, derivatives trading, etc.) have been transplanted and reshaped on-chain. This booming open finance demonstrates that blockchain can support high-value financial activities and provide 24/7 global services. Ethereum's powerful smart contract foundation and security enable the free combination of protocols. This Lego-like innovation further accelerates the iteration of financial products. It's no exaggeration to say that DeFi has triggered a paradigm shift in the financial industry: from centralized institutional monopoly to decentralized network collaboration, and from manual review to automated execution. In this process, Ethereum has become the foundational layer for the global "Internet of Value."

2. NFT craze: a new frontier for digital assets

At the end of 2017, an Ethereum game called CryptoKitties introduced people to the joy of blockchain-based NFT digital collectibles: users could own and breed unique virtual cats. The game unexpectedly became a hit, even clogging up the Ethereum network due to excessive transactions. NFTs are a token standard (commonly ERC-721) that uniquely marks ownership of assets on the blockchain. They can transform digital content such as artwork, collectibles, and game props into unique and freely tradable assets.

After an initial exploratory phase, the NFT market exploded in 2021. Ethereum saw the emergence of phenomenal projects like CryptoPunks and BAYC Yacht Club (BAYC). These pixelated avatars and cartoon apes became sought-after "digital fashion brands," fetching hundreds of ETH at auction and attracting celebrity and institutional endorsements. In March 2021, an NFT by digital artist Beeple fetched a staggering $69.3 million at Christie's, heralding the official arrival of digital art on the mainstream auction stage. Ethereum, as the primary platform, accounts for the vast majority of NFT transactions, fundamentally integrating blockchain technology into popular culture, including art, entertainment, and fashion. OpenSea, a major trading platform, briefly topped the Ethereum DApp revenue charts in 2021. Major brands and sports leagues are also tapping into the fan economy by issuing NFTs, such as the NBA's "Top Shot" highlight moment NFTs and game developers experimenting with trading in-game items on-chain. Of course, the NFT craze has also exacerbated the congestion of the Ethereum network. During the popular NFT minting period, gas fees soared to sky-high prices, and ordinary users were often discouraged by the high transaction fees.

