Strategy (previously MicroStrategy) recently made its third-largest Bitcoin purchase based on dollar cost. The company made this move just before announcing a significant success in the second quarter of 2025, indicating a long-term commitment.

Chairman Michael Saylor appeared in a recent interview to explain the company's future vision. Despite BTC slightly declining last week, he remains confident in his decades-long vision for cryptocurrency.

Strategy Continues to Buy Bitcoin

Strategy is a pioneer in Bitcoin financial techniques and has become a world leader in corporate cryptocurrency acquisition.

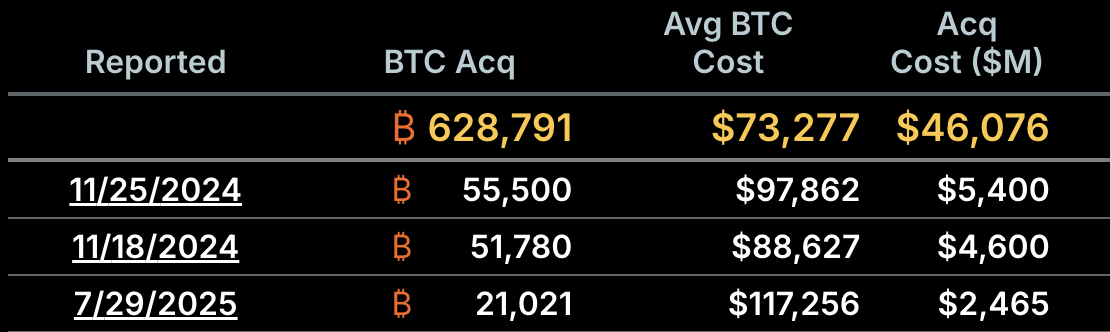

After consecutive stock offerings and ambitious purchases, the company made its third-largest purchase last week in dollar terms. This surpassed the company's largest move in 2025 and demonstrated a firm commitment.

Strategy's latest Bitcoin acquisition is impressive for several reasons. First, it occurred at the end of the company's highly profitable quarter, following the bleak performance in the first quarter of 2025.

Strategy continued purchasing before the new net profit was fully realized. Second, the Bitcoin price briefly declined shortly after this purchase for unrelated reasons.

MicroStrategy Bitcoin Strategy, What's Next?

To explain his unconventional moves, Strategy Chairman Michael Saylor agreed to an interview to discuss this ambitious Bitcoin purchase.

His statements were very passionate, dismissing minor price drops as routine.

"This is digital capital. Using traditional finance as capital means underperforming the S&P 500 by 10% annually. You're burning money. With Bitcoin, you're outperforming the S&P by about 40% annually. The more capital you accumulate and hold, the faster you create shareholder value," Saylor argued.

Essentially, Saylor downplayed the potential risks of Strategy's Bitcoin purchases, imagining a scenario where retail traders continue buying shares for higher returns.

Rather than claiming the company will hold assets forever, Saylor mentioned wanting to hold Bitcoin for 21 years. Meanwhile, these stock sales generate substantial profits.

When asked if he was interested in investing in other altcoins, he praised the TON ecosystem. He commended TON's technological innovation and passionate community, but Saylor remains a staunch BTC maximalist.

Whatever happens, Saylor will not be getting off this train soon. He mentioned Strategy investors' desire to achieve double returns using Bitcoin but claimed there is even more potential.

For now, the company will continue to maintain its corporate confidence in BTC.