This article is machine translated

Show original

Recently, Ray Dalio officially retired, with little media coverage. As an important teacher in my investment field, retiring at the 2025 milestone and stepping down gracefully is actually the best strategy. Currently, investment masters with over 20 years of experience are basically adopting defensive strategies. This can be seen from their 13F institutional holdings reports. 🧐

So I was curious about what strategy Dalio would choose for asset allocation in his family fund after retiring from Bridgewater, the fund he founded 50 years ago. Upon further exploration, I was surprised to find it's basically consistent with Buffett's approach: abandoning the active Alpha strategy and embracing Beta! 👇

🎯Dalio retired, but his approach taught me: Don't just think about making money, but more importantly, think about how to "preserve money"

I have been investing in US stocks and #Web3 for years, often tracking hedge funds and Wall Street big shots' moves. Recently, something particularly impressed me - Bridgewater founder and "hedge fund godfather" Ray Dalio officially retired.

To be honest, he is an investor I greatly admire. But his post-retirement move impressed me even more - he invested almost all of his family trust money in Beta strategies, not the Alpha strategy he was famous for.

Sounds contradictory? Let's study this carefully; perhaps Dalio's strategy might inspire you!

💡What exactly are Alpha and Beta? - One is "hunting", the other is "collecting rent"

Let's use a fishing analogy:

• Alpha: Your fishing skills are so good that you catch 10 fish a day while others catch only 3 - this is "excess returns".

• Beta: You directly rent a fish pond where fish naturally grow. As long as you don't make mistakes, you'll have fish every year - this is "market returns".

Alpha relies on human intelligence, judgment, and wisdom; Beta relies on systems, allocation, trends, and time.

🧠Dalio built his career on Alpha but ultimately entrusted his family's money to Beta

Bridgewater was built on Alpha, with a very advanced, complex, and highly timing-based strategy. Simply put: it survived on genius.

But after retirement, Dalio allocated his family trust assets into his self-designed "All Weather Strategy", essentially an extremely diversified system that earns money slowly through Beta.

I didn't understand this move initially: After earning money through Alpha your entire life, why wouldn't you "show off your skills" with your family wealth? Later, I understood.

🛡What truly needs inheritance is not massive profits, but stability

When we invest, we all want to take risks when young, chasing trends, going All In, but when truly considering wealth "passed down through generations" - you'll discover that relying on one person's judgment is very unreliable.

• Alpha is too person-dependent: Who will carry Bridgewater's banner after Dalio's retirement? The answer is uncertain.

• Alpha is unsustainable: Today's strategy might outperform the market, but tomorrow it might not work. Like pop songs, it won't be popular for more than three years.

• Alpha is expensive: Executive teams, researchers, algorithm developers all cost money, and management fees are extremely high.

But Beta is different.

• Beta follows market trends, holding the entire market and moving upward long-term.

• Beta can be systematically managed, not dependent on individual judgments.

• Beta is easy to inherit - even if you don't understand investing, following the system can generate stable compound returns.

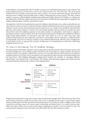

⚖The wisdom behind the "All Weather Strategy": Not gambling on predictions, but preparing for all possibilities

Dalio's "All Weather Strategy" core is four words: risk parity.

What does this mean? Instead of guessing whether the stock market will rise tomorrow or gold will be expensive, he directly diversifies money into:

• Stocks (growth)

• Bonds (good during recession)

• Commodities, gold (inflation resistance)

• Cash (countering contraction)

You'll encounter one of these economic cycles, and he doesn't predict which will come, but prepares for each in advance. This is "preparation > prediction". The All Weather Strategy provides the greatest inspiration as an investment strategy that can be appropriately modified to become a high-capacity, relatively stable investment system, especially when facing downward cycles!

After seeing Dalio's approach, as an investor still battling in the market, I was deeply touched. In our industry, many people only focus on "how to make money", but few think clearly about "how to preserve the money earned".

Dalio's choice represents a very strategic philosophical investment shift: "I no longer bet on genius, but construct a system that doesn't require genius." This is a manifestation of wisdom and a demonstration of belief in Beta, compound interest, and the power of systems. It's worth carefully studying and deeply contemplating! 🧐

Rocky

@Rocky_Bitcoin

01-26

我最近一直在思考,怎样的一个投资策略,来迎接即将到来的2025年,2025年我们知道,川普之年,是一个完全右倾化的不确定之年,我写这篇投资随笔的时候,他还没有登基,已经在打量着格陵兰岛,巴拿马运河和加拿大主意了。并且加密市场大概率会在2025年Q2左右迎来牛转熊市周期。随着2025年川普关税+移民 x.com/Rocky_Bitcoin/…

This is the real boss.

Brother Wukong, I will surpass him in the future

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content