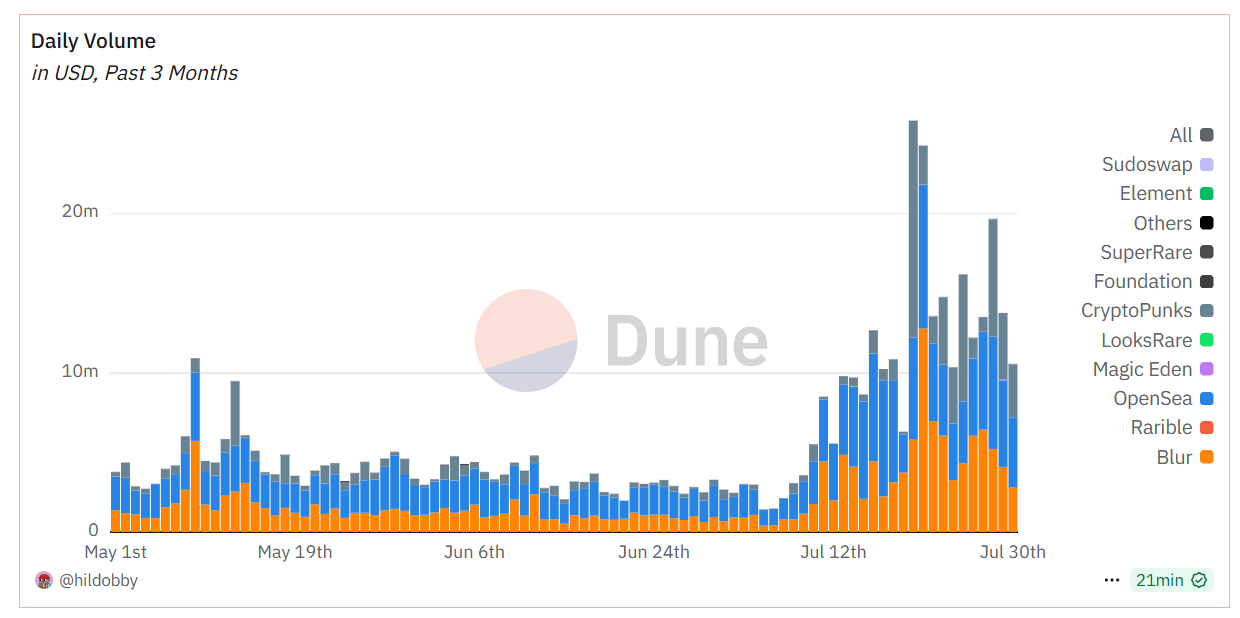

After several years of development, the NFT market has gradually returned to a more rational state after the frenzy. Although the Crypto Winter that began in 2022 caused NFT prices and trading volumes to decline, the sector has not disappeared, but has instead begun to evolve towards greater practical applications. For example, NFTs are increasingly being used as gaming assets, allowing players to truly own tradable in-game items; some NFTs are used as digital identities and membership credentials, granting holders special rights; and NFTs from major brands emphasize the practical value of engaging with fans. Currently, the daily NFT trading volume on Ethereum still reaches $10 million, and "digital collectibles" have become an indispensable component of the blockchain field.

Source: https://dune.com/hildobby/ethereum-nfts

3. DAO Governance: Reshaping the Way Organizations Collaborate

Ethereum has not only fostered a new form of asset but also a new organizational form: the decentralized autonomous organization (DAO). A DAO is a community-governing organizational structure that uses smart contracts and token voting to achieve community self-governance. Its purpose is to enable all participants to make decisions and manage funds collectively, without a centralized leader. As early as April 2016, the first large-scale DAO experiment took place on Ethereum: a decentralized venture capital fund called "The DAO." It raised over $150 million in ETH and attempted to allow token holders to vote to fund entrepreneurial projects. However, due to a code vulnerability, The DAO was hacked, resulting in losses of approximately $60 million. This incident led to Ethereum's infamous hard fork. The new chain, intended to recover the losses, retained the Ethereum name, while the original chain, which maintained a hands-off approach, became Ethereum Classic (ETC). Despite the failure of The DAO, the concept of autonomous organizations it pioneered continues to thrive. In recent years, numerous projects and communities have adopted the DAO model for governance: MakerDAO holders vote to determine the stablecoin fee and parameters, the Uniswap community proposes protocol upgrades, there are also investment-focused LAOs, PleasrDAO for collecting rare items, and even the sensational ConstitutionDAO in 2021, where thousands of people bid on a copy of the U.S. Constitution through an Ethereum crowdfunding campaign. Ethereum's own development and upgrade process is, to some extent, a manifestation of open governance: anyone can propose an EIP improvement, and after community discussion and client-side consensus, the network is upgraded. This governance model of multi-party collaboration and open debate has profoundly influenced numerous subsequent crypto projects, becoming a model for "community governance."

Ethereum provides a reliable infrastructure for DAOs: on-chain multi-signature wallets for escrow, governance tokens for voting decisions, and smart contracts for executing voting results, with all processes publicly accessible. This transparent and trustworthy mechanism significantly reduces the trust required for large-scale collaboration, allowing even strangers to form a "digital community" around a shared goal. While DAOs conceptually transcend traditional organizational boundaries, they also face practical challenges. For example, participation in many DAO governance votes is low, creating a challenge in incentivizing token holders to actively exercise their rights. Furthermore, the open and slow decision-making process often makes it difficult to respond to rapidly changing market conditions. Furthermore, a small number of "large holders" with large token holdings hold significant influence in DAOs, raising the question of how to prevent governance from becoming a monopoly.

5. Competition and Challenges Facing Ethereum

Currently, there are over 4,000 decentralized applications (dApps) running on the Ethereum mainnet, covering lending, trading, payments, gaming, social networking, and other sectors. The scale of its developer ecosystem remains the largest among public blockchains globally. The more applications and users join, the more Ethereum strengthens its position as the "Internet of Value" and its ecological moat. However, behind this prosperity, Ethereum also faces unprecedented competitive pressure and internal challenges.

1. Competitive Landscape: Ethereum’s Position in the Hundred Chain Competition

Looking back over the past decade, there have been numerous short-lived competing chains claiming to be "Ethereum killers." EOS, launched in 2017, boasted superior performance to Ethereum and raised a record-breaking $4.2 billion in its ICO. However, EOS quickly exposed issues such as centralized governance after its launch: just days after its mainnet launch, its nodes froze accounts, sparking community outcry. Since then, EOS's development activity and economic activity have plummeted. Binance Smart Chain (BSC), which emerged in 2020, attracted a large number of users and DeFi projects with its extremely low transaction fees. However, BSC utilizes a Proof-of-Authority consensus with only 21 validators, who are elected daily by Binance Chain's 11 supernodes, resulting in a high degree of centralized control. The potential risks posed by this centralized architecture have made many community members wary of BSC. Solana, which emerged in 2021, boasts a throughput of thousands of TPS and sub-second confirmation times, and is considered a "high-speed chain" for mass consumer applications. Amid the NFT and meme coin craze, Solana's on-chain transaction volume surged, briefly showing signs of challenging Ethereum. However, Solana's high performance also comes with a reduction in decentralization. Its network has repeatedly experienced large-scale outages (sometimes lasting several hours), preventing users from transferring their assets and raising questions about its reliability.

Of course, competitors are still rapidly evolving. Solana, thanks to the meme-driven wealth effect, briefly surpassed Ethereum in gas fees. The concept of modular blockchains is also gaining momentum. For example, Celestia focuses on providing a data availability layer, while EigenLayer proposes a "re-staking" solution that reuses Ethereum's trust layer. These are all exploring new blockchain architectures. While these new narratives and technological approaches expand the boundaries of blockchain applications, they also challenge Ethereum's role. In a multi-chain, layered future, how can Ethereum maintain its core position while collaborating and co-prospering with other chains? This is a new question that requires consideration.

2. Challenges and Responses Faced by Ethereum

After a decade of development, Ethereum has established its leading position in the industry, but it still faces many inherent challenges. These challenges include technical bottlenecks as well as challenges in market and governance.

- Long-standing scalability bottlenecks: The Ethereum mainnet's limited transaction processing capacity and high gas fees have not only drawn criticism from ordinary users but have also significantly limited its appeal to the mainstream public. This issue has directly led to the emergence of various scaling solutions, the most important of which is the rise of Layer 2 networks. However, while Layer 2 alleviates the pressure on the mainnet, it also introduces new challenges: the independence of different Layer 2 networks and their lack of direct interoperability results in liquidity being dispersed across various Rollup ecosystems. This fragmentation, to a certain extent, undermines the original intention of Layer 2 to improve user experience.

- Balancing performance and decentralization: The famous "Blockchain Trilemma" theory in the blockchain field states that decentralization, security, and scalability cannot be achieved simultaneously. Since its inception, Ethereum has prioritized decentralization and security. This means that the barrier to entry for running nodes is relatively low, enabling more participants around the world to independently maintain the network. However, this comes at the cost of limited single block capacity and block production speed, which in turn affects transaction throughput and confirmation times.

- Security challenges: As a programmable blockchain, smart contracts on Ethereum have repeatedly exposed vulnerabilities and suffered attacks, each of which served as a wake-up call for developers and users: once the on-chain code is released, it cannot be changed, making security audits and risk prevention crucial.

- Uncertainty in the external environment: As DeFi integrates with traditional finance and NFTs permeate mainstream culture, regulators around the world are increasingly concerned about the compliance risks of on-chain activities. Some Ethereum applications, such as decentralized exchanges and stablecoin issuance, may be incorporated into existing financial regulatory frameworks. Compliance pressures could drive some large players to exit or shift to permissioned blockchain environments, impacting the flow of talent and capital within the Ethereum ecosystem.

- Ethereum's governance and roadmap execution: As a decentralized, open-source protocol, Ethereum upgrades network functionality through the EIP proposal process. All consensus-layer changes require extensive community discussion and multi-client implementation. This open and transparent governance model ensures participation from all stakeholders, but it also results in lengthy decision-making processes and high coordination costs. Past major upgrades (such as the Berlin, London, and Paris hard forks) have experienced multiple rounds of delays and controversy. The rise of Ethereum "staking-as-a-service" platforms has led to a trend of centralization in the staking market: a small number of entities, such as Lido, Coinbase, Kraken, and Binance, control over half of all ETH staked, raising concerns about Ethereum's governance and transaction censorship.

To address the above challenges, the Ethereum community is adopting a multi-pronged strategy:

- Promote the Rollup-centric route: In the short term, rapidly expand capacity through Rollup solutions such as Optimism and Arbitrum. In the medium and long term, promote sharding technology to increase on-chain data processing capabilities by an order of magnitude, providing support for Rollup to further reduce costs.

- Ensuring decentralization: Maintaining high decentralization standards while shifting scaling to Layer 2. Following its transition to PoS, Ethereum is focusing on technologies like light clients, state expiration, and data sampling, hoping to reduce the resource requirements of full nodes and enable more ordinary users to run Ethereum nodes on their home computers or mobile phones.

- Strengthen security and developer support: Establish a bug bounty program and optimize the smart contract development framework to reduce security incidents; through the annual DevCon developer conference and hackathon events, bring together global developers to share knowledge, collaborate on innovation, and inject continuous vitality into the ecosystem.

- Regulatory Communication and Innovation Protection: Industry organizations, including the Ethereum Foundation, are actively communicating with regulators around the world, hoping to develop rules that both encourage innovation and protect users. For example, to address anti-money laundering (AML) and sanctions compliance, developers are exploring ways to provide on-chain auditing tools without sacrificing privacy.

- Improved governance mechanisms: The Ethereum community is already experimenting with introducing diversified staking clients, promoting trustless staking pools (such as Rocket Pool, SSV Network, etc.), and imposing economic penalties for censorship in extreme cases.

6. Ethereum’s Latest Developments and Future Outlook

On July 30, 2025, Ethereum celebrated its tenth anniversary. As the world's second-largest crypto asset and the largest smart contract platform, Ethereum is becoming a vital component of global investment portfolios. Its influence has permeated the intersection of the crypto economy and traditional finance, holding the potential to drive the next wave of innovation.

- Market capitalization and institutional participation: Ethereum's institutional era has arrived, with institutional funds pouring into Ethereum spot ETFs. Publicly listed companies such as Bitmine and SharpLink have established ETH treasury strategies, viewing ETH as a long-term value reserve and strategic asset.

- Improved Regulation and Mainstream Acceptance: The regulatory environment has improved compared to five years ago. The US Congress is pushing legislation recognizing ETH as a commodity rather than a security, and "on-chain dollar" stablecoins are now included in the regulatory framework, clearing the way for large institutions to confidently enter the Ethereum ecosystem. Companies like Visa used Ethereum to settle USDC as early as 2021, and banks like JPMorgan Chase are also experimenting with issuing tokenized deposits on Ethereum-compatible networks. These developments indicate that Ethereum is integrating into the mainstream financial system.

- RWAs on-chain: Since 2024, the tokenization of physical assets has become a new trend, with Blackstone, Franklin, and others issuing tokenized funds based on Ethereum. Currently, over 70% of on-chain RWA issuance occurs on Ethereum and its Layer 2. In the future, more traditional assets such as bonds and equities may be digitized and transferred through the Ethereum network, expanding the boundaries of blockchain applications.

- Technology Roadmap Outlook: Over the next few years, Ethereum development will shift its focus from theoretical research to increasing its practical impact. On a technical level, in addition to implementing sharding technology and achieving a 100-fold increase in capacity, the platform will also focus on improving user experience. Account abstraction will eliminate the need for users to manage cumbersome private keys, and features like social wallet recovery will be gradually implemented. Privacy technologies (such as ZK-EVM) will enhance transaction confidentiality. These advancements will lower the barrier to entry for average users.

Looking back on Ethereum's first decade, we witness a recurring story of rebirth amidst doubt. Whenever faced with bottlenecks, Ethereum always found a way forward through the wisdom and perseverance of its community. If the past decade has reshaped the underlying logic of digital finance, then in the next, this "world computer" is expected to become public infrastructure, integrated into the backends of various industries, playing a key role in finance, commerce, governance, and more, enabling the true interconnectedness of all things and the free flow of value. From the initial white paper vision to the now operational global network, Ethereum's story is still being written. What the next decade holds is even more compelling.

about Us

Hotcoin Research, the core investment research hub of the Hotcoin ecosystem, is dedicated to providing professional, in-depth analysis and forward-looking insights to global cryptoasset investors. We have established a three-in-one service system: trend analysis, value discovery, and real-time tracking. Through in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and 24/7 market volatility monitoring, combined with our twice-weekly "Hotcoin Selection" live strategy broadcasts and "Blockchain Today's Headlines" daily news updates, we offer precise market insights and practical strategies for investors of all levels. Leveraging cutting-edge data analysis models and a network of industry resources, we continuously empower novice investors to develop a cognitive framework, assist professional institutions in capturing alpha returns, and jointly seize value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries inherent risks. We strongly recommend that investors fully understand these risks and invest within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com